Author: Chainalysis

Translated by: Felix, PANews

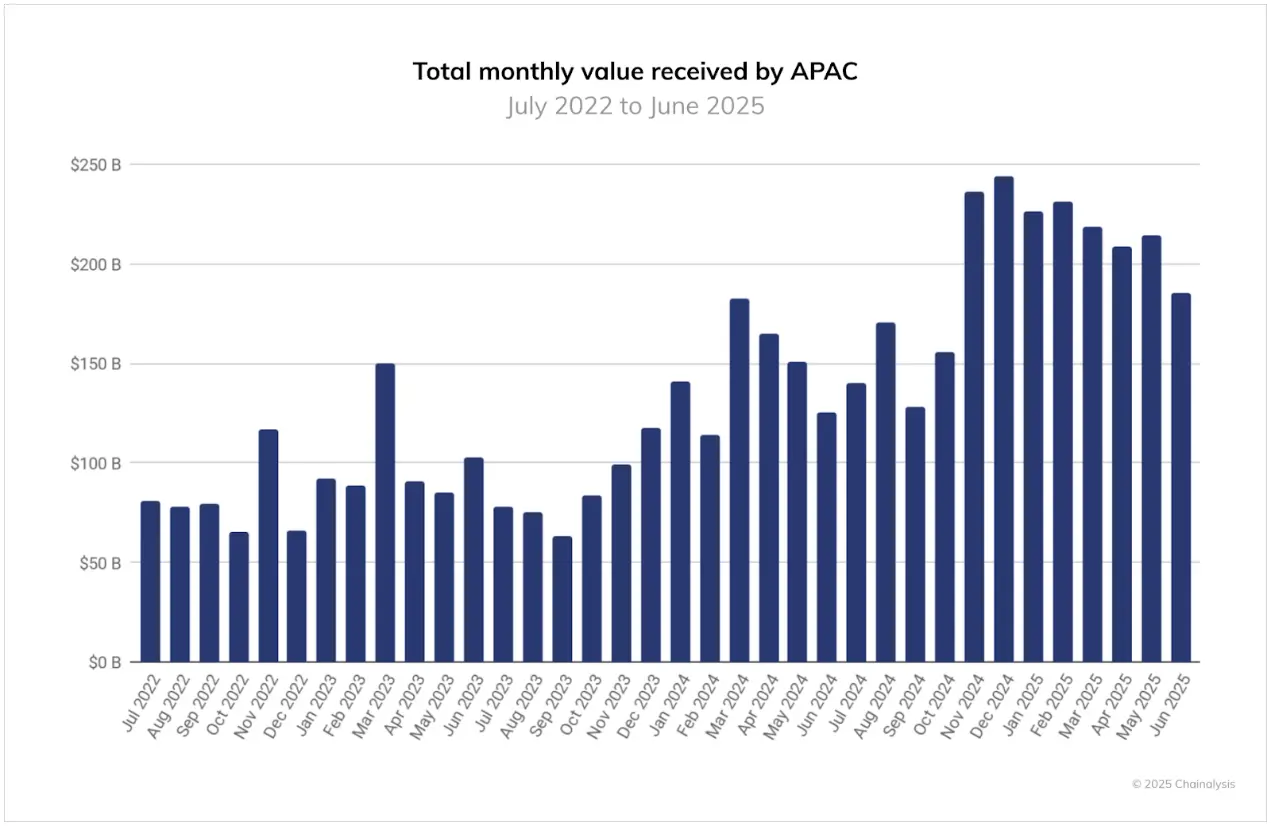

From July 2022 to June 2025, the Asia-Pacific region has shown strong growth in cryptocurrency activity, with estimated on-chain transaction values exhibiting a clear upward trend. Monthly on-chain transaction volumes grew from approximately $81 billion in July 2022 to a peak of $244 billion in December 2024, tripling over the span of 30 months.

Significant growth periods include:

- At the end of 2023 and the beginning of 2024, as the crypto market recovered, monthly on-chain transaction volumes first surpassed the $100 billion mark.

