I. Outlook

1. Summary at the Macro Level and Future Predictions

Last week, the Federal Reserve lowered the federal funds rate by 25 basis points to 4.00%–4.25%, as expected, marking the first rate cut since December of last year. The statement emphasized that this is a "risk management rate cut," primarily addressing the ongoing weakness in the job market. Market reactions were relatively mild, with the stock market experiencing slight upward fluctuations, while bonds and gold remained attractive.

Looking ahead, the Federal Reserve has entered a rate-cutting cycle but remains cautious, expecting 1–2 moderate rate cuts within the year, depending on subsequent inflation and employment performance. Overall, risk assets are still supported by liquidity in the short term, but increased volatility is inevitable after the positive news is priced in.

2. Market Changes and Warnings in the Cryptocurrency Industry

Last week, despite the Federal Reserve's announcement of a moderate 25 basis point rate cut bringing liquidity benefits, the cryptocurrency market remained generally weak. Bitcoin briefly surged to around $116,000–$117,000 but lacked sustained buying pressure, showing clear signs of a pullback; mainstream coins like Ethereum performed even more sluggishly, indicating insufficient market risk appetite compared to the resilience of U.S. stocks. In terms of funding, although ETFs saw net inflows, they were more concentrated in Bitcoin, while trading volume and interest in altcoins shrank, reflecting structural differentiation in the market.

Overall, while the cryptocurrency market still has liquidity support in the short term, it is performing significantly weaker compared to other risk assets. If Bitcoin breaks below key support levels, the pullback pressure may be rapidly amplified.

3. Industry and Sector Hotspots

Raising $12 million, PublicAI, backed by well-known institutions like Solana and Near, is innovating the AI ecosystem by providing high-quality, human-generated AI training data while allowing individuals worldwide to monetize their expertise; raising $7 million, OVERTAKE, led by the Sui Foundation, is a peer-to-peer trading market based on the Sui blockchain that enables the free circulation of game assets through a trusted trading infrastructure, supporting secure, fast, and decentralized trading of digital game assets via smart contract escrow.

II. Market Hotspot Sectors and Potential Projects of the Week

1. Overview of Potential Projects

1.1. Analysis of PublicAI, which raised $12 million with participation from well-known institutions like Solana and Near, building a decentralized intelligence layer

Introduction

PublicAI is innovating the AI ecosystem by providing high-quality, human-generated AI training data while allowing individuals worldwide to monetize their expertise. With a decentralized global network of verified contributors, the platform ensures unprecedented data quality through rigorous skill verification and staking penalty mechanisms.

As AI drives job displacement, PublicAI offers everyone a way to continue participating and benefiting in the AI economy. Human-in-the-loop (HITL) is not only crucial in AI training but also indispensable during the reasoning phase (when AI makes real-world decisions). As AI replaces conventional jobs, humans must transition to higher-value roles alongside it. PublicAI is building a decentralized reasoning human layer that enables real-time verification, review, and guidance of AI outputs.

Architecture Overview

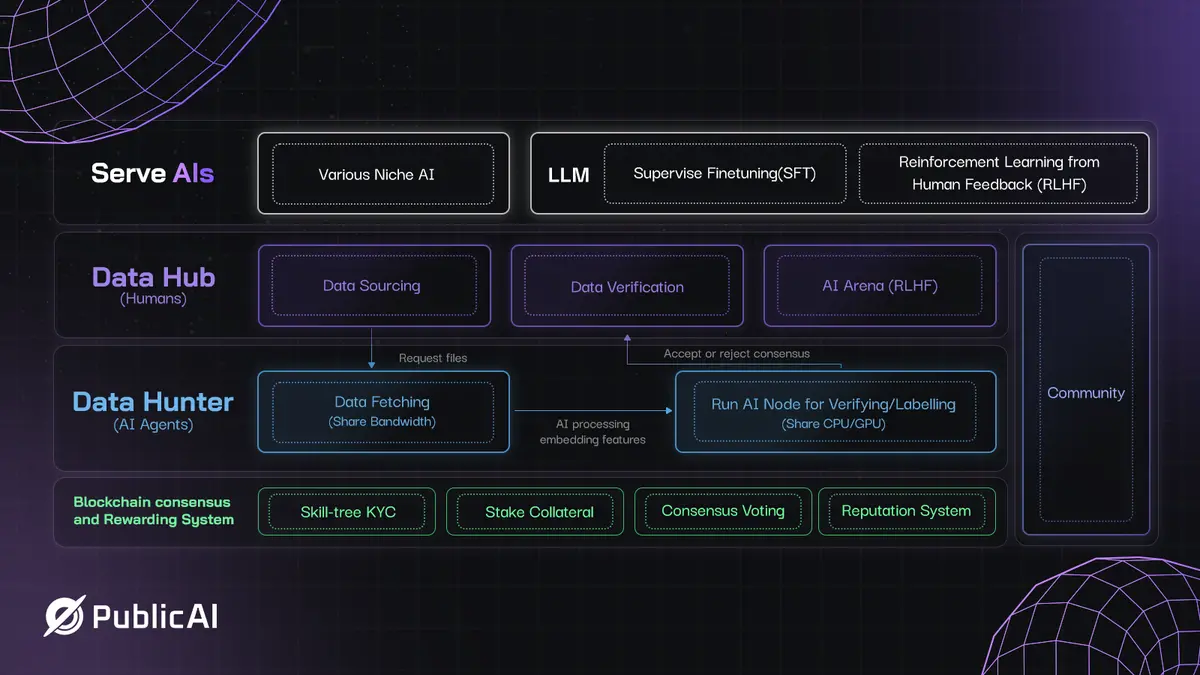

PublicAI Three-Layer Architecture

1. DataHub (First Layer)

Positioning:

DataHub is the main platform for data activities and quality verification, where uploaders and voters collaborate to ensure high-quality data required for AI training.

