Once regarded as the pioneer of "the fusion of scientific research and cryptocurrency," the leading player in the DeSci sector, $BIO, has faced significant pressure since its launch in January this year. Despite backing from top investors including Vitalik Buterin and CZ, it has not escaped the dual impacts of market conditions and liquidity, with its market capitalization shrinking by as much as 95% from its opening peak. This has made it the focal point of community dissatisfaction and skepticism, plunging a sector that once produced billion-dollar market cap legends like $RIF and $URO into a downturn.

However, with the recent official launch of BIO Protocol V2, which introduces new mechanisms such as Launchpad and staking points, the total amount staked surpassed 100 million BIO within a week of launch, and its market capitalization quickly doubled to over $200 million, reigniting market interest and imagination in the DeSci sector.

Why Did the Luxurious $BIO Fall from Grace?

The story of BIO's listing was originally a highlight for the DeSci sector: top exchanges like Binance, OKX, and Kraken all participated, with the trading volume exceeding $2 billion on the first day of TGE, and the FDV once reaching $250 million, making it one of the most sensational scientific cryptocurrency asset launches at the beginning of 2025. However, the excitement concealed the seeds of a price drop.

Yet, the heat of this feast did not last long. BIO was issued through an auction model, with an initial circulation ratio higher than most new coins, and combined with an inflated valuation upon listing, it appeared overpriced in the absence of immediate utility. In the early market, buyers were more driven by narrative and sentiment rather than practical value. When key features like Launchpad, staking systems, and BioXP points were still in the planning stage, investors quickly realized that the tokens in their hands could not provide actual returns in terms of participation benefits or governance rights in the short term. The gap between valuation and use cases became the first force driving the price down.

BIO's decline was also closely related to timing issues. The core functions did not launch simultaneously on the day of TGE, leading to a loss of confidence during the waiting period. Additionally, the independent operation of the Launchpad by Molecule Catalyst diverted funds and attention, weakening the cohesion of the main platform. Coupled with the macro market entering a phase of reduced risk appetite, funds quickly withdrew from high FDV projects with no immediate cash flow. The lack of sustained news support and coordination with product rollout rhythm caused BIO to gradually fall from being a star project at the beginning of the year into a trough of thin trading and price exploration.

The Resurgence of BIO Protocol

Creating an Accelerated Research Laboratory

In the first half of 2025, BIO Protocol has gone through a tumultuous journey—from the narrative peak at the beginning of the year to the price trough, yet its pace has not slowed down. It has not only delivered the most dazzling market results in the DeSci sector but has also pushed several biopharmaceuticals to the brink of clinical trials, allowing "on-chain research" to catch its first whiff of real medical validation.

The price pullback has not deterred the team's ambition; instead, it has led to more constructive actions: in May, BIO postponed the unlocking of team and advisor tokens through community governance, sending a signal to the market that "we are here for the long haul." The research progress is equally noteworthy—VitaRNA and VitaFAST have both initiated clinical trials in the UAE, taking only 11 months from concept to enrollment, while traditional models often require 4-6 years; 14 compounds predicted by AI to have a success rate of over 85% are awaiting efficacy readouts in Q3. Meanwhile, five new BioDAOs, including QBIO, Long Covid Labs, Curetopia, SpineDAO, and MycoDAO, have been established, raising a total of $8.9 million this year, injecting continuous fuel into this high-speed research machine.

V2: The Leap from DeSci 1.0 to DeSci 2.0

Additionally, the BIO team officially launched Bio Protocol V2 in August, aiming to put research financing and execution into "high-speed mode" to address the pain points of high FDV initial offerings, lack of immediate functionality, and ecological fragmentation in the DeSci 1.0 phase.

The core of V2 lies in four major engines:

Low FDV Fixed-Price Initial Offering: Drawing on the successful paths of Pump.fun and Virtuals, V2 reduces the starting valuation of projects to $205,000 FDV, with 35% of tokens sold directly, and all raised $BIO injected into the liquidity pool, providing depth and price momentum from the opening.

