Author: Jiahua, ChainCatcher

On September 5, Hyperliquid announced in its Discord group that it would issue its native stablecoin USDH and announced an 80% reduction in fees for spot trading pairs.

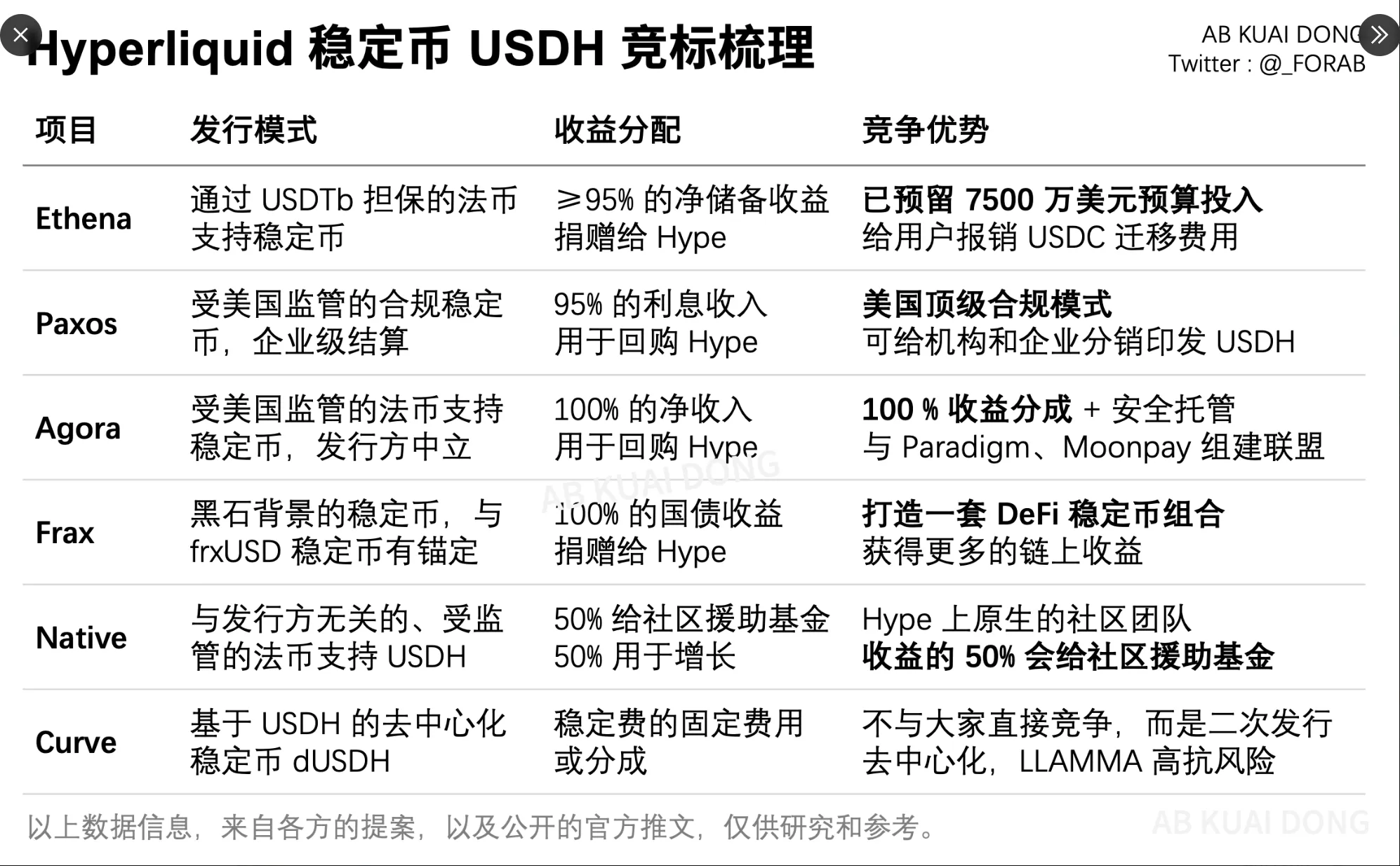

Subsequently, several institutions competed to become the issuer of USDH, including Sky (formerly MakerDAO), Ethena, Frax, Agora, and Native Markets. The response from Circle's CEO, the direct party affected by this action, was "Don't Believe the Hype."