- In the fourth quarter of 2024, driven by a surge in global markets following the U.S. presidential election, the region's year-end data for November and December was strong, setting records for on-chain transaction volumes.

- Although transaction volumes declined from the peak in December 2024, on-chain transaction values remained relatively high, exceeding $185 billion per month as of mid-2025.

As the fastest-growing region for global on-chain transactions, the Asia-Pacific region has become a key driver of global growth, with its monthly transaction volumes often second only to Europe and sometimes even surpassing North America. These figures reflect the Asia-Pacific region's increasing influence in the global market and its momentum for continued growth in the second half of 2025.

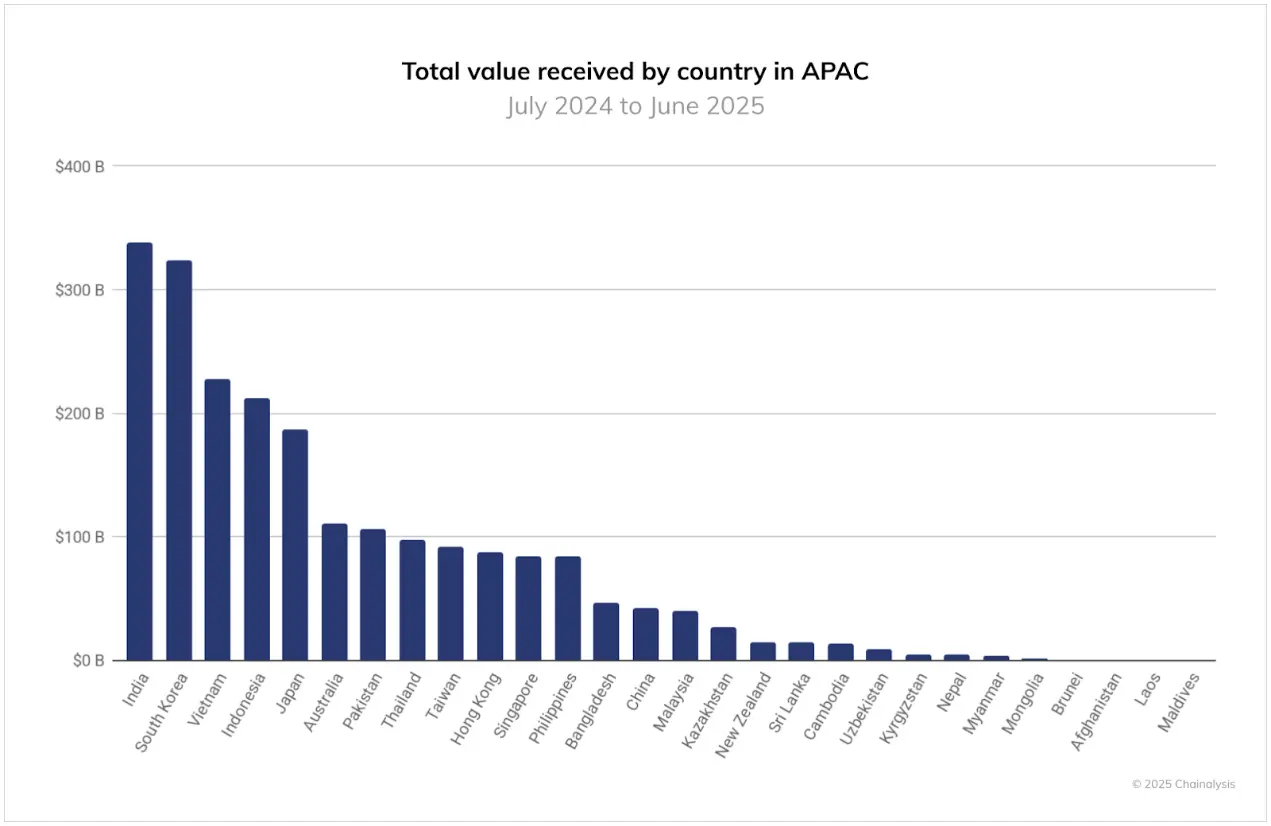

The cryptocurrency market in the Asia-Pacific region presents diverse development paths, with India becoming the largest market in the region at $338 billion. The characteristics of its crypto market include widespread grassroots adoption filling structural gaps in traditional finance: key drivers include the remittance needs of a large expatriate community, young people using crypto trading as a supplementary income source, and the influence of fintech tools like Unified Payment Interface (UPI) and eRupi.

