Author: Nancy, PANews

As the prices of Bitcoin and Ethereum continue to rise, Wall Street is accelerating its control over the pricing power of crypto assets through crypto ETFs, becoming an important barometer for insights into price trends and market sentiment. The recently concluded Q2 institutional earnings reports show that the strong influx of institutional funds has driven the expansion of crypto ETF scales while also intensifying the differentiation in market patterns, particularly as BlackRock's products have become the core allocation choice for new funds, while the performance of ETFs from other institutions has been relatively lackluster.

Distinct Fund Flow in Spot ETFs, BlackRock Dominates Inflows

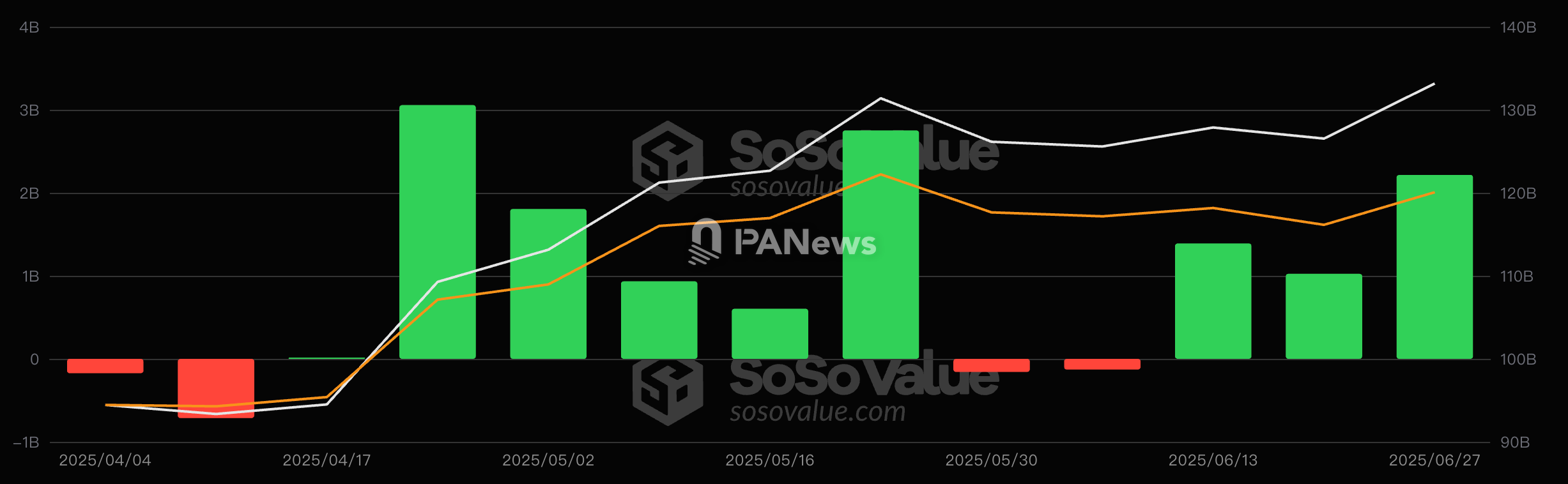

In Q2 of this year, U.S. Bitcoin and Ethereum spot ETFs performed strongly overall, but fund inflows were highly concentrated, with long-tail ETFs performing relatively poorly.

According to SoSoValue data, 12 related ETFs recorded a total net inflow of $12.8 billion in the quarter, averaging about $4.267 billion per month, but the inflows were almost entirely dominated by one entity.

BlackRock's IBIT attracted $12.45 billion in a single quarter, accounting for nearly 96.8% of the total market net inflow, with its stock price rising by 23.1% during the same period. In contrast, the performance of other institutions was lackluster, with Fidelity's FBTC recording about $490 million in net inflows and a stock price increase of about 23.15%; Grayscale's mini BTC saw inflows exceeding $330 million, with a stock price increase of 22.9%; Bitwise's BITB had inflows of over $160 million, with a stock price increase of 23%; VanEck's HODL had net inflows of less than $150 million, with a stock price increase of about 23.1%; the remaining seven products (such as Grayscale's GBTC and ARK Invest's ARKB) generally experienced net outflows.

