This article is from: Pantera; Original authors: Cosmo Jiang, Erik Lowe

Translation | Odaily Planet Daily (@OdailyChina); Translator | Azuma (@azuma_eth)

Editor's Note: On the evening of August 11, BitMine Immersion Technologies, a publicly listed company on the New York Stock Exchange, announced that as of 10:59 PM Eastern Time on August 10, the company's total ETH holdings had reached 1,150,263, valued at over $4.96 billion. This not only makes BitMine the largest ETH treasury company in the world but also the only entity currently holding over 1 million ETH.

On the evening of August 12, a public filing from the U.S. SEC revealed that BitMine plans to increase the total amount of common stock available for sale under the sales agreement to a maximum of $24.5 billion to acquire more ETH.

With BitMine's aggressive buying spree, the price of ETH has surged, nearing new highs, and BitMine's stock price has skyrocketed by 1300% since the end of June. In the following text, top VC Pantera dissects and analyzes the valuation logic of such treasury companies using BitMine as an example, which may help in understanding BitMine's accumulation strategy and the premium logic of treasury stocks like BMNR.

Below is the original content from Pantera, translated by Odaily Planet Daily.

Our investment theory for digital asset treasury companies (DAT) is based on a simple premise: DAT can enhance the net asset value per share (NAV/share) through yield strategies, and long-term holding will yield more underlying token ownership than merely holding spot assets.

Therefore, compared to directly holding tokens or investing through ETFs, holding shares of DAT may offer higher return potential.

