Author: 0xjacobzhao and ChatGPT 5

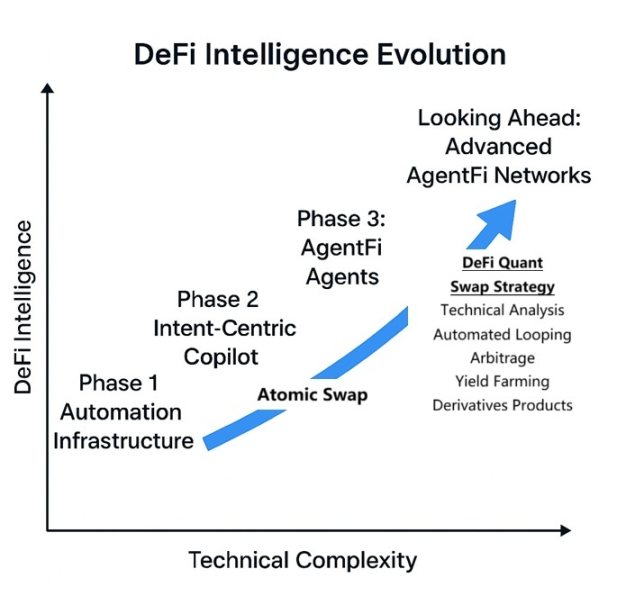

In the research report titled "The Intelligent Evolution of DeFi: The Evolution Path from Automation to AgentFi", we systematically sorted and compared the three stages of intelligent development in DeFi: Automation Tools, Intent-Centric Copilot, and AgentFi (On-Chain Agents). We pointed out that a significant portion of current DeFi projects still focuses on the core capability of "intent-driven + single atomic interaction" Swap transactions. These interactions do not involve ongoing yield strategies, lack state management, and do not require complex execution frameworks, making them more suited to the lightweight execution model of intent assistants and cannot be strictly considered as AgentFi.

In our high-level vision for the future of AgentFi, in addition to lending and yield farming, which are currently the most valuable and easily implementable scenarios, Swap combination strategies are also a potential direction. When multiple Swaps are combined in sequence or conditionally, they form a "strategy link," such as arbitrage or yield farming. This model requires state machine management for positions, condition triggers, and multi-step automated execution, embodying the complete closed-loop characteristics of AgentFi—perception → decision → execution → rebalancing.

1. DeFi Quantitative Strategy Map and Feasibility Analysis

Traditional Quantitative Finance relies on mathematical models, statistical methods, and algorithms, using historical prices, trading volumes, macro indicators, and other data for data-driven decision-making, and achieving low-latency, high-frequency, automated trading through programmatic execution, supplemented by strict risk control (stop-loss, position management, VaR, etc.). Its main applications include high-frequency trading (HFT), trend following and mean reversion (CTA), cross-market/cross-asset arbitrage, and derivatives pricing and hedging, forming a mature infrastructure, exchange system, and data ecosystem in traditional markets.

On-Chain Quantitative Finance continues the logic of traditional quant but operates in the programmable market structure of blockchain. Its data comes from on-chain transaction records, DEX quotes, and DeFi protocol states, executed in smart contracts (AMM, lending, derivatives protocols), with trading costs including Gas, slippage, and MEV risks, and can build automated strategy links through the composability of DeFi protocols.

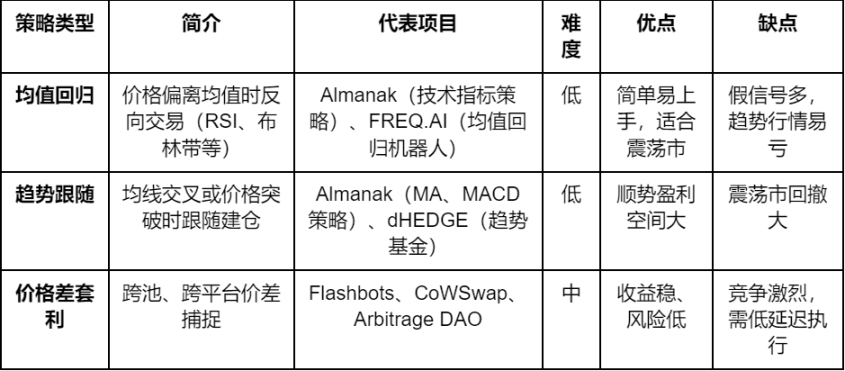

Currently, on-chain quantitative finance is still in its early stages, constrained by multiple factors that hinder the implementation of complex quantitative strategies: first, in terms of market structure, insufficient liquidity depth and the lack of ultra-fast matching mechanisms in AMM limit the feasibility of high-frequency and large transactions; second, in terms of execution and costs, on-chain block delays and high Gas fees make frequent trading unprofitable; third, in terms of data and tools, the development and backtesting environment is not perfect, and the data dimensions are singular, lacking multi-source information such as corporate finance and macroeconomics. Among the practically implementable DeFi quantitative strategies, the current mainstream directions focus on:

- Mean Reversion / Trend Following — Making buy/sell decisions based on technical indicator signals (e.g., RSI, moving averages, Bollinger Bands);

- Inter-Period Arbitrage — Represented by protocols like Pendle, profiting from the difference between fixed and floating yields;

- Market Making + Dynamic Rebalancing — Actively managing AMM liquidity ranges to earn fees;

- Leverage Cycle Yield — Enhancing capital utilization through lending protocols.

Future potential growth areas include:

- Maturation of the on-chain derivatives market, especially the widespread application of options and perpetual contracts;

- More efficient off-chain data access, enriching model input dimensions through decentralized oracles;

- Multi-Agent collaboration, achieving automated execution and risk balancing of multi-strategy combinations.