South Korea is the second-largest market in the region, with cryptocurrency trading resembling stock trading, characterized by high liquidity, speculation, and mainstream acceptance. New regulations, such as the Virtual Asset User Protection Act in 2024, are reshaping the activities of major exchanges in South Korea.

Vietnam ranks third, where cryptocurrencies are widely used for remittances, gaming, and savings in everyday infrastructure. Pakistan exhibits a fourth typical model: the country's young population prioritizes mobile devices, with $35 billion in remittances annually, stablecoins being used to hedge against inflation, and freelancers receiving payments in cryptocurrency, thanks to the government's recent signals of regulatory release rather than restriction.

In smaller markets, Australia is taking steps to update its anti-money laundering/anti-terrorism financing (AML/CFT) regime, cleaning up inactive digital currency exchange licenses and providing clearer regulations for the industry, laying the groundwork for a more mature market. Singapore and Hong Kong continue to show strong policy momentum, with regulators emphasizing that strict standards are the way to build digital asset hubs.

Regulatory Changes Boost Cryptocurrency Development in Japan

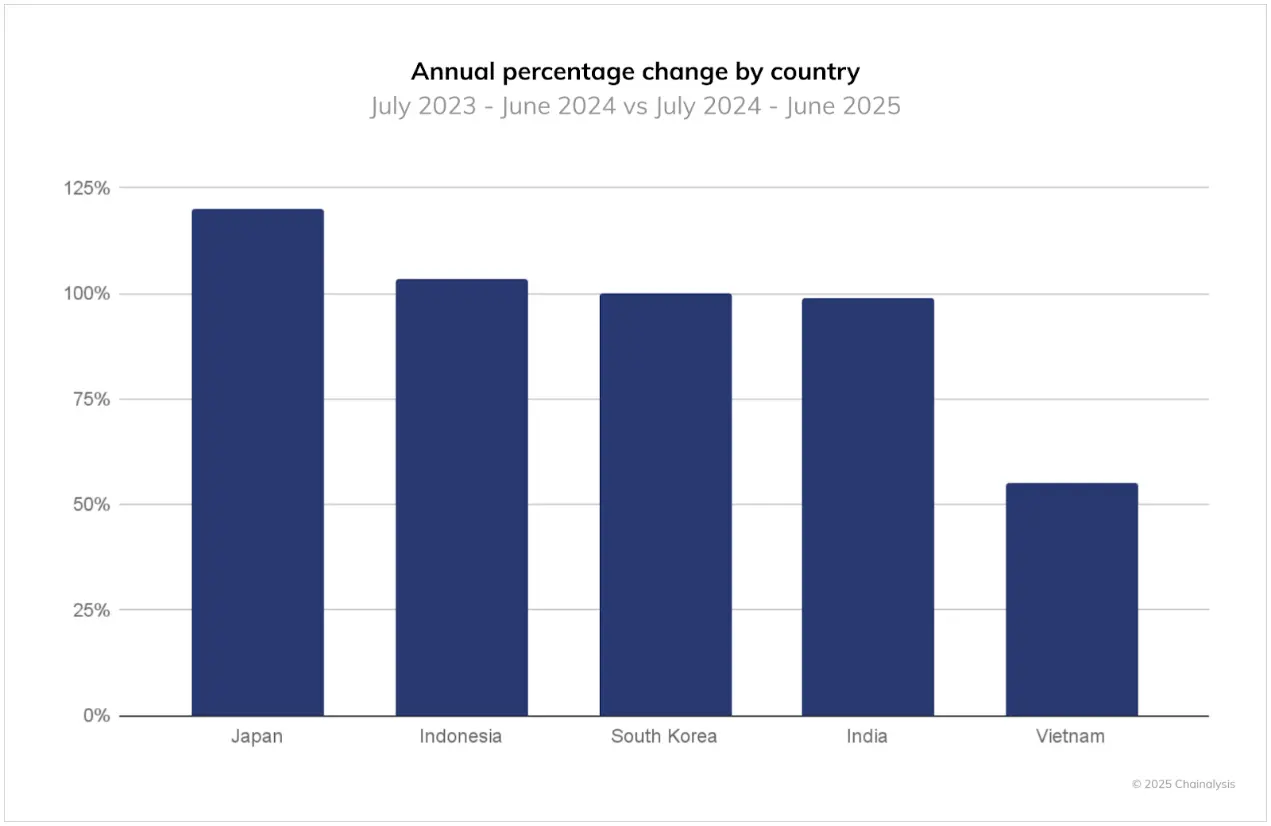

Among the top five markets in the Asia-Pacific region, Japan has shown the strongest growth. In the 12 months leading up to June 2025, on-chain transaction values grew by 120% year-on-year, surpassing Indonesia (103%), South Korea (100%), India (99%), and Vietnam (55%). The Japanese market has been relatively stable in recent years, and this growth is closely related to several policy adjustments that will support long-term market growth (including regulatory reforms that more clearly incorporate cryptocurrencies as investment tools, planned changes to crypto tax systems, and the approval of the first yen-backed stablecoin issuer).

In contrast, the growth in India, South Korea, and Indonesia reflects ongoing expansion, but this expansion is based on already high market benchmarks, resulting in lower growth rates than Japan; while Vietnam's 55% lower growth indicates that its crypto market is maturing, with cryptocurrencies deeply integrated into remittances and everyday financial activities.