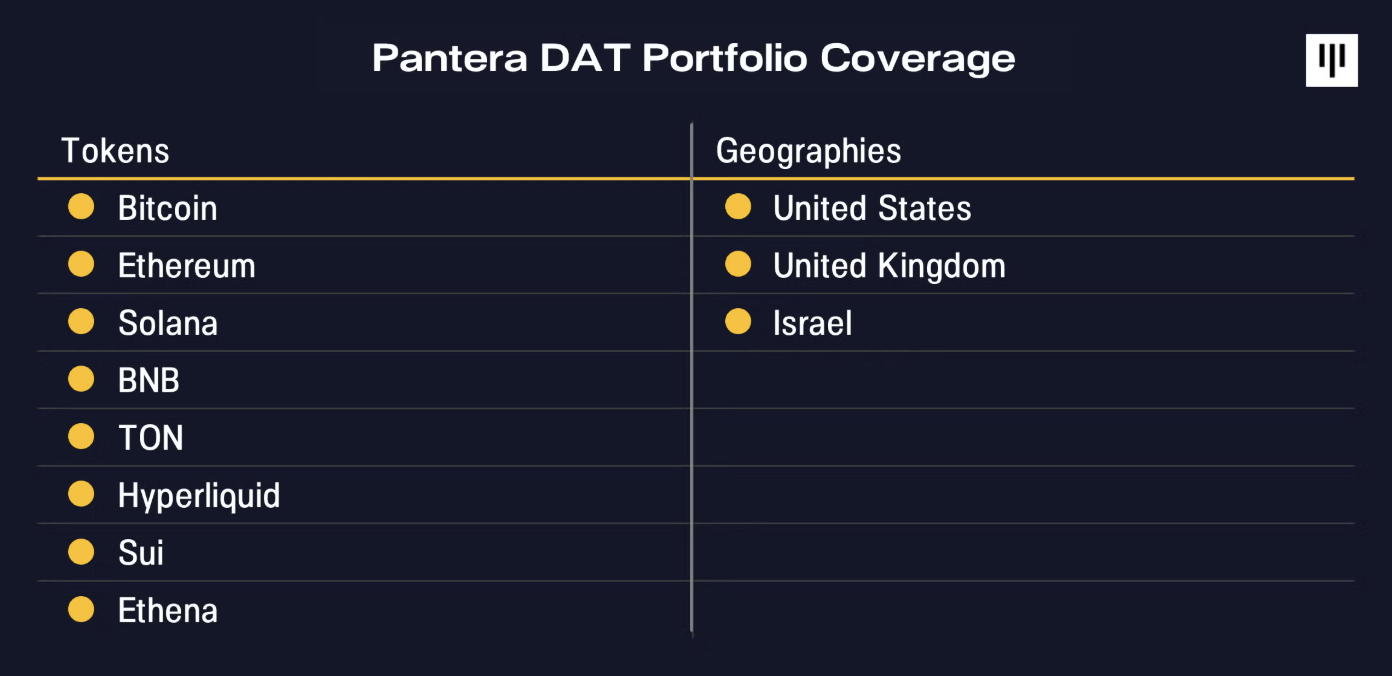

Pantera has invested over $300 million in DATs across different regions and focusing on different tokens. These DATs are leveraging their unique advantages to expand their digital asset holdings through per-share appreciation strategies. Below is an overview of our DAT portfolio.

BitMine (BMNR) Case Study

BitMine Immersion (BMNR) is the first investment of the Pantera DAT fund. BitMine has a clear strategic roadmap and strong execution capabilities. Tom Lee, founder of Fundstrat, serves as the chairman of BitMine's board and has proposed the company's long-term vision of acquiring 5% of the total ETH supply — which they refer to as "5% alchemy." We believe it is beneficial to explore value creation through BMNR as a case study of a high-execution DAT.

Since BitMine launched its asset treasury strategy, it has become the largest ETH asset treasury and the third-largest DAT globally, currently holding a total of 1,150,263 ETH, valued at $4.9 billion (as of August 10, 2025).

BMNR is currently the 25th most liquid stock in the U.S., with an average daily trading volume of approximately $2.2 billion (as of the five-day moving average on August 8, 2025).

Underlying Asset: Ethereum's Value Support

The success of DAT primarily depends on the long-term investment value of the underlying tokens. BitMine's core idea is that as Wall Street moves on-chain, Ethereum will become one of the most important macro trends in the next decade. As we mentioned last month, the tokenization of real-world assets (RWA) and the rise of stablecoins are driving the "on-chain migration" — currently, major public chains are hosting $25 billion in RWA and $260 billion in stablecoins, the latter of which has become the 17th largest holder of U.S. Treasuries.

On July 2, 2025, during a Pantera DAT conference call, Tom Lee stated: "Stablecoins have become the ChatGPT narrative of cryptocurrency."

As the primary platform for this migration, Ethereum will continue to benefit from the growing demand for block space. Financial institutions' reliance on Ethereum's security will further stimulate their participation in proof-of-stake networks, increasing the demand for ETH accumulation.

Increasing "Tokens Per Share (EPS)"

After establishing the investment value of the underlying tokens, the business model of DAT is to maximize its corresponding token holdings per share. The main methods to increase "tokens per share" include:

- Issuing shares at a premium: Issuing new shares at a price above the net asset value (NAV) per share;

- Issuing convertible bonds: Profiting from the dual volatility of stocks and tokens;

- Earning on-chain yields: Acquiring more tokens through staking rewards, DeFi yields, etc. (this is a unique advantage of ETH DAT compared to earlier Bitcoin DAT);

- Acquiring other DATs: Acquiring similar companies at prices close to or below NAV;