2. Almank's Positioning and Vision: Exploring AgentFi in On-Chain Quantitative Finance

In previous Crypto AI research reports, we introduced many excellent AgentFi projects, but most still focus on intent-driven DeFi execution, lending, or liquidity management for fully automated operations, with few teams deeply engaged in quantitative trading strategies. Currently, there is almost only one project in the market that clearly focuses on quantitative trading as its core direction: Almanak. This project enters the no-code quantitative strategy development space, providing a complete toolchain covering strategy writing (Python), deployment, execution, permission management, and vaulting, uniquely positioning itself as a core representative case in on-chain quantitative finance.

In traditional finance, Inclusive Finance aims to lower participation barriers and cover more long-tail users. Almanak extends this concept to the on-chain space, aiming to democratize quantitative trading capabilities. The platform uses AI-driven agents to execute strategies, significantly reducing capital, technical, and time costs, providing full-chain support from strategy conception to on-chain execution for active traders, financial developers, and institutional investors in the DeFi ecosystem, allowing ordinary users to participate in crypto asset trading and yield optimization without a professional technical background, using fully automated, on-chain transparent, and customizable quantitative strategies.

The Almanak platform introduces AI multi-agent collaboration (Agentic Swarm), enabling users to quickly create, test, and deploy Python-based automated financial strategies in a no-code environment during strategy development, execution, and optimization phases, while ensuring a non-custodial, verifiable, and scalable execution environment. With modules such as State Machine strategy framework, Safe+Zodiac permission management, multi-chain protocol access, and Vault asset custody, Almanak retains institutional-level security and scalability while significantly lowering the barriers to strategy development and deployment. This report will systematically analyze its product architecture, technical features, incentive mechanisms, competitive positioning, and future development paths, and explore its potential value in inclusive finance and on-chain quantitative fields.

3. Almank's Product Architecture and Technical Features

Almanak's product architecture is centered around "Strategy Logic → Execution Engine → Security Assurance → Assetization and Expansion," constructing a full-stack system for on-chain quantitative finance aimed at AI Agent scenarios. In this system, the Strategies module provides a strategy development and management framework from conception to execution, currently supporting Python SDK and will support natural language generation in the future; the Deployments module serves as the execution engine, automating the operation of strategy logic within authorized scopes and achieving adaptive optimization through AI decision-making capabilities; the Wallets module ensures fund and permission security with a Safe + Zodiac non-custodial architecture, achieving institutional-level key management and fine-grained permission control; the Vaults module transforms strategies into tokenized financial products, relying on standardized vault contracts (ERC-7540) to achieve fund raising, yield distribution, and strategy sharing—enabling complete composability of strategies and seamless integration into a broader DeFi ecosystem.

1. Strategy Infrastructure (Strategies)

Almanak's strategy infrastructure covers the complete link from conception to execution, including strategy ideation, creation, evaluation, optimization, deployment, and monitoring. Compared to traditional quantitative trading stacks, it has three core differences in design: first, it focuses on AI Agent-led strategy development rather than relying on manual workflows; second, it introduces a Trusted Execution Environment (TEE) to protect the privacy of strategy Alpha; finally, it adopts a non-custodial execution model with Safe Wallet + Zodiac permission management, ensuring the security and controllability of funds and execution from the ground up.

Core Features

- Based on Python: Written in Python, offering high flexibility and powerful programming capabilities.

- State Machine Architecture: Capable of implementing complex decision trees and branching logic based on market conditions.

- High Reliability: Operates on Almanak's dedicated infrastructure, equipped with comprehensive monitoring and failover mechanisms.

- Default Privatization: All strategy codes are encrypted and stored, protecting users' proprietary trading logic.

- Abstracted Trading Logic: Users do not need to directly handle underlying blockchain interactions, wallet management, or transaction signing.

In this architecture, the strategy framework is designed based on a persistent state machine, fully encapsulating on-chain interactions and execution layers. Users only need to write business logic in the Strategy component. Developers can either conduct highly customized Python development through the SDK or, in the future, use a natural language strategy generator to describe goals directly in English—subsequently, the multi-agent system will generate code for user review. Users have complete autonomy to approve, reject, or adjust strategies before deployment and can choose to publish them as independent strategies or Vaults. Vaults can also manage permissions through whitelisting, providing controlled access for entities such as institutions or liquidity funds. Strategy codes are stored encrypted by default, protecting users' proprietary logic; the underlying transaction construction, signing, and broadcasting are all maintained by the official team, ensuring high reliability and consistency in execution.

