Digital asset innovation provides new pathways for debt management, with investment opportunities emerging.

Author: AltSeason CoPilot

Translation: Baihua Blockchain

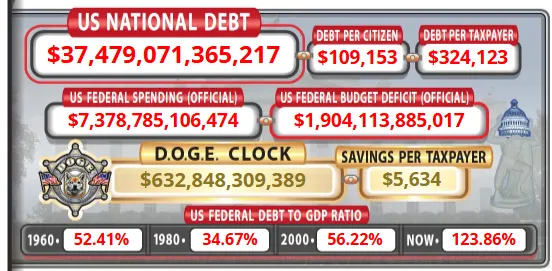

If you are like most investors, concerned about the spiraling rise of U.S. debt, you may be wondering if there is a realistic solution to the $37 trillion debt abyss that won't trigger an economic disaster.

You may have heard politicians promise solutions, while economists debate whether the U.S. can escape this unprecedented level of debt through "economic growth," leaving you uncertain about the prospects for investment and financial futures.

I have studied monetary innovation and debt crises for over 15 years, and the current development of stablecoins is the most promising breakthrough in debt management I have ever seen.

Major financial institutions, including ARK Invest and the Bank for International Settlements, are analyzing how digital assets can open up new pathways for the sustainability of national debt.

By the end of this article, you will clearly understand:

How stablecoin-backed U.S. Treasury bonds create a self-reinforcing cycle that alleviates debt pressure;

Why strategic digital asset reserves may be key to maintaining U.S. financial dominance;

Most importantly, how to adjust your investment portfolio to seize the most significant monetary innovation opportunity since the establishment of the Federal Reserve.

You will also discover that this is not a fantasy—legislators are already considering incorporating digital asset reserves into national debt strategies.

Are you ready to learn how digital finance is reshaping everything?

Image source: Jakub Żerdzicki on Unsplash

Image source: Jakub Żerdzicki on Unsplash

Why Traditional Debt Solutions Fail in the U.S.

What frustrates me is that most debt crisis analyses focus on spending cuts and tax increases, completely overlooking how technological innovation can create entirely new sources of revenue and debt management tools.

You may have heard countless debates about austerity versus stimulus policies, yet no one mentions how digital assets can fundamentally change the game.

The problem is not that traditional fiscal policy tools are ineffective, but that in the face of $37 trillion in debt, these tools are politically difficult to implement and economically destructive.

I have observed that the failure of decades of deficit reduction plans stems from their assumption that tomorrow's economy will operate like yesterday's, completely ignoring the new possibilities brought by digital finance.

By studying historical debt crises, I found that sustainable solutions often come from expanding the overall economy rather than merely reallocating existing resources.

The most successful debt solutions in history have involved creating new value and new demand through monetary innovation—from the establishment of central banks to the development of modern bond markets.

The reality is that when debt reaches a level that threatens system stability, solutions typically come from financial innovation rather than traditional fiscal adjustments.

If you feel that traditional debt analysis is insufficient, it is not your fault—most experts analyze 21st-century problems through a 20th-century framework.

In my experience, breakthrough solutions emerge when the following three factors converge:

- Technological capability

- Market demand

- Regulatory clarity

Currently, stablecoins are simultaneously creating all three, fundamentally changing how sovereign debt operates.

Here are the key insights I found that can change debt sustainability…

Four-Phase Digital Asset Strategy for Addressing Debt Pressure

By analyzing forecasts from major financial institutions and government studies, I summarize how stablecoins and digital assets can provide sustainable solutions to debt crises through four interconnected phases.

The beauty of this strategy is that each phase reinforces the others, creating compound benefits.

➝ Phase One: Surge in Treasury Demand Driven by Stablecoins

Current Situation: Stablecoin reserves (primarily holding U.S. Treasury bonds) could grow from current levels to $1-2 trillion by 2028, creating significant new demand for short-term U.S. debt instruments.

Importance: Unlike traditional foreign investors who may reduce their Treasury holdings for political reasons, stablecoin issuers need Treasury bonds to ensure operational stability. This creates structural, depoliticized demand for U.S. debt that automatically grows with the expansion of the digital economy.

