Author: BlockBeats

Only those who dare to burn money have the chance to print new money.

This afternoon, OKX dropped a bombshell in the market—an unprecedented large-scale destruction of 65.25 million OKB, with a market value reaching hundreds of millions of dollars at current prices. Following the announcement, the price of OKB surged rapidly, increasing by over 100% in a short time, instantly becoming the focus in a relatively sluggish market environment. Such volatility has left many investors with a sense of déjà vu.

Market associations quickly returned to four years ago—2021, during the sensational "platform token destruction war." At that time, exchanges repurchased and destroyed their own platform tokens with real money, not only reducing market circulation and creating scarcity but also signaling profitability and business growth to the outside world. This was a smoke-free yet exceptionally fierce arms race: repeated destruction announcements drove up token prices and reshuffled market capitalization rankings.

Now, as OKB once again takes a large-scale destruction action, market sentiment and memories are ignited simultaneously. The difference is that the industry environment in 2025 is no longer what it was back then—global regulations are stricter, and the competitive model and ecological layout among exchanges have changed significantly.

However, this does not prevent us from asking the same question—on today's platform token track, is it still possible to see a tenfold market surge like in 2021?

Reviewing the 2021 Platform Token Destruction War

Let's rewind the timeline to four years ago.

From late 2020 to early 2021, the crypto market experienced an epic bull market. Bitcoin broke through the $20,000 mark and continued to rise, Ethereum returned to the $1,000 range, leading to a comprehensive explosion in the altcoin sector. A large amount of speculative capital first flowed into low-priced, highly volatile altcoins, pushing up short-term gains and rapidly igniting market sentiment.

Subsequently, as profits from altcoins were realized and flowed back, the trading volume and profits of exchanges were significantly boosted.

At this time, platform tokens had the conditions for a "post-increase": the high profits brought by the bull market enabled exchanges to repurchase and destroy tokens on a large scale, reducing circulation and creating scarcity; while the demand for market capitalization management made exchanges willing to use destruction to showcase their strength to the market.

Leading platforms keenly captured this opportunity, using destruction as a weapon in the competition for brand and investor confidence.

A "destruction show of strength" catalyzed by the altcoin frenzy and supported by exchange profits began, with platform tokens completing a positional shift from "catching up" to "leading."

In that destruction war, no one was willing to be a silent observer.

The frequency, scale, and variety of actions taken by major exchanges were almost as stimulating as the price curves. To occupy a higher position on the market capitalization leaderboard, they showcased their strength to the market in different ways—some launched a shock attack, some chose to stabilize the rhythm to build trust, some directly engaged in the secondary market, while others relied on high-frequency presence.

Ultimately, four distinct camps emerged on the battlefield, each representing a different strategy: BNB, HT, OKB, and FTT. They not only shaped the landscape of platform tokens in 2021 but also provided templates for later entrants to imitate or even improve upon.

In that smoke-filled destruction war, BNB was the first cannon to fire.

In April 2021, Binance burned 1,099,888 BNB in one go, amounting to $595 million at the time, directly setting a record for the largest single destruction in crypto history. This not only drastically reduced circulation but also demonstrated to the market what "the speed of profit realization" looked like. Shortly after, CZ sent out an even more aggressive signal—completing the destruction target of 100 million tokens ahead of schedule and introducing an automatic destruction mechanism, making this action sustainable and predictable. Such bold moves and steady rhythm allowed BNB to rise from $37 to $690 during that year's bull market, securing a spot among the top three in market capitalization globally.

Similar to BNB, HT's rise was not the first wave of leadership but followed the rhythm of "altcoins rising first—platform tokens rising later." In January-February 2021, funds mainly flowed into hot altcoins, and when these funds returned to exchange profits and platform tokens, HT experienced a concentrated explosion. From about $4 in early January 2021 to nearly $39 at its peak in May, the increase was close to tenfold.

OKB chose a more direct route. It eliminated the intermediate repurchase step and directly bought and destroyed tokens in the secondary market. This approach was like shooting bullets directly into the price curve, reducing the space for speculators to ambush in advance while also creating a significant market impact at the moment of the announcement. Throughout 2021, OKB destroyed nearly 30 million tokens, with the price soaring from single digits to $40, firmly occupying a position in the second tier.

Image source: CCTV interview video

As a newcomer, FTT clearly did not want to lose in rhythm to its established competitors. FTX chose to strike frequently—repurchasing and destroying tokens weekly, incorporating trading fees, leveraged token redemption fees, futures funding fees, and other revenues into its arsenal. This sense of rhythm kept it at the center of discussion during the 2021 bull market, with prices peaking at $85, second only to BNB and OKB. However, this model was highly dependent on trading volume, and once the market reversed, the firepower would dwindle. As expected, in 2022, when exchanges faced crises, FTT's story abruptly ended, falling from stardom to ruin.