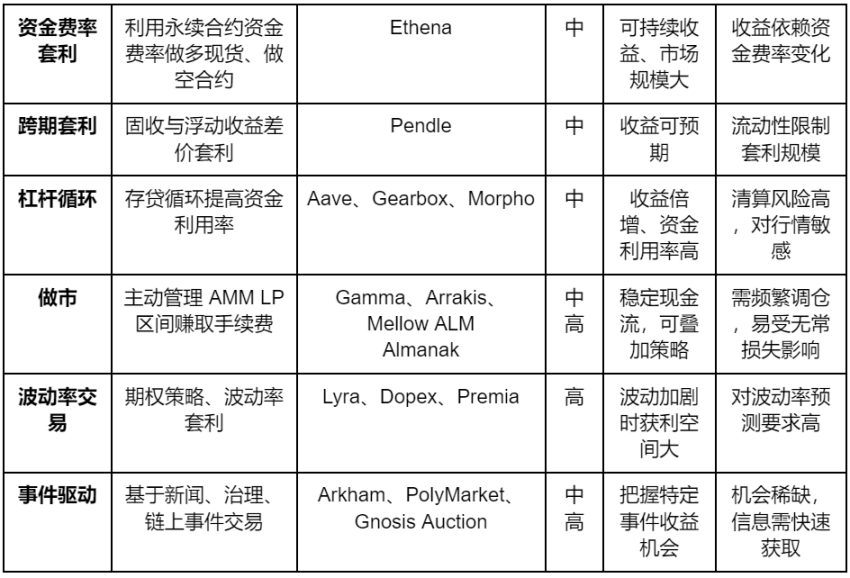

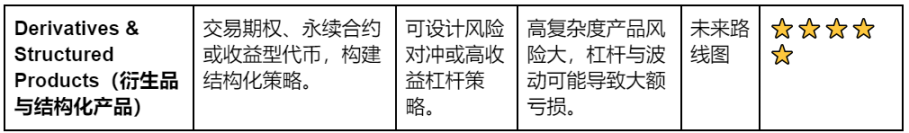

In the currently whitelist-only accessible Almanak strategy library AI KITCHEN, we can glimpse its strategy landscape: the currently launched strategies include Tutorials and Technical Analysis, while internally developed strategies cover Liquidity Provisioning, Automated Looping, and Custom Strategy. The future roadmap plans to introduce advanced strategies such as Arbitrage, Advanced Yield Farming, and Derivatives & Structured Products, reflecting a complete product evolution path from basic entry-level to professional quant, from single strategies to complex cross-protocol combinations.

2. Deployments

Deployments are the core execution layer connecting strategy logic with on-chain execution, responsible for automating transactions and operations within the user-authorized permission scope. The current main form is StrategyDeployment, which runs on a scheduled or triggered basis according to preset logic, suitable for executing clearly defined and reproducible trading strategies, emphasizing stability and controllability. The upcoming LLMDeployment will introduce one or more large language models (LLM) as decision engines, enabling strategies to adapt to market changes and continuously learn and optimize, exploring new trading opportunities within a strictly controlled permission framework.

The Deployment workflow covers the entire process from authentication and authorization, strategy execution, transaction construction, permission verification, to signature submission and execution monitoring. The underlying execution is completed by core classes maintained by the official team: TransactionManager converts strategy actions into compliant on-chain transactions and simulates verification; AccountManager generates transaction signatures; ExecutionManager broadcasts transactions, tracks status, and retries when necessary, forming a high-reliability closed loop from strategy to on-chain execution. In the future, Almanak will expand to multi-Deployment collaboration, cross-chain execution, and enhanced analytical capabilities, supporting more complex multi-agent strategy operations.

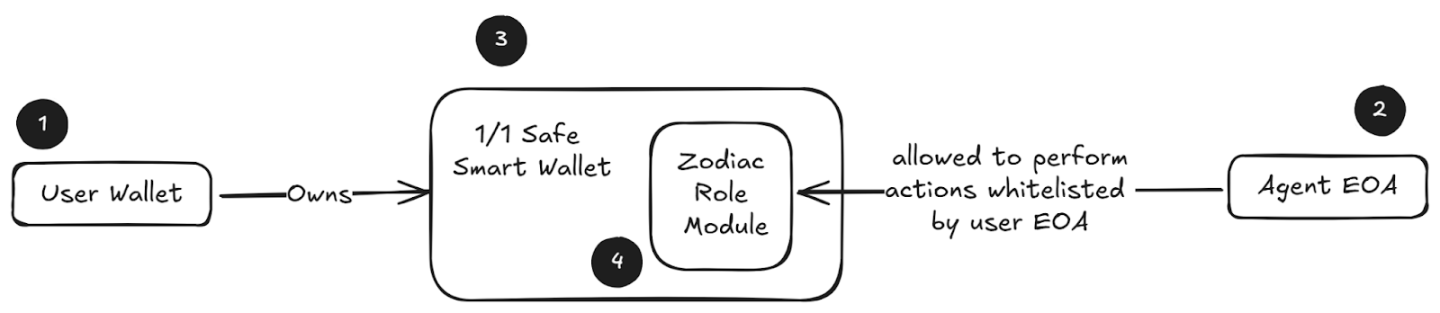

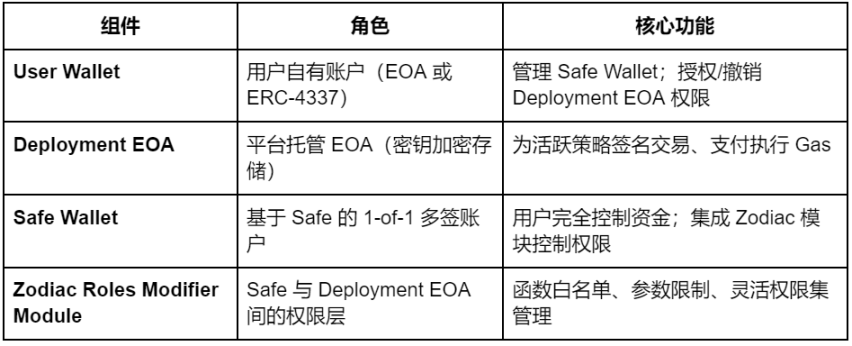

3. Wallet System and Security Mechanism

The wallet system is the core to ensuring fund security and controllable strategy execution. Almanak adopts a non-custodial solution with Safe + Zodiac, ensuring users have complete ownership of their funds and precisely and controllably delegating the permissions required for strategy execution to automated execution accounts (Deployment EOA). Users directly control the Safe Wallet through User Wallet (EOA or ERC-4337 smart account). The Safe Wallet integrates the Zodiac Roles Modifier module, allowing strict function whitelisting and parameter restrictions for Deployment EOA, ensuring that "only allowed actions can be performed," with permissions revocable at any time.

The Deployment EOA is hosted by the platform, with its private keys stored using enterprise-level encryption in static storage, managed by Google’s security infrastructure, and completely inaccessible to anyone. In extreme cases, the platform will immediately notify users to revoke permissions and generate a new EOA for replacement, ensuring uninterrupted strategy operation. To ensure continuous execution of strategies, users need to purchase the Autonomous Execution Fees service package, covering on-chain operating costs (including Gas). This architecture achieves institutional-level security standards through complete isolation of funds and execution permissions, refined permission management, institutional-level key security, and rapid anomaly response, laying a trust foundation for the large-scale adoption of automated DeFi strategies.