Core Functions:

Hosts data collection activities, allowing uploaders to submit datasets based on task instructions.

Supports voters in assessing the quality of uploaded data to ensure it meets activity requirements.

Maintains data quality and integrity through a voting-based consensus mechanism.

Key Features:

Uploaders can earn USDT rewards and $PUBLIC airdrop points by participating in activities and submitting high-quality data.

Voters help filter quality data by voting on whether the uploaded data meets activity instructions.

Contributors and voters receive corresponding rewards based on their participation and alignment with consensus (e.g., "hit consensus" or "deviate from consensus").

2. Data Hunter (Second Layer)

Positioning:

Data Hunter focuses on enabling node operators to support AI Agents, enhancing data processing capabilities and community engagement.

Core Functions:

Node operators can run AI Agents through the Data Hunter plugin, contributing computing power resources for DataHub's data quality checks.

Promotes active community participation, such as completing tasks: using AI to reply to popular X (formerly Twitter) posts (views >1k).

Key Features:

Node operators:

Provide computing power resources to enhance AI Agent efficiency, accelerating DataHub's data verification process.

Use the "AI Reply" feature to interact with popular X posts, generating valuable AI feedback data.

Earn $PUBLIC airdrop points by running nodes and participating in AI-driven interactions.

3. Blockchain and Smart Contracts (Third Layer)

Positioning:

The blockchain layer ensures security, transparency, and fairness in data contribution and reward management.

Core Functions:

Manages tasks through smart contracts, such as voting consensus, uploader rewards, and node operator incentives.

Tracks and guarantees all activities, ensuring data source traceability and immutability.

Provides decentralized governance, allowing community members to influence platform development.

Key Features:

Consensus Mechanism: Implements Byzantine Fault Tolerance (BFT) algorithms to verify data quality through decentralized voting.

Incentives and Penalties: Loyal contributors receive rewards, while malicious behavior is penalized through on-chain automatic mechanisms.

Transparency: Ensures all data lifecycle activities are publicly transparent and immutable.

Tron Comments

PublicAI's advantage lies in its use of a decentralized network that incorporates globally verified contributors into the ecosystem, ensuring data quality through skill verification and staking penalty mechanisms, allowing individuals to monetize their expertise in the AI economy, not only for training but also extending to the reasoning phase of human-in-the-loop (HITL), providing real-time supervision and correction for AI decisions.

Its disadvantage, however, is its high dependence on large-scale community participation and incentive mechanisms, high operational complexity, and ongoing challenges in data review efficiency, sustainability of node incentives, and compatibility with traditional AI enterprise data standards.

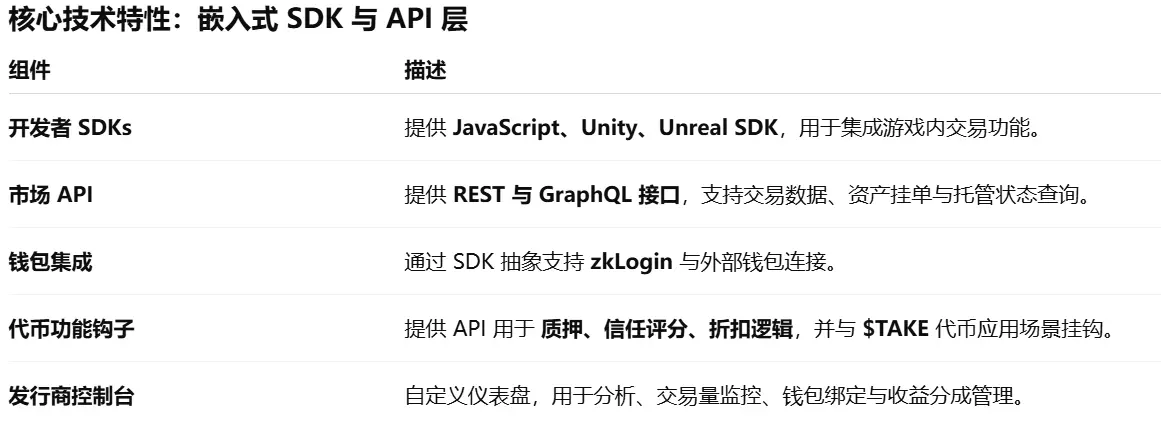

1.2. Interpretation of OVERTAKE, which raised $7 million led by the Sui Foundation, enabling free circulation of game assets — a trusted trading infrastructure based on Sui

Introduction

OVERTAKE is a peer-to-peer trading market based on the Sui blockchain, supporting secure, fast, and decentralized trading of digital game assets such as items, game currencies, accounts, and collectibles through smart contract escrow. It integrates AI-driven smart search, automated buying strategies, and seamless cross-market listings to enhance liquidity, trading speed, and user trust.

