Compiled by: Luan Peng, RootData

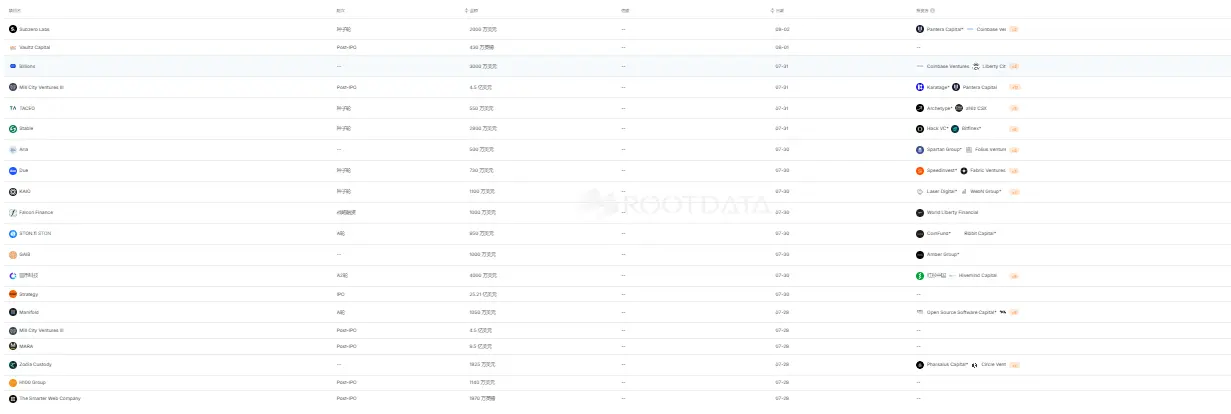

According to incomplete statistics from RootData, during the period from July 28 to August 3, 2025, there were a total of 30 public financing events in the blockchain and cryptocurrency industry, with a cumulative financing amount of approximately $4.634 billion.

From the distribution of sectors, the projects that received financing were mainly concentrated in the infrastructure and CeFi sectors. Popular projects include the crypto startup Subzero Labs, the digital identity verification platform Billions, the Dutch crypto derivatives exchange D2X, and the crypto pair trading platform Pear Protocol.

In addition, according to Decrypt, the development team of the TON ecosystem DEX project STON.fi announced the completion of a $9.5 million Series A financing round, led by Ribbit Capital and CoinFund.

(List of projects with financing greater than $5 million last week, data source: Rootdata)

1. Infrastructure

Crypto startup Subzero Labs completes $20 million seed round financing, led by Pantera Capital

According to Fortune magazine, crypto startup Subzero Labs has completed a $20 million seed round financing, led by crypto investment firm Pantera Capital, with participation from crypto venture capital firms Variant, Coinbase Ventures, and the high-frequency trading firm Susquehanna's crypto division.

Subzero Labs co-founder and CEO Ade Adepoju declined to disclose the company's valuation for this round of financing. He stated that the transaction was completed in the first quarter of this year, and the financing included equity and token subscription warrants (i.e., the right to allocate future unreleased crypto tokens).

Subzero Labs plans to launch a new blockchain called Rialo aimed at real-world applications. Rialo is not a traditional Layer 1 blockchain—Adepoju stated that it "is not Layer 1, 2, 3, 4, 5, or 6," and he is reluctant to compare it to existing crypto products. Rialo is designed for developers without a crypto background, allowing engineers to build functionalities on the blockchain that are typically only achievable off-chain. For example, it can access off-chain data such as FICO credit scores without the need for oracles.

According to official news, the digital identity verification platform Billions has announced the completion of $30 million in financing, with participation from Polychain, Coinbase Ventures, Polygon, LibertyCityVentures, BITKRAFT Ventures, and others. The funds from this round will be used to build the first universal human and AI network.

According to Web3 asset data platform RootData, Billions Network is a digital identity verification platform aimed at providing a mutually trusted future for humans and AI, including Sam Altman's crypto project World. The platform utilizes zero-knowledge proof technology to provide a scalable and secure method for verifying the identities of humans and AI.

According to CoinDesk, the new blockchain project Stable, built around Tether's USDT, has announced the completion of $28 million in seed round financing, led by Bitfinex and Hack VC, with other supporters including Franklin Templeton, Castle Island Ventures, KuCoin Ventures, and angel investors such as Tether CEO Paolo Ardoino and Braintree founder Bryan Johnson.

The Stable blockchain aims to use USDT as the base gas token to build a fast, low-cost stable payment network. Its roadmap is divided into three phases: the first phase achieves USDT payment of gas fees and sub-second block confirmations; the second phase provides block space assurance for enterprise-level payments; the third phase focuses on developer tools and performance upgrades.

Payment service provider Due completes $7.3 million seed round financing, led by Speedinvest

Payment service provider Due has completed $7.3 million in seed round financing, led by Speedinvest, with participation from Semantic Ventures, Fabric Ventures, Strobe Ventures, and Polymorphic Capital.

Due is integrating local payment channels, liquidity markets, and blockchain networks into a unified infrastructure.