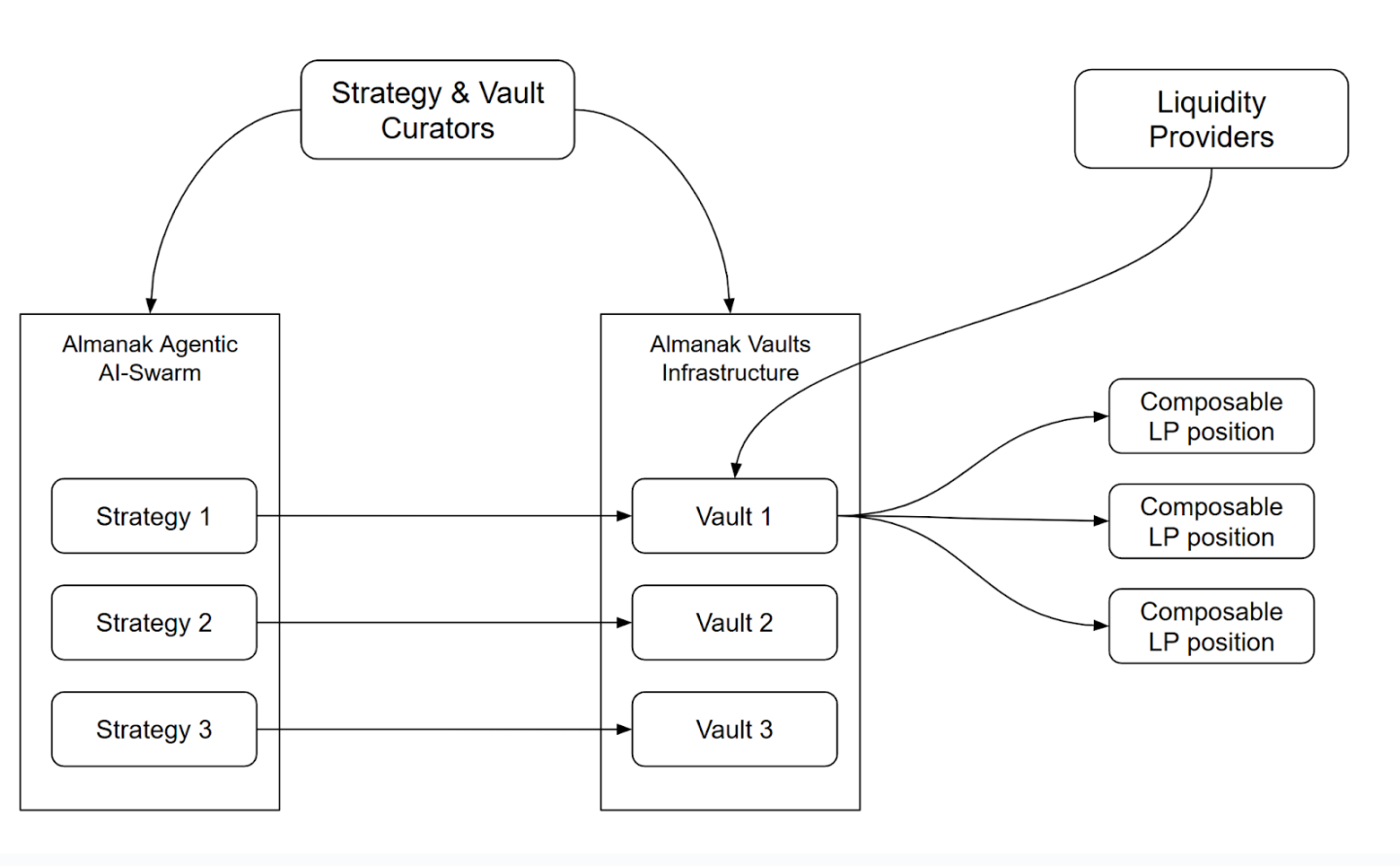

4. On-Chain Quantitative Strategy Vaults

Almanak Vaults are user-deployable, fully on-chain, permissionless vault contracts that transform trading strategies into tokenized, composable financial products. Unlike static "closed containers," these vaults are built on the asynchronous expansion standard ERC-7540 based on ERC-4626, designed as programmable capital allocators that can natively integrate into the DeFi ecosystem.

By tokenizing AI-generated strategies, the vaults introduce a new DeFi primitive: the strategy itself becomes an ERC-20 asset, which can be used for LP, collateral, trading, transferring, or combined into structured products. This composability unlocks "DeFi Legos" at the strategy level, enabling seamless integration with protocols, funds, and structured products.

Vaults can be curated by individual curators or owned by the community. Almanak Vaults are implemented based on Lagoon Finance's open-source contracts (MIT license), inheriting Lagoon's audit and security guarantees and complying with the ERC-7540 standard. Its permission management mechanism is consistent with Almanak Wallets, relying on Zodiac Roles Modifier to execute function whitelisting and parameter restrictions, ensuring all operations are completed strictly within authorized scopes.

The operational process includes:

- Strategy Binding – Binding existing Python strategies or AI-generated strategies to the vault;

- Fund Raising – Investors purchase vault tokens to gain proportional ownership;

- On-Chain Execution and Rebalancing – The vault trades according to strategy logic and dynamically adjusts positions;

- Profit Distribution – Earnings are distributed according to token holding ratios, with management fees and performance fees automatically deducted.

Core Advantages:

- Each vault position exists in the form of ERC-20 tokens, ensuring portability and interoperability;

- Strategies are deterministic, auditable, and executed on-chain;

- Capital is both secure and liquid—safety and composability are no longer in opposition;

- Developers can integrate vault tokens into their protocols without permission, while capital allocators can flexibly allocate capital within the ecosystem.

In summary, Almanak Vaults evolve DeFi capital management from isolated packaging containers into intelligent, composable systems. By transforming AI-generated strategies into tokenized financial primitives, it pushes DeFi beyond passive yield containers towards a responsive, modular capital network, realizing the long-standing vision of programmable, interoperable finance.