Architecture Analysis

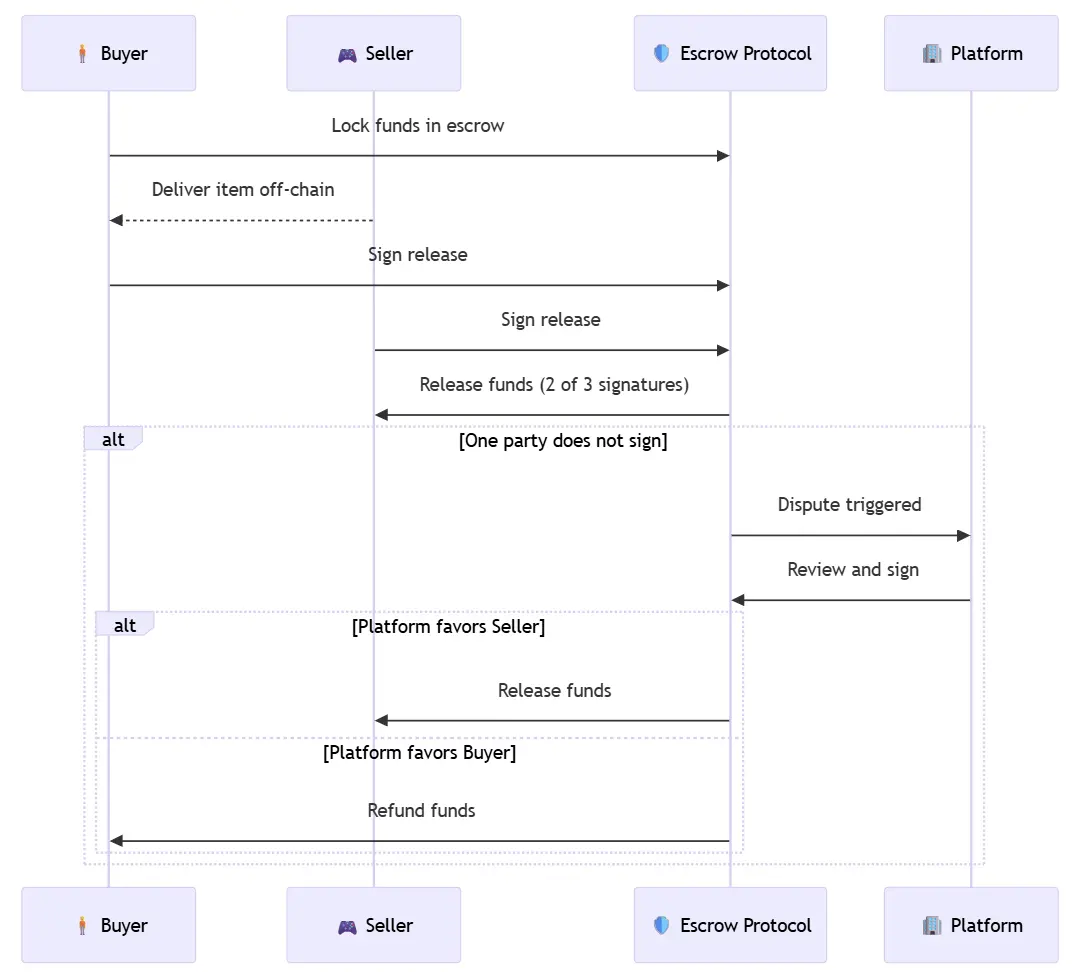

1. On-Chain Escrow System

At this stage, the platform replaces Web2-style trading models with a smart contract escrow system, establishing programmable trust between users. This system supports secure peer-to-peer trading of game accounts and items, coordinating on-chain logic with off-chain delivery to ensure transaction safety and reliability.

We utilize Sui's object-centric model and programmable transaction blocks to achieve a decentralized escrow mechanism. The system employs a 2-of-3 multi-signature logic, allowing the platform to intervene and mediate disputes without directly holding assets.

