Source: SHOALRESEARCH

Translation: Zhou, ChainCatcher

Modern blockchains have achieved scalability but have yet to achieve determinism. While Solana leads in throughput and latency, it still lacks reliable execution guarantees for high-risk applications. Raiku introduces a programmable coordination layer that restores determinism, predictability, and trust to on-chain systems without compromising performance. Built as a Sidecar to the Solana validator network, Raiku enables developers to pre-allocate block space, schedule transactions precisely, and avoid all mempool chaos.

This article explores how Raiku brings execution guarantees, MEV resistance, and pre-confirmation to Solana's monolithic architecture, providing a system that emphasizes not only speed but also reliability in a distributed adversarial world.

Current State of Blockchain Architecture and the Need for Execution Determinism

The global market demands determinism. Cryptocurrencies often only bring hope.

Today's blockchain infrastructure is rife with architectural compromises. In the pursuit of scalability, the systems we build violate core principles of distributed computing, assuming infinite bandwidth, ignoring latency ceilings, and forcing applications to use generic state models that they do not require. What is the result? Fragile abstractions, unreliable performance, and a developer experience that feels more like survival than innovation.

Imagine launching a modern financial product and being told that your transactions might fail unless you spam, bribe validators, or just pray to get included.

Blockchain systems should ultimately abstract this complexity and provide effective decentralized infrastructure. But in reality, we have replaced server racks with validator nodes, and latency issues have shifted from physical hardware to Layer 1 congestion.

This is the everyday reality of Web3. Ethereum, as the most widely used smart contract platform, processes only 15-30 transactions per second. During high-demand periods such as NFT drops, liquidations, and memecoin seasons, the underlying network becomes congested, fees soar, and Layer-2 is the only escape route. These Layer-2 Rollups provide tremendous throughput by moving execution off-chain while lowering gas fees, but they also introduce new trade-offs: liquidity fragmentation, bridging complexity, differentiated trust models, and slightly flawed user experiences.

Meanwhile, Ethereum's re-staking ecosystem has also introduced greater fragility. Protocols like EigenLayer require validators to leverage Ethereum's social consensus to secure third-party systems, which effectively amounts to betting that the community will coordinate a rescue if any issues arise. Even Vitalik considers this practice high-risk. Ethereum's scaling remains a roadmap that will take a decade to complete. Builders need to act now.

On the other hand, Solana pursues a high-performance monolithic design: it centralizes consensus and execution on a single chain, achieving extremely fast block times and parallel execution. In practice, Solana can typically handle 3,000-4,000 TPS on a global state machine, far exceeding Ethereum's throughput. This design can achieve low fees and near-instant finality under normal conditions. However, Solana's single-chain architecture also shows stress under extreme loads. During spikes in usage, Solana experiences congestion and even interruptions as all dApps compete for the same global resources.

For example, historically, a sudden surge in traffic (such as popular NFT minting or arbitrage bots) has led to block stalls and transaction failures. Notably, in February 2024, a bug triggered by the Solana runtime caused the network to pause for nearly five hours. Even when the network remains operational, users and bots often see transaction failures or timeouts during peak demand, undermining Solana's otherwise strong user experience. In fact, high-frequency traders on Solana have observed failure rates of up to 75% when the network is congested. This occurs because Solana's leader scheduling and QoS (Quality of Service) prioritization favor certain validators, and when too many transactions flood in, many transactions simply cannot be included in a timely manner.

In addition to throughput limitations, both ecosystems face issues of MEV exploitation and unpredictable execution. Despite Solana's adoption of a public leader scheduling mechanism, it still grapples with its own MEV dynamics. Solana's stake-weighted transaction scheduling mechanism means that large validators or order flow specialists can reach deals that prioritize certain off-chain transactions. This lack of transparency leads to centralization issues, where well-connected bots or firms can access quickly, while ordinary users struggle to get their transactions through. Although Solana has introduced priority fees and Jito (a dedicated MEV-aware client) to create a more open fee market, the underlying problems remain: when the network is busy, inclusivity turns into a bidding war or an insider game, leaving ordinary users facing uncertainty and transaction delays.

From a state perspective, Ethereum's rollup-centric model disperses applications across various chains. Each rollup becomes an island, requiring bridging, redundant tools, and additional security assumptions. When liquidity and contracts no longer coexist, the magic of DeFi—composability—disappears.

What blockchain lacks is scalability, avoiding latency spikes, state fragmentation, or transaction failures. The precision required by global finance is still lacking in blockchain.

This is the design space that Raiku occupies.

