Written by: Glendon, Techub News

Since Bitcoin broke through $124,000 on August 14, setting a new historical high, the cryptocurrency market has continued to decline over the following days. Bitcoin once fell below $113,000, and Ethereum dropped below $4,100, erasing all gains from the past week.

Data from Sosovalue shows that the U.S. Bitcoin spot ETF switched from net inflow to net outflow starting at 8:00 PM EST on August 15, resulting in four consecutive trading days of net outflow, totaling over $970 million. On the same day, the U.S. Ethereum spot ETF also ended its streak of eight consecutive trading days of net inflow, with a cumulative net outflow of approximately $730 million over four trading days.

Excluding the ETF fund flow situation, Ethereum faces more severe risks compared to Bitcoin. According to Validator Queue statistics, the amount of Ethereum queued for unstaking peaked at 910,000 coins on August 19, setting a historical record, but the number of Ethereum waiting to join the network is still less than one-third of that. Although the amount of unstaked Ethereum has slightly decreased, this data indicates that Ethereum's market may still experience significant volatility in the short term.

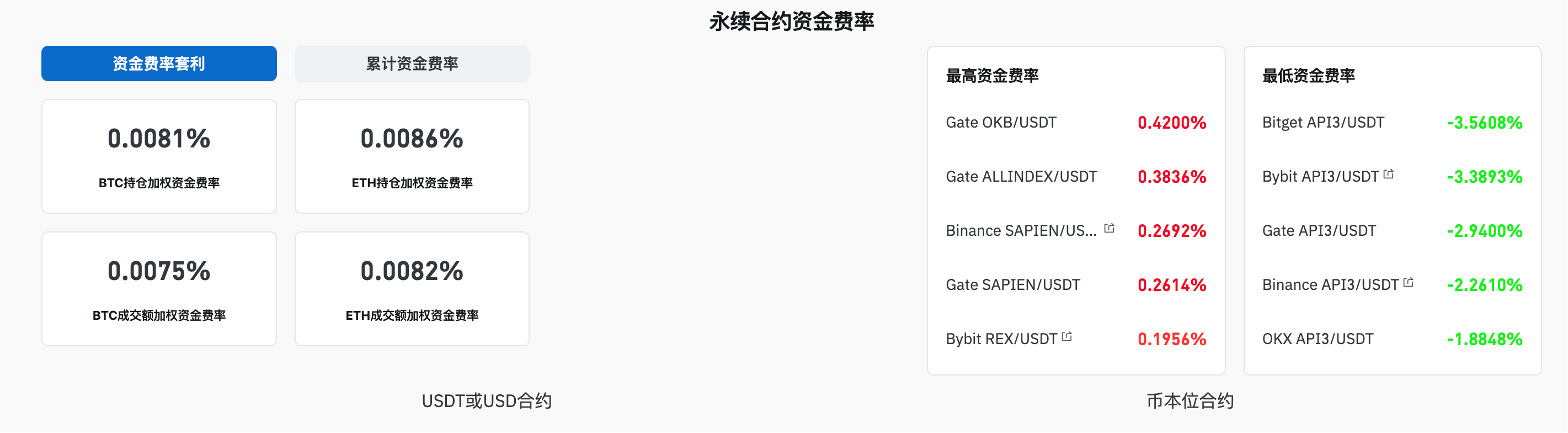

Meanwhile, cryptocurrency market analysis platform Santiment tweeted that retail investor sentiment on social media has shown the strongest pessimistic shift since the panic of June 22. Additionally, data from Coinglass indicates that the funding rates on mainstream CEX and DEX platforms also show that the market is turning bearish. (When the funding rate is greater than 0.01%, it indicates a generally bullish market; when the funding rate is less than 0.005%, it represents a generally bearish market.)

Fortunately, today's market has seen a slight rebound, with Bitcoin touching $115,000 and Ethereum returning above $4,300, providing the market with a breather. However, one cannot help but wonder: has this bull market peaked? Is the current market decline a regular correction, or the beginning of a downturn? What will be the next catalyst for the market?

Has the Bull Market Peaked?