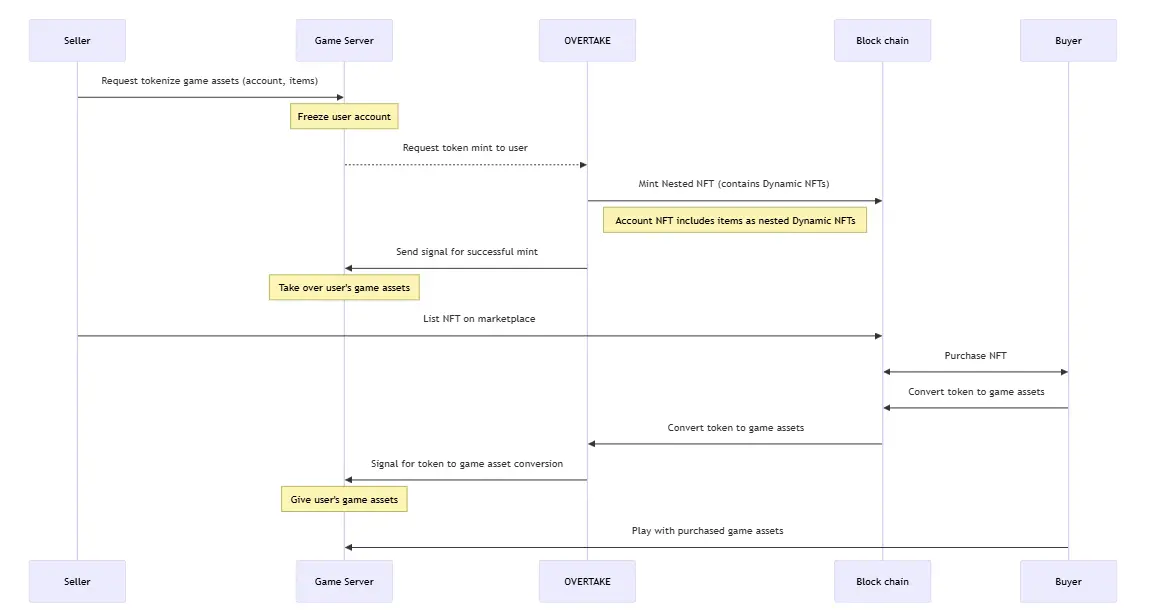

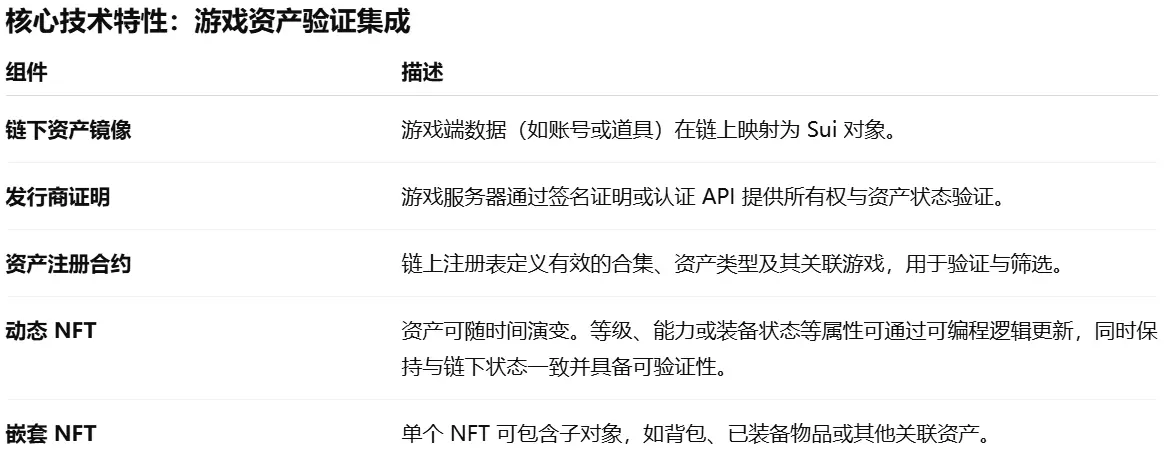

2. In-Game Asset Verification and Transaction Integration

In the second stage, OVERTAKE's goals extend beyond basic peer-to-peer trading, directly interfacing with game publishers to enable verified in-game asset transactions, such as accounts, game currencies, or high-value items.

These assets are no longer just tokens on the chain but correspond to real items in the game, verified by server data and subject to the rules of the game environment.

In this model, the escrow mechanism is no longer necessary. Players do not need to rely on coordination or dispute mediation between users, as the authenticity and ownership of assets are verified at the source — with the game publisher. This allows players to trade with greater confidence, ensuring that the assets they buy and sell are legitimate, real, usable, and fully functional.

This stage is based on practical experience:

During the launch of Somnis: Rumble Rush, OVERTAKE closely collaborated with developer MetaEdition to build a Web3 trading market that connects both the Immutable blockchain and the game backend.

Through this deployment, OVERTAKE has demonstrated its capabilities to:

Manage real-time tokenized assets;

Verify asset ownership from off-chain databases;

Support instant transactions in real-time gaming environments.

Looking ahead on the Sui blockchain, OVERTAKE will further expand:

Utilizing Sui's support for nested and dynamic NFTs to create asset structures that can represent complex states (e.g., an account with a backpack or a weapon with upgrade history), while achieving dynamic updates over time with complete verifiability.

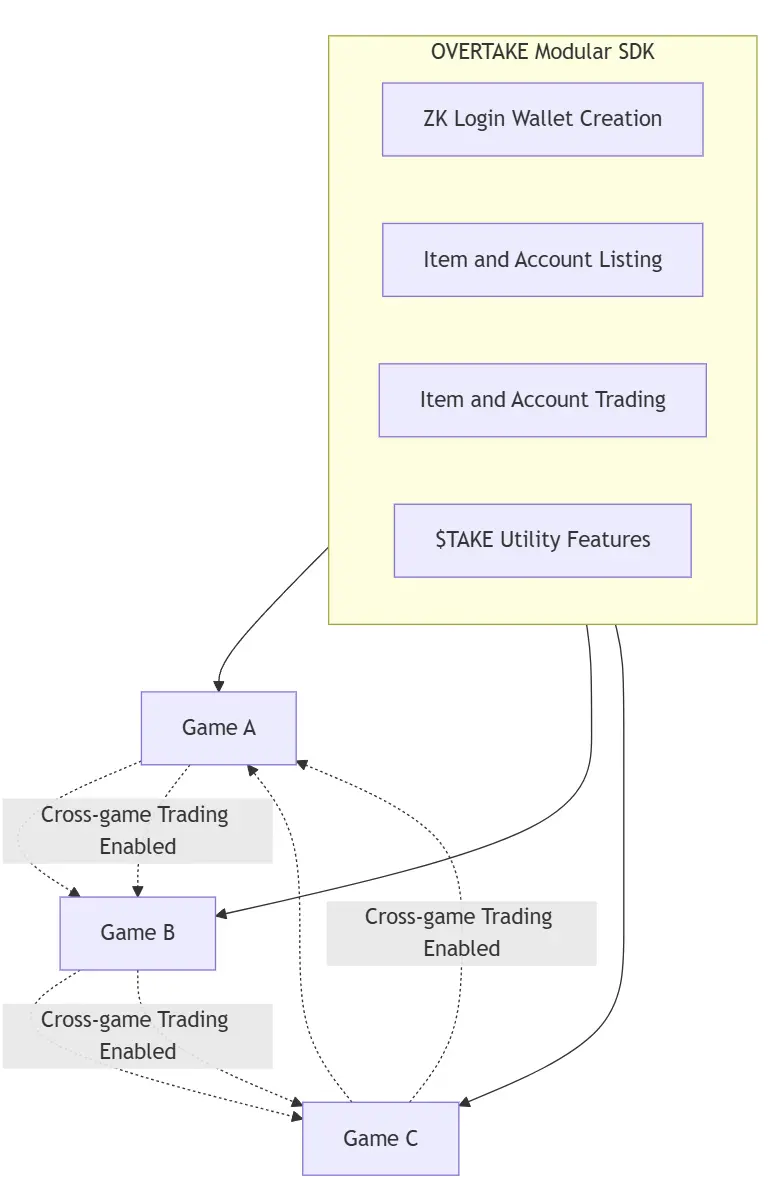

3. Embedded Infrastructure

In the final stage, OVERTAKE will evolve into "invisible infrastructure."

It will no longer exist as an independent trading market but will allow developers to embed trading functionalities directly into their games through modular APIs and SDKs.

This includes a complete set of tools:

Asset listing and purchasing

Wallet creation

Escrow logic

Staking mechanisms

Use cases for the $TAKE token

All functionalities can be conveniently accessed through client libraries and management consoles.