Raiku was born out of years of dissatisfaction with Ethereum's infrastructure and a profound respect for elegant system design, introducing a brand new infrastructure for Solana that focuses not on more rollups but on precise execution. It expands Solana's core by providing programmable building blocks—a compute environment—that offers dedicated fast lanes, guaranteed bandwidth, and deterministic settlement for applications without the need to manage separate chains or disrupt composability.

If Solana is the global highway, then Raiku is the intelligent traffic control system, providing fast lanes for the applications that need them most.

This is not another Rollup, nor is it a sidechain. Raiku is a rethinking of blockchain execution: fast, modular, programmable, and predictable. The system is built not to chase trends but to meet the needs of institutions, developers, and globally scaled applications that require determinism rather than hope.

From Limitations to Vision: The Origin of Raiku

Raiku was born from a simple observation: not all blockchain workloads need to run in the same crowded kitchen. At the end of 2023, a group of researchers and Solana veterans began to ask how they could offload heavy computation from Solana's L1 without losing on-chain advantages. The initiative started as a research project (supported by Superteam and the Solana Foundation) stemming from their frustration with the "stagnation" of Ethereum-centric infrastructure. While Ethereum's ecosystem boasts a rich array of Layer-2 solutions, it has not achieved the leaps in performance or developer experience that these researchers hoped for; rollups are making incremental progress but still rely on a relatively slow and congested base layer. In contrast, Solana represents an opportunity to try something different: its L1 is already fast and has proven that a scalable blockchain is possible, but it can also improve by refining its architecture.

The Raiku team noted that by January 2024, many Solana applications were "naturally inclined" to extend their architecture, or in other words, projects were attempting to build their own mini rollups or isolated execution layers to further scale the throughput of the base layer. Due to the lack of an official framework, some teams attempted to repurpose tools like the Sovereign SDK (for independent chains) to create Solana extensions or what could be called rollups. The results were not ideal: misusing Ethereum-oriented rollup frameworks on Solana led to poor performance and significant friction. Each project launching its own extension resulted in state fragmentation (essentially encountering all the issues that Ethereum faces) and duplicated efforts. More importantly, these DIY solutions could not integrate cleanly with Solana's design, encountering data throughput limitations, timing issues, and the inability to share state or accounts with Layer 1.

This pattern highlighted a clear design problem: Solana needs a purpose-built extension framework, not a framework forcibly shoved in from elsewhere.

The founding team of Raiku, led by Robin A. Nordnes and others, set out to address this issue by fundamentally building an "edge computing" layer that is tightly coupled with Solana. After researching other new L1s like Aptos and Sui, they chose Solana, believing it had unique advantages to support their vision. Solana has a large user base, a strong developer community, and a solid architectural foundation (often compared to early Ethereum's rapid improvements). Importantly, Solana's leadership and ecosystem are open to innovation, with core developers releasing updates every few weeks and being enthusiastic about new extension methods. Their idea was not to launch another independent L1 or to create a completely separate shard, but to extend Solana in a complementary way.

As one team member put it: "We are neither L2 nor L1… we are somewhere in between." More formally, Raiku positions itself as a block-building architecture, an infrastructure protocol that connects validators, applications, and the base chain to coordinate high-performance execution, surpassing the capabilities that the base layer itself can provide. If Solana L1 is the highway, then Raiku builds the fast lanes and traffic control systems that allow certain applications to run faster and more predictably when needed.

A key insight in Raiku's design is that many high-scale dApps do not need to continuously interact with the entire global state. Some applications can operate largely independently (with their own order books or game engine logic) as long as they can occasionally settle to the main chain and leverage its security and liquidity when needed. As Nordnes explained, "Most use cases with large-scale potential do not require constant state composability." You can sandbox the execution of applications in their own area (like L2) while still benefiting from the main chain's advantages in settlement finality, shared user accounts, on-chain price data, and asset security.

This realization underpins Raiku's architecture: it aims to provide applications with their own sovereign execution environment (so they are not bottlenecked by other environments) while retaining the advantages of Solana's Layer 1 (a unified asset and identity space, as well as a high-performance settlement layer). In the Ethereum world, similar goals can be attempted through launching Optimistic Rollups or ZK Rollups, but as the team pointed out, "You can build Layer 2 on Ethereum, but you are still severely limited by the underlying Layer 1." Even the best Rollups are constrained by Ethereum's data publishing throughput, latency, and upgrade timelines (fixing Layer 1 will take a decade). The Raiku team did not wait; instead, they saw an opportunity to leverage Solana's current advantages and innovate on top of them.

Raiku will introduce a new layer that runs in parallel with Solana's consensus, operated by the validator community (and aligned with its economics) to coordinate advanced execution capabilities. Its vision is bold: to leverage Web2 and TradFi systems (like AWS or NASDAQ) to make on-chain applications "faster, more reliable, and more competitive in the market," all without compromising decentralization.

