Author: Yuliya, PANews

Before making each on-chain operation, have you ever subconsciously checked your wallet, silently wondering: "Do I have enough ETH to pay for Gas?" "Will the transaction get stuck?" The anxiety of seeing Gas prices soar, fearing that the transaction might fail or costs could double, is a shared memory among all Web3 users. Ethereum, as a global decentralized computer building a new financial system, undoubtedly has grand prospects. However, the current user experience is far from ideal. Network latency, wildly fluctuating Gas fees, and uncertainty in transaction confirmations create an invisible barrier hindering mass adoption. Every transaction feels like a gamble on speed and cost; this friction is not only a pain point in user experience but also a "hidden tax" imposed on the entire digital economy.

The birth of the ETHGas project aims to break this deadlock and lead a paradigm revolution towards "real-time Ethereum." Its goal is to build a real-time infrastructure that can "speed up" Ethereum, completely eliminating Gas fee anxiety, allowing transactions to flow smoothly, achieving "Invisible Gas."

Building a Digital City with Zero Gas Feel

To understand ETHGas's solution, we first need to look at Ethereum's congestion issue from a different perspective.

Imagine Ethereum as a rapidly expanding digital city, where every 12 seconds, a brand new piece of land—this is the so-called "block"—is created for development. The "blockspace" is the limited area available for construction on this land. Each user transaction and NFT minting is akin to wanting to build a house on this new land. When the market is booming, thousands of people rush in simultaneously, competing for this limited "digital real estate." To ensure their "building plans" are prioritized, users must engage in fierce bidding, which is the origin of high Gas fees.

For years, users have felt like they were participating in a chaotic auction, worrying that a low bid would lead to transaction failure while fearing that a high bid would waste money. In response to this situation, the mainstream exploration direction in the industry has been "account abstraction" (like ERC-4337), which, while promising, has introduced new complexities, costs, and slow ecological adoption challenges.

ETHGas's solution is entirely different: it does not patch the existing system but reconstructs the rules at the underlying level, transforming the chaotic "blockspace" auction market into a structured financial market, thereby building a truly "real-time Ethereum."

Reshaping Ethereum's Operating Model: Four Pillars to Build a Growth Flywheel

To achieve this grand vision, ETHGas's solution is built on four interrelated and mutually reinforcing strategic pillars.

1. Say Goodbye to 12-Second Waits: Click and Complete (Millisecond Pre-confirmation)

Ethereum produces a block every 12 seconds, which feels snail-paced to frontrunning bots and high-frequency traders. As the first step of transformation, ETHGas uses "Inclusion Preconfirmations" technology to reduce transaction settlement time from 12 seconds to an astonishing 3 milliseconds. For users, DEX swaps and NFT bids can be completed with a click, completely eliminating the anxiety of "waiting for packaging."