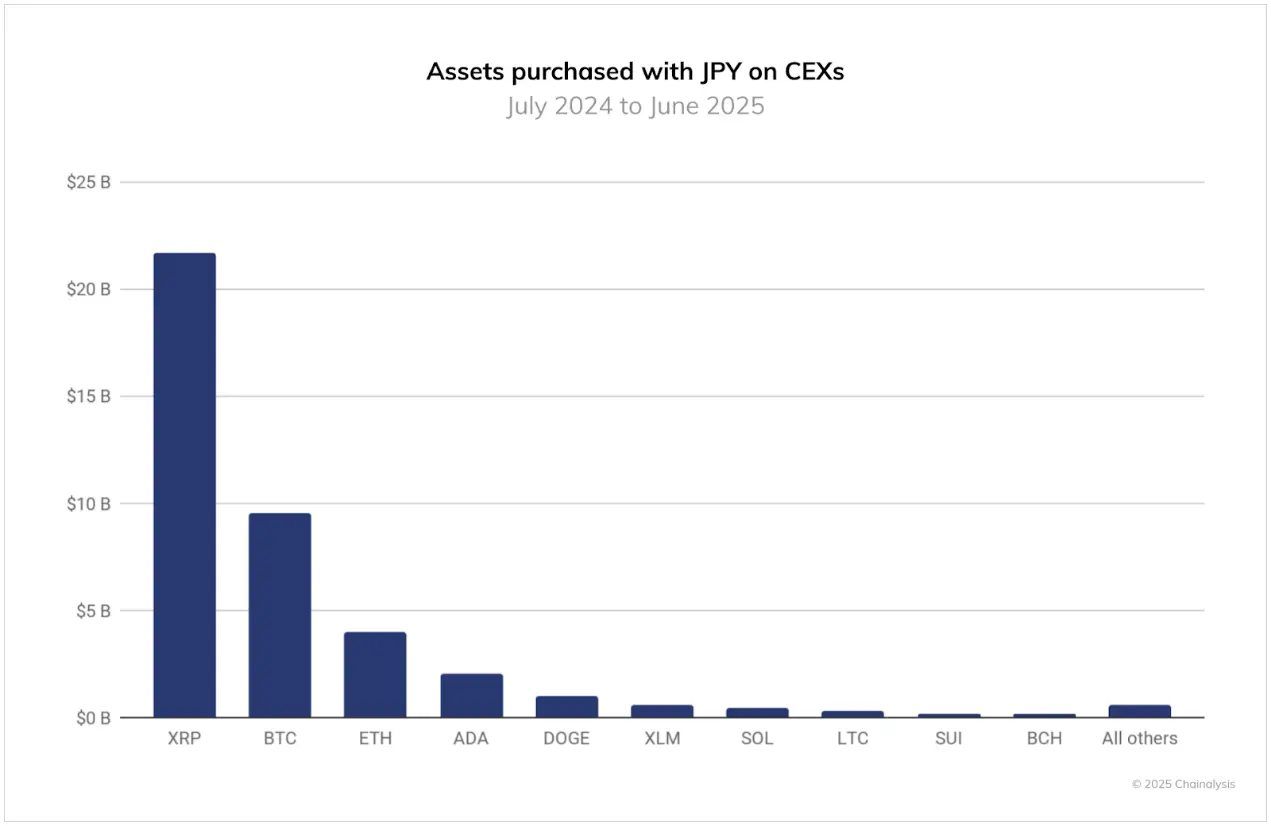

Japan's growth closely follows significant advancements in its crypto industry. For some time, regulatory restrictions have hindered the listing of stablecoins on Japanese exchanges, but this situation is changing. In the 12 months leading up to June 2025, cryptocurrencies purchased with yen primarily flowed into XRP, with fiat transaction volumes reaching $21.7 billion, followed by Bitcoin ($9.6 billion) and Ethereum ($4 billion). XRP's dominant trading volume suggests that investors may be betting on XRP's utility in the real world, aided by Ripple's strategic partnership with SBI. Looking ahead, the market will closely monitor the acceptance of stablecoins like USDC and JPYC.