By early 2024, this vision gained widespread attention. The concept of scaling Solana became a hot topic, and the community ultimately decided to use the term (or network scaling) to replace L2, emphasizing scaling on top of L1 rather than forking. Raiku became one of the leading projects to implement this concept.

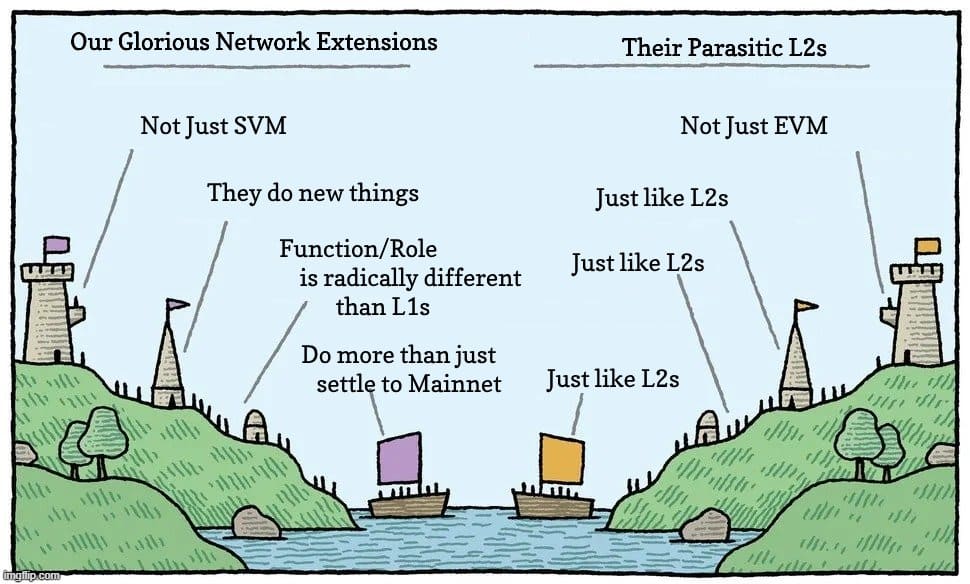

Technically, scaling is similar to Rollups or sidechains, a label that perhaps underestimates the capabilities the Raiku team is building. Raiku adopted the term "edge computing" to describe its execution zone. The term "edge computing" borrows from traditional IT (referring to computing done at the edge of the network, closer to where the computation is needed). Raiku's edge computing environment is not an independent blockchain competing with Solana but a modular execution zone located at the edge of the Solana network, specifically built to handle certain workloads with deterministic performance. This term resonates with Web2 infrastructure teams and institutional participants, bridging the conceptual gap between Rollups and familiar edge servers. Essentially, Raiku provides a custom Rollup-like environment integrated into Solana's edge computing zone (scaling). This grants developers execution autonomy, allowing them to run their own logic and scheduling freely without the hassle of launching an entirely new chain or fragmenting users across ecosystems.

Redefining Rollups: From "Scaling" to "Edge Computing Environment"

It is worth mentioning that Raiku is reshaping the landscape of custom execution environments. In the Solana community, the term "scaling" is used to describe these Solana-customized rollups. However, the Raiku team believes this term is somewhat narrow (even stigmatized due to early rough attempts). To capture the imagination of both cryptocurrency and traditional Web2 audiences, Raiku is building not just scaling solutions; they are constructing "edge computing environments."

Source: https://x.com/owocki/status/1830621049190560061

Source: https://x.com/owocki/status/1830621049190560061

With Raiku's edge computing environment, we no longer view Layer 2 networks as external add-ons above Layer 1; instead, they are an integral part of the network architecture, an extension of Layer 1, located at the network's edge, close to users and applications. Raiku refers to this as a "modular execution zone," emphasizing that different modules (each a runtime/virtual machine) can be inserted into a unified system. These modular execution zones allow developers to insert different execution runtimes or custom virtual machines into a unified system, enabling them to shape the underlying application logic with unparalleled control.

The Raiku team believes that large-scale performance is not an afterthought but something built from the ground up. Raiku's starting point is precisely where other technologies have stalled: breaking through the physical limits of distributed networks, such as bandwidth, geographic location, and time constraints. Specifically, Raiku is able to provide:

- System reliability that maintains strong performance even under extreme loads and stress.

- Deterministic execution guarantees that each transaction has predictable outcomes.

- Low latency by placing high-performance edge computing (HPEC) capabilities directly at the edge of the Solana network, enabling transaction processing in just a few milliseconds.

- Developers can freely customize low-level logic, providing unparalleled flexibility and control.