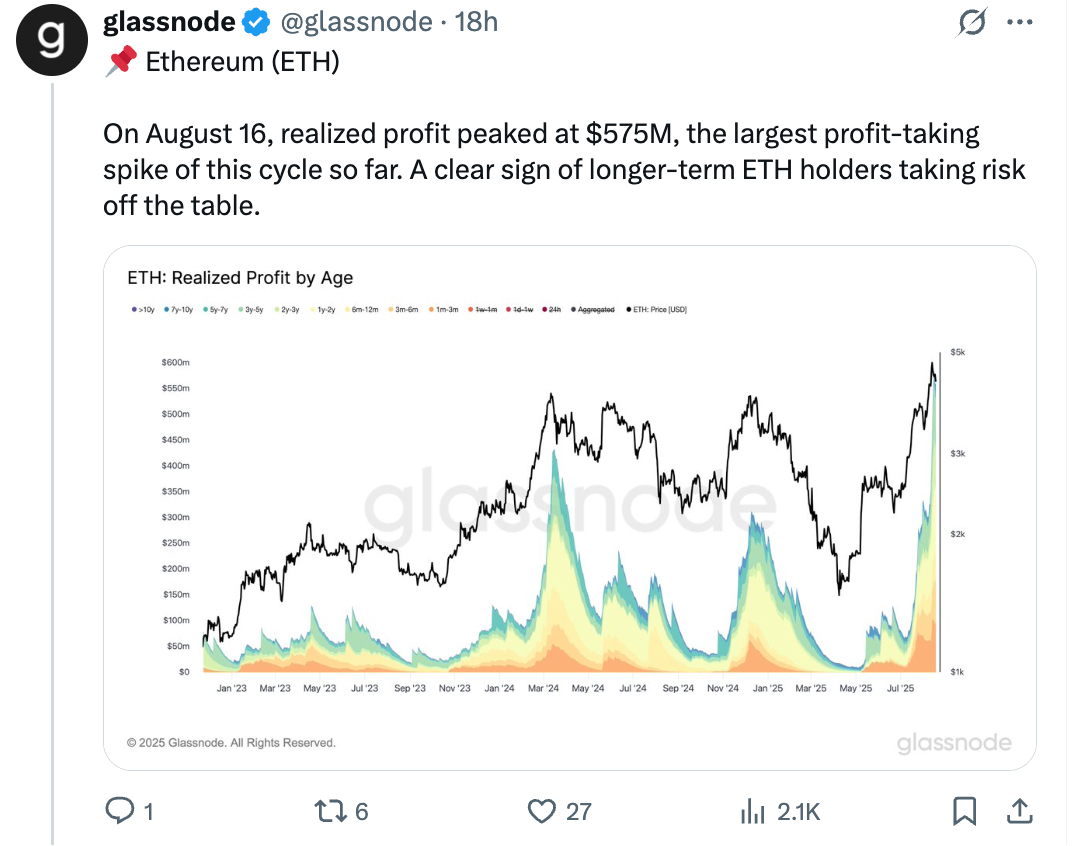

It is important to clarify that the market has a natural demand for technical corrections. Historical data shows that cryptocurrencies typically experience short-term adjustments after rapid increases, which is a profit-taking phenomenon. Glassnode's analysis indicates that the signs of market contraction are mainly due to large-scale profit-taking by investors holding positions for over a month (non-day traders). On August 16, Ethereum realized profits of $575 million, marking the largest profit-taking wave of this cycle, indicating that long-term holders of Ethereum are engaging in risk aversion.

Aside from internal market factors, the correlation between cryptocurrencies and macroeconomic factors is also becoming stronger. LMAX Group strategist Joel Kruger noted in a report that since last week's historical high, Bitcoin has been in "adjustment mode," primarily influenced by U.S. wholesale inflation data exceeding expectations, which weakened market expectations for a Federal Reserve rate cut. Additionally, the market may also be affected by recent statements from U.S. Treasury Secretary Janet Yellen. Last week, Yellen stated that the U.S. Treasury would stop selling its Bitcoin holdings but would not purchase more, indicating that the U.S. Treasury will not expand its Bitcoin holdings through purchases.

Delphi Digital stated that the U.S. Treasury will initiate a replenishment of the Treasury General Account (TGA) in the coming weeks, planning to withdraw approximately $500 billion to $600 billion in liquidity from the market over the next two months. Unlike previous rounds, this replenishment lacks a buffer. In simple terms, this fundraising will directly extract funds from market liquidity.

It is known that the cryptocurrency market is particularly sensitive to this change. Historical data shows that the supply of stablecoins contracts with TGA replenishments. Once the supply of stablecoins contracts again, high Beta assets like Ethereum may face larger declines compared to Bitcoin.

