I. RWA Explosion Period: BlackRock's BUIDL Fund Becomes the Benchmark for On-Chain Government Bonds

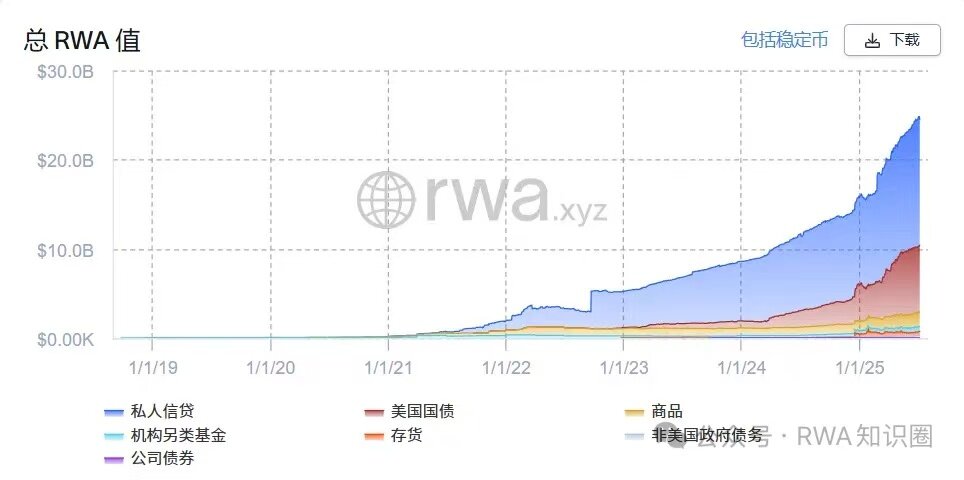

By July 2025, the total market value of RWA (Real World Asset Tokenization) had reached $24.52 billion, a staggering 115.1% increase from $11.4 billion in the same period last year. In the segmented field, private credit leads with $11.4 billion, followed closely by government bonds at $7.5 billion. In the government bond sector, the BUIDL Fund launched by BlackRock, the world's largest asset management group, stands out — with a scale of $2.821 billion, it occupies nearly 40% of the on-chain government bond market. The success of this phenomenal project holds the common key to the breakthrough of all RWA projects.

II. Compliance First: The Survival Bottom Line and Faith Foundation of RWA Projects

In its annual letter released in March 2025, BlackRock stated: “Every asset can be tokenized, which will bring about an investment revolution.” The BUIDL Fund, born in March 2024, is a forward embodiment of this concept — investing 100% in a combination of cash, U.S. government bonds, and repurchase agreements, it became BlackRock's first tokenized fund issued on a public chain.

A successful RWA project must first have an absolute reverence for compliance. The BUIDL Fund is issued under Rule 506 (c) of the 1933 Securities Act and Section 3 (c) of the 1940 Investment Company Act, strictly limiting participation to “qualified purchasers”: individuals or family offices must have at least $5 million in investable assets, with a minimum initial investment of $5 million, and must pass KYC/AML checks through Securitize Markets to enter the whitelist. This “compliance first” design is the core confidence that attracts institutional clients.

The improvement of the global regulatory system has given more participants a firm belief in compliance. Policies such as the U.S. “Genius” Act, Hong Kong Stablecoin Regulations, and the U.S. “CLARITY Act” have paved a clear legal path for RWA. However, for small and medium-sized enterprises, accurately interpreting complex regulations and adapting to regulatory requirements is not easy, often stagnating in compliance due to a lack of professional teams, making it difficult to advance projects as quickly as the giants.

III. Ecological Synergy: Deep Binding of Technology and Resources is the Key to Breaking the Deadlock

Compliance is the bottom line, while resource integration is the engine for the leap of RWA projects. The collaboration between BlackRock and Securitize demonstrates an effective model of ecological synergy — not merely a simple client-vendor relationship, but a deeply symbiotic ecological partnership.

Securitize plays a core role in the entire tokenization process: it is both the technology platform that digitizes fund shares and the transfer agent managing issuance and redemption, as well as the compliance gateway responsible for investor access, with its subsidiary directly acting as the placement agent. This “technology + service + channel” full-chain support allows the BUIDL Fund to stand on a resource high ground from its inception. More importantly, BlackRock's strategic investment in Securitize and the appointment of executives to the board have completely broken down the collaboration barriers between the two.

Challenges such as connecting blockchain technology platforms, building KYC systems, and establishing asset mapping channels are often difficult to overcome alone. The RWA accelerator can directly link to Securitize-level technology service providers and even assist enterprises in strategically investing in quality infrastructure companies, replicating BlackRock's ecological construction path and quickly forming a complete issuance closed loop.

IV. Model Design: Economic Logic Determines Project Lifecycle

After the technology is implemented, the economic token model becomes the lifeline of RWA projects. The design of the BUIDL Fund provides a useful reference:

- The subscription phase achieves a seamless connection between fiat currency and on-chain tokens — investors wire dollars to Bank of New York Mellon, and after BlackRock purchases the underlying assets, Securitize mints BUIDL tokens to the whitelist address at a 1:1 ratio, with the entire on-chain record being traceable.

- The redemption mechanism is a groundbreaking innovation: in addition to traditional T+1/T+2 fiat redemptions, the collaboration with Circle provides an instant redemption channel for USDC, allowing investors to convert BUIDL into stablecoins at any time, perfectly resolving the contradiction between traditional financial settlement and DeFi immediacy. Etherscan data shows the high-frequency invocation of the “Circle: BUIDL Off-Ramp” contract, confirming the market value of this design.

Of course, the whitelist mechanism also brings the “balance dilemma between compliance and openness” — BUIDL cannot directly access permissionless protocols like Aave and must achieve encapsulated integration through intermediaries like Ondo Finance. Regardless of whether the asset type is government bonds, real estate, or minerals, a token model that adapts to its own attributes must be designed. Small and medium-sized enterprises often struggle to independently complete model designs that meet market demands due to a lack of professional teams, easily falling into the “issue and die” dilemma.

V. Long-Term Perspective: Expanding RWA Boundaries by Standing on the Shoulders of Giants

From compliance frameworks to ecological synergy, and then to economic model design, every step of the BUIDL Fund's practice provides valuable experience for the RWA industry. Its significance goes far beyond being a successful project; it offers a replicable development path for the entire industry:

- Expanding asset categories: breaking the limitation of “only standardized assets can be tokenized,” validating the scalable potential of non-standard assets like real estate and photovoltaic facilities, allowing more types of assets to see the possibility of going on-chain;

- Deepening DeFi integration: exploring an innovative model of “compliance encapsulation,” while maintaining regulatory bottom lines, allowing token yields to more flexibly integrate into the DeFi ecosystem, releasing asset liquidity.

The value of the RWA accelerator lies in transforming the experiences of giants like BlackRock into standardized tools — from compliance templates to technical interfaces, from resource networks to model frameworks, enabling more enterprises to grasp the next wave of RWA dividends directly at the forefront of the industry without starting from scratch.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。