Raiku's coordination engine can precisely coordinate transactions, ensuring that transactions are sent, scheduled, and confirmed quickly, supported by a well-developed pre-block space market, thus ensuring transaction packaging (more details will be covered in later sections). Validator plugins support Ahead-of-Time (AOT) and Just-In-Time (JIT) execution. Combined with streaming proofs, these plugins can achieve instant pre-confirmation of transactions, transforming today's unreliable, best-effort interactions into reliable and schedulable execution.

The edge computing environment has practical significance. It helps narratively distinguish the approaches of Solana and Ethereum: Ethereum adopts "Layer-2 Rollups," while Solana (through Raiku) adopts "edge computing." The latter implies enhancement rather than separation. This is a term that traditional finance can understand. In enterprise computing, edge computing is a positive concept, meaning faster responses by moving computation closer to where it is needed.

Raiku is essentially saying: we are moving execution closer to applications (in a logical sense) while still anchoring in the main network.

Therefore, in this report, we will alternately use "edge computing environment," "scaling," and "modular execution zone" to reflect the specific implications of the Raiku concept. Looking ahead, as Raiku's mainnet goes live and more marketing occurs, you may see "Raiku edge computing" become a branded term, similar to Polkadot's "parachains" or Avalanche's "subnets." This terminology also makes it easier to express new functionalities: for example, Raiku can say "deploy your own edge computing environment on Solana in a week," which sounds like setting up a cloud environment, making it familiar to developers.

By emphasizing "edge computing," Raiku aligns with the broader trend in web infrastructure: to improve speed, logic is moving closer to users (edge networks, CDNs, etc.), where "users" refers to application transactions, and the edge is a special area within the network. This is a powerful analogy that can help more people understand how Raiku differs from ordinary scaling hacks.

Raiku's design follows several key principles:

Not all dApps need continuous global state:

Some of the highest throughput applications (exchanges, games, payment networks) can operate in isolated environments for most activities, only using the main chain when necessary. Raiku addresses this by providing selective isolation mechanisms, freeing these applications from competition in the global memory pool while still allowing them access to Layer-1 liquidity/state when needed. This is in stark contrast to the Ethereum DeFi philosophy, where everything is highly interwoven on a single chain (a powerful concept, but one that does not scale when every small application requires global atomic composability). Raiku recognizes that temporal or contextual composability (only when needed) is sufficient in many cases, leading to significant performance improvements.

Maintain the feel of a single network:

Despite introducing modular partitions, Raiku still strives to avoid the user experience challenges that come with multi-chain setups. Global accounts and orchestration engines ensure that from the user's perspective, Solana remains a single network. You do not need to manage multiple tokens across different chains/partitions to pay for gas, nor do you need to manually switch RPC endpoints. You interact with Solana, and Raiku will route your transactions to the scaling chain or main chain based on your situation in the background. This is fundamentally different from the Cosmos application chain model, or even Ethereum's Layer-2 architecture, where using a new chain means new tokens, new block explorers, and a shift in mindset.

Raiku's edge computing zones are more like "network extensions" rather than independent networks, indicating that they extend Solana rather than compete with it. Its architectural advantage lies in retaining network effects: the utility of the SOL token still supports the whole (fees, staking), and Solana's community will not splinter into dozens of small chains. This addresses a common criticism of Ethereum's rollup-centric roadmap, which is that Ethereum may merely become a settlement layer while user activity migrates to various Layer-2 tokens and ecosystems, potentially undermining Ethereum's economic security. Raiku's approach increases capacity while placing it under Solana's economic umbrella.

Leverage existing security, do not reinvent it:

Raiku will not create a new foundational consensus mechanism, nor will it require users to delegate funds to a brand new set of validators (in fact, Raiku will not hold funds separately; assets remain on Solana). This is advantageous compared to launching a sovereign application chain or a new Layer-1. If a project chooses to launch its own chain now (whether through Cosmos SDK, Avalanche subnets, or some sovereign rollup scheme), it faces a daunting task: guiding validators, incentivizing them (often through inflationary new token rewards), and ensuring bridge connections with other ecosystems. Raiku simplifies this process by building on Solana's validator community and natively bridging through global accounts.

No separate bridging contracts are needed; this scaling is logically part of Solana. Compared to the sovereign chain approach, this significantly reduces security risks and development overhead. For example, some teams have attempted to use the Sovereign SDK on Solana, which ultimately led to state fragmentation and performance issues because the Sovereign SDK was not designed for Solana's scenarios. Raiku's custom solution avoids these pitfalls and maximizes the reuse of Solana's proven components (such as the network, validator incentives, etc.).

Predictability and Transparency as Core Features:

Both builders and users value understanding what will happen in the future. Raiku achieves predictability at the protocol level. Included signals eliminate guesswork during the transaction submission process. The design of MEV makes it more efficient (no private mempool, all transactions are conducted through auctions or known channels). This fosters a healthier ecosystem.