However, as of September 15, Hyperliquid's native token HYPE continued to break new highs, rising to $53.64. According to CoinGecko data, its price increased by 7.77% over the past 7 days.

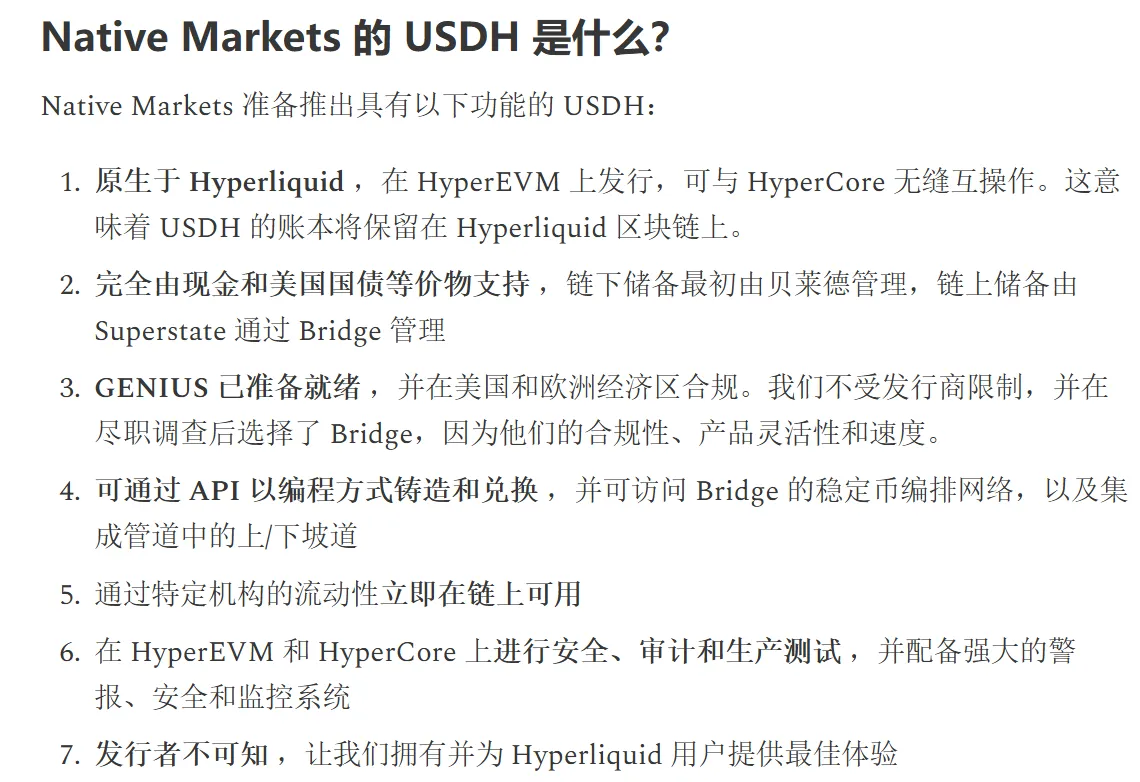

Currently, the Native Markets team has won the Hyperliquid USDH stablecoin bidding and plans to enter the testing phase "within a few days."