The entire destruction war's firepower concentrated in the first four months of 2021.

Between January and April, platforms like BNB, OKB, HT, and FTT frequently announced record-breaking repurchase and destruction data, with single instances often exceeding $100 million. Coupled with high trading volumes during the bull market, token prices surged in waves, continuously pushing market sentiment to its peak.

Entering July-September, the destruction rhythm continued, but the scale was reduced compared to the first half of the year. Announcements were more about maintaining expectations, and price reactions became milder, entering a cooling-off period. By the fourth quarter, as BTC and ETH entered adjustments, trading volumes at exchanges significantly declined, leading to a drop in both the scale and frequency of destructions. The news effect could no longer drive platform tokens strongly upward, and enthusiasm quickly waned.

Ultimately, this nearly year-long destruction arms race not only left steep peaks and valleys on the price curve but also reshaped the landscape of platform tokens. BNB, with its dual advantages of firepower and rhythm, firmly held the top position; OKB, with its robust mechanism and decisive execution, secured a solid place in the second tier; while FTT, despite its earlier prominence in the bull market, collapsed in 2022 due to its model's excessive reliance on trading volume and external conditions, becoming a cautionary tale in the history of platform tokens.

The aftermath of this war continues to this day, providing a sobering reminder for later entrants—within the world of platform tokens, not only must one be able to burn, but one must also endure.

Platform Tokens That Soared in 2025

The rise of platform tokens is often not a linear ascent but rather a "stair-step" leap: they may seem calm most of the time, but once a key event occurs (massive destruction, major product launch, licensing approval, ecological explosion), prices can surge steeply in a short time, then establish a new price center at the new height.

In several past cycles, these "super surge-type" platform tokens have almost all followed a common script:

First, pave the way—lay the groundwork in ecology, products, compliance, etc.; then ignite—trigger the market with a large-scale action, such as BNB's Alpha launch, OKB's massive destruction, or BGB's dual ecological closed loop; take advantage of the momentum to expand—continuously release new positive news at new price highs to maintain enthusiasm and capital inflow.

In 2025, we can see BNB, OKB, and BGB all interpreting this logic in their own ways.

1. BNB

From about $250 at the beginning of 2023 to over $800 in 2025, BNB achieved more than three times the increase in two years.

The main line of this round of increase was largely ignited by Binance Alpha.

In the past six months, Binance Alpha has become the largest traffic pool in the crypto space. On the Alpha page, users can participate in early project IDOs by completing tasks, staking BNB, and have the opportunity to gain token lottery qualifications before the project launches, with retail investors earning far more than the average white-collar salary each month.

However, Alpha is not an isolated product; it connects the entire on-chain operation scenarios on BNB Chain: Alpha not only provides tasks and lottery opportunities but also serves as a traffic entry point guiding users to explore BNB Chain on-chain.

Users transitioned from being passive "coin hoarders, fee reducers" to "on-chain natives"—learning to use various on-chain ecosystems like Binance Wallet, Pancakeswap for swaps, LPs, lending, and even trading memes and contracts, becoming true "BNB Chain natives." This shift in operational habits is a significant driving force behind BNB's growth during this cycle.

Since early 2024, BNB Chain has not only seen the explosion of core projects like Pancake, Lista, Four.meme, and Aster at the protocol level, but also witnessed a simultaneous rise in overall network metrics.

