Author: Alex Liu, Foresight News

Pendle is the most successful DeFi protocol that has emerged in this cycle, and it doesn't even need the phrase "one of" to qualify it. There are already many articles explaining Pendle, and this article aims to analyze the unique aspects of Pendle's successful protocol mechanism and value capture design in light of recent developments. Readers familiar with Pendle's mechanism can skip the previous explanation and read the analysis that follows.

What is Pendle

Pendle is a protocol for trading "yields" (Yield Trading). To explain how to trade yields, we introduce two assets from the synthetic stablecoin protocol Ethena: USDe and sUSDe.

USDe is a stablecoin pegged to the US dollar at a 1:1 ratio, and simply holding USDe does not generate interest, but it does generate Ethena airdrop points, which can be allocated to sENA tokens based on the number of points after each quarterly airdrop ends. sUSDe is the staked version of USDe, which generates interest, with interest rates fluctuating between 5% and 15% based on market sentiment and funding rates. The Ethena points earned from holding sUSDe are lower than those from holding USDe.

For the two assets mentioned above, the yield from holding USDe is Ethena points, while the yield from holding sUSDe consists of both interest and Ethena points.

Whether it's interest or points, both are quite "time-sensitive." Interest rates can fluctuate dramatically with market conditions, and the value of points is closely related to the snapshot date and the real-time price of the tokens. Therefore, the "yields" being traded require a time frame. It could be the yield for the next 3 months, but it should not be for the next 300 years.

The yield is generated by the underlying asset, and we refer to the current value of the asset that will generate yield after a certain period as "principal." This brings together three elements: principal, yield, and time frame.

Pendle packages yield-generating assets into a standardized yield token (Standardized Yield, abbreviated as SY) using a unified token standard, then splits it into a principal token (Principal Token, abbreviated as PT) and a yield token (Yield Token, abbreviated as YT) and establishes a time frame, allowing the "yields" within a certain period to be traded.

Before maturity, holding YT will yield the corresponding underlying token's returns. After maturity, the value of PT will equal SY, while the value of YT will drop to zero. (For example, if there are 10 days left until maturity, YT represents the yield of the underlying asset for those 10 days and has value; after maturity, it represents the yield of the underlying asset for 0 days and has no value.)

For instance, 1 USDe can be packaged into a standardized yield token USDe (Sep 2025) SY, which can then be split into 1 USDe (Sep 2025) PT and 1 USDe (Sep 2025) YT, with their values adhering to:

1 USDe (Sep 2025) SY = 1 USDe (Sep 2025) PT + 1 USDe (Sep 2025) YT.

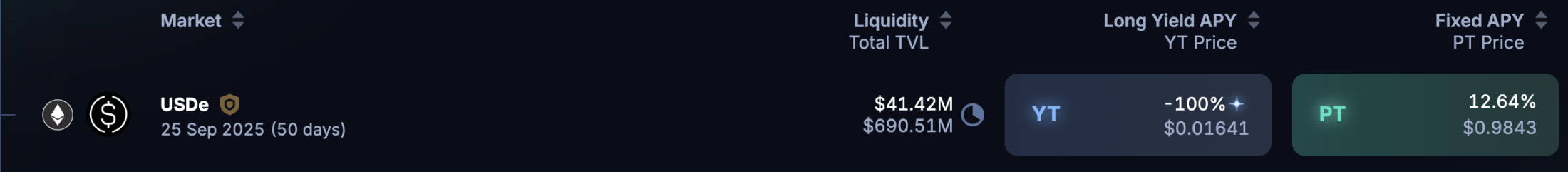

The value of 1 USDe SY is the same as the underlying asset of 1 USDe, which is 1 dollar. For convenience, we assume 1 USDe (Sep 2025) PT = 0.99 dollars and 1 USDe (Sep 2025) YT = 0.01 dollars. Now, there is about 1 month left until the maturity date in September 2025.