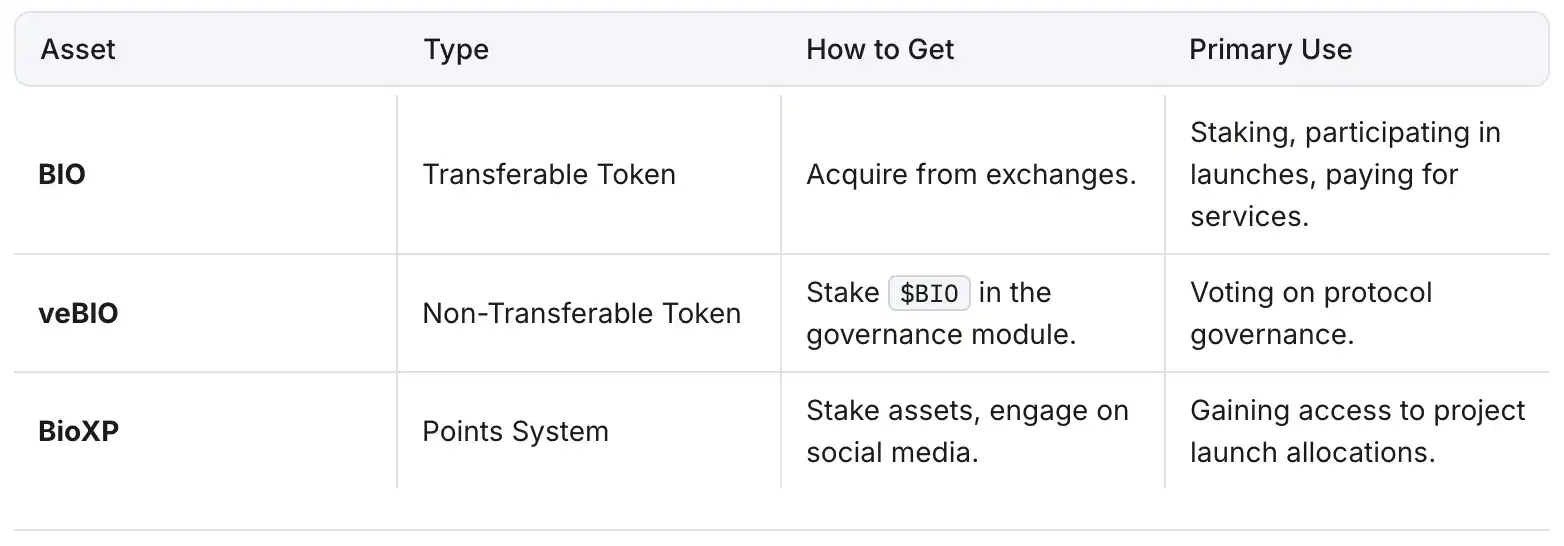

BioXP Points System: This quantifies behaviors such as staking, LP, on-chain interactions, and social dissemination into points, linked to the DeSci Score. Points are valid for 14 days and are used to allocate quotas for low FDV projects, with highly engaged users continuously enjoying priority opportunities.

Staking & veBIO: Staking BIO not only earns points but also governance voting rights; staking other assets within the ecosystem yields higher point returns, encouraging support for the entire network.

Liquidity Engine: Automatically generates LP after the initial offering, charging a 1% fee on each transaction in the secondary market (70% goes to the project treasury, 30% to the protocol), forming a positive cycle of "active trading—research funding increases—results advance—market heat reignites."

Accelerating Implementation, Welcoming a New Cycle for DeSci

VitaRNA and VitaFAST are pushing DeSci from concept to reality. The two drugs will simultaneously advance trials in the UAE, Singapore, and Switzerland, potentially becoming the first cases fully funded by DeSci to enter clinical stages within two years at a cost of less than $500,000. This not only breaks the traditional barriers of drug development, which often takes years and costs tens of millions of dollars, but also sets a benchmark for on-chain research. Meanwhile, BIO is collaborating with Pfizer to explore a compliant Intellectual Property Tokenization (IPT) model, establishing a new capital flow and value distribution mechanism for future drug development.

Bio Protocol will launch decentralized research agents to automate key research processes such as drug screening, clinical operations, and fund allocation. The upcoming BIO Copilot will serve as an on-chain research assistant for scientists, advancing research to a programmable, scalable, and machine-driven collaborative stage, freeing research from human bottlenecks and entering a high-frequency iterative intelligent track.

