The story of Solana itself is a reflection of the incredible allure of the crypto world.

Written by: angelilu, Foresight News

In just two days, Solana secured over $2 billion in massive bets from institutional investors managing tens of billions of dollars in assets.

Can SOL, which shone brightly in the last meme market, replicate the "homework" of BTC and ETH this time?

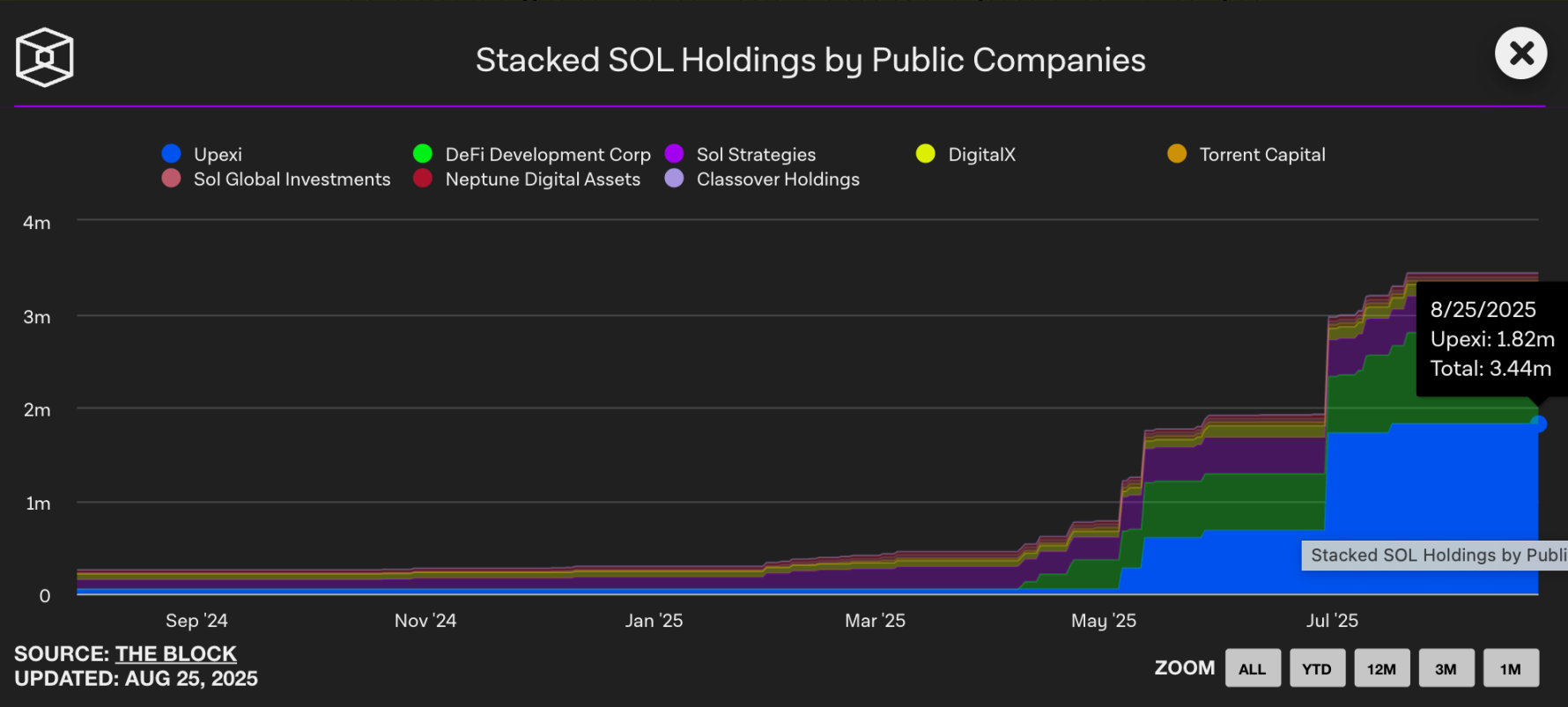

An increasing number of publicly listed companies are beginning to hold SOL on their balance sheets. Currently, Solana has a total market capitalization of $101.4 billion. According to data from The Block Dashboard, publicly listed companies hold a total of 3.44 million SOL, valued at approximately $650 million based on an average price of $190 at the time of writing. Among them, Upexi holds over 1.82 million SOL, worth about $350 million.

However, new capital layouts are reshaping the current landscape. The SOL held by publicly listed companies currently accounts for only 0.69% of the circulating supply, while the recent $1.25 billion injection from Pantera Capital and the combined $1 billion commitment from Galaxy, Multicoin, and Jump will be 3.5 times the current holdings of SOL by listed companies.

Big players entering the arena, a silent capital contest

On August 25, Galaxy Digital, Multicoin Capital, and Jump Crypto officially announced a joint initiative, negotiating with potential supporters to raise approximately $1 billion specifically for accumulating Solana.

This is not a simple investment but a meticulously planned market action. The three giants have hired the well-established Wall Street investment bank Cantor Fitzgerald LP as the lead bank, planning to create a digital asset financial company focused on Solana by acquiring an unnamed publicly listed company.

Notably, the Solana Foundation has expressed support for this, and the transaction is expected to be completed in early September.

This action is not an isolated event but part of a long-term strategy. Multicoin and Jump have previously made significant investments in Solana ecosystem projects. Galaxy Trading had also raised approximately $620 million specifically to purchase SOL at a discount from FTX's bankruptcy assets. Now, they are joining forces to increase their stakes.

