Recently, two topics have sparked the most discussion on-chain: one is the "arbitrage event" involving the leading Perp DEX Hyperliquid's XPL, and the other is the launch of the WLFI project led by the Trump family. The name TechnoRevenant has appeared multiple times in both discussions. There are no photos of him online, his real name is unknown, and his background is unclear, but this mysterious figure, who enjoys Techno music and uses a bionic persona, has amassed nearly $300 million from the on-chain market in just one week.

In just 20 minutes, while users on Hyperliquid lost over $100 million, TechnoRevenant made $38 million. He had also invested $15 million earlier this year to become a "whale" in WLFI. Who exactly is TechnoRevenant, and how did he achieve this?

WLFI Whale's "Fat Finger"

On the evening of September 1, as many addresses that participated in the presale rushed to claim WLFI tokens to sell at a high point during the opening, the address moonmanifest.eth, which held 1 billion WLFI tokens, calmly claimed its tokens despite Ethereum gas fees exceeding 100 Gwei. It was later verified by the community that this was TechnoRevenant, who had gained fame last week for making $38 million on Hyperliquid.

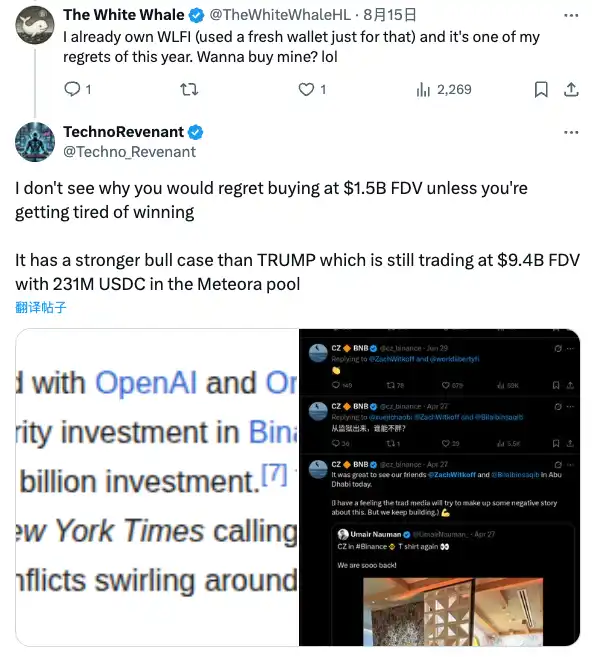

TechnoRevenant began positioning himself in the World Liberty Financial project as early as January 2025, when Trump had not yet officially taken office as President of the United States, and the official "Gold Paper" stated that WLFI could not be transferred. Nevertheless, TechnoRevenant invested $13 million in USDC and $2.01 million in USDT through the wallet moonmanifest.eth, totaling about $15 million to participate in the first round of public offerings, purchasing approximately 1.5% of the total supply.

On September 1, 2025, after WLFI officially began trading, TechnoRevenant received 200 million WLFI as a 20% unlocked share, valued at about $49 million, while the remaining 800 million tokens remained locked. Based on the current price of $0.245, the total value of his 1 billion WLFI reached $245 million, achieving a paper profit of 8-16 times.

In addition to being a whale in the Trump family project WLFI (worldlibertyfi), it was his "accidental" substantial returns from going long on XPL as a "contract novice" on Hyperliquid that truly surprised the market.

The events that occurred on the morning of August 27, 2025, were a harsh lesson for those hedging or shorting the Plasma project token XPL on Hyperliquid.

From 5:36 AM on August 27, over the next two hours, approximately $159 million in positions on Hyperliquid were liquidated, affecting over 1,000 traders. Some noticed several addresses buying large amounts of tokens to "manipulate" the already low liquidity of the XPL pre-market on Hyperliquid. However, this "novice" TechnoRevenant, who was making his fifth contract operation, later admitted that this was caused by his "fat finger" mistake.

TechnoRevenant stated that he was optimistic about XPL but did not participate in the presale, so when Hyperliquid launched its perpetual contract trading in the pre-market, he began to establish exposure. Prior to this, he had accumulated 54.4 million XPL over two days, purchasing with three wallets at a scale of $44,000 each time, with a total value estimated between $31 million and $33 million at that time.

However, within a brief 15 seconds from 05:36:05 to 05:36:20, he claimed that due to being "sleepy," he accidentally added an extra "4" to the amount he intended to purchase and repeated it 10 times. This caused his single purchase amount to switch from $44,000 to $444,000, resulting in an investment of about $4.44 million to buy 7,288,505 XPL, which accounted for 77.37% of the total long position at that time. This action also pushed the XPL price from $0.587 to $0.65 within a minute, a rise of 10.8%.

