Written by: Bitpush

The Federal Reserve (Fed) held its Federal Open Market Committee (FOMC) meeting on Tuesday and Wednesday this week, which renowned financial commentator Nick Timiraos described as one of the most "peculiar" meetings in the institution's history.

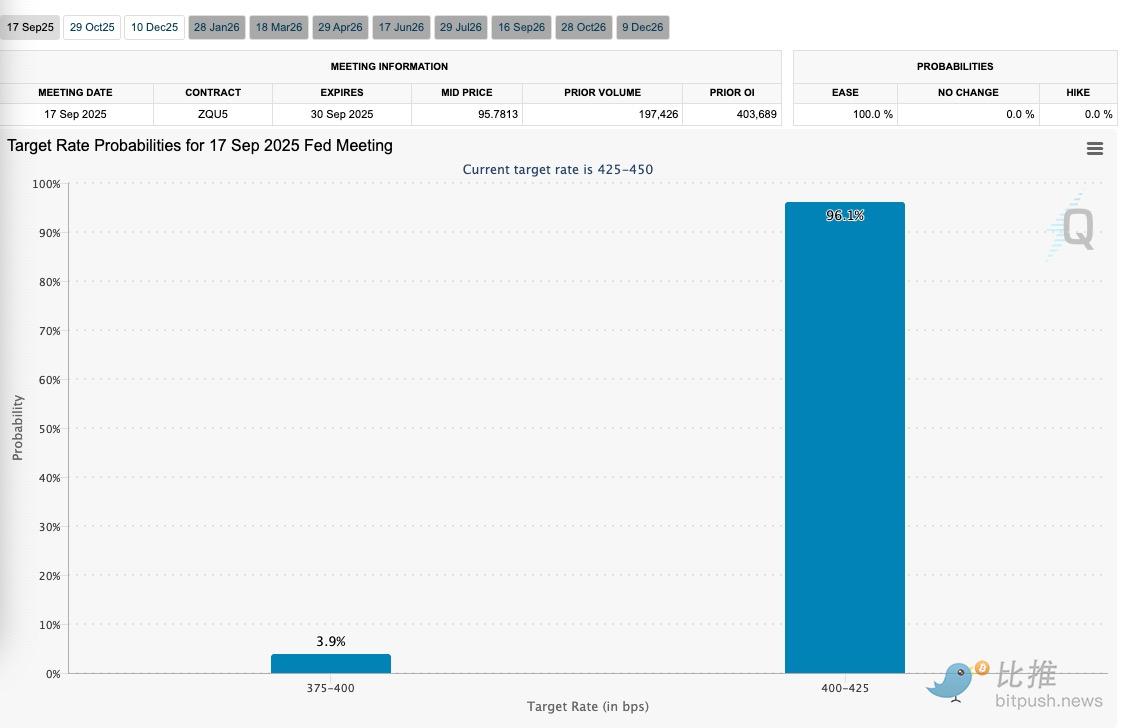

The market almost unanimously expects that after the two-day policy meeting, the Fed will announce its first rate cut in nine months on Wednesday. According to CME's FedWatch tool, the probability of a 25 basis point cut to the 4.25%−4.50% range is as high as 96%, making it almost a certainty.

The Fed has finally decided to initiate a rate-cutting cycle, primarily due to the ongoing weakness in the U.S. labor market and increased confidence among officials that inflation caused by tariffs may only be a temporary phenomenon.

Data from the Labor Department shows that over the three months ending in August, the average number of new jobs added per month was only about 29,000, the weakest three-month increase since 2010 (excluding the pandemic period). Additionally, the number of unemployed individuals has now exceeded the number of job openings; initial claims for unemployment benefits have reached a nearly four-year high; and the number of long-term unemployed (those unemployed for more than 26 weeks) has hit its highest point since November 2021. Preliminary revisions to last week's employment data further indicate that the fundamentals of the U.S. labor market have been weaker than previously thought since the summer.

Moreover, Fed Chair Jerome Powell laid the groundwork for this rate cut in a speech at the end of August, where he explicitly stated, "The risks to employment are rising." This reflects that concerns within the Fed about achieving its "full employment" mandate have surpassed worries about inflation.

However, while the rate cut has become a foregone conclusion, the uncertainty surrounding this meeting and future monetary policy has reached unprecedented heights. These unresolved factors are the real keys influencing financial markets and asset pricing.

Suspense One: The Future Rate Path "Dot Plot" – How Many More Rate Cuts This Year?

Since the 25 basis point cut has already been largely priced in by the market, traders will no longer focus on "whether there will be a rate cut," but rather on the Fed's policy forecasts for the remainder of 2025.