A day later (August 26), Pantera, led by former Tiger Management executive Dan Morehead, also revealed its ambitious plan in a report by The Information, seeking to raise up to $1.25 billion to acquire a Nasdaq-listed company and transform it into an investment firm focused on Solana, named "Solana Co."

This is not an impromptu move by Pantera. As early as April 2024, they began raising over $1 billion for a new fund. Now, the ambition behind this seemingly ordinary fund has finally come to light—targeting the Solana ecosystem.

Most notably, Pantera is not only increasing its own stake but is also collaborating with ParaFi Capital to support Sharps Technology, a company dedicated to developing financial tools for Solana, which is raising over $400 million. This series of actions reveals Pantera's firm confidence in Solana's future.

But Pantera's strategy goes beyond this. Reports indicate that they have quietly invested approximately $300 million in digital asset financial (DAT) companies across "various tokens and regions." This layout not only generates returns but also increases net asset value, showcasing the mature strategy of established investment institutions in the crypto space.

Why Solana? The strategic logic of institutional capital

Smart investors are always adept at spotting opportunities in crises. It is not difficult to see that before the trend of treasury companies clustering around Bitcoin and Ethereum became popular, both Pantera and Galaxy had purchased SOL tokens at significant discounts from the bankrupt FTX. Simply put, they have already made considerable profits from SOL.

The first batch of SOL tokens sold from FTX's bankruptcy assets (ranging from 25 million to 30 million) was sold at $64 each, over 60% lower than the market price of SOL at that time, while the second batch was sold at prices between $95 and $110 per token (15% to 26% lower than the market price). There is no public information disclosing how much Pantera and Galaxy profited from FTX's bankruptcy restructuring. However, the aggressive new strategy can easily be interpreted as a signal of having made money.

The rise of the digital asset financial (DAT) company model provides these institutional investors with a new way to capture value. Through this model, they can not only hold SOL for potential appreciation but also earn stable returns through various DeFi protocols, achieving multiple asset growth.

The large-scale entry of institutional capital will undoubtedly provide strong support for SOL's price. Historical experience shows that when institutional investors begin to systematically accumulate a certain crypto asset, it often drives it into a relatively stable upward channel.

The example of Ethereum has already proven this. With the launch of ETFs and the entry of institutional investors, ETH not only saw its price rise but also experienced a significant reduction in volatility, leading to a more mature market structure. Currently, the ETH reserves held by 69 Ethereum treasury entities have reached 4.1 million, accounting for 3.39% of Ethereum's circulating supply, with a holding value of approximately $20 billion. Ethereum's recent breakthrough of its highest record in nearly four years is partly due to these entities' purchases.

Now, Solana seems to be replicating this path, but its scale still lags far behind BTC and ETH. As more institutional holders join, the liquidity structure of SOL will undergo a qualitative change, potentially forming a more stable yet concentrated holding pattern. Additionally, after the approval of spot ETH for BTC and ETH for over a year, analysts have suggested that SOL's spot ETH may be approved this year.

Traditional financial institutions' interest in Solana is not a momentary impulse but is based on its unparalleled technical advantages. In balancing the three major challenges of blockchain (decentralization, security, and scalability), Solana stands out with its astonishing transaction processing capability and low Gas fees.

While Ethereum is still struggling with high transaction fees, Solana is already capable of processing thousands of transactions per second while maintaining almost negligible costs. For institutional investors accustomed to the efficiency of traditional finance, this performance undoubtedly aligns more with their expectations.

More importantly, Solana's ever-growing ecosystem of decentralized applications (dApps), NFTs, and DeFi protocols provides it with rich application scenarios and growth potential. This comprehensive ecosystem prosperity is one of the key factors attracting institutional investors.

For developers and project parties on Solana, this is undoubtedly good news. More capital means more experiments, innovations, and application scenarios, and the ecosystem is expected to enter a new phase of accelerated development.

In particular, the success of the digital asset financial company model may give rise to more similar investment vehicles. This model not only provides institutional investors with convenient entry channels but also offers a feasible path for the integration of traditional finance and the crypto world.

In the coming years, we may see more investment companies focused on specific blockchain ecosystems emerge, forming a new landscape of institutional investment.

The potential risks of power redistribution

When Solana was born, few could foresee that it would attract so much institutional capital attention in just a few years. From nearly disappearing due to the FTX collapse to now becoming a favored investment target for institutional giants, Solana's story itself is a reflection of the incredible allure of the crypto world.

The current wave of institutional investment is likely just the beginning. As pioneers like Pantera and Galaxy set benchmarks, more traditional financial institutions may follow suit, incorporating Solana into their diversified investment portfolios.

However, the large-scale entry of institutional capital also brings new concerns. When a small group of institutions holds a large amount of SOL, this may, to some extent, re-concentrate the originally decentralized assets and could affect the level of decentralization of the Solana network. The SOL treasury company DeFi Dev Corp. is actively accumulating tokens while also stating on Twitter that it will vote in favor of the Alpenglow proposal for Solana this week. This proposal, in simple terms, aims to make Solana's voting "faster." When ordinary users face these complex technical terms, will they follow the vote, turning Solana into one that aligns more with the interests of large institutions?

Additionally, the risk of price manipulation may also increase. Once these large holders decide to adjust their positions, the market may face severe fluctuations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。