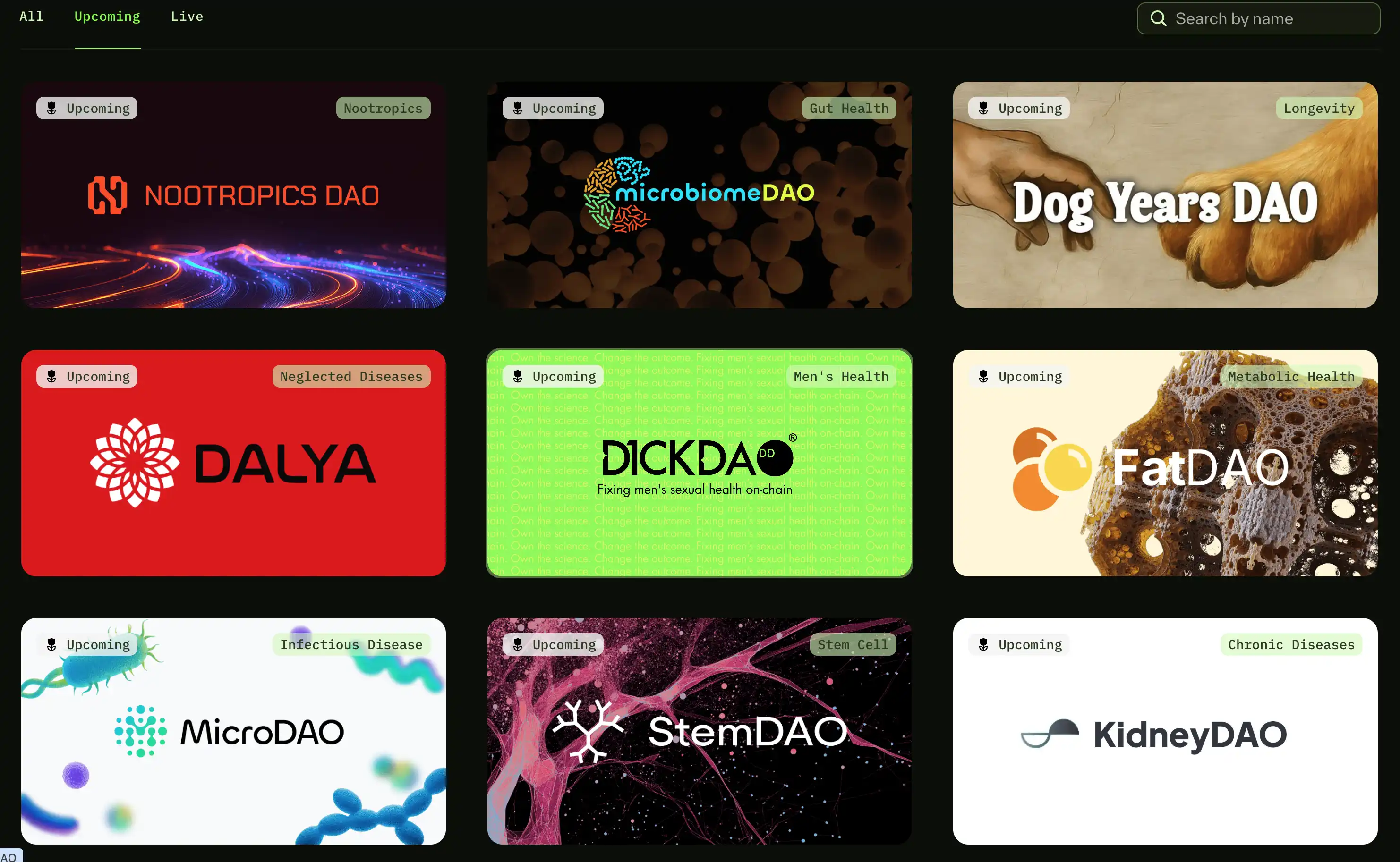

Moreover, the capital and market flywheel is quietly starting up. The Launchpad 2.0 plans to launch 10-20 low market cap projects in the coming months, covering areas such as Agent, IPT, and research tools, with an average fundraising of $70,000, starting with the Base chain, followed closely by Solana. Meanwhile, the "Founding LP Program" is attracting liquidity providers willing to invest over $100,000 in BIO LP, offering returns enhancement, points bonuses, priority allocations, and exclusive support to participants. Drawing on the high returns from initial offerings seen in projects like Virtuals, BIO aims to ignite a new wave of market enthusiasm, creating a closed loop of research funding flow, token flow, and information flow, propelling the arrival of "Scientific Singularity."

What is DeSci? A Decentralized Engine for Accelerating Research

If the operational logic of traditional science resembles a massive steam engine, then decentralized science (DeSci) is more like a high-speed electric motor—lighter, faster, and more transparent.

In the past, the funding sources for scientific research were almost entirely controlled by government foundations, academic institutions, and large pharmaceutical companies. A project often had to go through months or even years of approval processes from project application to funding disbursement; research results were locked behind expensive paywalls, making it impossible for the general public to access data and papers even for taxpayer-funded projects. The storage of research data, the ownership of intellectual property, and the transformation of results were all tightly controlled by centralized institutions and processes. While this model is stable, it also brings inefficiency, conservatism, and a natural aversion to disruptive innovation.

DeSci aims to disrupt this top-down, slow, and closed scientific ecosystem. It uses blockchain's open ledger to ensure transparency in funding flows, progress of results, and data usage; it replaces small review panels with decentralized autonomous organizations (DAOs), allowing the fate of research projects to be decided by broader community votes; and it employs tokenized incentive mechanisms to deeply bind early supporters with the benefits of research outcomes, attracting more funding and talent. This model not only shortens the funding turnover cycle for research but also breaks down disciplinary and geographical barriers through global collaboration, providing opportunities for innovative ideas that would otherwise struggle to secure funding.

In this sector, BIO Protocol is undoubtedly a representative and ambitious player. It not only provides early financing channels for biotechnology projects but also builds a complete set of infrastructure, including project selection, fundraising, on-chain liquidity management, data transparency, and research automation. Through BIO, researchers can "crowdfund" research funding directly from the global community, just like launching a cryptocurrency project; investors can get involved in the early stages of projects and share profits when research outcomes are commercialized. Compared to traditional research, BIO aims to create a scientific ecosystem where funding approval waits are eliminated, monopolization by single institutions is avoided, and everyone can participate and benefit.

Conclusion

BIO Protocol has experienced dramatic fluctuations from its high-profile launch at the beginning of the year to price troughs mid-year, and now it has achieved a phase rebound with the launch of V2. The new low FDV initial offerings, points staking, and liquidity mechanisms have injected new momentum into the ecosystem and reignited market interest in the DeSci sector. However, whether it can sustain this rebound and bring stable returns from new offerings will still depend on the coordination of project rollout rhythm and market conditions, with uncertainties remaining in the short term.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。