On Ethereum, despite improvements, users still worry about being targeted by arbitrage bots when sending Uniswap transactions. On Solana, users are concerned that transactions may "fail to complete" when the network is busy. Raiku aims to eliminate these concerns, making the blockchain feel reliable and "boring" in the best way, similar to AWS infrastructure; if you schedule a task, you trust it will run on time. This is a key selling point for institutional adoption (which requires SLAs and predictability) and for widespread consumer use (no one wants to keep sending "submit" commands hoping a transaction will succeed).

Practical Use Cases Supported by Raiku's Edge Computing Design

What functionalities can developers actually implement with Raiku that were previously unattainable? The answer is: build on-chain applications at the speed and assurance of off-chain systems, and deploy new types of services on Solana that may have previously required separate chains or centralized solutions. Let’s explore some illustrative use cases envisioned by the Raiku team and community, highlighting how the edge computing approach plays a role:

High-Frequency Trading and Exchanges (e.g., Drift Protocol's Swift):

Drift is a leading Solana-based perpetual contract exchange that handles massive trading volumes. In early 2025, they launched the Swift protocol, a direct on-chain ultra-low latency matching engine built on Solana. It keeps the order book and matching logic on-chain, then routes completed trades to Drift's perpetual contract program for settlement. While Swift is innovative, it still faces a limitation: when it needs to settle these matched trades on Solana Layer 1, it is affected by the usual network conditions and may experience delays or contention (especially during market volatility when many exchanges are active).

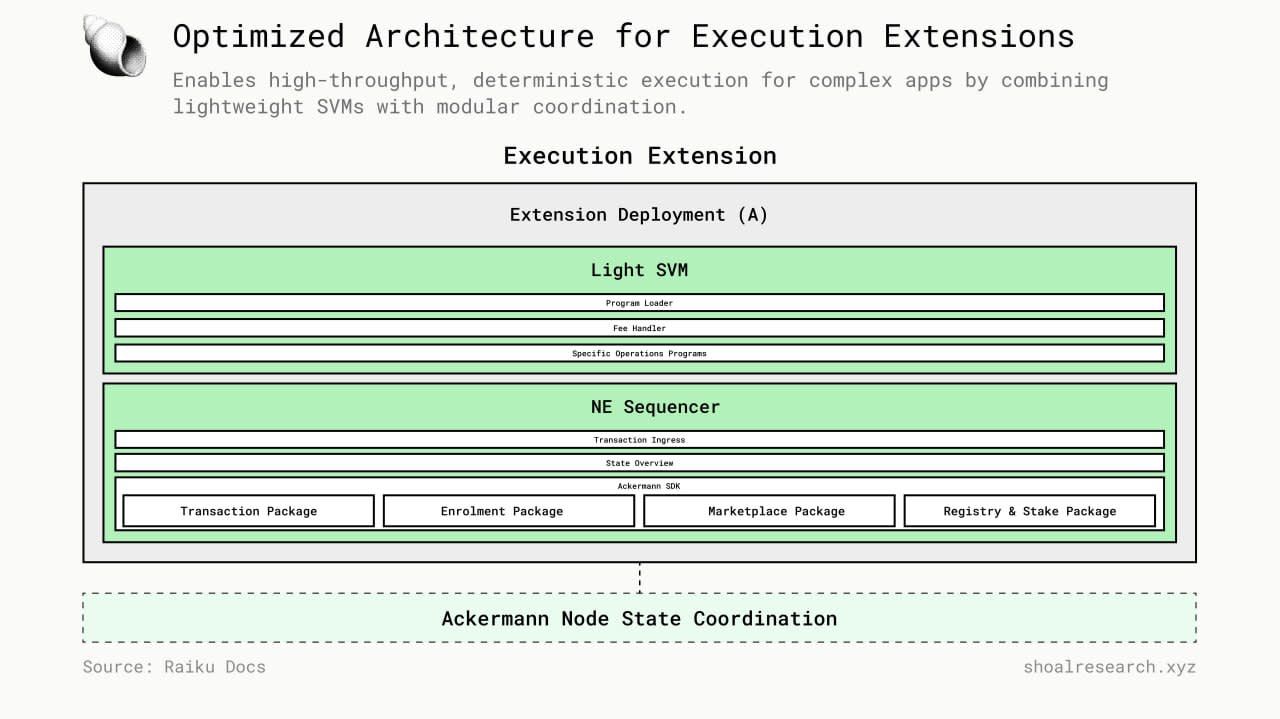

Enter Raiku: DEXs like Drift can deploy dedicated edge computing extensions for their trading engines. In this extension, orders can be matched and completed on-chain (in the extension) with microsecond precision, even faster than Solana's 400-millisecond block time. This extension can utilize a Light SVM optimized for trading, achieving thousands of operations per second (e.g., matching buy and sell prices, updating trader positions) with deterministic timing. Crucially, with Raiku's guaranteed inclusion feature, once a trade is successfully matched, it can be scheduled for settlement in the next Solana block with no uncertainty. No more racing against time or praying for a transaction to be recorded; trade settlements will be pre-reserved and confirmed.