A combination of various factors has led to the market's continued decline over the past few days without any significant bearish news. So, has the bull market peaked? Based on multiple data analyses, it has not yet peaked.

Analyst Ignas pointed out that CryptoQuant's "Omni Momentum Indicator" shows that Bitcoin is in the mid-stage of a bull market. Delphi's Bitcoin top signal dashboard also indicates that the market is approaching overheating but remains within a controllable range: the strength score is 56.7, while tops typically occur around 80. Furthermore, none of the 30 indicators tracked by Glassnode show that the market has peaked.

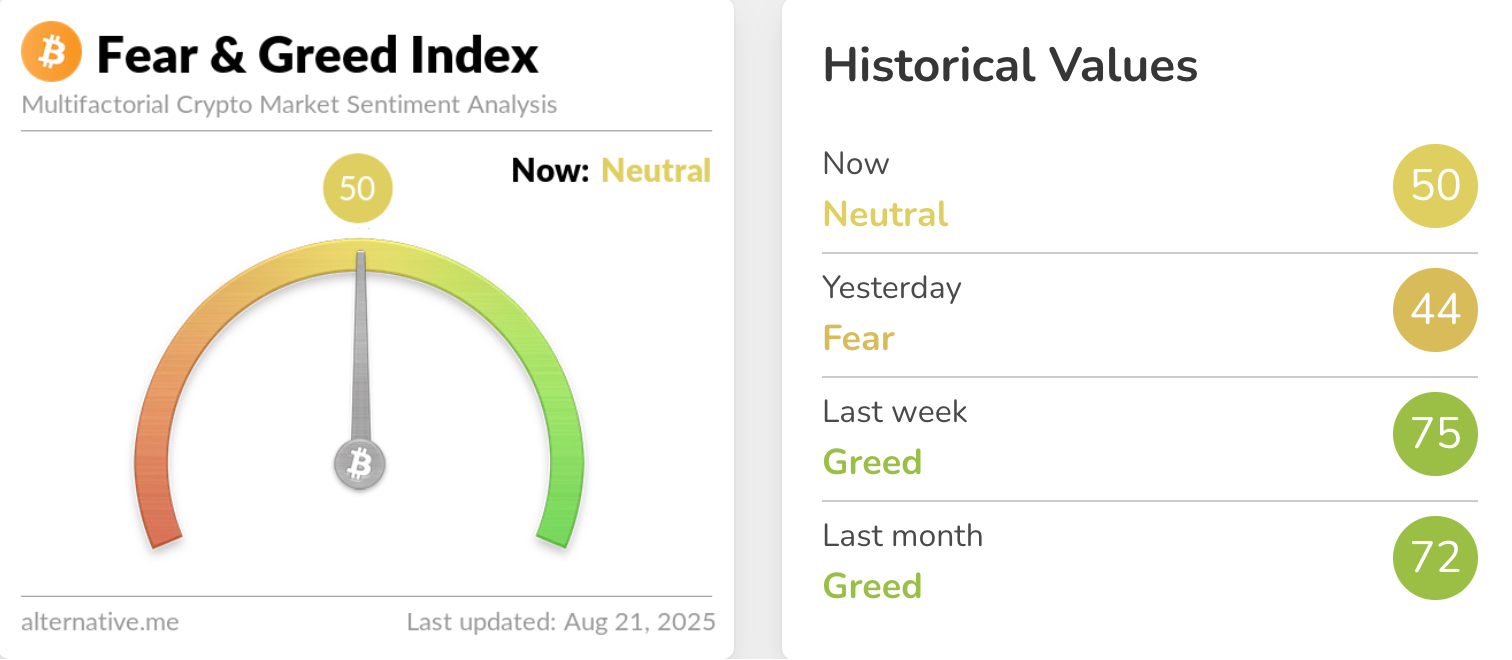

Today's slight market rebound also reflects a shift in market panic sentiment. According to Alternative.me data, the cryptocurrency fear and greed index rose to 50 today, indicating that market sentiment has returned to neutral.

What Will Be the Next Market Catalyst?

With the bull market not yet peaked, what catalysts could drive the market to continue rising?