Mathematical Impact: If stablecoin reserves reach $1.5 trillion and are backed by Treasury bonds, this would represent 4% of the current debt level, and as global digital payments expand, this demand will continue to grow.

Implementation Insight: Legislation such as the GENIUS Act has linked stablecoin reserves to ultra-safe assets (like Treasury bonds), establishing a regulatory framework that directly associates the growth of digital assets with U.S. debt demand.

➝ Phase Two: Creation of Strategic Digital Asset Reserves

Mechanism: The U.S. government creates digital asset reserves backed by stablecoins (holding Treasury bonds), Bitcoin, and other digital assets, diversifying the investor base and reducing refinancing risks.

Value Proposition: Strategic digital asset reserves can capture global digital transaction flows and serve as collateral for payment and asset issuance innovations. Unlike traditional reserves, digital assets can generate income through transaction fees while potentially appreciating in value.

Real-World Example: If the government's Bitcoin holdings appreciate from $60,000 to $120,000 while earning transaction fees through digital Treasury products, the reserves will create direct value to offset debt service costs.

Network Effects: As blockchain-based Treasury bonds circulate internationally, they can capture transaction and holding fees, potentially generating billions of dollars in new revenue for the government each year.

➝ Phase Three: Coordination of Interest Rate Policies

Strategic Approach: By deliberately lowering interest rates while supporting debt service costs and the appreciation of digital asset reserves, a balance is created between traditional debt management and new growth channels.

Timing is Key: Lowering interest rates can reduce the government's annual debt service costs by over $1 trillion while making digital assets more attractive to institutional investors seeking yield alternatives.

Multiplier Effect: The combination of reduced debt service costs and appreciating digital asset reserves can produce a dual benefit—lowering expenditures while increasing revenues through the same policy coordination.

Historical Precedent: This is similar to past monetary innovations that achieved debt sustainability through expanding economic activity and creating new sources of revenue.

➝ Phase Four: Strengthening the Global Dominance of the Digital Dollar

Final Outcome: Stablecoins become key infrastructure for global payments, driving demand for dollars worldwide, even as traditional foreign sovereign demand declines, thereby "rebooting" America's international monetary privilege through digital channels.

Strategic Importance: Rather than combating the decline in foreign Treasury purchases, this approach creates new forms of dollar demand through digital infrastructure that are difficult for other countries to evade or replace.

Market Expansion: Increased adoption of stablecoins will stimulate the growth of new digital financial products, further deepening the digital asset footprint of U.S. Treasury bonds and creating a sustainable competitive advantage.

Cumulative Advantage: When these four phases work in synergy, they create what economists call "network effects"—each user or participant increases the value of the system for others, generating sustainable compound growth.

Key Insight: This is not about replacing traditional debt management but adding a digital layer that creates new forms of value and demand while reinforcing the existing dollar system.

The technology is already in place, market demand is growing, and regulatory frameworks are forming.

What This Digital Debt Revolution Means for Your Investment Strategy

Image source: micheile henderson on Unsplash

After analyzing these four phases, it is clear why major financial institutions take this seriously and why getting ahead of the curve is crucial for portfolio performance. Based on current growth trajectories and institutional adoption patterns, here are reasonable expectations for investors:

➢ Within the Next 12-18 Months:

Regulatory clarity regarding stablecoin reserves and Treasury holdings is expected to accelerate. The government may announce specific digital asset reserve plans, creating immediate opportunities for traditional Treasury markets and digital asset infrastructure companies.

➢ Expansion of the Stablecoin Market:

Current forecasts suggest that the stablecoin market cap could triple, with most growth supported by Treasury bonds. This will create sustained, structural demand for U.S. debt, unaffected by foreign government policy decisions.

➢ Interest Rate Environment:

If this strategy gains political support, coordinated monetary policy is expected to balance the reduction in debt service costs with the development of the digital asset market. Traditional bond investors should prepare for a flatter yield curve and new dynamics in short-term Treasury demand.

➢ Boom in Digital Asset Infrastructure:

Companies building stablecoin technology, Treasury tokenization platforms, and digital payment systems may experience explosive growth due to government adoption and scaling.