As a trader, I can now use 100 dollars to buy 10,000 YT, which corresponds to the yield generated by 10,000 USDe over this 1 month (i.e., Ethena airdrop points). After maturity, YT will drop to zero, and the value will transfer to the unclaimed Ethena airdrop points. The motivation for traders to purchase is their bullish outlook on the yield value of USDe, believing that the value of Ethena's airdrop will exceed the cost of purchasing YT.

Using 100 dollars to leverage 10,000 dollars to generate points, this ability to leverage points with a small principal has brought massive growth to Pendle during the previous points frenzy. YT traders have frequently seen significant wins: traders leveraging YT for EigenLayer airdrop eETH YT recouped all costs from the ETHFI airdrop, effectively getting EIGEN tokens for free; buying YT leveraged Ethena points when ENA was at 0.2 dollars, ENA surged above 0.6 dollars within 2 weeks, greatly increasing point value; Usual airdrop exceeded expectations, with YT purchases yielding over 10 times returns.

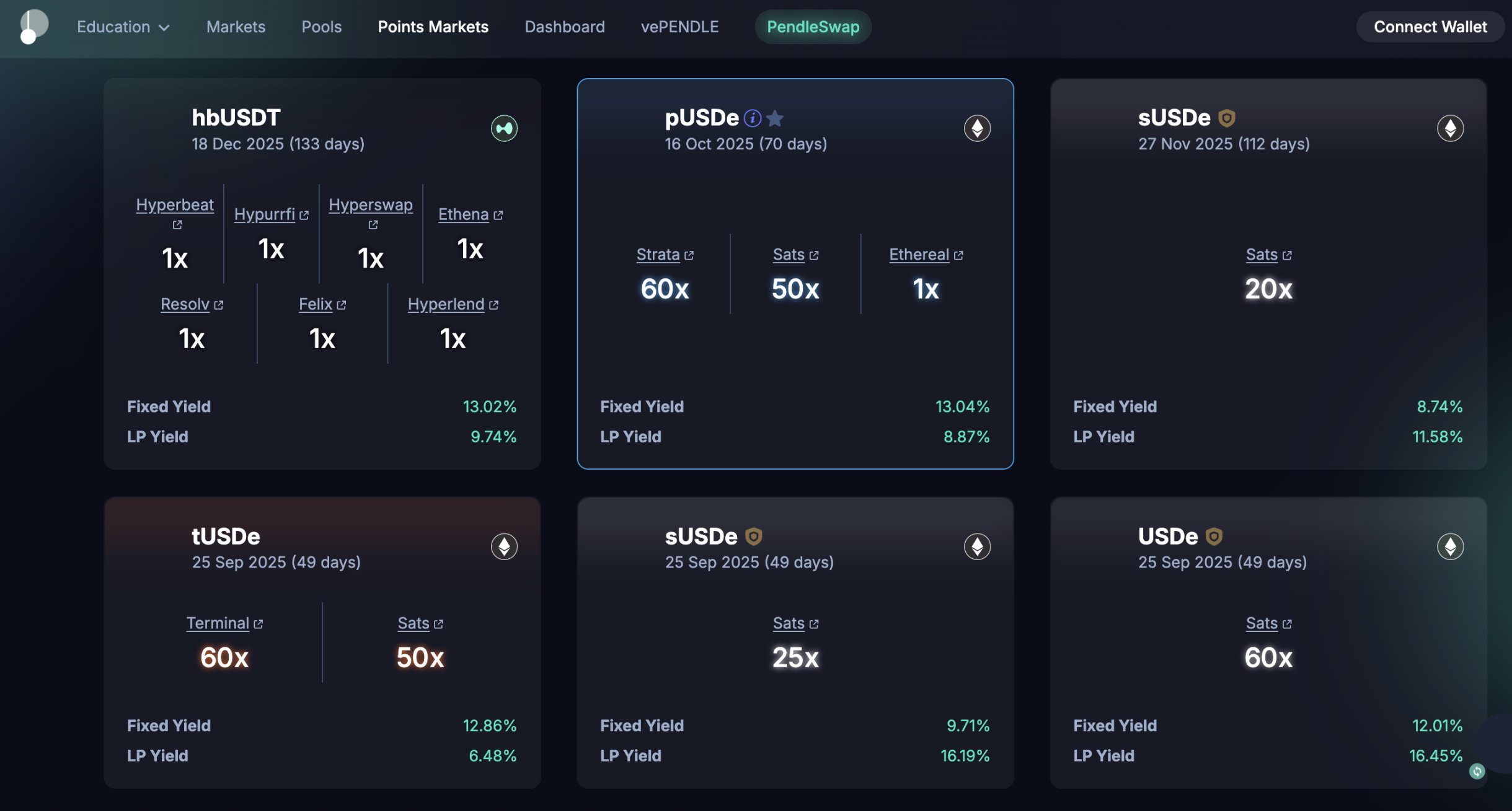

Pendle's "Points Market" Page

Holders of sUSDe YT not only earn Ethena points but also receive interest generated by the underlying asset. Although the value of YT drops to zero after maturity, holders can claim the USDe yield generated by the underlying sUSDe asset based on the actual interest rate from the Pendle contract.

Of course, there are also cases of losses in YT trading: leveraging YT for points in a project that delays token issuance, leading to infinite dilution of point value; going long on the underlying yield of USDT in Aave at an implied interest rate of 8%, only to find that the actual average interest rate during the period was 4% due to worsening market conditions, resulting in a loss of half the principal when purchasing YT.