South Korean Market Driven by Professional Traders and Stablecoin Growth

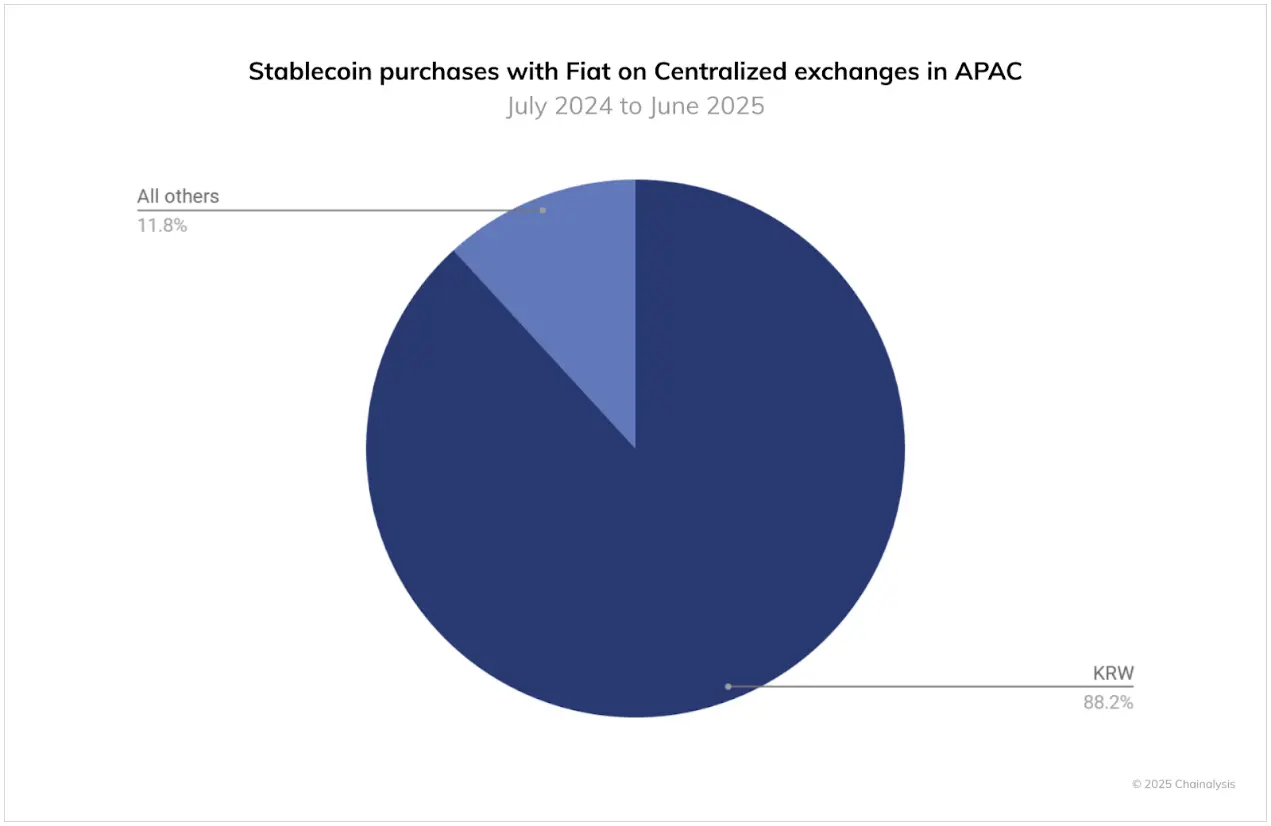

Since December 2023, major exchanges in South Korea, such as Bithumb and Coinone, have begun increasing USDT/KRW trading pairs, with trading volumes surging over 50% at the beginning of 2025. In the 12 months leading up to June 2025, stablecoins purchased with the Korean won reached $59 billion, indicating strong demand from traders for stablecoins, which are used for liquidity, hedging, and faster rotation between assets. The robust domestic demand for stablecoins in South Korea is influencing the policy environment, with legislators and regulators considering a regulatory framework for won-backed stablecoins.

Current discussions mainly focus on stablecoins issued by banks and regulated financial institutions, but there is still a lack of clear discussions regarding distribution, exchange listings, and secondary market trading. South Korea's stablecoin activity is far ahead in the Asia-Pacific region, with won-related transaction volumes around $59 billion, while the Thai baht only accounts for $450 million, and other currencies like the Indonesian rupiah, Australian dollar, and Hong Kong dollar have even smaller trading volumes. To continue promoting the adoption of stablecoins in South Korea, regulation needs to cover the entire lifecycle from issuance to distribution, circulation, and integration into payment settlement systems.