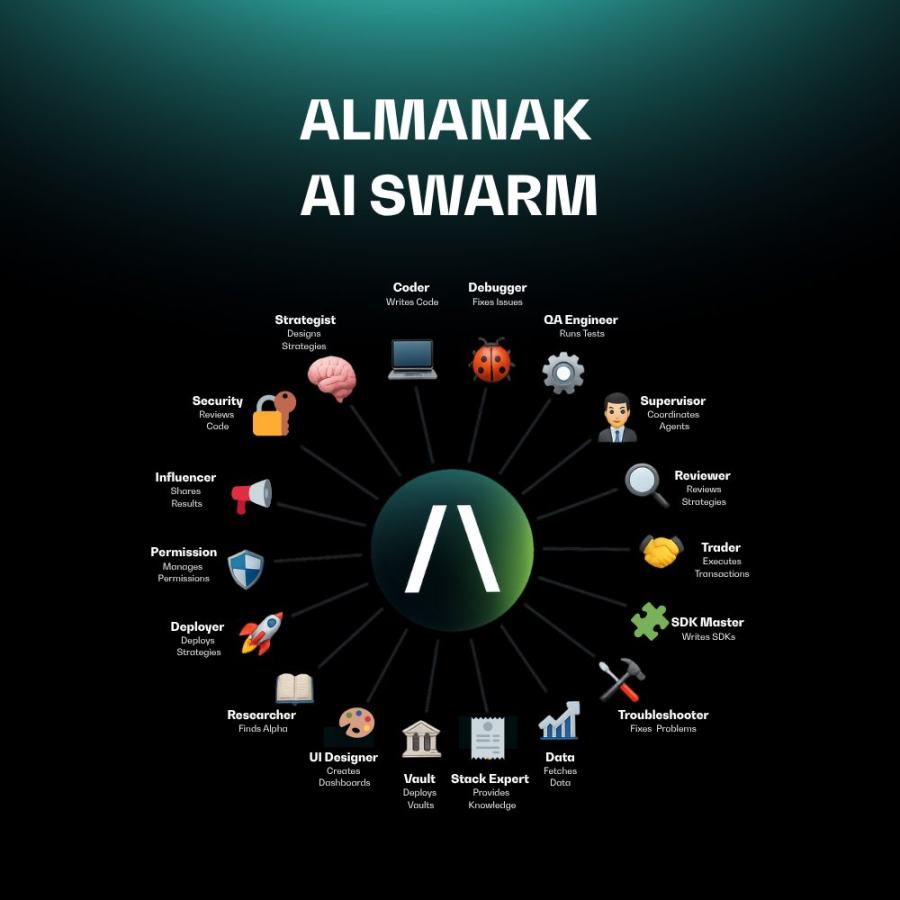

5. DeFi Agentic Swarm

The Almanak AI Swarm architecture serves as a one-stop platform covering the complete strategy development cycle, capable of autonomously completing the research, testing, creation, and deployment of complex DeFi strategies while ensuring users maintain full control and assets remain non-custodial, aiming to simulate and replace the full-process operations of traditional quantitative trading teams. Notably, the AI Swarm "team" consists of AI agents rather than real people.

Strategy Team: Converts users' natural language instructions into directly deployable on-chain strategies, covering strategists (designing logic), programmers (writing smart contract code), auditors (verifying correctness), debuggers (fixing errors), quality engineers (running simulation tests), permission administrators (configuring execution permissions), UI designers (building visual panels), and deployers (executing mainnet deployments), ensuring a complete link from conception to execution.

The strategy team achieves deterministic process orchestration, persistent state sharing (TeamState), human-in-the-loop (HITL) verification, parallel processing, and interruption recovery mechanisms through LangGraph. It can automatically execute the entire process but defaults to requiring human confirmation to ensure reliability.

Alpha Seeking Team: Continuously scans the entire DeFi market, identifying market inefficiencies, exploring new ideas and Alpha opportunities, and proposing new logic and strategy concepts to the strategy team.

Optimization Team: Conducts large-scale simulations on historical and forecast market data to rigorously evaluate strategy performance, performing hypothetical stress tests and periodic performance analyses before deployment, identifying potential drawdowns and vulnerabilities, ensuring strategy stability and robustness across different market environments.

Additionally, auxiliary AI tools include Stack Expert AI and Troubleshooting AI: the former focuses on answering users' various questions about the Almanak tech stack and platform operations, providing instant technical support; the latter focuses on real-time monitoring and problem identification during strategy execution, ensuring the stability and continuity of strategy execution.

Almanak's core principle is that all AI operations will be recorded, reviewed, and structured, with no AI operating independently, and all strategy logic must undergo complete human-in-the-loop verification before going live, with users retaining ultimate control and custodianship.

4. Almank Product Progress and Development Roadmap

Autonomous Liquidity USD Vault

Currently, Almanak has officially launched the Autonomous Liquidity USD (alUSDC Vault) stablecoin yield optimization vault deployed on the Ethereum mainnet through the community. Similar to AgentFi products like Giza and Axal, its core is the Stable Rotator Agent, which continuously scans the DeFi ecosystem to identify and capture the highest available yield opportunities, automatically rebalancing the portfolio based on customizable risk parameters. Before execution, the strategy conducts intelligent trading cost analysis, adjusting positions only when the yield increase is sufficient to cover all costs, and combines advanced routing optimization with automatic compounding features to maximize capital efficiency. Currently, this vault connects to various USDC derivative assets from protocols such as Aave v3, Compound v3, Fluid, Euler v2, Morpho Blue, and Yearn v3.