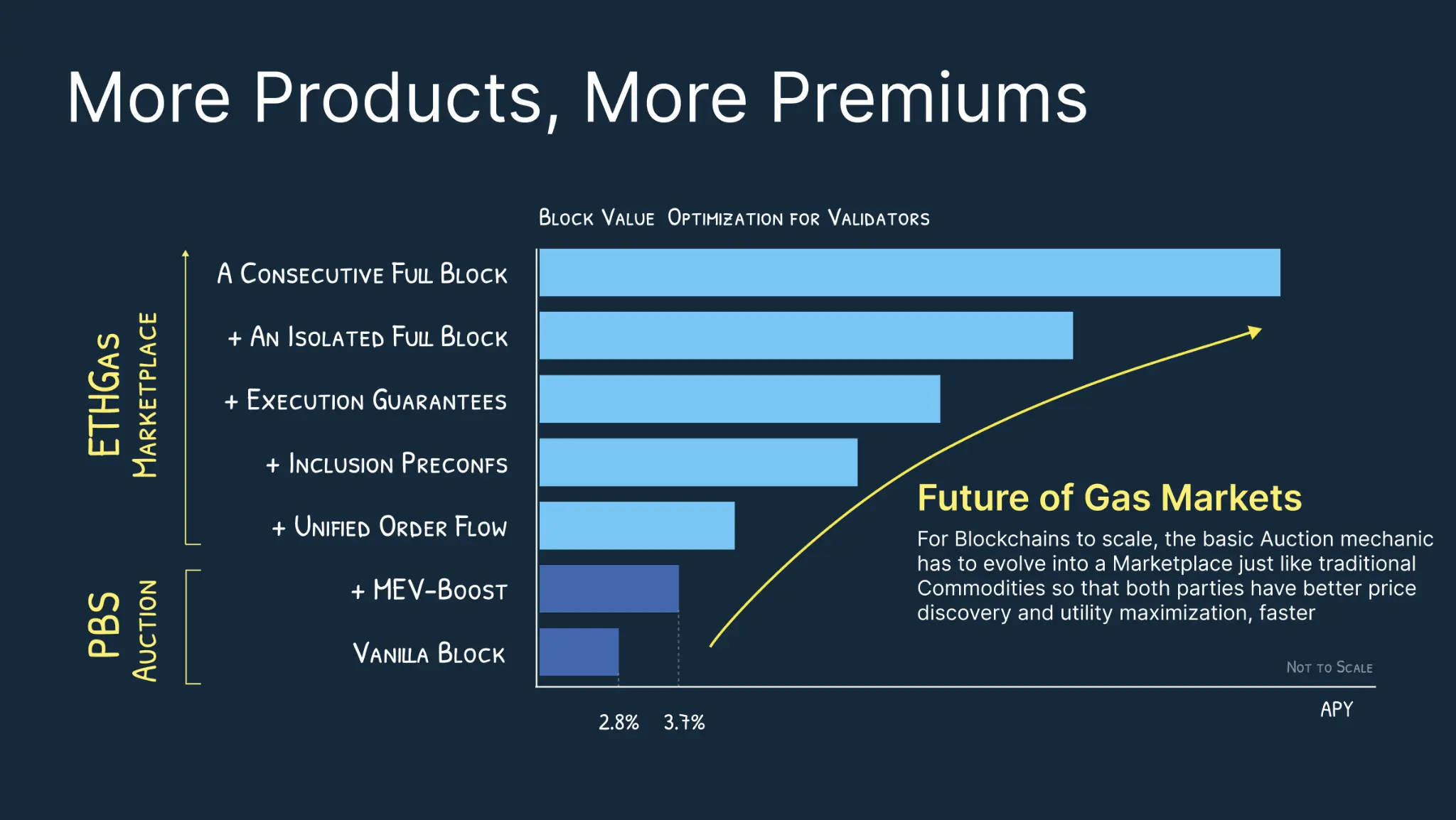

2. Transforming Blockspace into Tradable Financial Assets

Speed alone is not enough; an efficient resource allocation mechanism is also needed. The core of ETHGas is financialization. It transforms Ethereum's most core and chaotic resource—blockspace—into standardized tradable financial products and establishes a dedicated exchange for this purpose.

In this exchange, what is traded is not tokens, but:

- "Inclusion Preconfirmations": Pay to secure a "space" in a block, ensuring your transaction will be on-chain.

- "Whole Block Commitments": Wealthy MEV bots or large protocols can directly "buy out" an entire block, freely arranging transactions.

- Future "Base Fee Futures": dApps can lock in future Gas costs like buying insurance.

This essentially transforms the chaotic auction where the highest bidder wins into a structured financial market that can be traded and hedged like stock options. In this new market, participants are clearly divided into buyers and sellers:

- Blockspace Buyers (e.g., traders, developers): No longer need to build complex facilities to compete for blocks. They can now directly buy "certainty" in the exchange, significantly increasing efficiency and success rates.

- Blockspace Sellers (e.g., validating nodes): They can sell their blockspace as a high-quality programmable asset in this new market, opening up a powerful and predictable new source of income.