Given the current lack of internal driving forces in the cryptocurrency industry, institutional buying remains the most direct market driver. In the short term, listed companies and treasury firms have not abandoned their cryptocurrency asset strategies. For example, Hong Kong's Ming Cheng Group plans to invest $483 million to purchase 4,250 Bitcoins, Swiss investment firm Syz Capital intends to raise 2,000 Bitcoins through the BTC Alpha fund, KindlyMD has spent $678.9 million to acquire 5,744 Bitcoins, and SharpLink has increased its holdings by 143,593 Ethereum, among others.

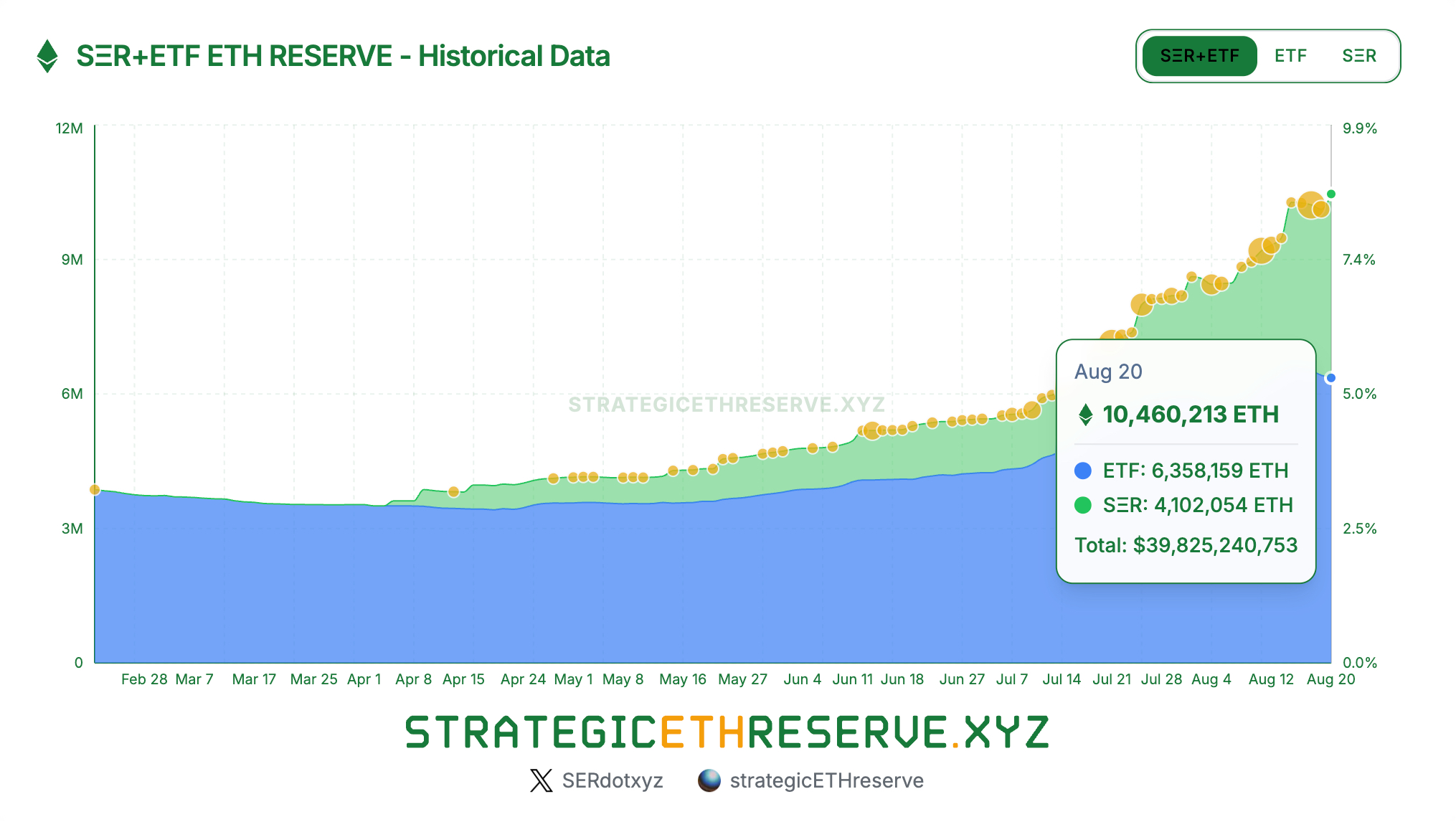

Data from the Strategic ETH Reserve website shows that as of August 20, Ethereum-listed companies hold approximately 4.1 million Ethereum, showing a steady growth trend.