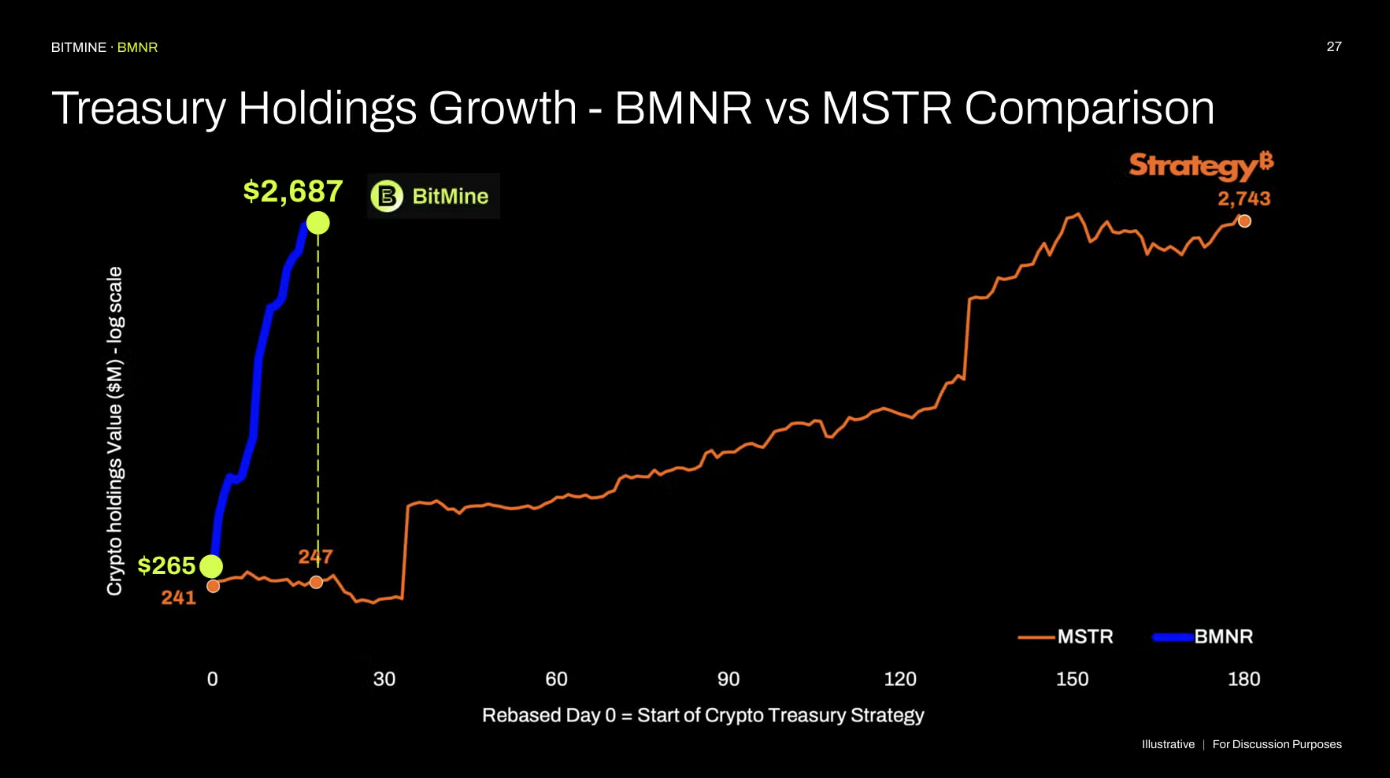

In the first month of launching its ETH treasury strategy, BitMine's growth rate of ETH holdings per share has surpassed the cumulative performance of Strategy (formerly MicroStrategy) in the first six months, currently mainly achieved through stock issuance and staking rewards, with potential future expansion into convertible bonds and other tools.