Trading requires counterparties. Behind the hot trading of YT, there needs to be market demand for PT to support liquidity. In the aforementioned situation, one could buy 10,000 USDe (Sep 2025) PT for 9,900 dollars, and after 1 month, it can be exchanged back for 10,000 USDe. Earning 1% in a month equates to locking in an annualized return of about 12% over that month, enjoying a "fixed rate."

This is similar to the model of government bonds; I buy a 100-dollar bond with a face value of 110 dollars for 1 year, and upon maturity, I redeem the bond for 110 dollars, thus locking in a 10% annualized return at the time of purchase. Similarly, bonds approach their face value as they near their redemption date, and they can be redeemed at par upon maturity.

As a seller of yields, PT holders sell the "uncertainty" of yields, locking in a "fixed rate."

Being a Pendle LP (Liquidity Provider) is akin to holding both SY and PT while selling part of YT. In addition to the fixed income generated from their PT portion, LPs can also earn PENDLE token emissions (liquidity mining).

It is clear that Pendle provides options for users who want to reduce risk and increase stable returns, users who want to take on risk for potentially higher uncertain returns, and users who simply want to mine DeFi. It addresses users' essential needs in a natural manner.

Pendle's Data

How successful is Pendle? The data speaks for itself. Despite a downturn in the market last week and Pendle experiencing the largest asset maturity in its history (meaning some users seeking stable returns realized "profit-taking"), Pendle's TVL (Total Value Locked) still reached a new high of 7 billion dollars.

