Original | Odaily Planet Daily (@OdailyChina)

In 2025, the crypto US stock market ushered in a genuine "bull market." With the Trump administration's push for the "American cryptocurrency capital" strategy and the signing of stablecoin legislation, the status of crypto companies on Wall Street rapidly rose. The clear signals from policies combined with huge capital expectations made crypto-related stocks the star assets of the capital market. Sensing this signal, crypto companies have chosen to list on Nasdaq or the New York Stock Exchange, attempting to leverage Wall Street's power for self-acceleration.

On August 13, the digital asset trading platform Bullish successfully completed its initial public offering (IPO), raising as much as $1.1 billion, with an issue price set at $37 per share, exceeding the market's previous estimate range of $32 to $33. This IPO was oversubscribed by more than 20 times, with a market capitalization reaching $5.4 billion, and the stock code is BLSH.

On its first day of trading, Bullish's stock price surged to $118 per share, an increase of over 200%, triggering multiple circuit breakers due to excessive volatility. Although the price has retreated somewhat after the initial excitement, it is currently at $62.89, still up nearly 70% from the issue price.

In the secondary market, on Bullish's first trading day, Ark Invest purchased over 2.5 million shares through its ARKK, ARKW, and ARKF ETFs, with a holding value exceeding $170 million, pushing the stock price up by more than 22% on that day, and the market capitalization surpassed $12 billion. On August 20, during a general decline in crypto concept stocks, Ark Invest further increased its position by 356,346 shares of Bullish stock (approximately $21.2 million), while also adding 150,908 shares of Robinhood stock (approximately $16.2 million).

The feedback from the capital market clearly indicates that the imagination of the crypto narrative remains strong.

Assets and Reserves: Block.one's "Blood Transfusion" and Bitcoin's Hidden Card

Bullish not only had a glamorous debut but also possesses a solid capital and asset foundation. Its CEO is former NYSE president Tom Farley, and the largest shareholder is Block.one CEO Brendan Blumer (holding 30.1%). With the financial and technical support from Block.one, Bullish aimed at the institutional client market from the outset, emphasizing trading security and liquidity advantages.

According to data from BitcoinTreasuries.net, after its IPO, Bullish, with 24,000 BTC in holdings, ranked among the top five publicly listed companies with Bitcoin reserves, surpassing leading players like Metaplante and Coinbase. In contrast, Tesla has fallen out of the top ten.

