Author: Nancy, PANews

A report about Tether negotiating a financing round with a valuation of $500 billion has propelled the company to new heights. If the deal goes through, its valuation will soar to the highest among global crypto companies, rivaling Silicon Valley super unicorns like OpenAI and SpaceX.

With substantial capital strength, Tether's profit levels have made its price-to-earnings ratio unattainable for many crypto and traditional institutions. However, it is seeking a new round of capital injection at a high-profile valuation, which not only serves as a strong testament to its profitability but also shapes market narratives through capital operations, paving the way for future business expansion and market development.

Valuation skyrockets over 40 times in a year, assessing well-known core investors

On September 24, Bloomberg reported that stablecoin giant Tether is planning to sell about 3% of its company shares at a valuation of $15 billion to $20 billion. If this transaction is completed, Tether's valuation could reach approximately $500 billion, placing it among the most valuable private companies globally and potentially setting a record for the largest single financing in the history of the crypto industry.

In comparison, in November 2024, the well-known financial services company Cantor Fitzgerald acquired about 5% of Tether for $600 million, when the company's valuation was around $12 billion. This means Tether's value has increased by over 40 times in less than a year. However, since Cantor Fitzgerald's former CEO Howard Lutnick is the current U.S. Secretary of Commerce, this transaction has been interpreted by outsiders as a "friendly price," potentially bringing more political support to Tether.

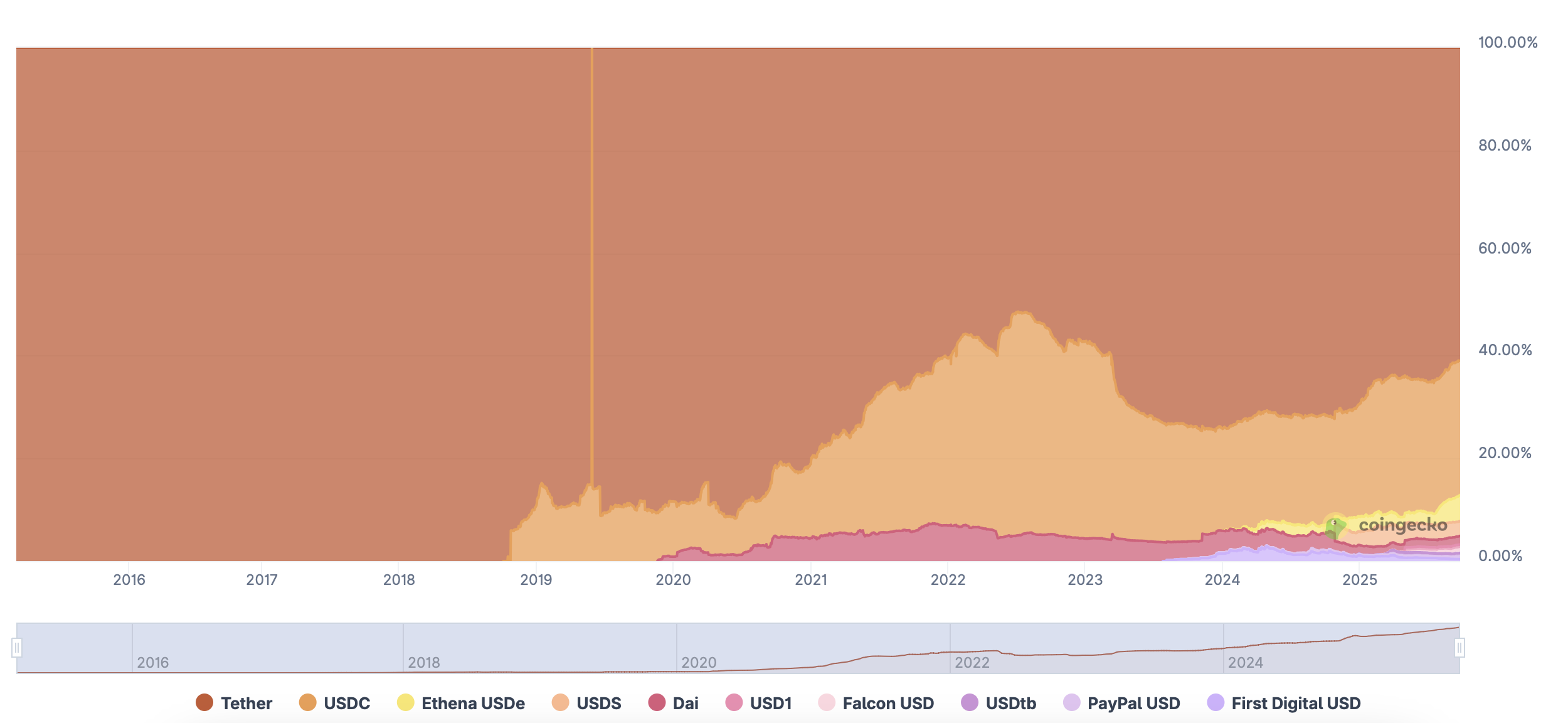

The rapid rise in Tether's valuation is attributed to its market share advantage, astonishing profit margins, and robust financial condition. According to CoinGecko data, as of September 24, the market capitalization of USDT surpassed $172 billion, reaching a new high and accounting for over 60% of the market. Meanwhile, Tether CEO Paolo Ardoino recently admitted that Tether's profit margin is as high as 99%. The second-quarter financial report further shows that Tether's finances are solid, with reserve assets reaching $162.5 billion, exceeding $157.1 billion in liabilities.