Three Driving Factors of Value Creation

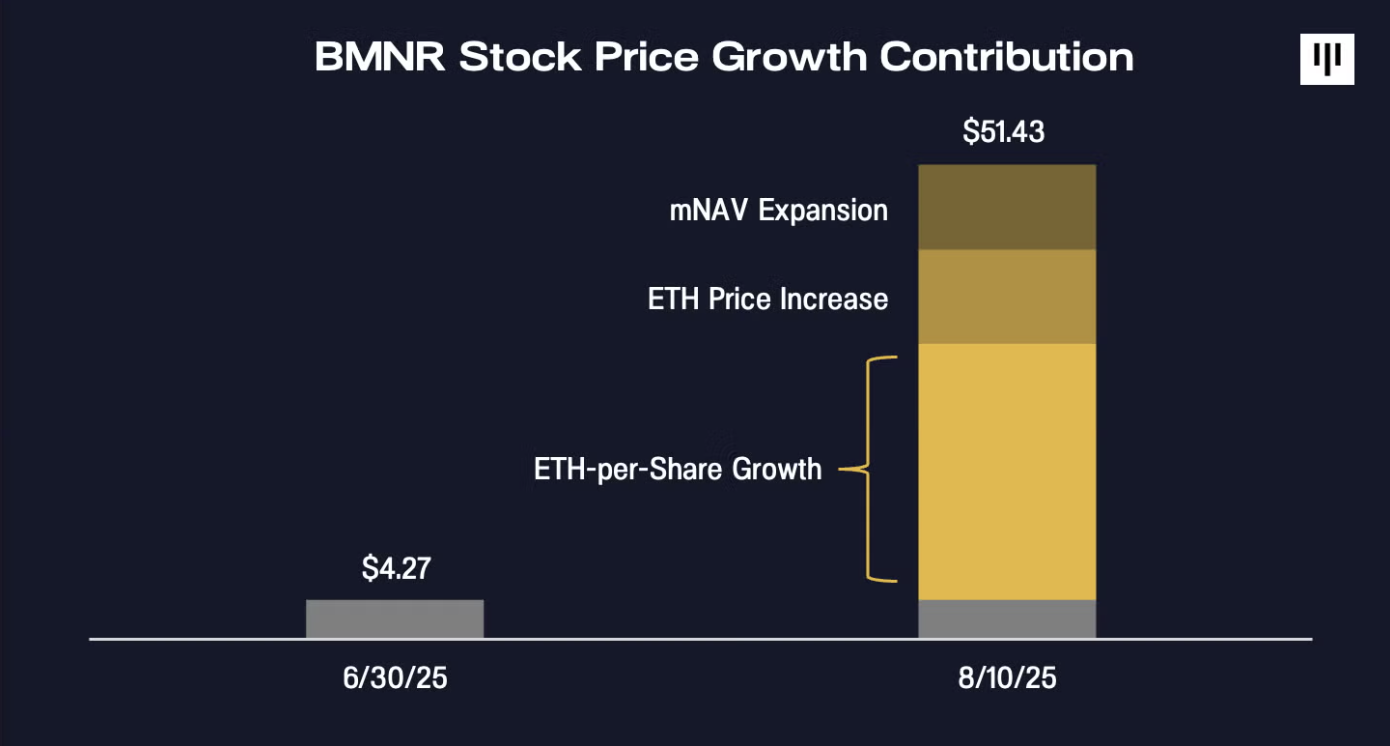

The stock price of DAT can be decomposed into the product of three main elements:

- Number of tokens per share;

- Price of the underlying token;

- NAV premium multiple (mNAV);