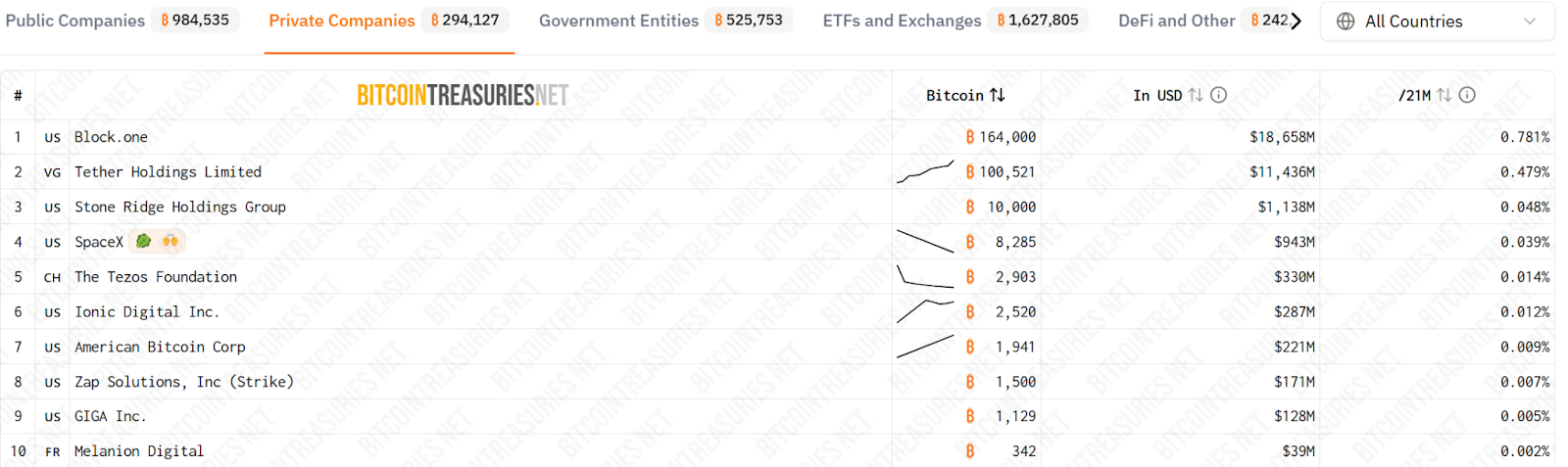

In addition, Block.one itself holds 164,000 Bitcoins (valued at over $18.6 billion), making it the private company with the largest Bitcoin holdings. A SEC financial report published on its official website shows that as of 2021, Bullish had total assets of approximately $5.85 billion, with net assets as high as $4.69 billion.

Overall, Bullish not only gained substantial funding through its IPO, but its underlying Bitcoin reserves and net asset scale also provide strong support for the company's long-term competitiveness in the crypto financial market.

From EOS to Bullish: A History of "Betrayal"

Bullish's rapid rise is inseparable from the deep background of its financial backer, Block.one. However, looking back at history, the love-hate relationship between Bullish and EOS remains poignant.

In 2017, Block.one launched EOS with the ambitious vision of "one million TPS, zero fees," raising $4.2 billion through an ICO, setting a record for fundraising in the crypto industry, and being hailed as the "Ethereum killer." However, the gap between ideals and reality emerged swiftly: cumbersome CPU and RAM staking mechanisms hampered user experience; node elections were controlled by large holders and exchanges, devolving into a game of voting rights, far from the fair ecosystem the community expected.

Deeper fractures arose from unfair resource allocation. Block.one promised to invest $1 billion to support the EOS ecosystem, but of the $4.2 billion raised, $2.2 billion was used to purchase US Treasury bonds, invest in Bitcoin, trade stocks, and acquire Silvergate Bank (which went bankrupt in 2023), leaving a dishearteningly small amount for EOS developers.

In 2021, Block.one turned around and launched Bullish with great fanfare, investing $100 million in cash and attracting top-tier capital such as Peter Thiel, Alan Howard, SoftBank, and Galaxy Digital, raising as much as $1 billion.

However, this new platform neither used the EOS chain nor supported EOS tokens, and it did not leave any resources for the EOS community. For EOS supporters, this was a blatant "betrayal": Block.one capitalized on EOS but, when the wind changed, started anew, leaving EOS on the sidelines of public chain competition.

The anger eventually evolved into a "governance uprising." The EOS Network Foundation (ENF) united nodes to promote on-chain proposals to strip Block.one of its governance rights. Although EOS achieved a formal "de-Block.one-ization," the control of funds still remained with Block.one, and the legal disputes between the two parties remain unresolved to this day.

Landing on Wall Street: Opening the Door to Traditional Finance

In fact, Bullish is not the first attempt to enter the capital market. As early as 2021, it planned to go public through a SPAC merger, but ultimately shelved the plan due to multiple factors. It wasn't until June 2025 that the Financial Times revealed that Bullish had secretly submitted an IPO application to the SEC.

This time, with the capital support from Block.one and Tom Farley's Wall Street background, Bullish finally opened the door to the New York Stock Exchange. A successful IPO not only means a boost in funding but also symbolizes the legitimization of crypto companies in the US capital market.

Notably, Bullish received $1.15 billion in IPO fundraising in the form of stablecoins, marking a milestone event as the first IPO in the US capital market settled in stablecoins. These stablecoins were primarily minted on the Solana network, including USDC, USDCV, USDG, PYUSD, RLUSD, USD 1, AUSD, and euro-denominated EURC and EURAU, all exclusively custodied by Coinbase. This innovation opens new pathways for the application of crypto assets in traditional finance and signals further integration of crypto assets with traditional finance.

Conclusion

Bullish's listing is a product of the dual drive of policy and market. On one hand, there is a loosening of the institutional environment, and on the other, a rapid response from capital. Its value lies not only in the $5.4 billion market capitalization and the 24,000 Bitcoins but also in its symbolic significance: crypto finance is moving from the margins of experimentation to the institutional stage.

Whether the enthusiasm for US crypto stocks can continue and whether it will drive a new round of industry prosperity remains to be tested by both the market and policy. However, Bullish has undoubtedly sounded the opening bell for this new chapter.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。