Enhancing liquidity does not mean the cryptocurrency market is bullish.

Authors: Ethan Chan & Hannah Zhang

Translation: Deep Tide TechFlow

The Federal Reserve cut interest rates this week and hinted at further easing in the future. Almost all mainstream cryptocurrency news headlines convey the same message:

Lower capital costs → Increased liquidity → Bullish cryptocurrency.

But the reality is more complex. The market has already priced in the expectations of rate cuts, and there has not been an immediate surge in the inflow of funds into BTC and ETH.

Therefore, let’s not stay on the surface but examine how rate cuts affect a part of DeFi—lending.

On-chain lending markets like Aave and Morpho dynamically price risk rather than relying on directives from regulatory bodies. However, the Federal Reserve's policies provide important context for this backdrop.

When the Federal Reserve cuts rates, two opposing forces are at play:

1) Reverse Effect: Federal Reserve rate decrease → On-chain yields increase as people seek uncorrelated assets

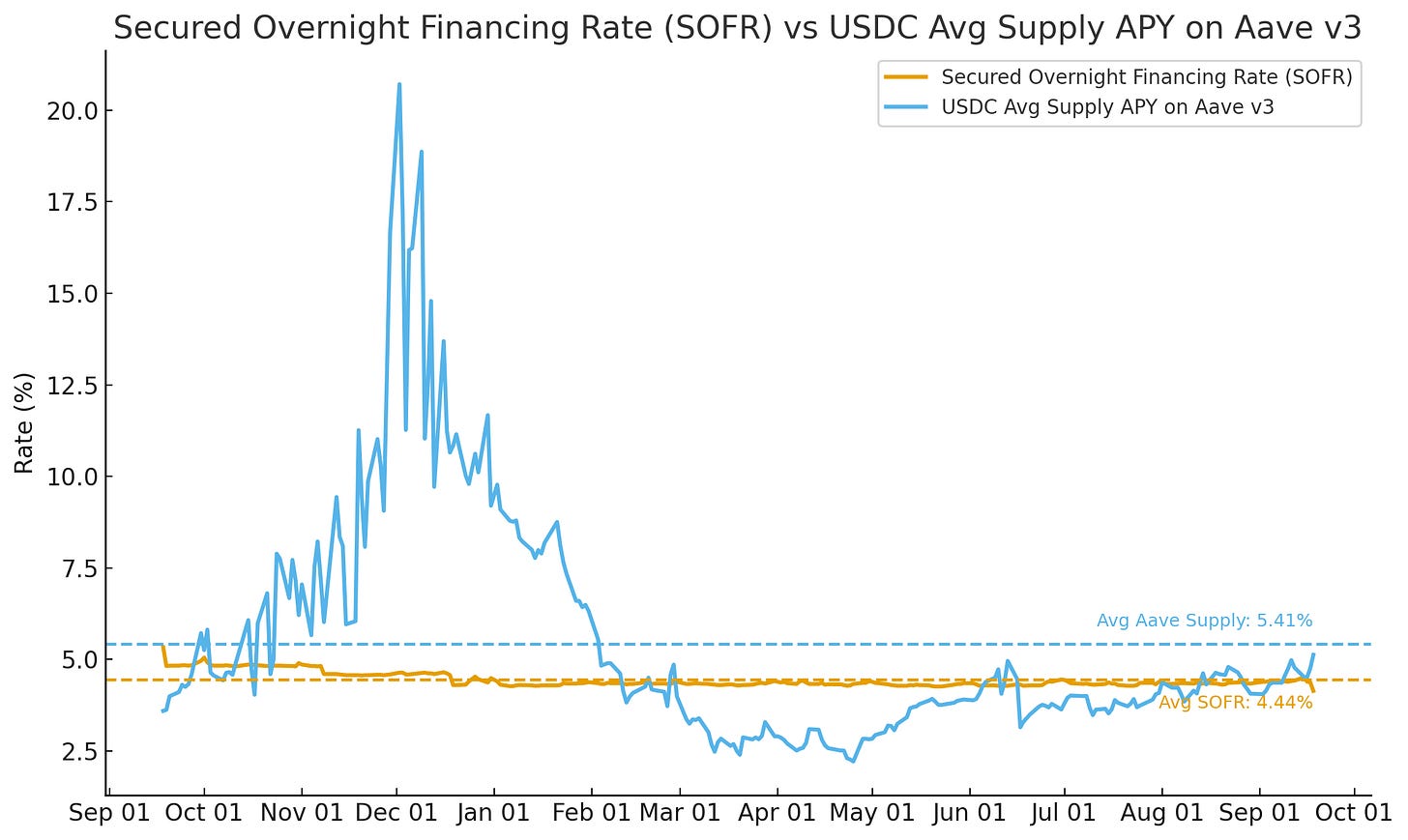

As capital seeks returns outside of traditional government bonds and money market funds, it may flow into DeFi, thereby increasing utilization and pushing on-chain rates higher. If we compare the annualized supply yield (Supply APY) of USDC on Aave with the SOFR (Secured Overnight Financing Rate), we can see this trend gradually emerging before the Federal Reserve's rate cut in September.