Payment and Fintech Infrastructure (e.g., "Stripe-like" payments, Squads):

Payment applications require both high throughput and high reliability. Imagine a Stripe-like service on Solana that processes thousands of transactions per second, serving merchants, payroll, micropayments, etc. On Solana Layer 1, this is theoretically feasible (considering high TPS), but in practice, if the network is congested, or if a particular program in a payment process consumes too many compute units, other programs may crash.

With Raiku, a payment extension can be created, essentially a dedicated (edge computing) area for payment transactions. This extension can be optimized for simple token transfers, including specialized/optimized environments or lightweight SVMs to maximize efficiency. Through Raiku's bandwidth reservation, payment operators (like stablecoin issuers or CBDC platforms) can continuously reserve throughput, such as 500 TP/S, to ensure their transactions can always proceed smoothly, regardless of external demand. Users sending funds will receive instant confirmations (no transaction stalls).

For enterprise or institutional use, Raiku can enable a private settlement network on Solana: "Private settlement channels with deterministic finality and encrypted flows between major financial institutions."

Imagine large banks settling foreign exchange trades or securities on a shared Solana extension, where they can have their own Raiku extension, with trades visible only to the parties involved (encrypted but still verifiable), ensuring finality. This would unlock use cases like cross-border payments, remittances, or interbank settlements on a public chain, while maintaining the predictability of SWIFT or FedWire.

On the consumer side, tools like SquadX (a popular Solana multi-signature and coordination tool) can use Raiku to ensure multi-signature transactions (which may involve multiple instructions) are reliably executed even during peak network times. A major pain point for DAO treasuries or multi-signatures is that complex transactions can fail due to network issues. Raiku can eliminate this problem by allocating a dedicated time slot once all signers approve, allowing multi-signature transactions to complete atomically.

Additionally, through liquidity integrations similar to RFQ, Raiku can empower new payment models: for example, decentralized payment applications can query market makers through Raiku's RFQ system to obtain the best exchange rates for currency swap transactions, all operations can be completed within a single extension without slippage or MEV. This is akin to how Stripe routes payments through various banks to optimize fees and success rates, allowing Raiku to route cryptocurrency payments to various liquidity sources in a controlled, deterministic manner.

DeFi Protocols and Services (Beyond Trading):

Beyond exchanges, many DeFi protocols can benefit from Raiku's edge computing environment. Lending platforms can utilize it for instant liquidations through dedicated channels (Raiku can even enable "microsecond precision automated risk management," meaning lending protocols can monitor positions and execute liquidation trades within guaranteed time windows, reducing bad debt). Options and derivatives platforms can use the edge computing area as a coordination hub, coordinating complex multi-branch strategies across platforms, with Raiku ensuring all branches execute atomically over continuous time periods.

For example, decentralized options exchanges (DEXs) can ensure that when users roll over (closing one option and opening another), the two transactions occur consecutively without price fluctuations interrupting. This level of control is currently only feasible in centralized systems. Stablecoin issuers can also benefit: imagine USDC using a Raiku extension to prioritize its large-scale minting/redemption processes, ensuring that large redemptions do not congest the network or get front-run. By allocating block space, they can maintain smooth operations even during stressful periods.

Hybrid CEX/DEX and Institutional Access:

Raiku may blur the lines between centralized exchanges and DeFi. Its architecture allows for a model similar to "regulated DeFi zones," where only KYC-verified entities (like institutions) participate, ensuring compliance while still settling on Solana. This hints at the vision of "hybrid centralized exchange/decentralized exchange with an excellent user experience," where liquidity is provided by centralized exchanges (or alliances), but trades settle on public network extensions. With edge computing, such platforms can offer the speed of centralized exchanges (matching engines on dedicated hardware) along with the transparency and custodial advantages of DeFi (settling on Solana).

Non-Financial Applications (Real-Time Gaming, Social, AI Agents, IoT):

While Raiku's focus seems initially on DeFi and financial markets, the framework's applicability is very broad. For real-time gaming or virtual worlds, Raiku can support extensions that handle rapid game state updates (imagine a fully on-chain fast-paced game, where Raiku's scheduling mechanism ensures operations are completed in a timely tick system). For social networks or messaging applications on Solana, Raiku can provide throughput to handle activity spikes (for example, a popular post that triggers thousands of replies can be processed through the extension to prevent the main chain from being overwhelmed).