Tron Comments

OVERTAKE's advantage lies in its phased evolutionary design: from on-chain escrow systems to in-game asset verification and then to embedded infrastructure, gradually addressing the three major pain points of transaction security, asset authenticity, and developer integration. Leveraging Sui's dynamic and nested NFTs, along with AI-driven anti-fraud and intelligent search capabilities, the platform can enhance liquidity, speed, and user trust.

Its disadvantage, however, is its high dependence on cooperation with game publishers, and ecological expansion must overcome the integration resistance of traditional manufacturers. Additionally, the multi-layered technical architecture brings implementation complexity, and the costs of early market education and user migration are also relatively high.

2. Key Project Details of the Week

2.1. Detailed Analysis of Centrifuge, which raised over $50 million led by Republic, focusing on RWA tokenization and decentralized financing infrastructure

Introduction

Centrifuge is a pioneering platform for the tokenization of real-world assets (RWA). Through Centrifuge, investors can access a diversified asset portfolio, enhance transparency, and gain deeper insights into their investment portfolios. Asset managers can tokenize their funds, simplifying the connection process with necessary service providers and investors, thereby reducing fund operating costs and unlocking new sources of capital.

Centrifuge also provides the infrastructure and ecosystem to support the tokenization, management, and investment of real-world assets, helping to build a complete and diversified RWA investment portfolio.

Architecture Analysis

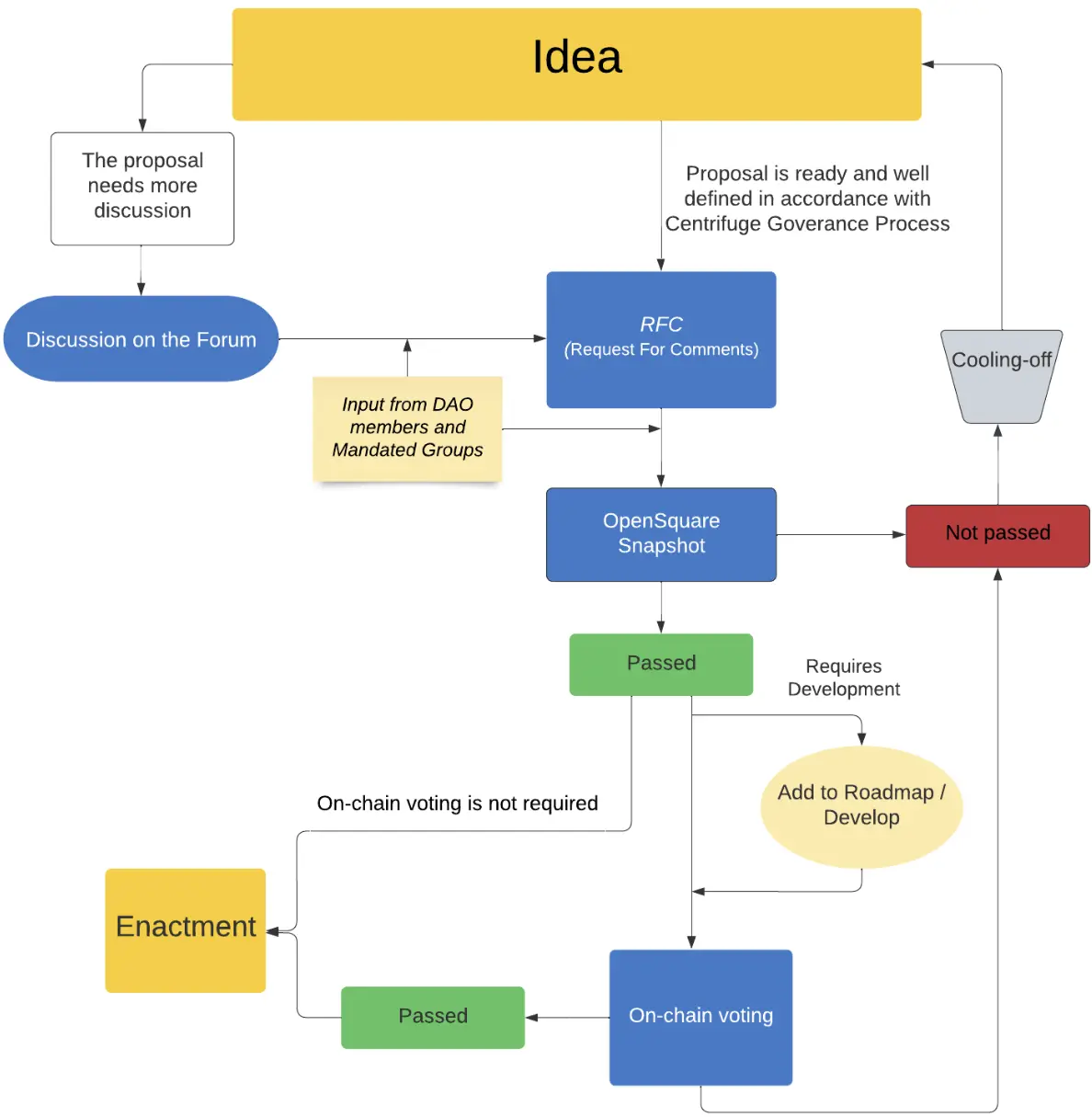

1. The Centrifuge DAO

At the governance core of Centrifuge is the community-driven Centrifuge DAO. CFG token holders play a key role, collectively deciding the protocol's development direction through on-chain and off-chain voting, and managing the use of the Centrifuge treasury. Meanwhile, some authorized working groups are responsible for guiding specific areas of the DAO and the protocol.

Management Process

The Centrifuge protocol is governed by CFG token holders, and all proposals must go through a governance process. The overall process can be divided into two parts: off-chain governance and on-chain governance.

Offchain Governance

This is the first part of the governance process, occurring in community forums (in the form of "Request for Comments RFC") and on the OpenSquare platform.

Purpose: To gather community opinions and support before submitting proposals on-chain.

Note: Not all proposals need to be submitted on-chain to be approved; some can be passed through community off-chain consensus.