The Issuance of USDH: An Expected Ecological Closed-Loop Strategy

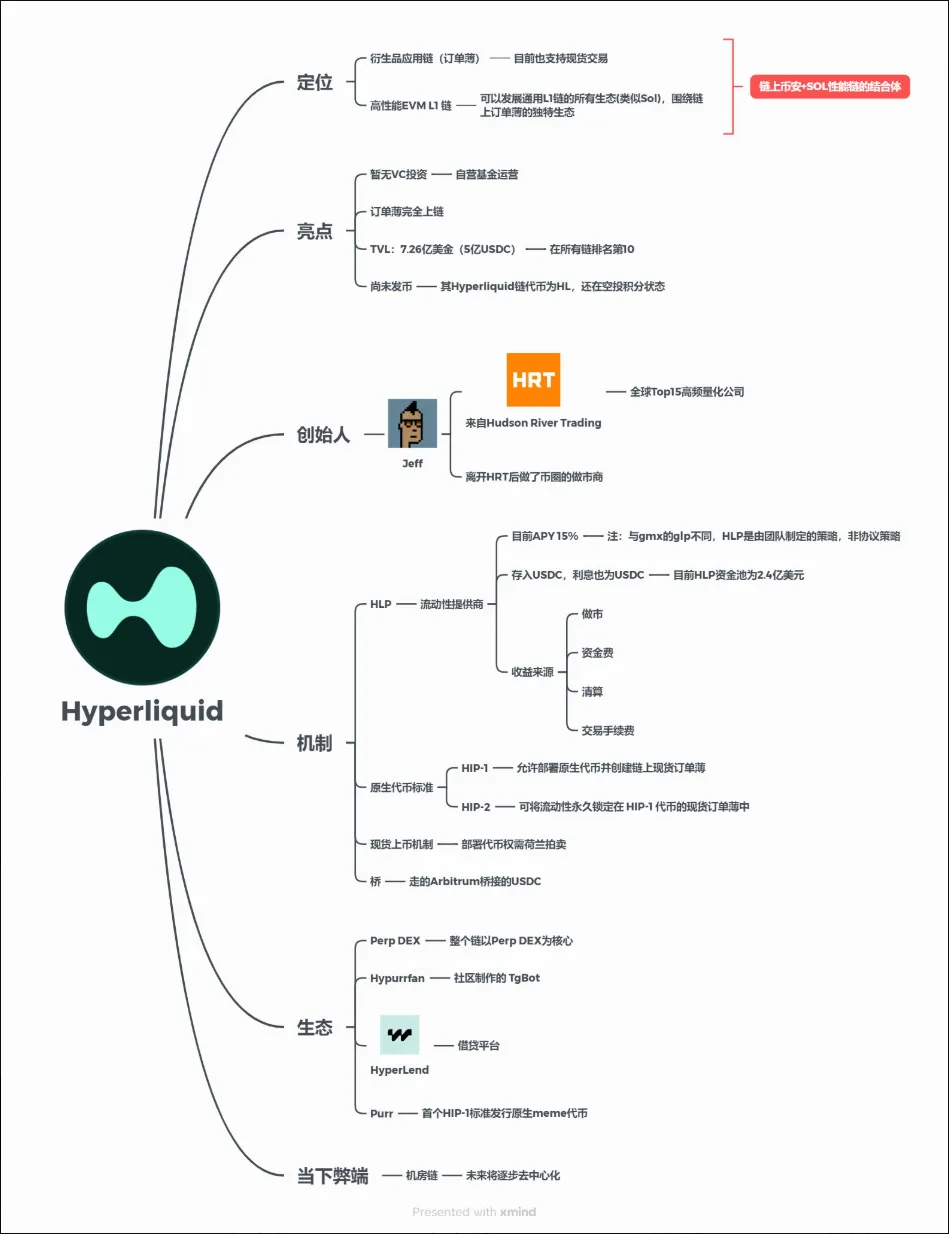

Hyperliquid was once considered one of the most successful projects in this cycle, with a team of only 11 people generating over $100 million in annual revenue per person, capturing over 75% of the decentralized contract market.

According to Defilama data, Hyperliquid's revenue reached $106 million in August 2025, with nearly $400 billion in perpetual contract trading volume.

As an undisputed industry giant, Hyperliquid has a fatal weakness. The platform's dollar liquidity relies on USDC, a centralized external stablecoin that could be frozen at any time.