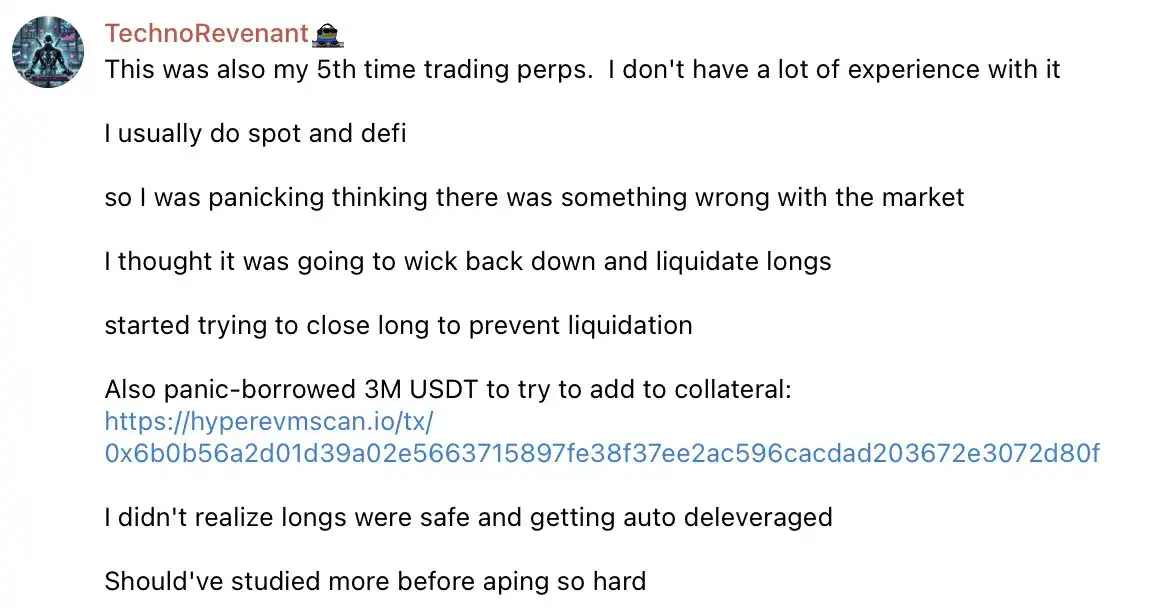

By the time he realized the issue, the market began to slightly retreat. He even nervously borrowed $3 million as a precaution. He attempted to close his long position but did not realize that his large holding made his long position safe. During this time, Hyperliquid activated its automatic reduction mechanism, and for the next 15 minutes, he continued to buy at a single volume of $45,000, gradually closing his long positions.

In the end, he made $38 million from this trade, and to this day, he still holds over $30 million in XPL long positions, accounting for 87% of the total open contracts on Hyperliquid, with an additional $26 million in cash available for further purchases. This has kept the XPL price on Hyperliquid at a 20-30% premium compared to other trading platforms.

Radical Opportunist or Market Manipulator

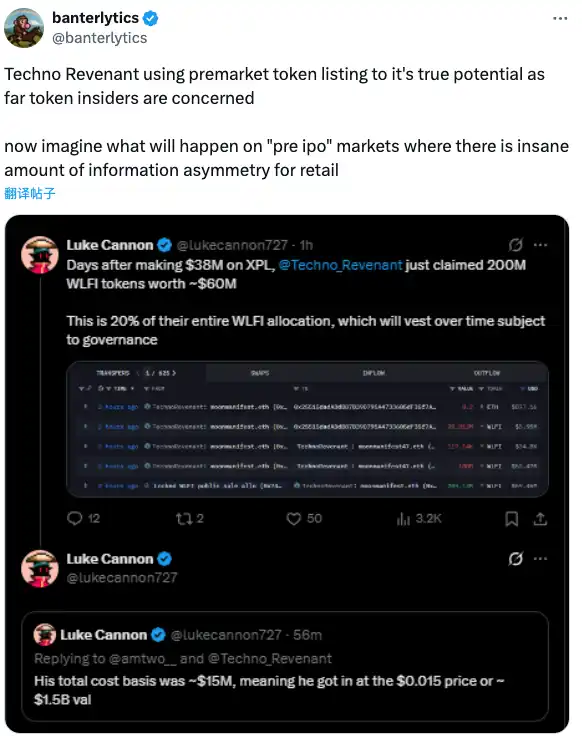

TechnoRevenant's operations have sparked intense discussions in the crypto community. Supporters hail him as a "god-level market interpreter," praising his consecutive victories. The community even memed the "fat finger" incident, calling it "the best typing error in history." Despite causing significant losses for many traders, discussions in the community revolve around his use of large funds to manipulate the market.

However, some opinion leaders, including Zhu Su, argue that he did not exploit contract loopholes but engaged in normal trading behavior. Additionally, unlike other recent DEGEN contract traders, his trading appears more rational rather than blindly extreme, leading many traders to choose to follow him in going long on WLFI (which has now seen its FDV rise to $24.6 billion).

On-chain data shows that moonmanifest.eth has had eight USDC transfers with Jump Trading, totaling $27 million, and has frequent interactions with top market makers like Wintermute and Amber. Coupled with his early heavy investment of $15 million in WLFI, when it was still uncertain whether the tokens could be "unlocked and transferred," these signs suggest that TechnoRevenant may not be an ordinary retail investor but a professional trader with institutional backing.

This has further raised concerns in the community about the recent hot on-chain equity (Pre IPO) model. KOL banterlytics stated on X, "Seeing how much impact TechnoRevenant has had on the token's premarket, imagine what would happen if it occurred in a Pre IPO with more insider information."

TechnoRevenant's on-chain behavior of "printing money" continues, showcasing how this mysterious trader can easily manipulate a market with weak liquidity. As we enter an era where everything is on-chain, the impacts caused by on-chain activities may extend beyond the chain itself; they could affect regional housing prices or the valuation of a startup. Before welcoming this "new era," whether the liquidity and mechanisms of blockchain can support these changes will be an unavoidable topic for us.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。