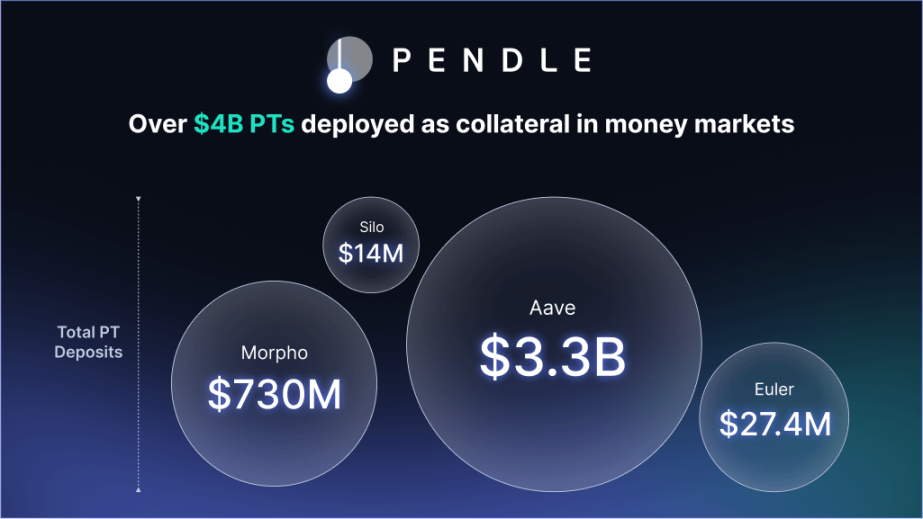

Over 48% of Ethena assets have been packaged as Pendle assets, amounting to 4.6 billion dollars. Over 4 billion of Pendle PT assets have been deposited into lending protocols such as Aave, Morpho, Euler, and Silo as collateral. The newly launched HyperEVM-related assets attracted over 80 million dollars in deposits within 4 days. Despite over 1.5 billion dollars in assets maturing mid-week, it only caused a decline of less than 3% in TVL in a single day, with a large amount of assets choosing to remain and continue participating in Pendle, reflecting trust in the protocol.

PT assets deposited in various lending protocols

Crypto Profit Models

There are two of the most profitable profit models in the world: one is to take a cut like a casino, corresponding to exchanges in the crypto world; the other is to earn the interest spread from lending and deposits like a bank, corresponding to lending protocols in the crypto world.