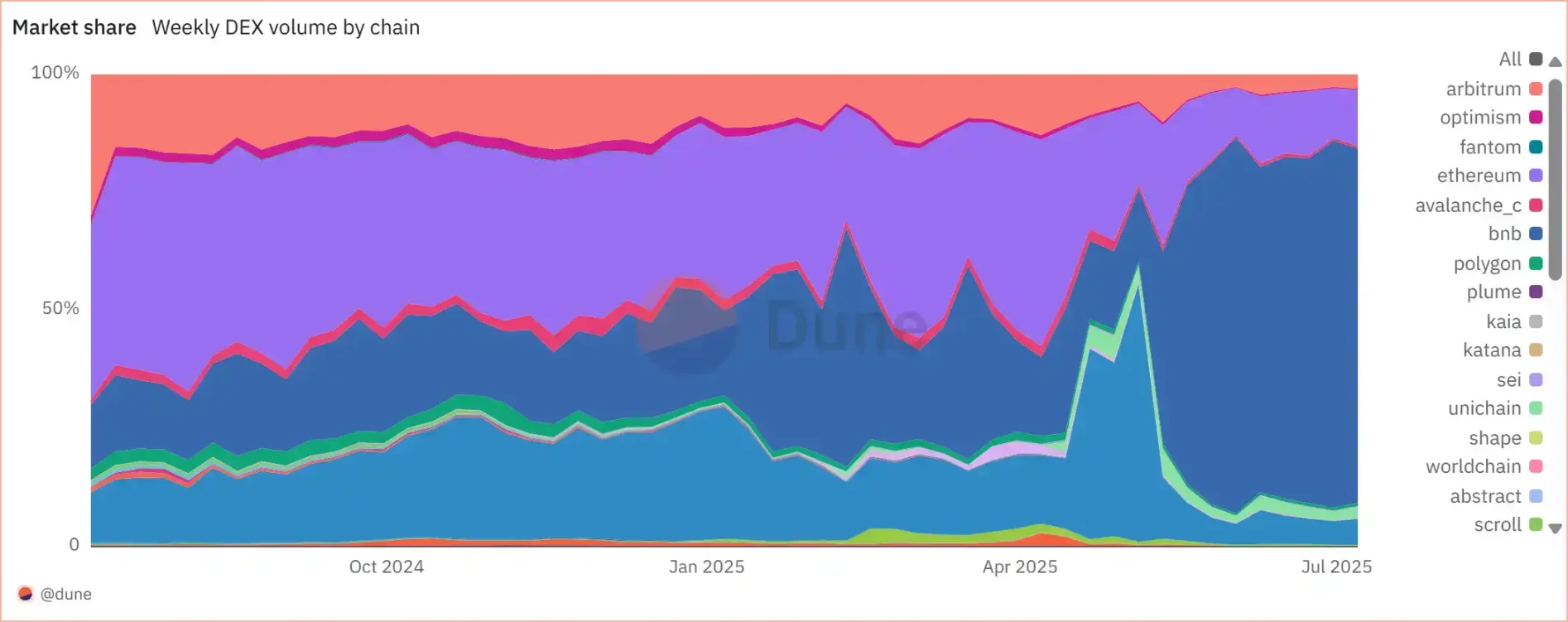

The evolution of each public chain's share in weekly DEX trading volume, with the dark blue area representing BNB Chain, data source: Dune

From this stacked area chart, it can be seen that BNB Chain has risen from a "steady follower" to the largest public chain by trading volume over the past year. Additionally, the Maxwell upgrade has brought new breakthroughs, as the third core network upgrade of BNB Chain this year reduced block time from 1.5 seconds to 0.75 seconds, resulting in faster on-chain responses.

To some extent, BNB has completed its evolution from "platform token endorsement" to "ecological value carrier," achieving absolute dominance in a multi-chain landscape.

From a broader financial market perspective, BNB has also attracted major institutions that are turning billions of dollars in strategic bets into on-chain reserves and capital accumulation, becoming a significant choice for holding coins in the U.S. stock market.

This evolutionary path from platform equity to ecological main token, and then to institutional reserve asset, is the main reason for BNB's continuous rise over the past two years.

2. OKB

From 2023 to 2025, OKB rose from $28 to $110.

In these two years, OKX's most notable main lines have been two: strengthening global licensing layout and accelerating the construction of Web3 tools, such as the OKX wallet.

In 2023, OKX established a subsidiary in France, set up an office in Turkey, and actively pursued regulatory licenses in Dubai, while also releasing proof of reserves to enhance transparency. By 2024 to 2025, the licensing matrix rapidly improved, obtaining the Singapore MAS payment institution license, the full operational license from Dubai VARA, and becoming one of the first crypto trading platforms to receive a MiCA license.

During the same period, OKX transformed its wallet product into a strategic core, transitioning from a "platform function" to a decentralized entry point: in 2022, it launched a Web3 wallet that supports multi-chain asset management, NFT, and DApp functionalities. In 2023, the wallet added an "authorization history analysis" feature to enhance user security and controllability. The most significant growth occurred during the Bitcoin ecosystem explosion, becoming a core channel for the Ordinals trading market: in 2023, the trading volume exceeded $1 billion, capturing 91.7% of the market share. Subsequently, OKX also launched a standalone OKX Wallet application, supporting over 130 blockchains, with daily trading volumes exceeding $1 billion, adding 500,000 new wallets daily, and total managed assets surpassing $44.5 billion.