Onchain Governance

This is the part of the governance process that occurs on the blockchain.

First, proposals are created on-chain (can be initiated by the public or committees).

Subsequently, a public referendum is usually initiated, where all token holders can vote in favor (Aye) or against (Nay).

Different types of proposals may have different governance processes, but all must start with a forum post. All Centrifuge proposals (CP) must also be submitted to the Centrifuge Proposal Repository (Proposals Repository) (Github).

Proposal Repository

All proposals must be submitted to the proposal repository on Github for record-keeping.

Proposal discussions (RFC phase) occur in the forum, and if there are any modifications to the proposal, they must be updated during the RFC phase via a PR before entering snapshot voting or on-chain voting.

This ensures that proposals cannot be tampered with during or after the voting period.

A proposal is only considered valid and final once it has been submitted to the proposal repository and merged.

After submission, the system will automatically generate a PR number (XXX), which will serve as the proposal's index and be included in the title of the forum post (prefixed with CPXXX). The forum post must include a link to the proposal on Github.

If spelling errors or minor issues are found in the final version of the proposal, corrections can be made. However, such changes must be handled by the Governance Coordination Group (GCG) and announced in the forum. If the community believes the modifications change the original intent of the proposal, they can raise objections.

Request For Comments (RFC)

Creating an RFC is the next step:

Published in the forum, the purpose is to gather community feedback, questions, and assess support for the proposal.

If community feedback requires modifications to the proposal, this should be completed at this stage.

Different proposals may require different discussion times; the RFC must run for at least 7 days, with a recommendation of no less than 14 days. The specific duration is determined by the proposer.

RFC posts must include the content required by the template (such as title, proposal content, etc.) and be published in the Centrifuge Proposals section of the forum. As the proposal progresses, the original post must be continuously updated to include the latest information at the end of the main post.

Onchain Proposal

The next step, if necessary, is to create an on-chain proposal.

On-chain proposals can be initiated in the following ways:

Democracy Proposal / Treasury Proposal: Any token holder can create.

Council Motion: Initiated only by the council.

Once the on-chain proposal submission is complete, the forum post must be updated with the following information:

Subsequent governance process description

Corresponding council motion/democracy proposal/treasury proposal link (Subsquare platform)Proposal's pre-image hash

If the council motion/democracy proposal passes, the forum post must be updated again to include the referendum link (on Subsquare) for community members to follow the proposal's progress.

Cooling-off Period

The cooling-off period refers to the time a proposal must wait before being resubmitted.

- If a proposal fails to pass (whether through off-chain voting or on-chain voting), it must wait for a 15-day cooling-off period (calculated from the end of the voting) before a new RFC can be resubmitted.

The significance of the cooling-off period is to:

Provide sufficient time to absorb community feedback;

Make necessary modifications to the proposal based on feedback;

Then resubmit the RFC, entering a new round of governance processes.

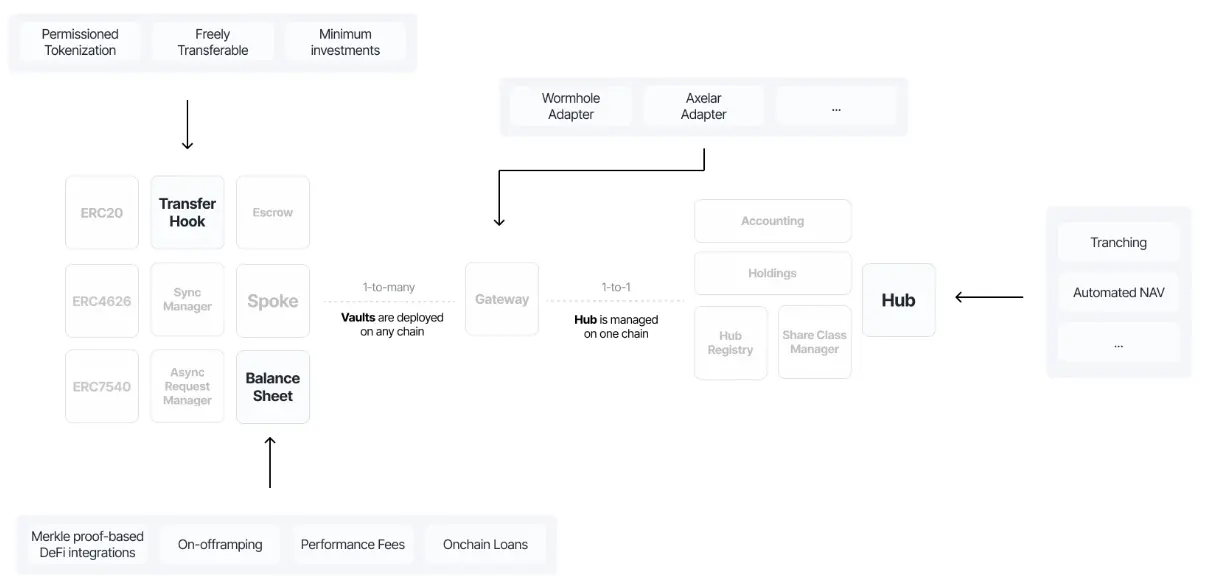

2. Centrifuge Protocol

Centrifuge V3 is an open, decentralized on-chain asset management protocol. Built on immutable smart contracts, it allows for the permissionless deployment of customizable tokenization products.

The protocol supports a wide range of application scenarios: from permissioned funds to on-chain loans, enabling rapid and secure deployment. Its support for ERC-4626 and ERC-7540 Vault standards allows tokenized assets to seamlessly integrate into the DeFi ecosystem.

Through the protocol layer's chain abstraction design, tokenization issuers can obtain liquidity across any network and manage it uniformly on a Hub chain of their choice.