According to Decrypt, the Bitcoin infrastructure project Midl has completed $2.4 million in seed round financing, led by Draper Associates, with participation from Draper Dragon.

The project aims to implement smart contract functionality on the Bitcoin network, supporting the native development of decentralized applications.

AI computing economic layer GAIB completes $10 million strategic investment, led by Amber Group

According to GlobeNewswire, the AI computing economic layer GAIB has announced the completion of a $10 million strategic investment, led by Amber Group. The funds will be directly used to purchase tokenized GPU assets on the GAIB platform to enhance the on-chain deployment of AI computing infrastructure and attract more institutional participation.

GAIB is a developing crypto AI platform aimed at tokenizing GPUs to make AI computing (the computational power required to train and run AI models) more accessible. AI computing is typically provided by GPUs and other hardware resources, and GAIB seeks to release the liquidity of these traditionally illiquid assets.

According to Web3 asset data platform RootData, last December, GAIB announced the completion of $5 million in seed round financing, led by Hack VC, Faction VC, and Hashed, with other participating investors including Spartan, Animoca Brands, MH Ventures, Aethir, Near Foundation, Chris Yin from Plume Network, and Lucas Kozinski from Renzo Protocol.

Decentralized AI infrastructure Manifold has announced the completion of $10.5 million in Series A financing, led by OSS Capital, with participation from Digital Currency Group, Tobi Lutke (co-founder and CEO of Shopify), Jacob Steeves (co-founder of Bittensor, founder of Affine), Ala Shaabana (co-founder of Bittensor, co-founder of Crucible Labs), and others. The new funds are intended to support the optimization of its AI cloud service Targon built on Bittensor to expand its commercial applications.

2. Gaming

Web3 game Aria completes $5 million financing, led by Folius Ventures and others

According to the official announcement, the Web3 role-playing game Aria (ARIA) has successfully raised $5 million in its latest financing round. This round was led by Folius Ventures, The Spartan Group, and Beam FDN, with participation from Animoca Brands, Galaxy, and others.

Aria is an RPG game where players can freely roam in an open-world environment while experiencing epic quests and the thrill of combat. The game's developer, Inutan Studios, has previously received investments from Tencent, NetEase, and Riot Games.

3. CeFi

According to a disclosure from Fosun's Xinglu Technology (Finloop) public account, the company recently completed nearly $10 million in Series A financing, with investors including the Solana Foundation and other Web3 industry institutions.

The funds from this financing will be used to rapidly build and enhance the company's new Web5 business system—RWA (Real World Assets), improving its integrated capabilities of fiat currencies, stablecoins, and digital assets, providing financial institution clients with a one-stop technology solution that links traditional finance with the digital asset world.

According to reports, Xinglu Technology is strategically conceptualizing Web5, with its business model primarily being a B2B service platform supporting all categories of financial products. This is achieved through a complete end-to-end technology solution and an AI operation platform, supporting a full range of Web2 products (such as cash management, public funds, private funds, bonds, bills, insurance, etc.) as well as all categories of Web3 products (such as standard financial assets RWA, non-standard assets RWA, VATP, virtual asset ETFs, overseas stablecoins, Hong Kong stablecoins, etc.). The fusion of these two will give birth to Web5, which not only continues the essence of finance in terms of security and compliance but also unleashes the infinite possibilities of the digital world.

Falcon Finance secures $10 million strategic investment from World Liberty Financial

According to official news, Falcon Finance has secured a $10 million strategic investment from World Liberty Financial.

World Liberty Financial is the issuing team for the fiat-backed stablecoin USD1. Currently, USD1 has become one of the collateral types supported by the Falcon platform. The two parties will collaborate on the construction of an on-chain dollar standard.

As a decentralized collateral infrastructure, Falcon Finance primarily provides on-chain liquidity and yield services. This collaboration will further promote the development of its cross-platform stablecoin business.

RD Technologies completes $40 million Series A2 financing, led by ZhongAn International and others

Hong Kong fintech group RD Technologies announced today that it has successfully completed nearly $40 million in Series A2 financing. This round was co-led by ZhongAn International (ZA Global), China Harbour, Bright Venture, and Hivemind Capital, along with existing and new investors. Other investors include Sequoia China (HSG), Eternal Digital, Junshi Investment, and Guotai Junan International Private Equity Fund.

CEO Liu Yu stated, "We are expanding platform capabilities, deepening global partnerships, optimizing product services, and actively preparing for Hong Kong's stablecoin licensing system, which will be implemented on August 1, 2025."

At the same time, ZhongAn Bank has signed a strategic cooperation memorandum with them to explore the application of stablecoins in compliant financial services.

Previous report indicated that RD Technologies plans to issue a Hong Kong dollar stablecoin HKDR on Ethereum.

Strategy completes $2.521 billion STRC stock IPO, increases holdings of 21,021 bitcoins

According to an official announcement from Strategy, Strategy (MSTR) has completed the initial public offering (IPO) of 28,011,111 shares of floating-rate Series A perpetual preferred stock "STRC," with an issue price of $90 per share. The STRC IPO is the largest IPO in the U.S. in 2025 and one of the largest cryptocurrency-related issuances in recent years. STRC is expected to be listed on the Nasdaq Global Select Market around July 30, 2025, with the stock code "STRC." The total funds raised from this transaction are approximately $2.521 billion.