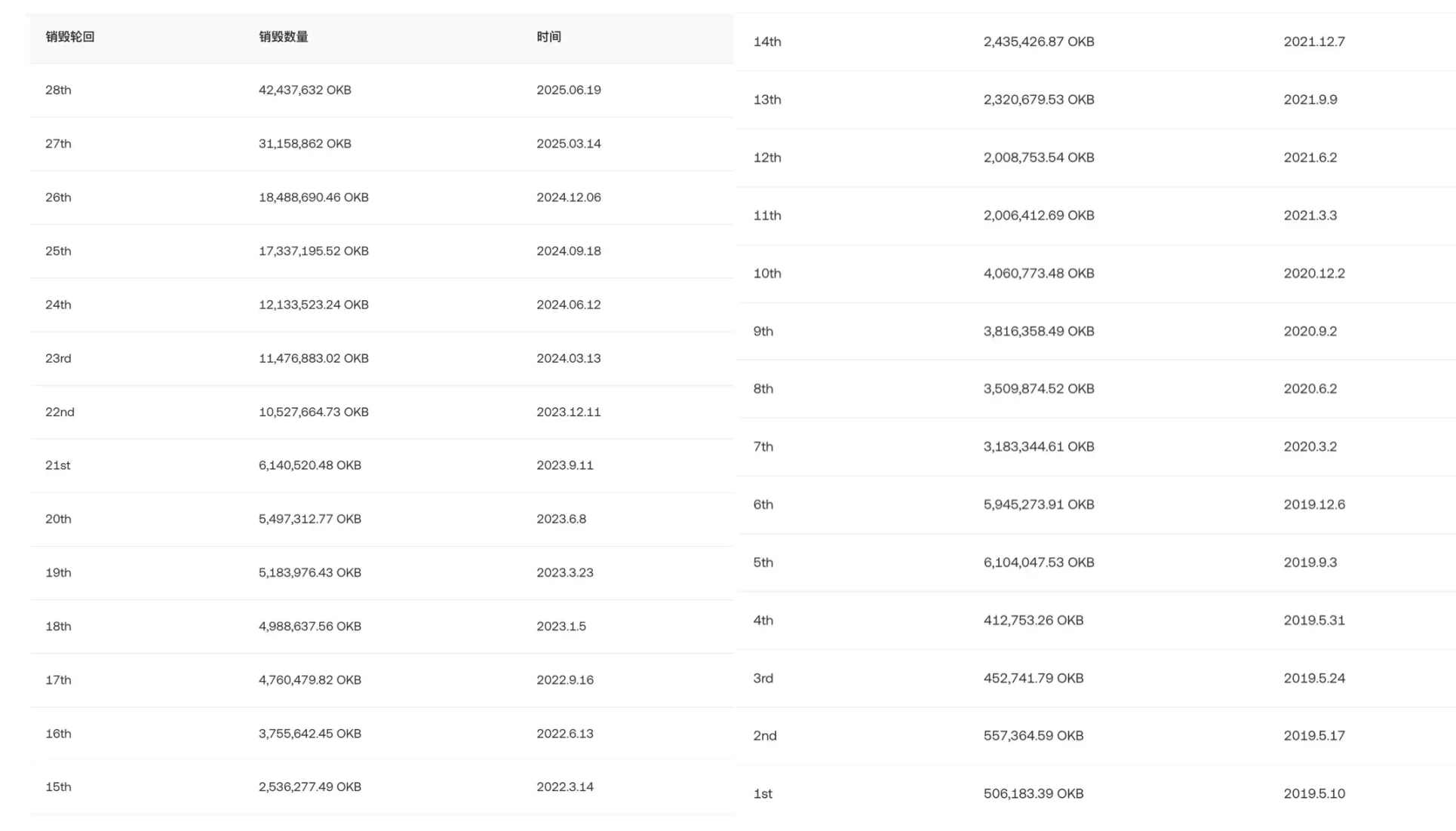

2025 was the year of the most significant increase for OKB, especially on the day it announced the "massive destruction of OKB." This marked the 29th destruction in OKB's history and the final destruction. The scale was rare in the crypto space.

On August 13, OKX announced the one-time destruction of over 65 million OKB from historical repurchases and reserves, and switched to automatically destroying all OKB entering the black hole address via smart contracts, completely halting manual destruction.

This means that the total issuance of OKB will be permanently locked at 21 million, establishing a scarcity level comparable to Bitcoin.