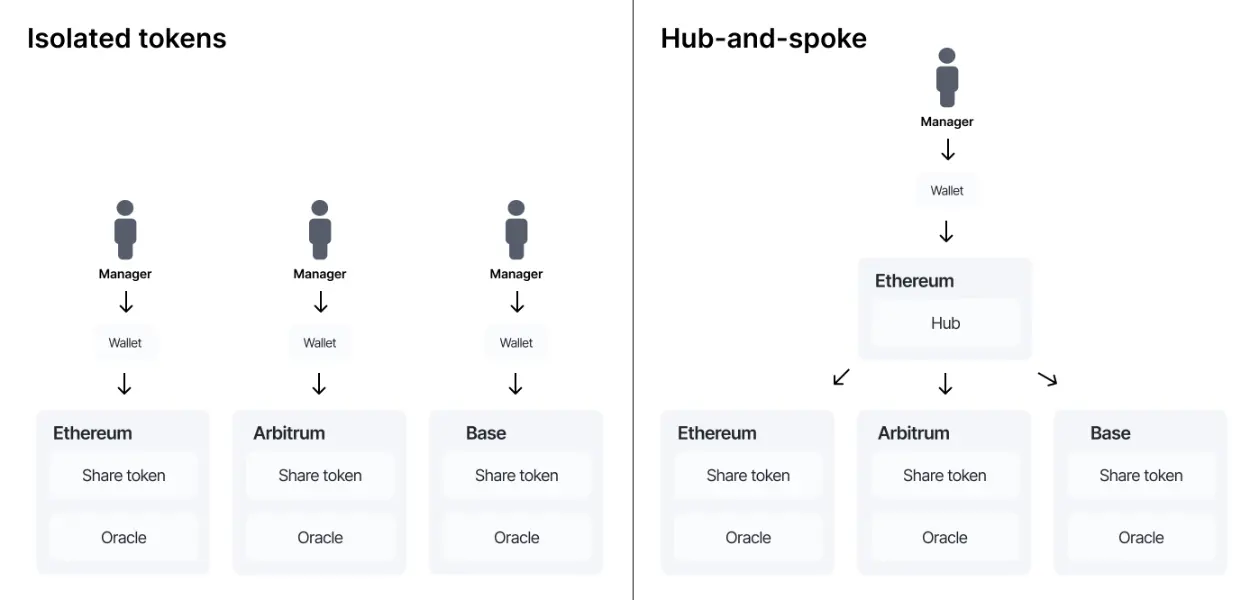

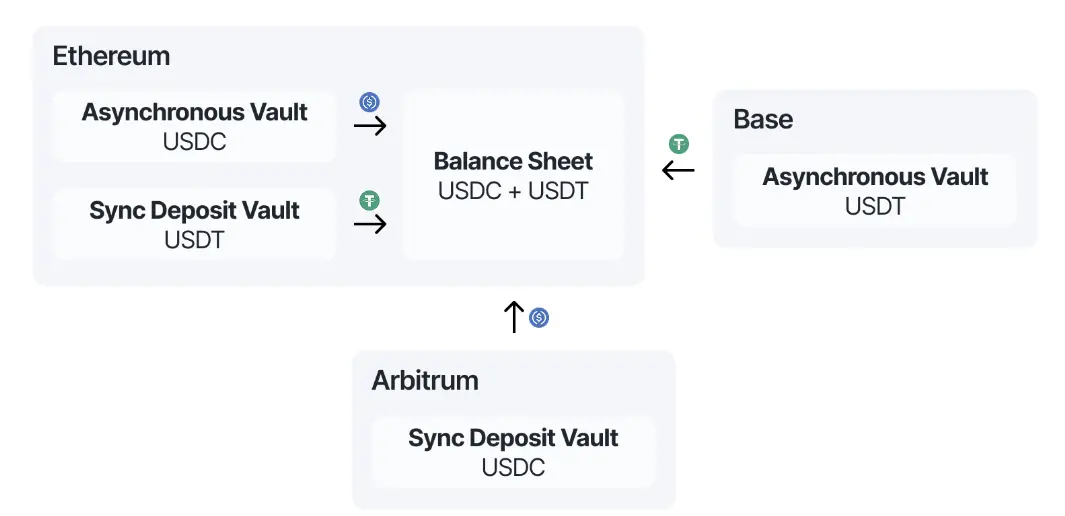

a. Centrifuge's Hub-and-Spoke Solution

Centrifuge V3 addresses the challenges of multi-chain asset management through a hub-and-spoke architecture.

Each pool selects a Hub chain as its authoritative "real source" and control layer.

On this Hub chain, the core state of the pool, vaults, and overall accounting records are managed uniformly.

The Spoke chain is where token deployment and liquidity acquisition occur, such as Ethereum, Base, Arbitrum, and other supported networks.

Scalable Cross-Chain Interoperability

To achieve this, Centrifuge has built-in a powerful messaging system between Hub and Spoke chains, capable of handling large-scale cross-chain activities with minimal overhead while maintaining the highest security.

Multi-message Proofs

To enhance the security of cross-chain communication, the protocol integrates multiple interoperability service providers.

Each message is accompanied by multiple independent proofs that can be verified by different providers.

This reduces the impact of a single interoperability provider's failure or attack on the system's security.

Automatic Batching of Messages

The protocol will automatically batch multiple messages into a single payload and proof.

This reduces the total number of messages that need to be relayed, significantly lowering gas costs.

Batching is executed automatically by the protocol, requiring no additional configuration from the pool deployer.

Automatic Gas Subsidies

The protocol provides an automatic gas subsidy mechanism for pool users:

Gas payments can be subsidized or reimbursed by the pool manager.

Users do not need to hold native gas tokens on each Spoke chain.

Centrifuge will automatically relay gas tokens across chains to fund transactions.

These designs alleviate the burden on users to manage gas in multi-chain interactions, ensuring a seamless experience even when performing cross-chain operations with vaults.

Built-in Retries and Repayments

Cross-chain message execution may fail for various reasons. To reduce operational burdens, the protocol implements:

A built-in repayment mechanism: to top up messages with insufficient gas funds.