Market Expectations for Future Guidance

In Wednesday's announcement, Fed officials will release their latest economic forecasts, with the most attention on the "Dot Plot" – which reflects FOMC members' expectations for future interest rate levels.

Expectations for Continued Rate Cuts: Traders are boldly betting that the Fed will not "cut rates all at once," but will instead initiate a cycle. According to CME's FedWatch tool, the market believes there is over a 70% chance of further rate cuts in October and December.

Potential Divergence Signals: Goldman Sachs economists expect the "Dot Plot" to show two rate cuts instead of three, but "the divergence will be small." If the Fed ultimately suggests that the pace of rate cuts is slower than the market expects, it could trigger a repricing and sell-off of risk assets. Conversely, if it suggests three or more cuts, it would be a significant dovish signal.

Goldman Sachs economists believe the key for this meeting is whether the committee will hint that "this will be the first of a series of consecutive rate cuts." They expect the statement will not explicitly mention an October cut, but Powell may "gently" hint in the press conference in that direction.

Divided Votes Between Hawks and Doves

The voting composition for this meeting is also filled with uncertainty. While a majority of members are expected to support a 25 basis point cut, there is a clear division within the committee:

- Voices Calling for a "Significant" Rate Cut: Newly appointed member Stephen Miran is very likely to cast a dissenting vote, advocating for a larger rate cut. Treasury Secretary Scott Bessent has also publicly encouraged the Fed to undertake a "comprehensive" rate cut.

- Voices Opposing Rate Cuts: Kansas City Fed President Jeffrey Schmid and St. Louis Fed President Alberto Musalem may oppose the rate cut, expressing concerns about inflation risks from tariffs.

This division will highlight the increasing policy disagreements within the committee, making the central bank's future actions even harder to predict.

Suspense Two: Powell's "Tone Setting" – How to Balance Inflation and Employment?

After the interest rate decision is announced, Powell's choice of words at the press conference is often more important than the FOMC statement itself, as he will be responsible for explaining the committee's thinking.

Is Inflation "Temporary" or "Persistent"?

Fed officials generally believe that the inflation rise caused by Trump administration's tariff policies may only be temporary.

San Francisco Fed President Mary Daly stated, "Tariff-related price increases will be one-time." Other officials also expect that the effects of tariffs will be transmitted over the next two to three quarters, and the impact on inflation will subsequently fade. They believe that against the backdrop of a weak labor market and an unstable economy, businesses have less flexibility to raise prices, thus reducing persistent inflationary pressures.

Powell's remarks must strike a balance between two missions: full employment and price stability. He needs to convey a "pragmatic yet more dovish" tone. As a strategist at B. Riley Wealth Management noted, his tone will be "pragmatic but more dovish," indicating that the Fed needs to defend its full employment mission more vigorously.

Data Dependence and Future Policy Flexibility

Traders will closely watch whether Powell gives any soft hints about actions in October. If he emphasizes "data dependence" and suggests that there is still significant room for policy adjustments in the future, it will leave the market in suspense, allowing asset prices to continue fluctuating with economic data.

Suspense Three: Unprecedented Political Interference – Challenges to Fed Independence

The uniqueness of this meeting partly stems from the political turmoil surrounding the core powers of the Fed. The ongoing pressure from the Trump administration on its independence is the "elephant in the room" at the meeting.

Rapid Ascension of New Governors and Voting

Trump's chief economic advisor Stephen Miran was confirmed by the Senate on Monday and sworn in on Tuesday morning, timely gaining voting rights for this FOMC meeting. This process, which typically takes months, was expedited and seen as Trump’s desire to have Miran cast a key vote in support of a "significant rate cut" at the September meeting. Miran himself stated that he would think independently, but his rapid confirmation undoubtedly reflects the political pressure influencing the Fed's operations.

Attempts to Dismiss Governor Cook

Trump has publicly expressed a desire for Republicans to hold a majority on the Fed Board and attempted to dismiss Fed Governor Lisa Cook at the end of August, setting a historical precedent. Although an appeals court temporarily blocked Trump's dismissal order, Cook was still able to vote at this meeting, but her position remains uncertain as litigation is ongoing.

These changes highlight the significant challenges to the Fed's political independence. This means that any policy decision it makes will carry a political shadow, and for investors relying on macro stability, this "noise" itself poses a risk.

Conclusion: The Market Awaits Signals, Not Decisions

A 25 basis point rate cut is already a consensus in the market. However, the true significance of this meeting lies in how it will set the tone for monetary policy in the last four months of 2025.

As BNY strategists noted, the Fed's "dual mandate goals are in a state of 'tension'," and the increasing politicization complicates the situation further. The market will closely monitor every word from Powell, looking for signals to guide investment portfolio allocations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。