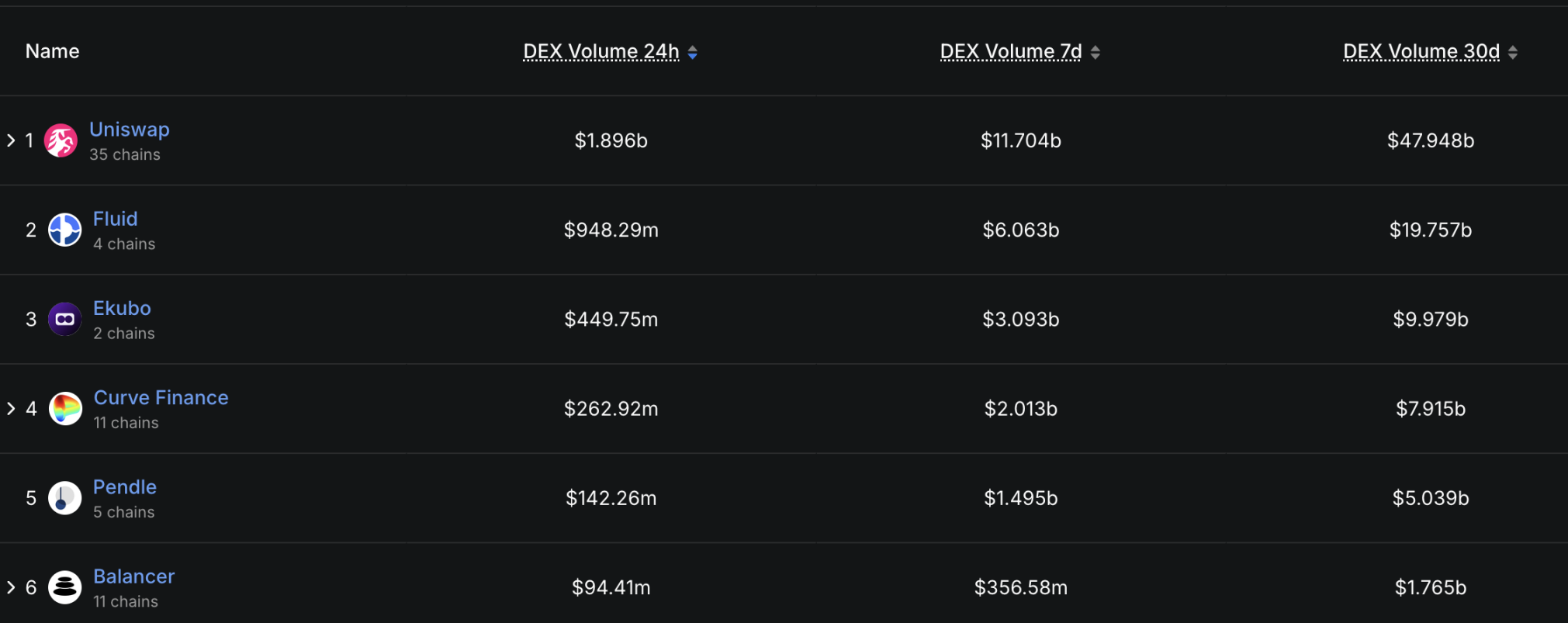

Pendle is the 5th largest DEX (decentralized exchange) by trading volume on Ethereum, belonging to the "cut" model that charges transaction fees. For traders, the "cut" model is often a zero-sum game — for perpetual contracts that earn the most fees for CEX, if the long side profits, the short side loses, and in the long run, only exchanges that continuously extract fees are the ultimate winners.

However, Pendle has scenarios where all participants can profit, and I believe this is what sets it apart, namely "positive externality."

Positive Externality

Pendle mainly involves three major participants at the user level: YT traders, PT traders, and LPs (liquidity providers). At the protocol level, it also involves partner protocols — Pendle can bring significant TVL increases to partner protocols, and the example of Ethena is sufficient to illustrate this. The first thing emerging projects often do to increase TVL is to "integrate Pendle."

PT traders can actually "guarantee" fixed returns by selling "uncertain" yields for a fixed rate; their only risk is that the "uncertain" yields they sold become too valuable, potentially earning less, but they will certainly not incur losses (in terms of currency, holding ETH-related YT will not result in a loss of the amount of ETH held). Moreover, PT traders voluntarily embrace "certainty," and they might use the 12% fixed annualized PT they received to stack in various DeFi protocols, creating a super mine with over 50% annualized returns, which may not necessarily result in less profit.

The essence of LPs is that they hold a portion of PT, and the SY portion often receives very high point multipliers from various projects. By earning fixed returns and efficiently mining points through PENDLE token emissions, it can be said that they are getting multiple benefits at once, ensuring profits.

The only participants who might incur losses are YT traders. YT traders often take small risks for large rewards, profiting when the actual market conditions are more optimistic than expected. The crypto industry is currently in a period of rapid development, with continuous new asset issuances and bullish market sentiment keeping expectations high. When the next new token airdrop exceeds expectations, and bullish sentiment drives actual interest rates above pricing, all participants in the Pendle ecosystem profit, while those footing the bill come from outside the ecosystem. Theoretically, everyone can make money, and the yield comes from outside the ecosystem, which is its wonderful aspect.

Pendle not only trades interest rates but also expectations. In a bullish environment that exceeds expectations, allowing every participant to profit is its "positive externality."

Value Capture of PENDLE

Even if the protocol is unique, is the PENDLE token a value token?

The PENDLE token adopts a ve (voting escrow) mechanism, allowing holders to lock PENDLE tokens to receive vePENDLE tokens. Currently, all profits from the Pendle protocol are distributed to vePENDLE holders. Pendle charges a 5% fee on all yields generated from YT (including points, meaning vePENDLE holders can receive benefits from various token airdrops), and the same fee applies to the yields from SY that have matured but not been redeemed. All trading fees from PT and YT are also allocated to vePENDLE.

In addition, the standard gameplay of the ve token mechanism includes: locking vePENDLE to gain LP liquidity mining bonuses, voting rewards from project bribery, etc., which not only brings returns to locked tokens but also reduces token circulation, enhancing token demand. (Details of the ve token mechanism could easily fill another 3000 words; readers unfamiliar with it can refer to materials related to CRV and Curve War.)