Automatic retry logic: to attempt failed messages again.

This ensures that cross-chain operations can be reliably executed without manual intervention from pool managers or end users.

b. Vaults

The Centrifuge protocol uses a tokenized vault standard to facilitate the redemption of investment and share tokens.

Vault Types

The protocol supports two types of vault models: asynchronous and synchronous.

1. Asynchronous Vaults

Fully request-based, following the ERC-7540 standard.

Deposits and redemption operations are completed through asynchronous processes.

All requests are managed and processed uniformly by the Centrifuge Hub.

2. Synchronous Deposit Vaults

Uses a hybrid model, combining ERC-4626 and ERC-7540.

Deposits: Executed immediately according to ERC-4626 behavior, allowing users to receive share tokens instantly.

Redemptions: Follow the asynchronous process of ERC-7540, queuing and managing withdrawal requests through the Hub.

3. Pooled Vaults

Supports multiple investment assets corresponding to a single share token through the ERC-7575 standard.

The liquidity of all vaults is aggregated into a single balance sheet, efficiently allocated to various assets by the protocol.

c. Modularity

The Centrifuge protocol is designed as a modular and scalable system to support complex financial products.

This architecture allows developers to access different components independently or in combination, enabling:

Permissioned tokenization

Cross-chain deployment

Custom pricing logic

Diversified collateral management

The following are the core smart contract components of the protocol and their extensibility points:

1. Transfer Hooks

Customizable restrictions and checks logic, directly embedded in the transfer logic of ERC20 tokens.

Used as a plug-and-play extension for:

Permissioned tokenization: Ensuring compliance and access control.

Freely circulating tokenization: For decentralized RWA token access to DeFi.

Minimum investment thresholds: Limiting the minimum amount for investment.

Through the hook mechanism, regulatory and operational controls can be implemented without modifying the core token logic.

2. Hub Managers

The Hub is the core smart contract responsible for managing:

Net Asset Value (NAV) calculations

Investor share class logic

Fund-level operational mechanisms

Developers can define custom logic through Hub Managers, such as:

Automated NAV and token pricing

Tranches and waterfall distribution

Customized share class management

Request processing logic

This module provides fine-grained control over fund structures and investor dynamics, enabling fully customizable on-chain fund operations.

3. Balance Sheet Managers

Enables the protocol to support and manage any form of collateral:

Tokenized real-world assets (RWA)

Stablecoins

Native crypto tokens

Other DeFi protocol assets

Functions include:

On-chain/off-chain asset channels

Integration with DeFi protocols

Performance tracking and management fees

Integration of on-chain loans

This module makes Centrifuge a bridge connecting traditional finance and DeFi, supporting various asset forms through modular asset management.

4. Adapters

The interoperability layer of the protocol connects Centrifuge pools to any blockchain, enabling cross-chain vault deployment and communication.

Supported adapters include:

Wormhole adapter

Axelar adapter

Adapters route cross-chain messages through Gateway contracts, maintaining a "one-to-many" relationship: a single Hub chain can manage multiple vaults across different chains simultaneously.

Tron Comments

Centrifuge's advantage lies in its pioneering position in the tokenization of real-world assets (RWA), possessing a complete modular architecture (Transfer Hooks, Hub Managers, Balance Sheet Managers, Adapters) that supports various vault standards (ERC-4626, 7540, 7575). Through the Hub-and-Spoke cross-chain design, it achieves efficient asset management and liquidity expansion, making it compatible with both TradFi and DeFi while providing flexible infrastructure for institutions and developers.

Its disadvantage, however, is that the ecosystem is still in its early development stage, with limited scale for real asset tokenization on-chain. The complexity of cross-chain communication and compliance execution is high, and it relies heavily on market education, liquidity cultivation, and deep cooperation with traditional financial institutions.

3. Industry Data Analysis

1. Overall Market Performance

1.1. Spot BTC vs ETH Price Trends

BTC

Analysis

Key resistance this week: $117,900, $122,100, $123,700

Key support this week: $113,400, $110,700, $107,400

ETH

Analysis

Key resistance this week: $4,440, $4,500, $4,640

Key support this week: $4,260, $4,210, $4,060

2. Public Chain Data

2.1. BTC Layer 2 Summary

2.2. EVM & Non-EVM Layer 1 Summary

2.3. EVM Layer 2 Summary

4. Macroeconomic Data Review and Key Data Release Nodes for Next Week

Last week, August retail sales recorded a month-on-month increase of 0.1%, far below the market expectation of 0.3%, indicating a slowdown in consumer momentum, reflecting that the high interest rate environment and weakening job market have begun to suppress household spending. Meanwhile, the Federal Reserve lowered the upper limit of the federal funds rate to 4.25% on September 18, as expected, marking the first rate cut since December last year.

This week (September 22-26), important macroeconomic data release nodes include:

September 24: U.S. EIA crude oil inventories for the week ending September 19

September 25: U.S. initial jobless claims for the week ending September 20

September 26: U.S. August core PCE price index year-on-year; U.S. September Michigan consumer sentiment index final value

5. Regulatory Policies

United States

The SEC has approved a general listing standard for cryptocurrency spot ETFs, eliminating the need for case-by-case approval, which may accelerate the launch of more crypto asset ETFs and promote the integration of mainstream finance and crypto.

United Kingdom

The FCA has expedited the registration approval process for crypto companies, increasing efficiency by more than three times and granting exemptions for certain compliance obligations, seeking a balance between consumer protection and encouraging innovation.

India

The government requires all exchanges, custodians, and intermediaries to undergo mandatory cybersecurity audits to enhance industry security standards and user protection, but this also increases the operational burden on businesses.

Bahrain

New regulations related to stablecoins and Bitcoin have been introduced, providing a clear legal framework for crypto activities, solidifying its position as a digital financial hub in the Middle East and attracting businesses.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。