"Tether's balance sheet has about $5.5 billion in cash, Bitcoin, and equity assets; if calculated based on the approximately $173 billion USDT in circulation and using a 4% overall yield, financing at a $500 billion valuation means its enterprise value to annualized earnings ratio (PE) is about 68 times," noted Dragonfly investor Omar.

Insiders revealed that the disclosed valuation figures currently represent an upper target, and the final transaction amount may be significantly lower. Negotiations are still in the early stages, and investment details may still be adjusted. This transaction involves newly issued shares rather than existing investors selling shares. Paolo Ardoino later confirmed that the company is actively assessing the possibility of obtaining financing from some well-known core investors.

Behind high valuation external financing, focusing on business expansion and compliance layout

In the public's perception, Tether has always been "not short of money." The stablecoin giant achieved a net profit of $13.7 billion in 2024 through interest income from U.S. Treasury bonds and cash assets. This profit level is sufficient to support continuous expansion for any tech or financial company. However, Tether has thrown out a high-valuation external financing plan at this time, which is not only a strategy for capital operations but also relates to business expansion and compliance endorsement.

According to Paolo Ardoino, Tether plans to scale up its strategic operations in existing and new business lines (stablecoins, distribution coverage, artificial intelligence, commodity trading, energy, communications, media) by several orders of magnitude.

He disclosed in July this year that Tether has invested in over 120 companies to date, and this number is expected to grow significantly in the coming months and years, focusing on key areas such as payment infrastructure, renewable energy, Bitcoin, agriculture, artificial intelligence, and tokenization. In other words, Tether is attempting to transform passive income reliant on interest rate environments into active growth through cross-industry investments.

However, pressure is mounting. With increasing competition and the Federal Reserve restarting its interest rate cut cycle, Tether's main sources of profit also face downward risks. The company has previously emphasized that its external investments come entirely from its own profits. A decline in revenue expectations means that the pool of funds available for expansion will shrink. The injection of high financing can reserve ample resources for Tether's investment layout.

What truly drives Tether's need for funds and resources is the expansion into the U.S. market. With the implementation of the U.S. GENIUS Act, the issuance of stablecoins has entered a new compliance framework. For Tether, this is both a challenge and an opportunity. Especially after its competitor Circle successfully went public and gained recognition in the capital market, with its valuation soaring to $30 billion, Tether's "absence" in compliance has been further magnified.

On one hand, USDT has long been on the gray edge, navigating regulatory boundaries. By engaging in a very small percentage of equity transactions paired with a massive valuation, Tether has not only successfully attracted media attention but also elevated the market narrative, breaking through negative perceptions and significantly enhancing its influence.

On the other hand, compared to Circle's choice to go public, Tether has opted for another path to gain mainstream market recognition. In September of this year, Tether announced that it would launch a U.S.-based stablecoin, USAT, by the end of the year. Unlike the globally circulated USDT, USAT is specifically designed for enterprises and institutions under the U.S. regulatory environment, issued by the licensed digital asset bank Anchorage Digital, and operated through Tether's global distribution network. This way, Tether retains core profit control while meeting compliance requirements.

The personnel arrangement also makes this new initiative intriguing. The CEO of USAT is Bo Hines (related reading: 29-year-old crypto newcomer Bo Hines: From White House crypto "liaison" to rapidly taking the helm of Tether's U.S. stablecoin), who was appointed by Tether in August as a digital asset and U.S. strategy advisor, responsible for formulating and executing Tether's development strategy in the U.S. market and strengthening communication with policymakers. According to previous reports from PANews, Hines served as a digital asset policy advisor at the White House, promoting crypto policies and facilitating the passage of the U.S. stablecoin GENIUS Act, accumulating extensive resources in political and business circles. This adds a layer of "protection" for USAT's entry into the U.S. market.

Additionally, the advisor for this financing, Cantor Fitzgerald, is also noteworthy. As one of the primary dealers designated by the Federal Reserve, Cantor has deep roots in investment banking and private equity for many years, with close ties to Wall Street's political and business networks. At the same time, it is also the main custodian of Tether's reserve assets, having first-hand knowledge of the latter's capital operations. For external investors, Cantor's involvement not only increases the credibility of Tether's financing valuation but also adds a degree of certainty to USAT's launch in the U.S. market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。