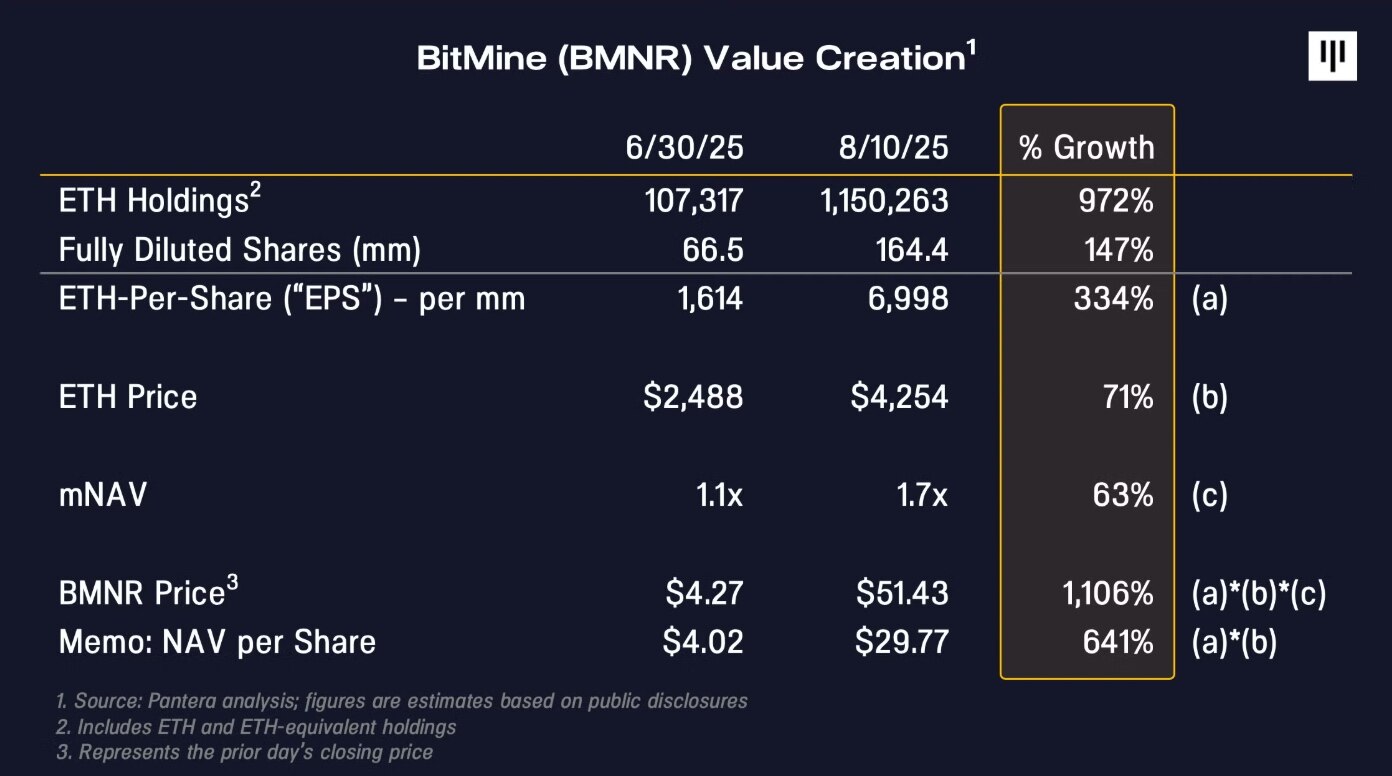

Taking BMNR as an example: At the end of June, BMNR's trading price was $4.27 per share, approximately 1.1 times its initial DAT capital raise NAV of $4 per share; a little over a month later, the stock closed at $51 (Odaily Note: the current stock price has risen to $62.44, corresponding to an increase of over 1300% since June 26), about 1.7 times its estimated NAV of $30 per share.

In this more than one-month period of a 1100% price increase:

- A 330% increase in the number of tokens per share contributed approximately 60% of the growth;

- The price increase of the underlying asset ETH (from $2500 to $4300) contributed approximately 20% of the growth;

- The mNAV increase to 1.7 times contributed approximately 20% of the growth;

This indicates that the rise in BMNR's stock price primarily comes from the management's controllable appreciation of each ETH, which is the core advantage of DAT compared to holding spot assets.

Another factor regarding mNAV that we have yet to discuss.

Naturally, one might ask: Why would someone buy DAT at a premium to NAV? I think it is useful to draw an analogy with balance sheet-based financial businesses (including banks). Banks seek to generate returns on their assets, and investors give valuation premiums to those banks that they believe can consistently generate returns above their cost of capital. The highest quality banks trade at a premium above NAV (or book value), for example, JPM trades at over 2 times NAV. Similarly, if investors believe that DAT can consistently increase its NAV per share, they may choose to value it at a premium to NAV.

We believe that BMNR's monthly NAV growth of approximately 640% has proven the reasonableness of its mNAV premium. BitMine's ability to continue executing its strategy will become evident over time, and challenges are inevitable along the way. BitMine's management team and its performance record to date have attracted support from traditional financial institutions, including Stan Druckenmiller, Bill Miller, and ARK Invest. We expect that the growth story of the highest quality DATs will gradually be appreciated by more institutional investors, similar to Strategy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。