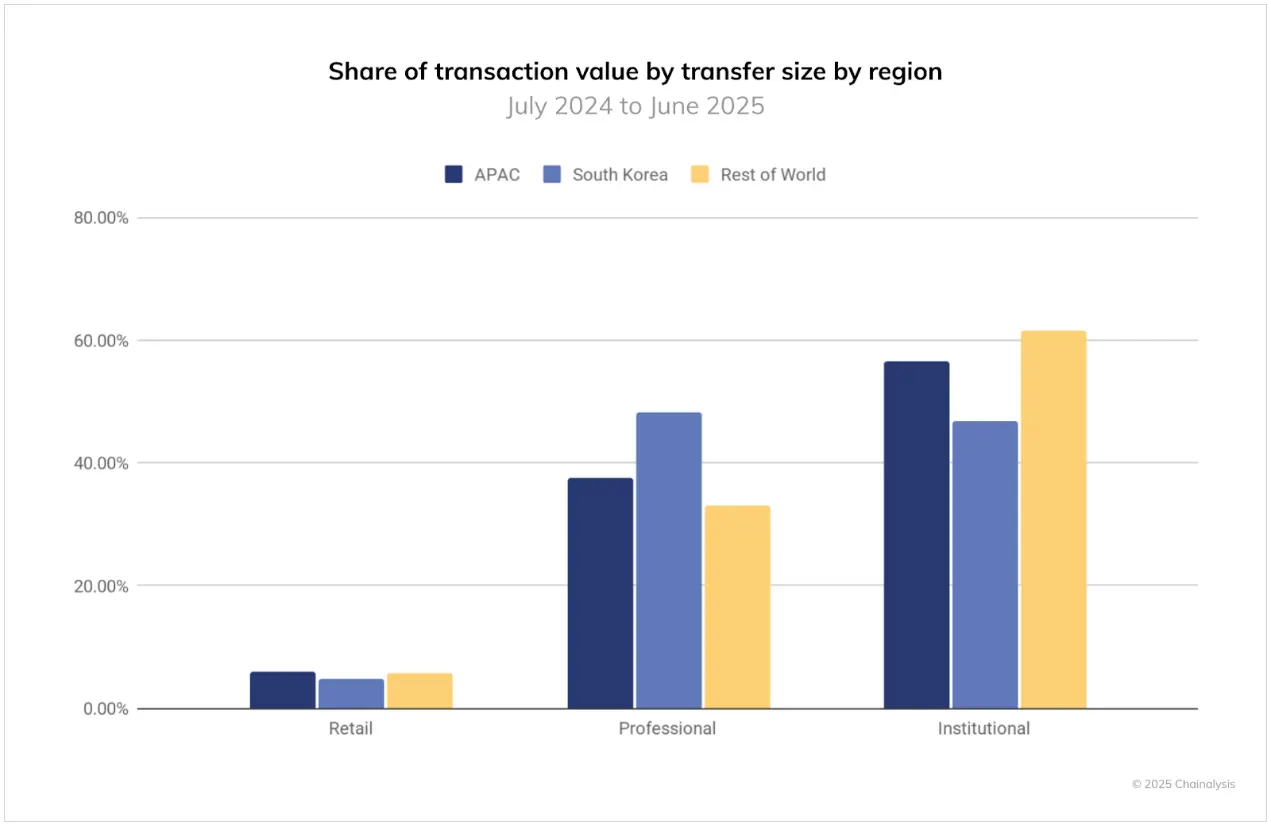

Returning to the topic of on-chain transaction volumes, the South Korean crypto market is highly active in the trading scale of $10,000 to $1 million, defined here as "professional" trading activity. Nearly half of South Korea's on-chain trading activity comes from this category, far exceeding the global level. This reflects a culture of active trading among users in developed economies. Although regulatory provisions have so far limited the entry of corporate and institutional participants into the South Korean market, recent regulatory enhancements are gradually opening the door for corporate participation, which could add diversity to the market.

Retail refers to transactions below $10,000. Professional refers to transactions between $10,000 and $1 million. Institutional refers to transactions above $1 million.

India Leads in Index with Grassroots and Institutional Strength

However, India's crypto market leads the Asia-Pacific region in on-chain transaction volumes and the 2025 Global Adoption Index ranking. This year, it ranks first in all sub-indices, with India's crypto market being both rapidly developing and highly complex. Organizations like the India Web3 Association are promoting cryptocurrencies as a secure and legitimate means of value transfer. Meanwhile, grassroots applications of cryptocurrencies in daily life are also evident, from young students experimenting with blockchain and programming to communities leveraging cryptocurrencies for small income opportunities.

India's broader digital economy provides a solid foundation for this growth. The country's thriving fintech ecosystem, widely used Unified Payment Interface (UPI), and innovations like eRupi showcase India's capacity for large-scale adaptation of new financial technologies. While regulators and law enforcement agencies are collaborating to establish clear frameworks and oversight mechanisms, this momentum indicates that cryptocurrencies are becoming an indispensable part of India's digital future.

The Asia-Pacific region is now one of the most active regions for cryptocurrency adoption globally, with countries taking distinctly different yet equally impactful paths. From India's dominance, South Korea's speculative maturity, to Japan's acceptance of XRP and experiments in smaller markets, the Asia-Pacific region highlights the adaptability of cryptocurrencies across different economic and cultural contexts. This diversity not only drives adoption but also positions the Asia-Pacific region as a bellwether for the development of global cryptocurrency applications in the coming years.

Related reading: How to Tap into the Asian Cryptocurrency Market? An Analysis of Differences, User Behavior, and Market Characteristics in Asian Countries

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。