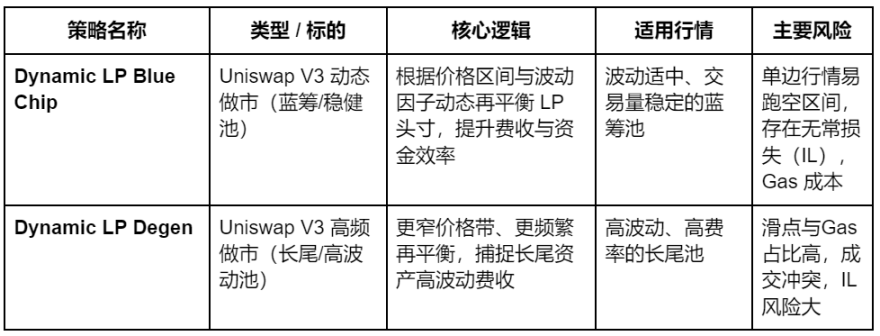

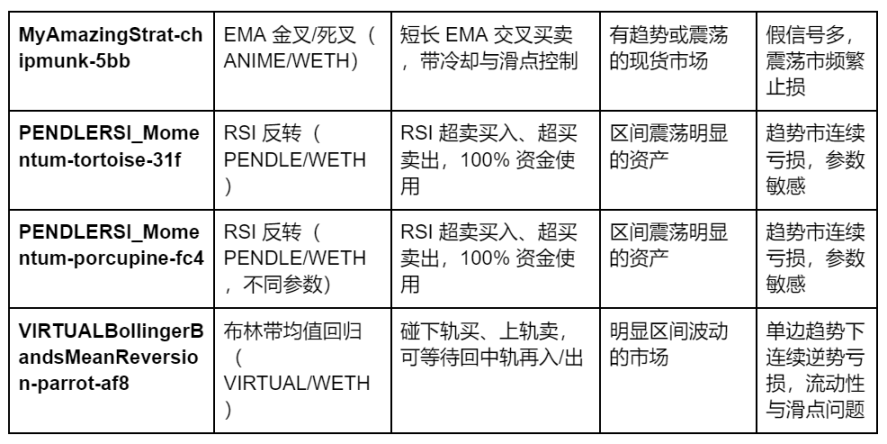

Almanak Liquidity Strategies and Swap Trading Strategies

The strategies launched by Almanak can be divided into two main categories: LP Series (Dynamic LP Blue Chip, Dynamic LP Degen) and Indicator Spot Strategies (MyAmazingStrat, PENDLERSI_Momentum, VIRTUALBollingerBandsMeanReversion). The detailed strategy content is shown in the table below:

Through the analysis of the above strategy codes using AI tools, we can draw the following conclusions:

- LP Dynamic Market Making (Blue Chip / Degen) is suitable for pools with sustained trading volume and can accept impermanent loss; Blue Chip seeks stable fee income, while Degen aims for higher frequency yield capture.

- Indicator Spot (EMA/RSI/BB) enables light, longable multi-parameter grid experiments; however, strict controls on cooling/slippage/minimum transaction volume must be maintained, with attention to pool depth and MEV.

- Capital and Scale: Long-tail assets (Degen/ANIME/VIRTUAL) are more suitable for small/multiple instance strategies to diversify risk; blue-chip LP is more suitable for medium to long-term/higher TVL.

- Minimum viable combination for live trading: Dynamic LP Blue Chip (stable fee income) + RSI/BB type spot strategies (for volatility capture) + small deployments of Degen LP or EMA cross for "high volatility testbed."

Almanak Development Roadmap

The evolution of the Almanak platform is divided into three phases, gradually achieving expansion from a technical foundation to full-chain accessibility.

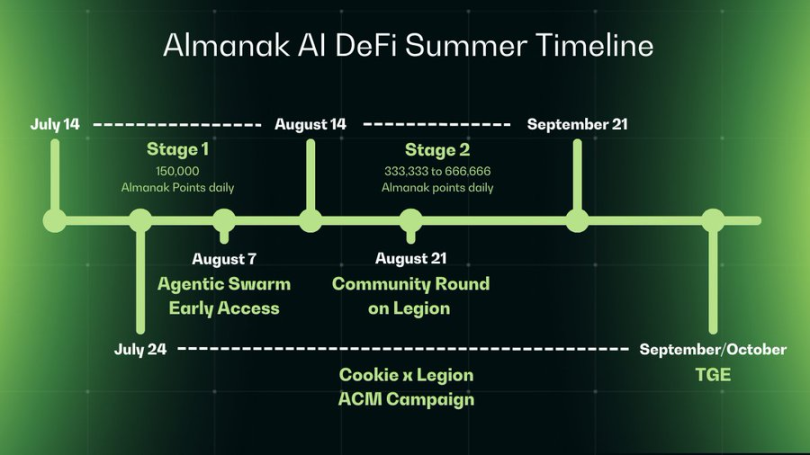

- Phase 1 focuses on infrastructure and early community building, launching a public beta version covering the complete quantitative trading stack, and forming a core user group through the Legion platform while distributing private testing qualifications. At the same time, it begins accepting funds into community vault strategies designed by AI, achieving on-chain automated management of the first batch of assets.

- Phase 2 Almanak plans to fully open the AI Swarm functionality to the public by the end of this year. Before that, access permissions will be gradually relaxed as the system expands to large-scale use; this phase will be the formal implementation period for the platform's token economy and incentive system.

- Phase 3 will shift focus to attracting global retail users, launching user-friendly products aimed at savings and retirement accounts, and integrating with centralized exchanges (such as Binance, Bybit) to achieve seamless connections between CeFi and DeFi. At the same time, it will expand asset categories using low-risk, high-capacity RWA strategies and launch a mobile application to further lower the participation threshold for users.

Additionally, Almanak will continue to expand multi-chain support (including Solana, Hyperliquid, Avalanche, Optimism, etc.), integrate more DeFi protocols, and introduce a Multi-Agent System and Trusted Execution Environment (TEE), using AI to drive automatic discovery of Alpha and build the world's most comprehensive AI DeFi intelligent execution network.