Meanwhile, Hyperliquid has nearly $5.7 billion in USDC deposits, meaning that every year (calculated at a 4% interest rate), over $220 million in interest income flows to external stablecoin issuers rather than the ecosystem itself.

Therefore, from both the platform's philosophy and revenue perspective, it is imperative for Hyperliquid to issue its own native stablecoin.

Validator Voting: Decentralization or "Pulling the Plug"

The issuance of USDH by Hyperliquid differs from the methods used by centralized companies like Circle or Tether, where reserve funds are controlled by the company, and interest income belongs to the company. The issuance of USDH is managed by a community-driven on-chain voting mechanism, and the income generated by USDH will be redirected to Hyperliquid's ecosystem for token buybacks or to provide funds to support ecological development.

This decision decentralizes power and is theoretically open and transparent, but critics argue that the voting power held by 21 validators is highly centralized. In contrast, Ethereum has over 40,000 validators, providing a strong defense mechanism against collusion.

Image source: X user Crypto Brave (@cryptobraveHQ)

As institutions like Ethena and Paxos expressed their intention to withdraw from the bidding, Native Markets, founded by Max Fiege, an advisor to Hyperion (HYPE Digital Asset Treasury Company), has essentially locked in victory. Although Native Markets does not have a record of issuing stablecoins, it distinguishes itself as the only team that has deployed and tested token liquidity on Hyperliquid's testnet and mainnet.

Image source: Native Markets proposal

However, there are many controversies within the community regarding this proposal, mainly focused on three aspects.

● Discontent with Existing Protocols

Max, the head of Hyperstable (an existing stablecoin protocol), protested that Hyperliquid had previously disabled the USDH code name, forcing them to use USH, and now reopening it to teams that have invested resources and built on USH is unfair. Max suggested continuing to disable USDH or having the Hyperliquid Foundation develop it internally to maintain neutrality.

● Fairness Controversy of Native Markets Proposal

Some users questioned the deployment address being a new wallet, which received funds five hours before the USDH plan was announced, suspecting an undisclosed relationship with the Hyperliquid Foundation. Max from Hyperstable also believes the proposal is overly detailed, suggesting prior insider knowledge.

● Potential Conflict of Interest with Stripe

Concerns have been raised about Native Markets' reliance on Stripe's Bridge platform. Agora CEO Nick van Eck warned that Stripe, as a vertically integrated competitor (involving wallets, infrastructure, etc.), could lead to Hyperliquid losing economic autonomy.

At the same time, the $JELLY incident in March 2025 exposed Hyperliquid's governance risks. In response to malicious attacks threatening network security, the team urgently delisted tokens through validator voting, which was also questioned as a centralized "pulling the plug" action.

The Vision of "On-Chain Binance": More Than Just a DEX

Hyperliquid addresses a series of issues with current centralized exchanges, starting with no KYC, zero gas fees, and an on-chain order book, gradually building its own L1 ecosystem.

Image source: X user Master Pang (@kiki520eth)_

At the same time, Hyperliquid has proposed its own HIP (Hyperliquid Improvement Proposals), similar to EIP.

HIP-1 defines the native token standard, allowing project parties to issue tokens on Hyperliquid and create on-chain order books, adding a spot market to Hyperliquid.

HIP-2, referencing UniSwap, provides liquidity strategies for token trading without requiring project parties to provide high market-making fees, thus attracting more project parties to choose to issue tokens on Hyperliquid.

HIP-3 allows users to stake 1 million HYPE tokens to deploy any type of contract market, including traditional stocks, funds, bonds, etc., laying the foundation for Hyperliquid to transform from a single DEX into an open financial infrastructure provider.

From an initial perpetual contract exchange to a spot market and liquidity mechanism driven by HIP proposals, and now the injection of the USDH native stablecoin, Hyperliquid's ambition has never been simply to become a DEX. So, will it become the next legend? The answer may lie in the next HIP proposal or the next price breakthrough of HYPE.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。