➢ Impact on Currency Stability:

The success of this approach may enhance the dollar's dominance through digital channels, making dollar-denominated assets more attractive even if traditional geopolitical relationships change.

➢ Investment Portfolio Impact Timeline:

As regulatory frameworks solidify and institutional adoption accelerates, the most significant opportunities may arise within 2-5 years. Getting ahead of the right digital asset infrastructure and Treasury-backed tools could yield excess returns.

➢ Risk Considerations:

Market vulnerabilities during the transition period may lead to volatility, especially when stablecoin redemptions put pressure on the Treasury market. However, successful implementation could significantly reduce long-term debt sustainability risks.

➢ Global Competitive Response:

Other countries may accelerate their own digital currency initiatives, potentially creating a multipolar digital currency system that presents opportunities and complexities for international investors.

This is not a bet on a single outcome but a recognition that digital assets are creating new pathways for debt sustainability that did not exist five years ago.

The convergence of technology, regulatory, and fiscal demands is creating investment opportunities at the intersection of traditional finance and digital innovation.

Your Digital Treasury Investment Strategy: Five Ways to Position for the Debt Solution Revolution

Research and institutional analysis clearly show that the integration of stablecoins with Treasury bonds is accelerating, creating specific investment opportunities that most portfolios have yet to capture.

Here are clear steps on how to align your investments with this potential transformation:

Image source: Alexander Mils on Unsplash

Step 1: Immediately Gain Exposure to Treasury-Backed Stablecoin Strategies

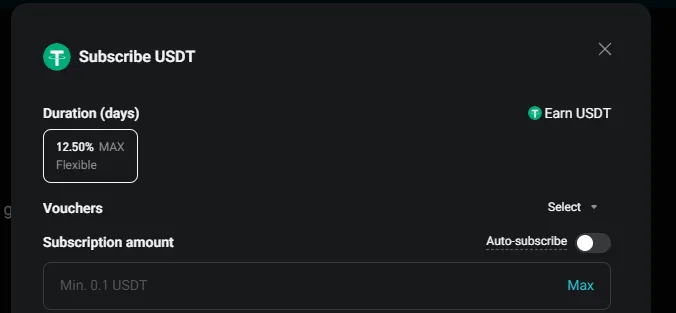

Don't just buy ordinary cryptocurrencies—focus on stablecoins like USDC or USDT that have transparent Treasury backing, which directly benefit from government-sanctioned enhancements.

The simplest way to start is to allocate 5-10% of your stable value investments to these tools and provide liquidity on trading platforms like Bitget for passive income.

Providing stablecoin liquidity on Bitget can earn high returns.

Step 2: Systematically Invest in Digital Asset Infrastructure Companies

Target companies that build stablecoin technology, Treasury tokenization platforms, and payment processing systems, as these will benefit from increased government adoption. Look for companies that already have government contracts or a clear path to serve the Treasury market.

Step 3: Strategically Rebalance Fixed Income Allocation

Consider increasing exposure to Treasury bonds while reducing corporate bond holdings, as the demand for Treasury bonds supported by stablecoins may favorably compress yields. Focus on short-term Treasury bonds that align with stablecoin reserve requirements.

Step 4: Position for Coordinated Monetary Policy Benefits

If interest rates are lowered while supporting debt service and the appreciation of digital assets, consider investing in assets that benefit from this coordination—Treasury-backed digital assets, dividend growth stocks that benefit from low rates, and digital infrastructure real estate investment trusts (REITs).

Step 5: Diversify Cautiously into Bitcoin and Strategic Digital Assets

If the government creates strategic digital asset reserves, getting ahead with Bitcoin and mature cryptocurrencies may benefit from institutional adoption and legalization. Allocate 5-15% of growth investments to mature digital assets with clear regulatory pathways.

The stablecoin-Treasury revolution is not something that will happen someday—it is happening now through regulatory developments, institutional adoption, and government research.

Article link: https://www.hellobtc.com/kp/du/09/6027.html

Source: https://c1nb.cn/fq52n

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。