5. Almanak's Token Economics and Points Incentive System

Almanak's token economic system aims to build an efficient and sustainable value exchange network for AI-driven financial strategies, enabling high-quality strategies and liquidity capital to be efficiently matched on-chain. The platform constructs an ecological closed loop through dual core roles: Strategy & Vault Curators and Liquidity Providers. The former utilizes an Agentic AI-Swarm to design, optimize, and manage verifiable deterministic strategies in a no-code environment, introducing external funds through deploying permissionless vaults and collecting management fees and performance shares; the latter deposits funds into these vaults to gain tokenized strategy exposure and participate in profit distribution.

In terms of strategy privacy, strategy curators can choose between a private mode (closed source, not included in the strategy library, accessible only to themselves) or a public mode (open source and included in the strategy library, available for community and third-party protocol use), thus achieving a balance between IP protection and knowledge sharing.

The token economic model draws on the dynamic capital allocation logic of traditional hedge funds, integrating Bittensor's demand-driven emission allocation mechanism and Curve Finance's governance incentive model: the former allocates emissions weighted by TVL and strategy yield, encouraging capital concentration towards high-performance strategies; the latter introduces a "veToken + Bribe" model, allowing protocol parties to increase the emission multiplier of specific vaults through voting, thereby guiding agentic traffic towards designated protocols.

Emission distribution adopts a weighted formula based on AUM and ROI, ensuring that the vault's contributions to attracting capital and generating yields are directly converted into token rewards; while the governance bonus mechanism (Almanak Wars) can add up to 3x weight to target vaults, forming an incentive market among project parties, curators, and liquidity providers. To maintain long-term sustainability, protocol fees (vault fee shares, computation resource surcharges, etc.) will partially flow back to the emission pool, gradually offsetting new emission pressures as the ecosystem matures.

Token functions include Staking and Governance: token holders can obtain discounts on platform computation resources, increase voting weight, direct emissions to specific vaults, and participate in DAO governance, deciding key parameters such as computation resource surcharge rates, vault fee ratios, and emission curves. The governance structure is expected to include an Ecological Parameter Committee and an Innovation Development Committee, responsible for protocol parameters, revenue distribution and fund management, ecological funding, and other matters.

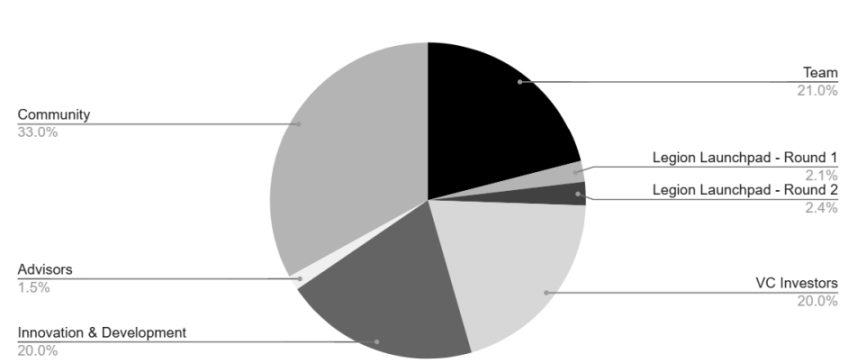

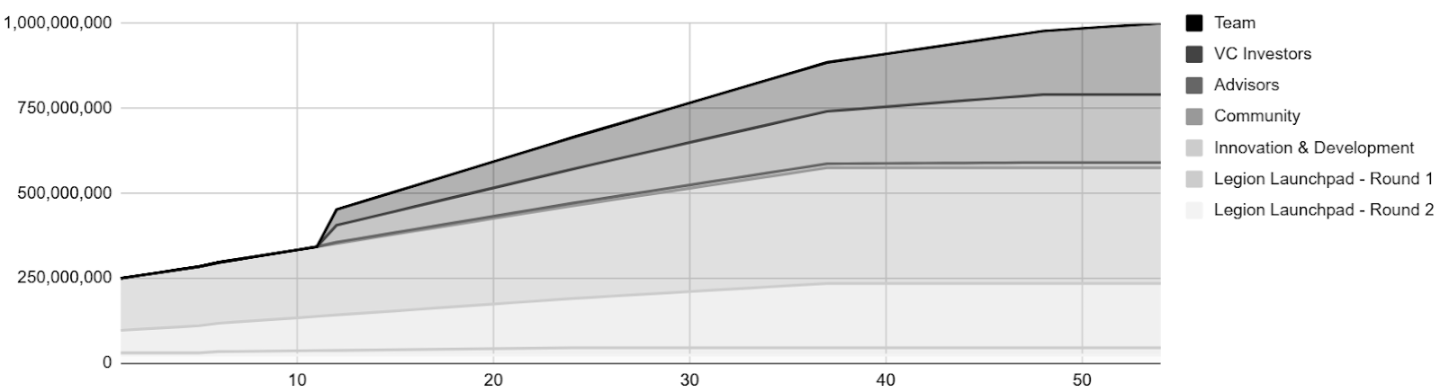

In terms of token distribution, Almanak has set the following: Team (54 months linear release, 12 months lock-up), Institutional Investors (48 months linear release, 12 months lock-up), Advisors (48 months linear release, 12 months lock-up), Innovation and Ecological Development (35% released at TGE, remaining 36 months linear release), Community and Early Participants (45% released at TGE), Legion Community Round (two rounds, first round 30% TGE + 24 months linear release, second round 100% TGE). The emission pool is used to reward network participants and early incentives, distributed according to an annual halving inflation model to maintain long-term incentives and governance activity.

Almanak Points: Quantitative Incentive Mechanism for Platform Participation

Almanak Points are the core mechanism for measuring and rewarding users' participation and contributions on the platform, aiming to drive asset retention, strategy usage, and community growth through a points system. Points are distributed in phases according to seasons, with the emission volume, participatory activities, and calculation methods adjusted for each season.