The website's use cases explicitly mention bringing "AI agents, DePIN, social networks, payment infrastructure, capital markets, high-frequency trading, and the internet to Solana." This grand vision indicates that Raiku believes it can support any high-demand application that may currently think blockchain cannot meet its scale or speed.

For instance, AI agents executing dozens of on-chain operations per second (like participating in auctions, rebalancing portfolios, etc.) can leverage Raiku to reliably handle these operations. DePIN (projects similar to Helium or decentralized Uber/Airbnb concepts) often require a large number of microtransactions and device interactions, and Raiku can ensure IoT devices have reserved throughput to continuously log data or settle payments.

The common thread across all these cases is that Raiku achieves performance and trust levels that a single Layer-1 cannot. It allows developers to envision on-chain services that rival the response speeds of centralized servers.

Raiku's Innovative Approach: Predictable Performance through Execution Consensus Separation

Raiku introduces a new block building architecture that internally improves Solana's foundational layer. It achieves this by enabling programmable coordination, allowing validators and applications to execute with greater certainty without introducing a separate consensus mechanism or fragmented environment.

We can imagine the Raiku network as a dedicated execution layer that runs in parallel with Solana's main chain, driven by the same set of validators, requiring only the Raiku Sidecar to join. This way, Raiku liberates dense application logic from competing with all traffic on Solana, but it is not an island; it remains tightly synchronized with Solana to ensure finality and data availability.

Unlike other ecosystems that are still struggling to balance modular trade-offs or fragmented execution models, Solana offers a high-performance, monolithic foundational layer. It provides sub-second block times, ultra-low fees, and parallel execution enabled by Sealevel. These features make it the most likely blockchain to implement concepts like instant (JIT) or ahead-of-time (AOT) block auctions at scale without incurring high latency.

While Solana achieves fast block generation times, low fees, and parallel execution through Sealevel, the current block building process still has limitations:

- Validator profitability remains unstable, heavily reliant on native inflation subsidies and occasional MEV peaks.

- Transaction inclusion is unpredictable, especially for applications that require atomicity, deterministic ordering, or pre-confirmation.

- Off-protocol coordination is emerging, with protocols like Jito stepping in to address the lack of robust auction mechanisms and bundled execution guarantees.

What is missing is a programmable coordination layer that can provide validators with more consistent revenue opportunities, offer reliable execution capabilities for dApps, and integrate into Solana's native architecture without compromising its low-latency, high-throughput characteristics.