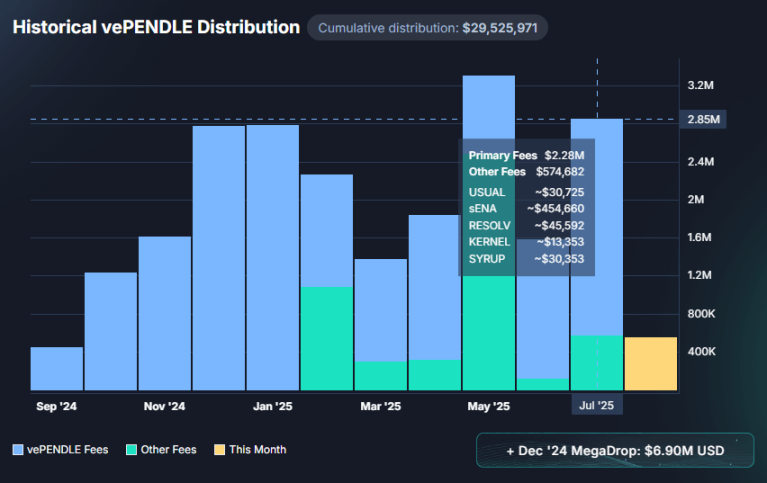

According to the official page, the fees for vePENDLE in July 2025 reached 2.85 million dollars, and even after excluding the more uncertain airdrop portion, it still reached 2.28 million dollars.

As of the early morning of August 8, the PENDLE token broke through 5 USDT, rising over 25% in a single day, leading the DeFi sector.

Team and Financing

The Pendle team was established in 2020, with founder TN Lee being a founding member of Kyber Network. This team, primarily based in Singapore and Vietnam, launched the first version of Pendle in 2021 — a product similar to an on-chain crypto index, along with the introduction of the PENDLE token. However, this version of Pendle did not find product-market fit (PMF) at the time and was not considered successful.

Pendle completed a round of private financing in April 2021, raising 3.7 million dollars, with investors including HashKey Capital, Mechanism Capital, and others. At the same time, it raised 11.83 million dollars through an IDO at a price of 0.797 dollars per token.

Pendle Founder TN Lee

After the market peaked in 2021, it quickly entered a bear market. However, the Pendle team leveraged its keen sense and foresight to build and rapidly transform during the bear market, ultimately launching the now highly successful Pendle V2 version in 2022, successfully revitalizing the project across cycles.

In July 2023, Pendle was launched on Binance Spot through Launchpool. A month later, Binance Labs (now Yzi Labs) announced an investment in Pendle.

Simple Future Outlook

Pendle currently has no significant competitors. Whether it’s Spectra on EVM or RateX on Solana, similar products are far behind in terms of liquidity, capital volume, and protocol integration. (I personally bought up all reasonably priced USDe YT on RateX.) As Pendle establishes more ecological interactions and DeFi Lego plays with leading protocols like Ethena and Aave, its dominance in the sector will become increasingly difficult to shake.

The contract security validated over time, along with the accumulated brand effect and user trust, gives us reason to believe that if traditional capital (Tradfi) wants to enter the yield trading sector, collaborating with Pendle is likely to be the first choice.

Additionally, Pendle's newly launched funding rate trading protocol Boros is seen as the next major growth point. The funding rate market is considered to have an open interest value of 200 billion dollars, with a potential daily trading volume exceeding 300 billion dollars. Since its launch 24 hours ago, Boros has achieved impressive figures of 15 million dollars in open interest and 36 million dollars in nominal trading volume. I plan to introduce this protocol in a future article.

When I first introduced Pendle in March 2024 (when PENDLE was 1.2 dollars), I wrote: yield and risk are the core factors in finance, and balancing the two is an eternal play. Through the magic of decentralization, Pendle makes all of this happen on-chain, continuously bringing potential yields from outside the ecosystem into the ecosystem, achieving a positive-sum game, and gradually becoming an indispensable infrastructure in DeFi, which I believe has limitless potential. I am confident that the valuation of good applications will ultimately exceed that of "ghost chains."

Now, a year and a half later, Pendle has become an indispensable infrastructure in DeFi, and its token price has surpassed many "ghost chains." In the foreseeable future, Pendle will continue to grow rapidly, leading the DeFi sector.

Disclaimer: The author of this article holds PENDLE tokens, with a value that meets disclosure standards.

Click to learn about job openings at ChainCatcher

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。