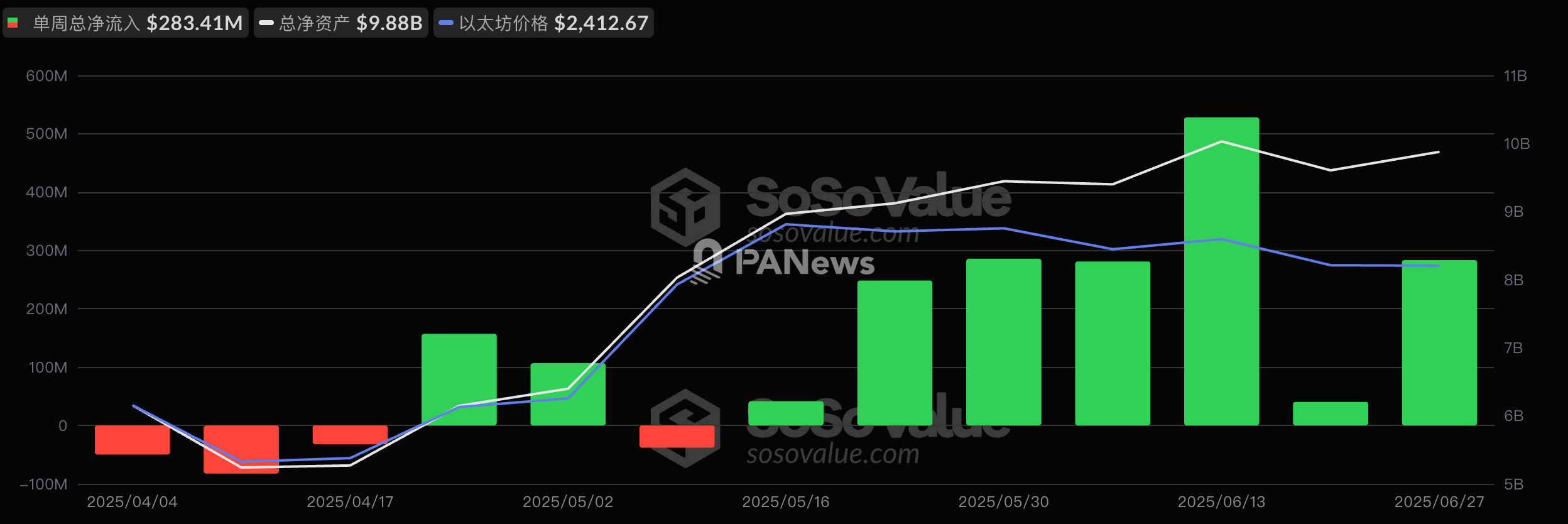

Ethereum spot ETFs also performed impressively. SoSoValue data shows that nine Ethereum spot ETFs had a cumulative net inflow of over $1.79 billion in this quarter, averaging over $590 million per month.

Among them, BlackRock's ETHA remained the main recipient of funds, with a net inflow of nearly $1.45 billion and a stock price increase of 11.5%; Fidelity's FETH attracted over $250 million in net inflows, with a stock price increase of 34.6%; Grayscale's mini ETH saw net inflows exceeding $160 million, with a stock price increase of 34.7%; Bitwise's ETHW had net inflows of about $33.27 million, with a stock price increase of 36.37%; VanEck's ETHV received $5.81 million in inflows, with a stock price increase of 34.76%; Grayscale's ETHE experienced net outflows exceeding $130 million, with a stock price increase of 34.26% for the quarter; Franklin's EZET had a net inflow of about $632,000, with a stock price increase of about 34.61%; 21Shares' CETH saw inflows of $814,000, with a stock price increase of 34.63%; Invesco's QETH had net inflows of $337,000, with a stock price increase of about 33.6%.

12 Companies Hold a Total of $15.8 Billion, BlackRock Products Become Core Holdings

PANews has summarized the Bitcoin/Ethereum spot ETF holdings of 12 listed companies in Q2, showing that these institutions generally increased their allocations to Bitcoin and Ethereum ETFs, with total holdings of about $15.8 billion, accounting for about one-tenth of the total market value of all Bitcoin ETFs, while also enhancing risk management and yield optimization through call/put options.

In terms of Bitcoin spot ETFs, IBIT and FBTC are the key targets for institutional investment, with most institutions such as Goldman Sachs, Jane Street, Haina International, and Millennium Management significantly increasing their holdings; meanwhile, ARKB saw explosive increases in holdings among some institutions, such as Haina International and Schonfeld Strategic Advisors. For Ethereum ETFs, ETHA became the preferred target for various institutions, with Goldman Sachs, Millennium Management, and Capula Management all significantly increasing their positions in Q2. FETH was also increased by several institutions, but its scale and increase were relatively smaller compared to ETHA, while most other Ethereum ETFs lagged behind.