Source: Allium

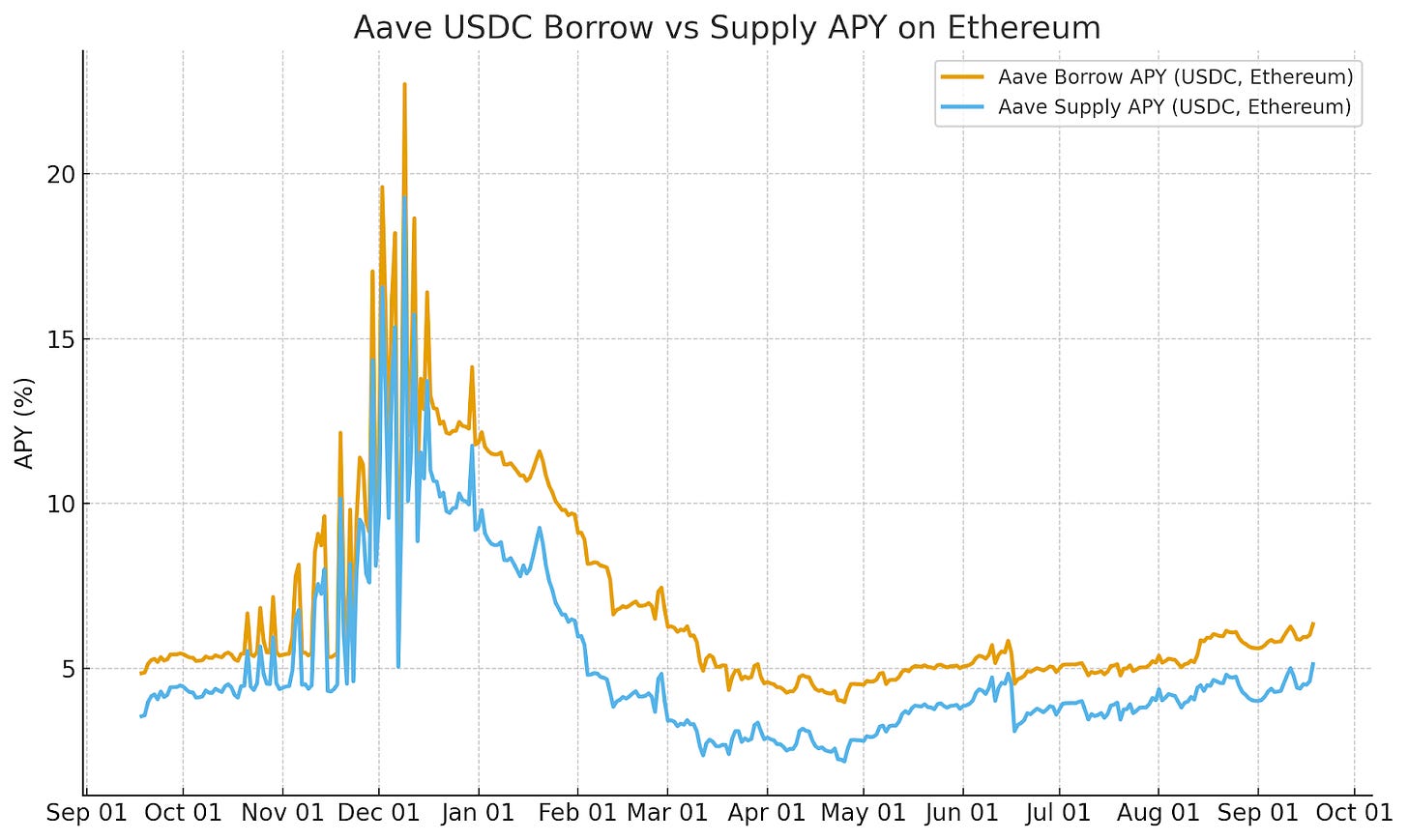

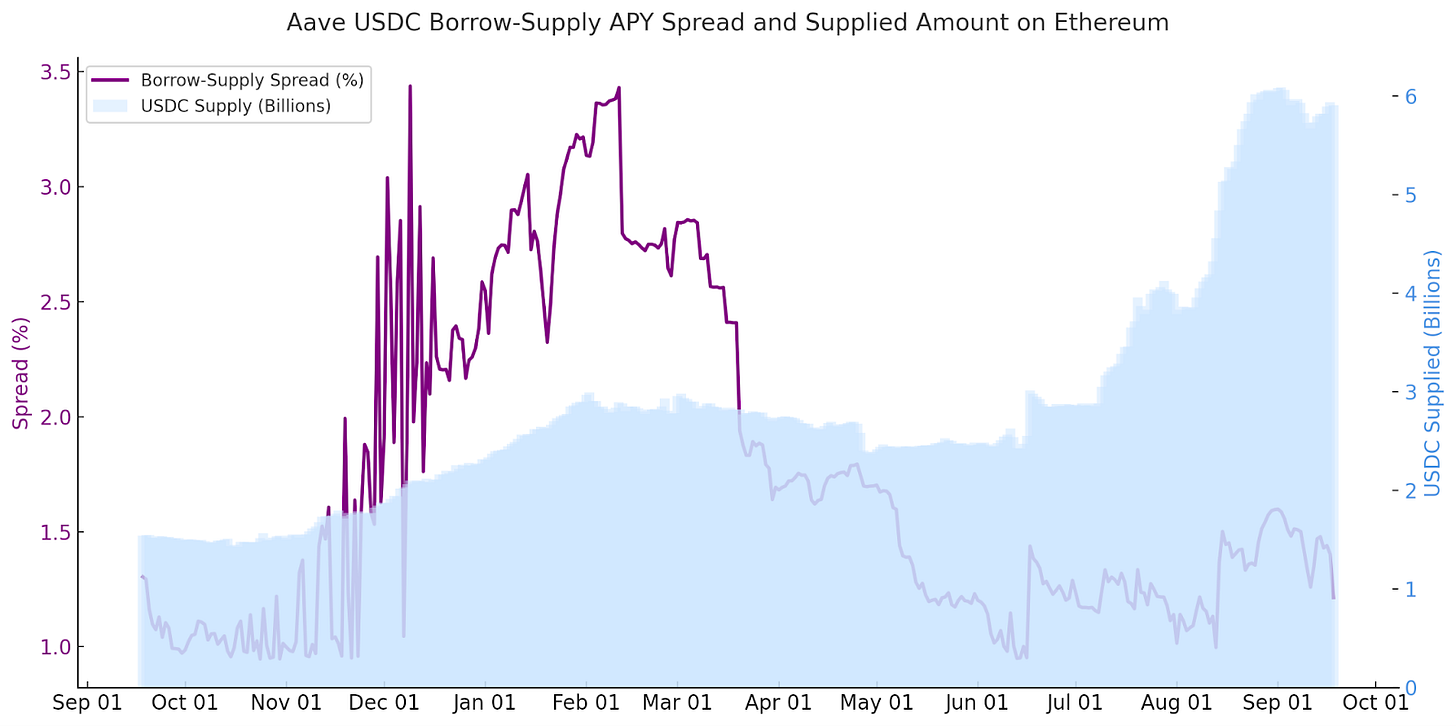

We also see this situation occurring as the DeFi lending-supply yield spread narrows.

Taking Aave's USDC lending situation on Ethereum as an example, in the days leading up to the Federal Reserve's rate cut announcement, the lending-supply yield spread gradually shrank. This was mainly due to more capital chasing yields, supporting a short-term reverse effect.

Source: Allium

2) Direct Correlation: Federal Reserve rate decrease → On-chain yields also decrease as alternative liquidity sources become cheaper

As the risk-free rate declines, the cost of alternative liquidity sources, such as cryptocurrencies, also decreases. Borrowers can refinance or leverage at a lower cost, thereby driving down both on-chain and off-chain lending rates. This dynamic typically persists in the medium to long term.