Strategy (MSTR) has increased its holdings of 21,021 bitcoins at a total value of approximately $2.46 billion, with an average purchase price of about $117,256, achieving a 25% bitcoin yield year-to-date in 2025. As of July 29, 2025, Strategy holds 628,791 bitcoins, with a total value of approximately $73.73 billion, each bitcoin having a cost price of about $73,277, with a total expenditure of approximately $46.08 billion.

According to CoinDesk, the Dutch crypto derivatives exchange D2X has completed €4.3 million (approximately $5 million) in strategic financing, with investors including Circle Ventures, CMT Digital, Canton Ventures, Point72 Ventures, Tioga Capital, GSR, and Fortino Capital.

D2X holds a multilateral trading facility (MTF) license under the EU MiFID II framework and has recently launched Bitcoin and Ethereum futures contracts priced in US dollars, with plans to launch related options products.

According to an official announcement, Swedish listed company H100 Group AB has completed a directed stock issuance, raising approximately 109.19 million Swedish Krona.

The company stated that since launching its Bitcoin asset allocation strategy, it has raised a total of 1.095 billion Swedish Krona (approximately $114 million).

4. AI

According to GlobeNewswire, AI-driven crypto trading platform Kuvi.ai has announced the completion of $700,000 in seed round financing, led by Moon Pursuit Capital, with participation from Transform Ventures investor Michael Terpin, achieving a valuation of $30 million.

The company aims to use the new funds to support its message input-based trading platform, simplifying the crypto trading interface through conversational methods.

Decentralized edge cloud project ARO Network has announced the completion of $2.1 million in Pre-Seed round financing, aimed at accelerating the creation of a decentralized edge cloud network specifically designed for peer-to-peer content distribution and AI computing.

This round of financing was led by NoLimit Holdings and Dispersion Capital, with participation from Escape Velocity, Maelstrom, and several strategic angel investors.

ARO Network is a decentralized edge cloud project that allows users to convert idle internet resources into income by running nodes. Users running ARO nodes can earn ARO tokens, supporting real-time AI computing.

5. Others

According to NLNico, UK listed company Vaultz Capital has completed £4.3 million in financing, with Aura Digital investing £2.6 million. The company is currently conducting a new round of fundraising, targeting a total of approximately £6 million.

Additionally, the company has appointed Erik Benz as the new CEO and established a Bitcoin advisory committee. Vaultz Capital plans to expand its Bitcoin reserves and infrastructure strategy.

Mill City Ventures III announces fundraising of $450 million to launch SUI treasury strategy

According to Businesswire, Nasdaq-listed Mill City Ventures III has announced that it has signed a securities purchase agreement to raise $450 million through a stock offering to launch its SUI treasury strategy, with Karatage Opportunities as the lead investor. The Sui Foundation is also providing funding, with other participants including Big Brain Holdings, Galaxy Digital Inc, Electric Capital, GSR, Selini, Protagonist, and ParaFi Capital.

It is reported that this transaction is expected to be completed around July 31, 2025, but is subject to customary closing conditions.

According to TFN, Austrian crypto technology startup TACEO has completed $5.5 million in seed round financing, led by Archetype VC, with participation from a16z CSX, Cyber.Fund, a_capital, and Polymorphic Capital. The new funds will be used to enhance infrastructure performance and develop developer tools, focusing on expanding privacy-compliant applications in finance, AI, and stablecoin sectors.

The core technology developed by the company, "Private Shared State," enables collaborative computation on encrypted data among multiple parties and has successfully supported biometric authentication for 14 million users in the World ID project under Sam Altman. Its technology integrates multi-party computation (MPC) and coSNARKs zero-knowledge proofs, allowing for the verification of computational accuracy without exposing the original data.

According to Decrypt, the development team of the TON ecosystem DEX project STON.fi announced the completion of $9.5 million in Series A financing, led by Ribbit Capital and CoinFund.

STON.fi is a decentralized automated market maker (AMM) built on the TON blockchain, offering nearly zero fees, low slippage, an extremely simple interface, and direct integration with the TON wallet.

According to DL News, the crypto pairing trading platform Pear Protocol announced the completion of $4.1 million in strategic round financing, led by Castle Island Ventures, with participation from Compound VC, Florin Digital, and Sigil Fund.

It is reported that the platform has completed native integration with the Hyperliquid perpetual contract order book.

MARA Holdings successfully raises $950 million to purchase more Bitcoin

According to NLNico, MARA Holdings successfully raised $950 million through 0% convertible bonds, which will be used to purchase Bitcoin, repay $50 million in old bonds, and meet general corporate purposes.

UK listed company The Smarter Web Company announced that it has increased its holdings by 225 bitcoins, bringing the total holdings to 2,050 bitcoins. The average purchase price for this increase was $118,080.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。