Goldman Sachs: Spot Holdings Exceed $2.7 Billion, ETHA Increased by 283%

As of Q2 2025, Goldman Sachs has increased its investment in crypto ETFs, with its spot holdings exceeding $2.7 billion, particularly notable for the increase in Ethereum-related products. Specifically, Goldman Sachs slightly increased its holdings in IBIT this quarter, with holdings exceeding $1.568 billion, and held over $1.25 billion in IBIT call and put options; at the same time, the institution also increased its holdings in FBTC, with a value exceeding $430 million, while reducing corresponding put options.

In terms of Ethereum spot ETFs, Goldman Sachs significantly increased its holdings in ETHA, with the number of shares rising by 283% quarter-on-quarter, and the market value of its holdings exceeding $474 million, along with new call options valued at over $14.3 million; additionally, it slightly increased its holdings in about 1.95 million shares of FETH, with a holding value reaching $246 million.

Brevan Howard: Spot Holdings Close to $2.3 Billion, Significantly Increased IBIT

Brevan Howard is one of the largest macro hedge funds in the world. As of Q2 2025, Brevan Howard held over 3,750 shares of BlackRock's IBIT (valued at about $2.296 billion), having increased its holdings by over 15.9 million shares compared to Q1, an increase of 74%. Additionally, Brevan Howard also added $400,000 worth of IBIT put options this quarter to hedge against potential risks. Furthermore, the institution also added over 43,000 shares of BlackRock's ETHA, valued at about $806,000.

Jane Street: Main Increases in IBIT and ETHA, Dual Strategy in Spot and Options

In Q2 2025, globally renowned quantitative trading firm Jane Street significantly increased its spot allocations in multiple Bitcoin/Ethereum spot ETFs, with total holdings exceeding $2.2 billion, and enhanced yield and risk management through volatility trading and hedging, with holdings primarily centered on BlackRock's ETF products.

In terms of Bitcoin spot ETFs, this quarter Jane Street held 23.967 million shares of IBIT (valued at about $1.467 billion), an increase of 268% compared to Q1, while also significantly increasing its exposure to IBIT call and put options, with the total value of related options holdings rising to $1.78 billion; ARKB held 11.43 million shares (valued at about $409 million), a quarter-on-quarter increase of 128%, and simultaneously expanded its ARKB call and put options significantly; GBTC held 1.02 million shares (valued at about $86.55 million), a quarter-on-quarter increase of 219%, while holding about $24 million in related call and put options; BITO's holdings exceeded $53.74 million, with shares increasing by 232% compared to Q1; it also newly held 190,000 shares of BITB, valued at about $11.6 million. In contrast, Jane Street slightly reduced its holdings in Grayscale's mini BTC and significantly decreased its holdings in DEFI.

In terms of Ethereum spot ETFs, Jane Street held ETHA valued at over $130 million in Q2, having increased its holdings by over 3.78 million shares compared to Q1, and added over $42 million in related call and put options; FETH's holdings reached $47.37 million, a quarter-on-quarter increase of 36%. Additionally, the holdings of ETHE, ETH, EZET, and QETH were all around several million dollars, while ETHW and CETH were significantly reduced or even completely liquidated.

Haina International Group: Heavy Holdings in IBIT and FBTC, Aggressively Building Ethereum ETF Positions

As of Q2 2025, Haina International Group held Bitcoin/Ethereum spot ETFs valued at nearly $1.5 billion and increased its options scale to manage volatility risks.

Among them, Haina International held over $680 million in IBIT, as well as up to $1.56 billion in call options and $750 million in put options; FBTC's holdings exceeded $310 million, while it allocated nearly $950 million in call and put options; ARKB's holdings increased to $357 million, with the number of shares increasing by 4,565% quarter-on-quarter, making it the most significant increase in holdings; BITB's share count also increased by 1,093% quarter-on-quarter, with a holding value of about $100 million; and it also held several thousand dollars in Grayscale's GBTC and BTC, as well as several million dollars in BTCW and HODL.

In terms of Ethereum spot ETFs, Haina International held ETHA valued at $17.9 million and added over $84 million in call and put options; Grayscale's ETH saw its share count increase by 588% quarter-on-quarter, with holdings valued at about $23.27 million. Additionally, the institution also expanded and added positions in FETH, FETH, and ETHW, with most valued in the millions.

Horizon Kinetics Asset Management: Bitcoin ETF as Core Allocation, Position Changes Not Significant

Horizon Kinetics Asset Management's crypto ETF positions are valued at over $1.43 billion, with Bitcoin ETFs as the main allocation. In Q2, Horizon Kinetics slightly reduced its holdings in GBTC, with holdings still exceeding $1.23 billion, and held $146 million in Grayscale BTC, with the number of shares remaining the same as the previous quarter; at the same time, IBIT's holdings expanded to $58.88 million, with the number of shares increasing by about 11% quarter-on-quarter; HODL and FBTC positions did not show significant changes, with asset values in the hundreds of thousands. Additionally, the institution also held a small amount of Grayscale's ETHE and ETH.