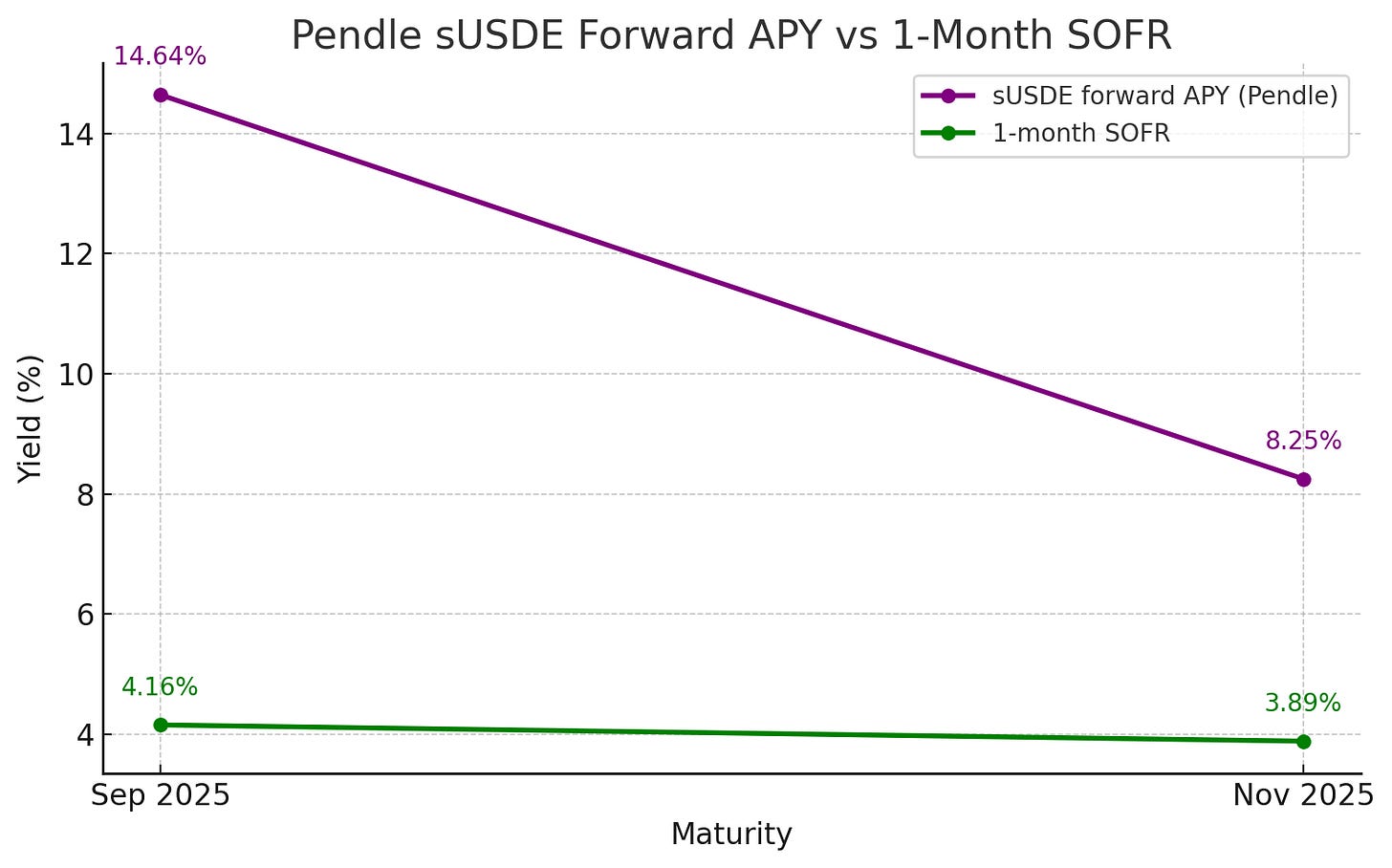

We will see signs of this in the forward yield market data.

Pendle is a forward yield market in DeFi where traders can lock in or speculate on future DeFi annual percentage yields (APY). Although Pendle's expiration dates do not perfectly match traditional benchmark rates, they are very close to SOFR, allowing for valuable comparisons—such as those in late September and late November.

On these dates, the 1-month SOFR rate was approximately 4.2% (September) and 3.9% (November). The implied sUSDe yield of Pendle for similar maturities was significantly higher (14.6% and 8.3%, respectively). However, the shape of the yield curve tells the whole story. Like SOFR, Pendle's forward yields are also declining as expectations of further easing by the Federal Reserve are digested.

Source: Allium

Key Point: Pendle's movement aligns with the direction of traditional interest rate markets, but with a higher benchmark. Traders expect that as macro policies change, on-chain yields will decline.

Conclusion: The impact of the Federal Reserve's rate cuts on the crypto market is not as simple as the headlines suggest

Rate cuts do not just impact the cryptocurrency market (just as in traditional capital markets, rate cuts typically affect the stock market). Rate cuts also bring various effects—declining on-chain yields, narrowing interest rate spreads, and changes in the forward yield curve—that ultimately shape liquidity conditions.

Beyond lending, we can further understand the impact of the Federal Reserve's rate cuts on the cryptocurrency market, such as how the circulation of stablecoins will change as issuer yields or real yields decline, leading to increased ETH staking inflows.

By combining real on-chain data, we can move beyond the headlines and truly see how macro policies permeate the cryptocurrency market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。