New Opportunities for Korean Stock Investors?

Author: Heechang

Translated by: Deep Tide TechFlow

xStocks provides tokenized stock services, allowing investors to trade tokenized versions of popular U.S. stocks (such as Tesla) in real-time. Although still in its early stages, it has already shown some interesting phenomena.

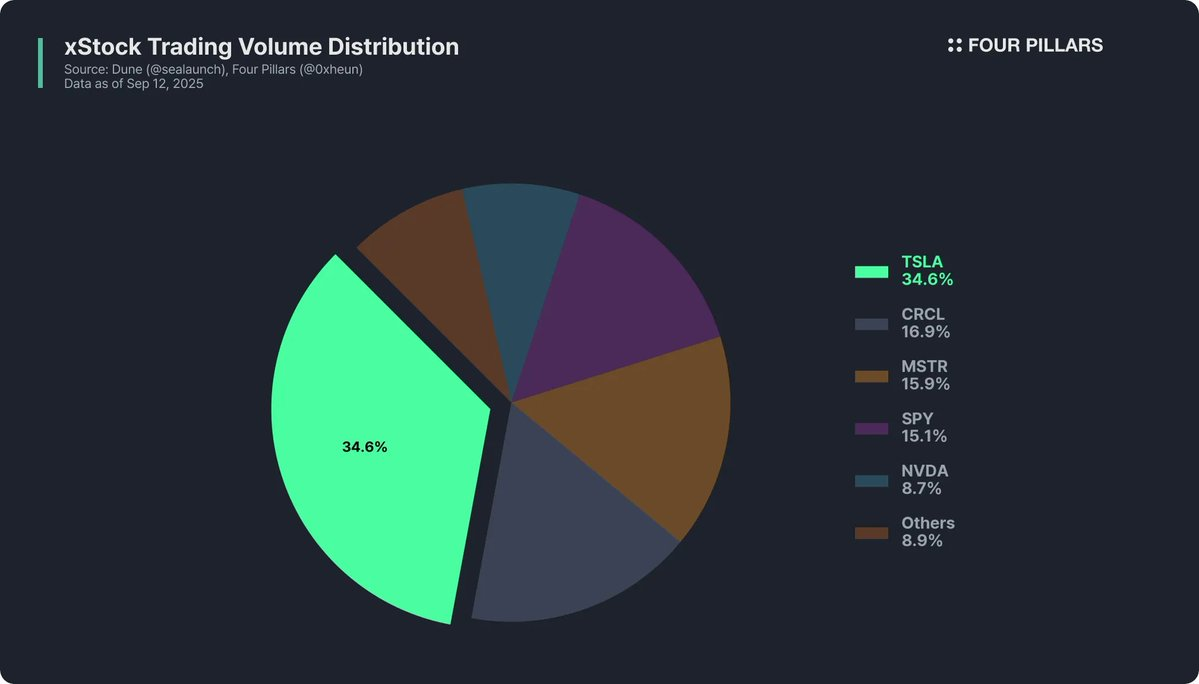

Observation 1: Trading Concentrated on Tesla (TSLA)

Similar to many emerging markets, trading activity quickly concentrates on a few stocks. Data shows that trading volume is highly concentrated in the most well-known and volatile stocks, with Tesla being the most prominent example.

This concentration is not surprising: liquidity often accumulates in assets favored by retail investors, and early participants typically use familiar high beta stocks to test new infrastructure.

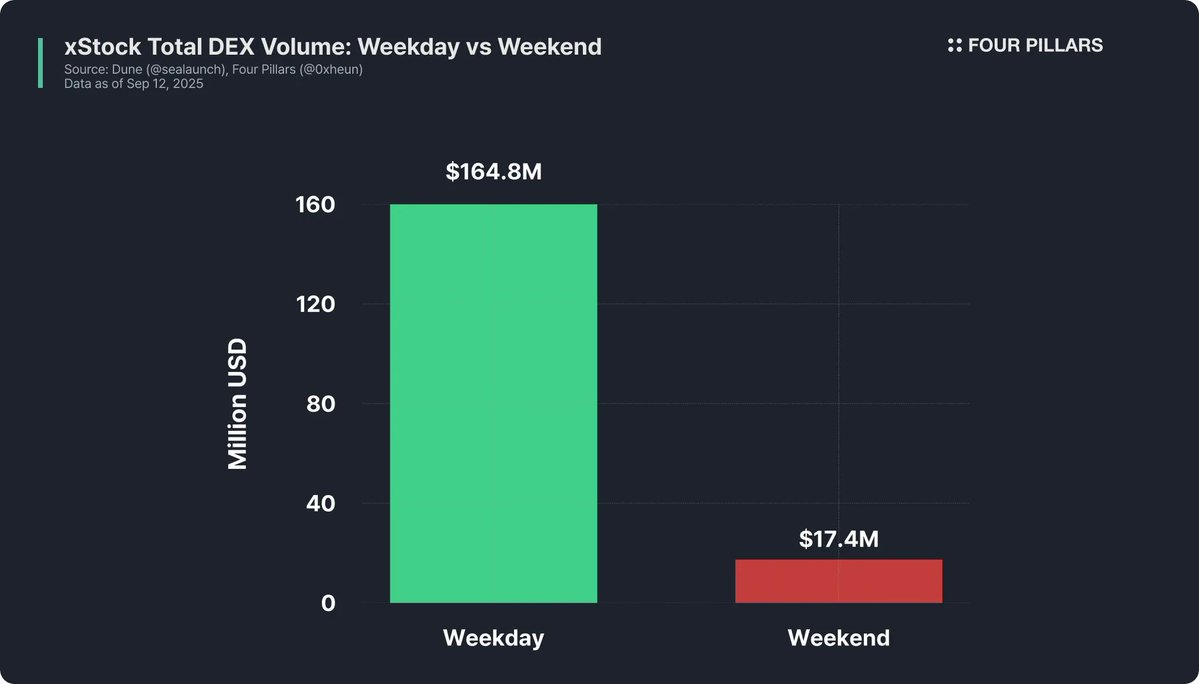

Observation 2: Weekend Liquidity Decline

Data indicates that weekend on-chain stock trading volume drops to 30% or lower of weekday levels. Unlike crypto-native assets that can be traded seamlessly around the clock, tokenized stocks still inherit the behavioral inertia of traditional market trading hours. When reference markets (such as Nasdaq and the New York Stock Exchange) are closed, traders seem less willing to trade, possibly due to concerns about arbitrage, price gaps, and the inability to hedge positions off-chain.

Observation 3: Prices Align with Nasdaq

Another key signal comes from the pricing behavior in the early stages of launch. Initially, the trading price of xStocks tokens was significantly higher than their corresponding stocks on Nasdaq, reflecting market enthusiasm and potential friction in bridging fiat liquidity. However, over time, these premiums have gradually decreased.

Current trading patterns show that token prices are at the upper end of Tesla's intraday price range, highly consistent with Nasdaq reference prices.

Arbitrageurs seem to maintain this price discipline, but small deviations still exist at intraday peaks, indicating that some inefficiencies in the market may present opportunities and risks for active traders.

New Opportunities for Korean Stock Investors?

Korean investors currently hold over $100 billion in U.S. stocks, with trading volume increasing 17 times since January 2020. The existing infrastructure for Korean investors trading U.S. stocks faces many limitations, such as high fees, long settlement times, and slow cash-out processes, creating opportunities for tokenized or on-chain mirror stocks. As the infrastructure and platforms supporting the on-chain U.S. stock market continue to improve, a new group of Korean traders will enter the crypto market, which undoubtedly represents a significant opportunity.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。