Moreover, cryptocurrency treasury strategies are no longer limited to Bitcoin and Ethereum; they are expanding to more cryptocurrencies such as SOL, BNB, LINK, TON, and HYPE. Some projects, like Tron and Chainlink, have also begun to establish strategic token reserves.

For example, Chainlink has launched Chainlink Reserve to establish a strategic reserve of LINK. This reserve strategy accumulates LINK by utilizing off-chain revenues and on-chain services from large enterprises adopting the Chainlink standard. Since its launch, LINK's performance has continuously strengthened, rebounding to nearly $27 today after briefly falling below $22 on August 15, erasing its losses and showing momentum for further increases.

Thus, it can be seen that, at least in the short term, the market will continue to benefit from various cryptocurrency treasury strategies. The risk lies in whether institutional buying power can offset market selling pressure. Once buying power is exhausted, the market is likely to trigger a sustained downward trend.

In contrast to the institutions leading the buying frenzy, retail speculators, who were the main force in the last cycle, have not yet fully entered the market. Taking Ethereum as an example, although its price once approached historical highs, there has not been a surge intense enough to cause congestion in this bull market. On-chain activity has been mediocre, and trading volume and DeFi data have not reached new peaks, which may indicate that investors are becoming more calm and rational, but it also suggests that this cycle has not attracted sufficient liquidity.

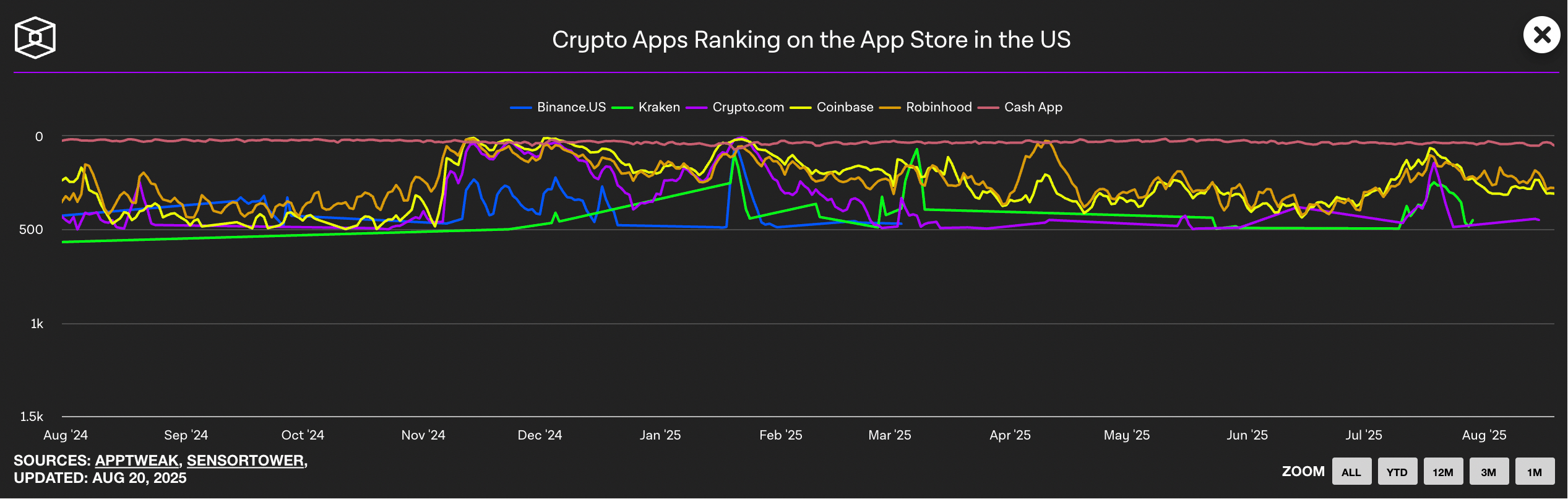

This can also be seen from the cryptocurrency application data in app stores. Additionally, the long-awaited "altcoin season" has yet to arrive, meaning that more retail speculators will be a "catalyst" that cannot be ignored in the market.