Users can earn Points in various ways: ① Deposit funds into community vaults listed on the Almanak platform, with points calculated based on deposit size and holding time (current vault deposits enjoy a 2× points multiplier); ② Hold assets in the Almanak Wallet, accumulating points based on balance and holding duration; ③ Activate and actively manage Deployments, earning additional points based on managed asset size, duration, and strategy complexity; ④ Refer new users to participate in platform activities, with the referrer receiving an additional reward of 20% of the referred user's points. Points are non-transferable and non-tradable but will be converted to tokens at a 1:1 ratio upon token issuance. Additionally, points will serve as the basis for governance rights, functional usage permissions, and ecosystem benefits.

Project Financing and Token Issuance Strategy

Almanak collaborates deeply with Cookie.fun and Legion.cc, introducing the Snaps/cSnaps mechanism to analyze on-chain traceable contribution points through Attention Capital Formation, linking users' multidimensional activity in community dissemination, content interaction, and financial support directly to token distribution, achieving a transparent and structured distribution logic of "contribution equals ownership."

In terms of capital background, Almanak received early incubation support from Delphi Digital and the NEAR Foundation, and subsequently attracted investments from well-known institutions such as Hashkey Capital, Bankless Ventures, Matrix Partners, RockawayX, AppWorks, Artemis Capital, and SParkle Ventures, with a total financing amount reaching $8.45 million.

- January 8, 2025: Completed a $1 million IDO through Legion, with a valuation of $43 million. 30% of the TGE is unlocked, and the remaining 70% is set with a 6-month lock-up period, to be released linearly over 24 months.

- August 21, 2025: The Legion community round financing is about to launch, with a valuation of $90 million FDV and a target financing of $2 million, with a maximum cap of $2.5 million. This round is open to all verified accounts, and tokens will be 100% unlocked at TGE. The TGE is expected to take place from late September to early October.

- Cookie DAO Priority Rights: The top 25 Snappers and the top 50 cSnappers will have priority to invest at a $75 million FDV, with 100% unlocked at TGE.

- Activity Incentives – 0.55% of the total supply will be used for incentive distribution: of which 0.4% is allocated to the top 500 cSnappers (accounting for 80% of the reward pool), 0.1% to the top 250 Snappers, and 0.05% to $COOKIE stakers.

This issuance mechanism not only optimizes the fairness of token distribution and lowers participation thresholds but also deeply binds capital raising, community building, and long-term governance, forming a sustainable community of interests, laying the foundation for Almanak's long-term expansion in the AI × DeFi space.

6. Investment Logic and Potential Risk Analysis

Investment Logic

Almanak currently aligns more with the positioning of "the easiest retail DeFi strategy sandbox," possessing significant advantages in user experience, security architecture, and low entry barriers, especially suitable for retail investors who have never written code or lack on-chain strategy experience to quickly get started. Almanak's core competitiveness lies in the deep integration of AI multi-agent architecture and a non-custodial execution system, providing institutional-level security and strategy privacy protection while ensuring performance. Its tech stack consists of TEE (Trusted Execution Environment) + Safe Wallet + Zodiac Roles Modifier, enabling fully automated on-chain execution under permission management that is granular down to contract function parameters, significantly outperforming most AgentFi models that rely solely on EOA delegation.

The technical architecture has formed a complete closed loop: from data acquisition (Sensors), strategy logic execution (persistent state machine architecture, Prepare / Validate / Sadflow), transaction execution (TransactionManager / AccountManager / ExecutionManager), to monitoring and metrics systems, and then to productization (ERC-7540 Vault) and external fundraising fees, the link is smooth and has commercial scalability. Particularly, the Vault productization capability allows strategies to upgrade from self-use tools to financial products that can be issued externally, bringing scalable management fees and performance-sharing income to the platform.

On the operational side, the Points incentive system has been launched, with transparent rules oriented towards AUAM (Assets under Agentic Management), effectively driving lock-up amounts and activity levels; through the Attention Capital Formation model, on-chain traceable contribution points are analyzed, deeply binding capital raising, community building, and long-term governance, forming a sustainable community of interests, laying the foundation for Almanak's long-term expansion in the AgentFi space.

Potential Risks

Although Almanak has a high level of completeness in its technology and functional system, it still faces several key challenges:

First, the protocol testing has not yet been fully opened. Currently, it only supports lending protocols on the Ethereum mainnet, as well as LP and Swap strategies based on Uniswap V3. The underlying Kitchen already supports Ethereum, Base, and Arbitrum, with the capability to expand to 8+ EVM chains and 200+ protocols. The pace of broader openings such as multi-chain expansion (e.g., Base, Solana, Hyperliquid), multi-protocol access, and CEX integration will directly impact the diversity of strategies, yield opportunities, and market competitiveness.

Second, the strategy level remains relatively basic. Existing strategies primarily focus on entry-level technical analysis (TA), still falling short of institutional or professional quantitative standards. In the future, it will be necessary to introduce a richer library of advanced strategies (covering on-chain liquidity management, funding rate arbitrage, cross-pool price differences, and multi-signal fusion, etc.), and improve backtesting and simulation trading tools, built-in cost optimization engines, and multi-strategy portfolio management functions to grow into the preferred entry point for retail investors entering DeFi quantification.

Additionally, the ecosystem and user base are still in the early stages. Although the points program and Vault mechanism have been launched and entered the first tier of AgentFi, the growth of TVL managed by AI-driven Vaults still requires time for validation, and user activity and retention rates will be key indicators in the medium to long term.

Overall, Almanak possesses a combination of mature technical architecture, clear commercialization pathways, and driving force from incentive mechanisms, making it rare in the AI-driven on-chain quantification and asset management space. However, the speed of ecosystem expansion, the evolution of competitive landscapes, and the stability of technological implementation will be the three core variables determining whether it can maintain its leading position in the long term.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。