3. Predictable Returns Injecting "Fuel" into the Ecosystem

A market needs active sellers. So why would validating nodes be willing to sell their blockspace? The answer lies in stable and more generous incentives. ETHGas provides validators with a plug-and-play module—Commit Boost. Once activated, validators automatically list their blockspace for sale to large buyers in the exchange, generating stable and additional income that far exceeds traditional MEV earnings, transforming validators from "miners" into "blockspace sellers." More importantly, because the income is predictable, staking operators can launch "fixed-rate financial products," attracting significant traditional financial capital into the Ethereum ecosystem.

4. "Invisible Gas" Removing User Experience Barriers

Once the underlying speed, market, and incentives are ready, the final value will be passed on to ordinary users. Compared to still exploring complex "account abstraction" solutions, ETHGas offers an immediately usable "zero-code" solution, centered around an innovative Gas fee subsidy and refund mechanism.

dApps can directly collaborate with ETHGas to subsidize users' Gas fees. In this model, users still need to pay Gas fees during transactions, but the collaborating dApp promises to cover this expense and sends the corresponding subsidy amount to ETHGas. Subsequently, users can claim the Gas fees subsidized by the protocol on the rebate dashboard that ETHGas will launch in Q4, achieving "Gas fee cashback" and ultimately realizing "0 Gas transactions."

For users, when performing token swaps, minting, or staking, they not only receive Gas cashback to save costs but can also accumulate points to enjoy more rewards in the future, incentivizing them to contribute to the ecosystem.

For dApps, this is not only a short-term user acquisition marketing strategy but also a long-term competitive barrier. First, use subsidies to attract users, then gradually internalize Gas costs into their business models through data analysis.

These four components work together to build a growth flywheel for ETHGas, allowing every participant to benefit:

- Validators/Staking Nodes (Sellers): No longer limited to earning a bit of staking rewards and relying on MEV. Now, through ETHGas's "Commit Boost" module, they can sell their blockspace as premium goods to institutional buyers in the exchange, generating stable and higher additional income. This opens up the possibility of "fixed-rate staking," greatly increasing its appeal to institutional capital.

- Traders/Protocols (Buyers): No longer need to build complex infrastructure to compete for blocks. They can now directly buy "certainty" in the exchange. Frontrunning trades, emergency liquidations, oracle updates… all time-sensitive operations can be resolved with money, significantly improving efficiency and success rates.

- dApps/Protocols (User Growth Side): The exchange makes Gas costs predictable and hedgeable (through futures), allowing dApps to confidently offer users Gas-free transactions. Gas-free transactions can attract a massive user base, leading to a natural increase in transaction volume and the value of blockspace.

- Ordinary Users (End Beneficiaries): The most direct benefit is Gas cashback. When you trade on a collaborating dApp, ETHGas reimburses you. This is like a "cashback site" for on-chain life, saving you money on every operation.

The idea of liquidity never sleeping is being played out in new ways here.

Introducing a Points Program to Expand the Community, Potentially Linked to Token Rewards in the Future, Becoming Early Participants in the Revolution

To convey this vision to a broader community, ETHGas launched the "Beanstalk Bonanza" event on September 11, aimed at rewarding early participants and contributors.

Participation is simple and direct:

Visit the event page: [Related Link]

Bind your Twitter account: Just 30 seconds to activate your "Bean" account.

Complete beginner tasks: Easily earn your first batch of "Beans" through social actions like following and retweeting.

Remember: Every "Bean" earned today is part of future rewards and a testament to your identity as an early builder of "real-time Ethereum"!

The ETHGas community plan will be advanced in chapters, with the first chapter focusing on social tasks and referrals, while the second chapter will revolve around Gas reports, laying the groundwork for further optimization of the blockspace market.

Reshaping the Interaction Experience is the Ultimate Goal

ETHGas's ultimate goal is to make Gas fees completely "disappear" from users' perception. To achieve this, ETHGas will expand across major Layer 2s and attract institutional capital by providing predictable returns.

Imagine when Ethereum becomes instantaneous and Gas is completely imperceptible; decentralized applications will finally be able to compete with Web2 giants in user experience. This is not just an optimization of experience but a foundational revolution opening the door to the next billion users.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。