On the macro front, the most anticipated event in the industry is undoubtedly the Federal Reserve's rate cut in September. Based on historical experience, a rate cut will lower borrowing costs, release market liquidity, and more funds will choose high-yield assets, thereby driving up cryptocurrency prices. According to CME's "FedWatch" data, as of the time of writing, the probability of a Federal Reserve rate cut in September exceeds 82%, and the market also considers the likelihood of a rate cut in September to be very high. It is important to note that a rate cut does not guarantee an immediate rise in cryptocurrencies; the upward trend may vary based on the macro environment and investor sentiment.

However, the speech by Powell this Friday may dampen market optimism regarding a September rate cut. If the Federal Reserve maintains a hawkish stance, it could trigger broader volatility in risk assets, including the cryptocurrency market, which may continue to face pressure.

Nonetheless, Tom Lee, chairman of BitMine's board, believes that most institutional investors expect Powell to maintain a hawkish tone, and the market has already set this as a precondition. Therefore, Powell's speech may be interpreted as "dovish," potentially leading to a temporary rebound in U.S. stocks and risk assets after the speech. Overall, the market outlook for September is likely to become clearer.

In addition, the stablecoin market will also bring new driving forces. It is well known that Trump officially signed the "Guidance and Establishment of the U.S. Stablecoin National Innovation Act" (the "GENIUS Act") on July 19, which has greatly promoted the development of stablecoins. On August 20, Wyoming became the first state in the U.S. to issue a stablecoin, Frontier (FRNT), backed by the U.S. dollar and short-term government bonds, marking a key step in the practice and application of stablecoin legislation, which may prompt more states in the U.S. to follow suit.

Goldman Sachs released a research report indicating that the stablecoin market is entering a new expansion cycle, with a potential scale that could reach trillions of dollars. Their analysts pointed out that, in the long term, the payment sector will become the core driving force for the expansion of the total addressable market for stablecoins. Although the current use of stablecoins is still dominated by cryptocurrency trading and offshore dollar demand, the penetration potential in payment scenarios has not been fully developed.

It is worth mentioning that Ethereum will also benefit from the development of the stablecoin market, as the issuance of stablecoins is more concentrated on Ethereum. Although the short-term contribution to its revenue is limited, the future incremental space as a medium- to long-term potential makes it generally favored by the market.

Finally, regulatory policies will also be a long-term catalyst. The U.S., Hong Kong, and even the global community are researching and exploring the regulation and legislation of cryptocurrencies. Taking the U.S. as an example, there was the stablecoin bill, and now there is the pending cryptocurrency market structure bill (the "CLARITY Act"), which is also highly anticipated by the industry. This bill clarifies the regulatory classification of digital assets, placing decentralized tokens like Bitcoin and Ethereum under the jurisdiction of the CFTC, while the SEC retains jurisdiction over security tokens, thereby reducing compliance uncertainty.

U.S. Senator Cynthia Lummis from Wyoming stated today that she plans to submit the cryptocurrency market structure bill to the President for signature by the end of the year, leaning towards the Digital Asset Market Clarity Act passed by the House of Representatives as a foundation. Lummis mentioned that she will try to retain the House's amendments regarding stablecoins and market structure to respect its bipartisan support. The Senate version may still undergo adjustments, with the goal of completing the legislative process before Thanksgiving.

Additionally, the White House has allowed 401(k) retirement plans to invest in cryptocurrencies, Illinois has signed the Midwest's first cryptocurrency consumer protection bill, the SEC has issued guidelines clarifying the scope of liquid staking regulation, and various states in the U.S. have introduced Bitcoin reserve bills, all of which have provided a friendly policy environment for the cryptocurrency industry to varying degrees.

What is most important for the industry is the open attitude and clear regulation of cryptocurrencies held by various countries. Unlike the previous wild growth and speculative frenzy, both the U.S. stablecoin bill and Hong Kong's "Stablecoin" regulations are guiding the industry towards a compliant and reasonable path, encouraging more institutions to participate in the industry, thereby enabling better stable growth.

Industry insiders believe that Bitcoin is likely to rise to $150,000 to $200,000 within the next year, but the next phase of the market will no longer be limited to Bitcoin; Ethereum, Solana, and DeFi tokens are expected to become the main directions for capital inflow. As the U.S. pushes to become the "global cryptocurrency center" under the Trump administration, this cycle is also expected to extend to 2026, making new market highs still worth looking forward to.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。