As soon as the news of the "massive destruction" was released, the market ignited instantly. At 14:15, OKB began to accelerate, reaching $99.27 at 14:40, an increase of 112%; in just 25 minutes, the price doubled. Subsequently, the battle between bulls and bears intensified, and OKB continued to rise, peaking at around $134 at 15:00, with a maximum increase of 186% in a single hour.

Total of 29 destructions of OKB

Accompanying the "massive destruction" was the X Layer upgrade, which represents OKX's "second fuse" in its public chain strategy.

X Layer is its zkEVM Layer 2 network based on Ethereum, supported by Polygon CDK technology. The upgraded X Layer will achieve a throughput increase to 5000 TPS; gas costs will drop to nearly zero; and security and compatibility with the Ethereum mainnet will be significantly enhanced.

OKB will continue to serve as the only gas and native token for X Layer, providing core value support in paying transaction fees, on-chain governance, and ecological incentives. This means that the on-chain demand for OKB and its external value binding will deepen further, transitioning from a purely CEX platform token to a decentralized "public chain gas."

This shift can also be subtly signaled by the rumors of "OKX's IPO in the U.S."

After Trump took office, the IPO gap in the crypto industry opened up, and OKX's consideration of an IPO in the U.S. is something that is "both unexpected and expected." On June 23, according to The Information's crypto reporter Yueqi Yang, the cryptocurrency trading platform OKX, after returning to the U.S. market in April this year, is considering an initial public offering (IPO) in the United States.

BiyaPay analysts believe this is a necessary stage in the industry's development: the past "barbaric growth" is no longer sustainable, and if it wants to win the trust of global financial institutions and users, compliance and going public is a rational choice. The involvement of regulatory bodies like the SEC means more constraints, but it will also push the entire crypto industry towards transparency, stability, and capitalization.

For OKB, this will be a rebranding.

To reduce the securities attributes constrained by U.S. stock listing requirements, OKB's path must be as a gas at the public chain level, thus transforming into a part of the decentralized ecosystem, minimizing the binding relationship with CEX.

3. BGB

From $0.20 at the beginning of 2023 to $5 in 2025, BGB has charted a nearly 25-fold curve over two years.

Bitget's approach is closer to that of OKX. The rise of BGB is not due to a single event but rather the continuous accumulation of platform strategy, ecological binding, and expansion of use cases.

In 2025, Bitget's core actions regarding platform tokens are accelerated destruction and revenue repurchase.

Previously, BGB destruction was conducted on a quarterly basis, but this year they directly increased the frequency and used part of the transaction fee income for BGB repurchase, which then entered the destruction pool. This transparent and sustainable deflationary mechanism directly links the platform's trading activity with price expectations.

At the same time, Bitget launched a dual model of Launchpad and staking mining. Launchpad provides early project participation opportunities, allowing users to stake BGB to obtain quotas. Staking mining combines CEX users' asset retention with on-chain mining returns, making holding BGB not just "hoarding coins and waiting," but an asset that continuously generates income.

More importantly, Bitget has also integrated its wallet into this closed loop.

After the upgrade of Bitget Wallet, BGB is interconnected with the points system, allowing wallet users to earn or consume BGB points directly when swapping on-chain, cross-chain, or participating in DeFi. This step extends the use cases of BGB beyond the exchange, expanding the value anchor of the platform token from a single CEX internal to real on-chain demand.

This "internal and external cultivation" approach allows BGB to carve out an independent path in the competition among CEX platform tokens:

Internally, it uses Launchpad and staking to lock liquidity, while externally, it creates consumption scenarios with wallets and on-chain points, supplemented by high-frequency destruction for value support. From the price curve, BGB does not rely on a single positive event for a surge but continuously builds market expectations through new actions that can be implemented each quarter.

This seems to explain why BGB can maintain high beta while steadily rising among similar platform tokens in 2025.

The Platform Token Race Will Not Cease

Looking back at 2021, that "destruction war" used real money to boost market capitalization and reshape the landscape; four years later, platform tokens remain the sharpest weapon for exchanges—they can create scarcity and FOMO while also demonstrating real use value in ecological expansion.

The difference is that platform tokens in 2025 are no longer merely fee discount coupons but are composite assets fighting on three fronts: global licensing, on-chain ecology, and capital markets. The respective rising paths of BNB, OKB, and BGB are examples of this round of evolution.

Could this be the starting point for a new round of CEX "arms race"?

No one can provide a definitive answer. But it is certain that in this race, there has never been a true ceasefire—whoever can burn, sustain, and run fast will be able to leave their competitors behind in the next market cycle.

After all, in the increasingly competitive CEX landscape, what matters is not just destroying circulation to boost token prices, but also the opportunities presented by competitors.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。