Schonfeld Strategic Advisors: Total Holdings Exceed $1.1 Billion, Significantly Increased ARKB

Multi-strategy hedge fund management company Schonfeld Strategic Advisors continued to increase its holdings in Bitcoin and Ethereum-related funds in Q2, with total holdings valued at about $1.12 billion.

In terms of Bitcoin spot ETFs, Schonfeld Strategic Advisors held FBTC valued at over $437 million, with a slight increase in the number of shares quarter-on-quarter; IBIT's holdings increased to about $347 million, with new call options valued at $1.53 million; ARKB's share count surged by 1,228% quarter-on-quarter, with a holding value close to $120 million; BITB's holding value expanded to $113 million, along with about $530,000 in GBTC.

At the same time, the institution increased its holdings of approximately 1.68 million shares of ETHA this quarter, with a holding value of $84.45 million; it established a new position of 500,000 shares of ETHW, valued at about $9.03 million; the number of shares held in FETH remained unchanged from the previous quarter, valued at approximately $4.04 million.

Avenir Group: IBIT Holdings Exceed $1 Billion, Ranking First Among Asian Institutional Investors

Avenir Group is a family office founded by Li Lin. As of Q2 this year, Avenir Group holds over $1.01 billion in IBIT, with the number of shares increasing by 12% quarter-on-quarter, ranking first among Asian institutional investors, and it added call options valued at approximately $12.2 million; the holding value of FBTC is about $5.51 million.

Millennium Management: IBIT Accounts for More Than Half, Increasing Ethereum ETF Allocation

As of Q2 2025, global alternative investment management company Millennium Management holds over $940 million in crypto ETFs, primarily in Bitcoin spot ETFs.

Among them, Millennium Management holds IBIT valued at over $488 million, with the number of shares increasing by 22% compared to Q1, and it also holds call and put options valued at over $28 million; the number of shares held in FBTC remained relatively unchanged from the previous quarter, with an asset value reaching $160 million; BITB saw a slight reduction, with a holding value close to $45.3 million; ARKB holds approximately $38 million, with the number of shares increasing by 207% quarter-on-quarter; Grayscale BTC and GBTC holdings are valued at nearly $30 million and $1.96 million, respectively.

In terms of Ethereum spot ETFs, Millennium Management added over 5.8 million shares of ETHA in Q2, valued at over $110 million; the number of shares held in Grayscale ETH also increased by 103% quarter-on-quarter, with a holding value reaching $58.85 million; FETH also saw a significant increase in holdings, with a holding value of approximately $10.52 million; the position in ETHW remained unchanged from the previous quarter, with the asset value rising to around $2.6 million.

Capula Management: Total Holdings Exceed $800 Million, IBIT Dominates

Capula Management is one of the largest hedge fund management companies in Europe, holding over $868 million in Bitcoin/Ethereum spot ETFs in Q2. Among them, Capula Management holds over 9.48 million shares of IBIT (valued at about $580 million), an increase of 23% quarter-on-quarter. At the same time, the institution holds FBTC valued at approximately $140 million, but this represents a significant decrease of 65% compared to Q1.

In terms of Ethereum spot ETFs, Capula Management expanded its related allocation this quarter, with holdings of ETHA surging by 196% to 5.35 million shares, valued at over $100 million; while FETH's holdings slightly increased to about $45.21 million.

Symmetry Investments: Holds Over $680 Million in IBIT, Slight Increase in Q2

Symmetry Investments is a hedge fund company based in Hong Kong, focusing on fixed income arbitrage and global macro strategies. In Q2 2025, Symmetry Investments increased its holdings in IBIT by approximately 4% compared to the previous quarter, holding over 11.23 million shares, corresponding to a value of over $688 million.

Mubadala Investment: Maintains IBIT Holdings

Mubadala Investment is a sovereign investment institution with a global asset management scale exceeding $330 billion. The fund held over 8.72 million shares of IBIT in Q2, maintaining the same number of shares as the previous quarter. However, due to the increase in IBIT's stock price, its holding value rose to approximately $534 million.

Sculptor Capital: Total Holding Value Exceeds $500 Million, Significantly Increased IBIT Holdings

Global alternative asset management company Sculptor Capital held over $500 million in Bitcoin spot ETFs in Q2. Specifically, the institution significantly increased its holdings in IBIT this quarter, with the number of shares increasing by 60%, and the holding value exceeding $270 million. Additionally, the institution holds FBTC and BITB valued at over $200 million and $21.52 million, respectively, with the number of shares remaining unchanged from Q1.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。