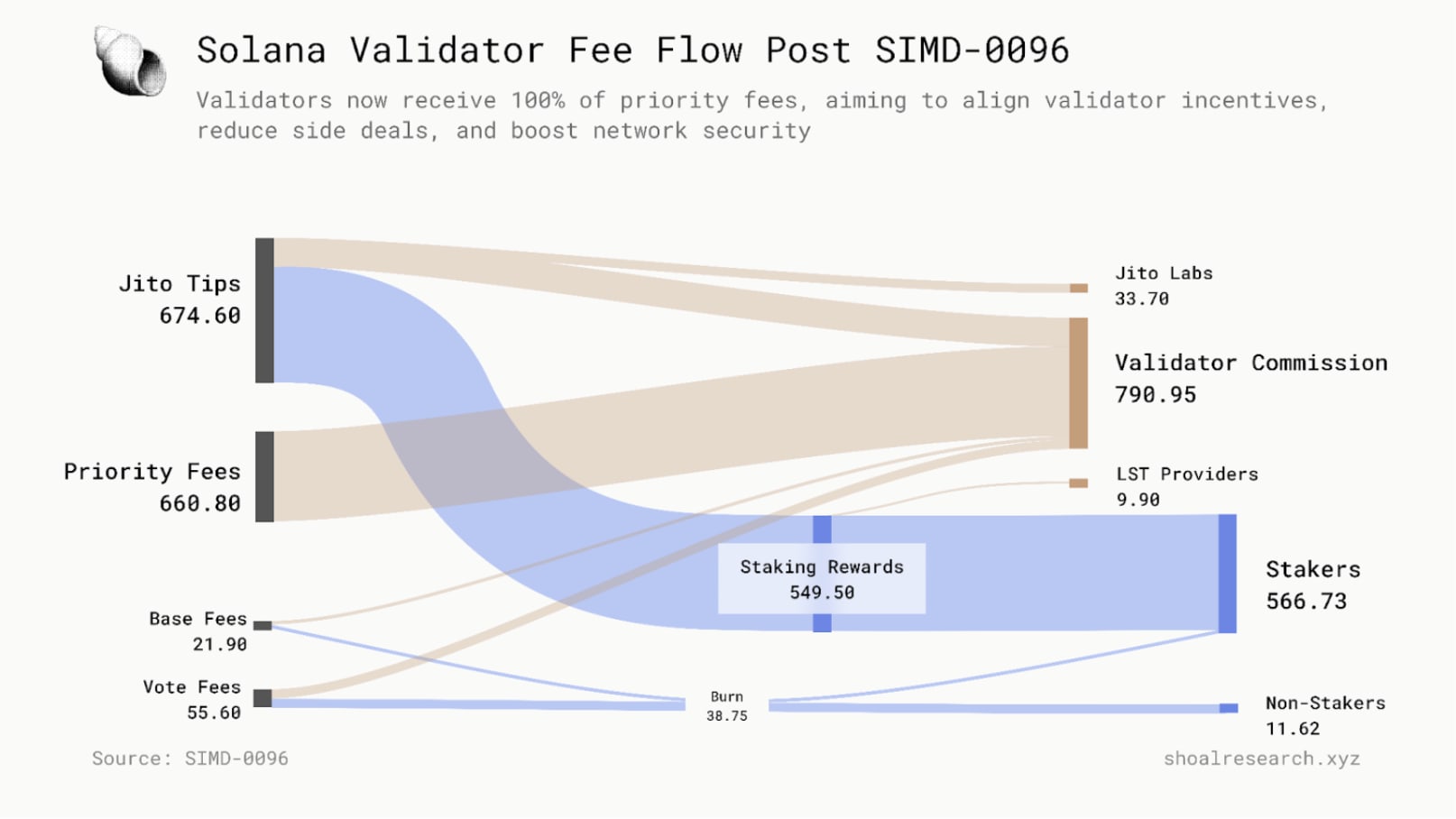

Under a series of key Solana Improvement Documents (SIMD), Solana's incentive and economic framework is rapidly evolving. These proposals reshape the core validator incentive mechanisms, transaction prioritization mechanisms, and reward distribution, laying the groundwork for a more competitive and robust ecosystem:

- SIMD-0096: Redirecting 100% of priority fees to validators, significantly improving validator profitability and preventing off-chain transactions.

- SIMD-0123: Introducing a native, scalable protocol mechanism for validators to directly allocate rewards to stakeholders, enhancing economic consistency and transparency.

- SIMD-0228: Introducing a dynamic, market-driven issuance schedule that adjusts the inflation rate based on staking participation to improve economic efficiency and security. (However, this proposal failed to achieve the required two-thirds supermajority in the March 2025 vote and has not yet been initiated.)

While these changes focus on coordinating incentive mechanisms, they also intensify competition among validators, prompting them to seek new external revenue sources, which is particularly important when MEV and priority fee opportunities diminish during bear markets.

The ongoing evolution of Solana's market structure lays the foundation for Raiku's orchestration engine, designed to achieve reliable, predictable, and high-performance decentralized execution.

The benefits of this separation of execution from consensus are profound.

First is predictable packaging: Typically, a user's transaction may linger in the mempool or queue, hoping to be packaged into the next block (or discarded due to a surge in load), whereas Raiku's design aims to provide hard guarantees on packaging and timing. Transactions submitted through Raiku can receive "pre-packaging" confirmations, effectively reserving them in the upcoming block. This is achieved through Raiku's novel scheduling and auction mechanisms (which we will discuss later). For users and dApp developers, this means no longer needing to send junk transactions or anxiously wait to see if critical transactions are mined; you can know within milliseconds whether your transaction is scheduled for a specific time slot in the future. This focus on deterministic and predictable execution is its key distinction. Traditional L2s on Ethereum can improve fees and throughput, but they often cannot accurately guarantee when transactions will reach L1 (especially for challenging Optimistic Rollups). In contrast, Raiku provides time slot guarantees on Solana, which is known for its 400-millisecond block time. Raiku essentially extends Solana with a "global scheduler," allowing applications to utilize this scheduler to reserve block space.

Another major advantage is fault isolation. In a monolithic L1, if one application (for example, a popular NFT minting program) suddenly consumes a large amount of resources or crashes, it can lead to degradation or halting of the entire chain. We have already seen this on Solana, where the workload of one dApp can slow down the entire network. With Raiku, applications can run in isolated execution zones (also known as edge computing). If one of these zones encounters issues, such as an out-of-control program consuming too much compute, it will not directly block Solana's main chain or other zones. Faults are contained within that extension environment. Solana's consensus remains unaffected, and other extensions continue to operate normally. This fault isolation is akin to having multiple "sandboxes" on the network: each application (or group of applications) can utilize dedicated capacity segments and even have custom parameters without jeopardizing overall stability.

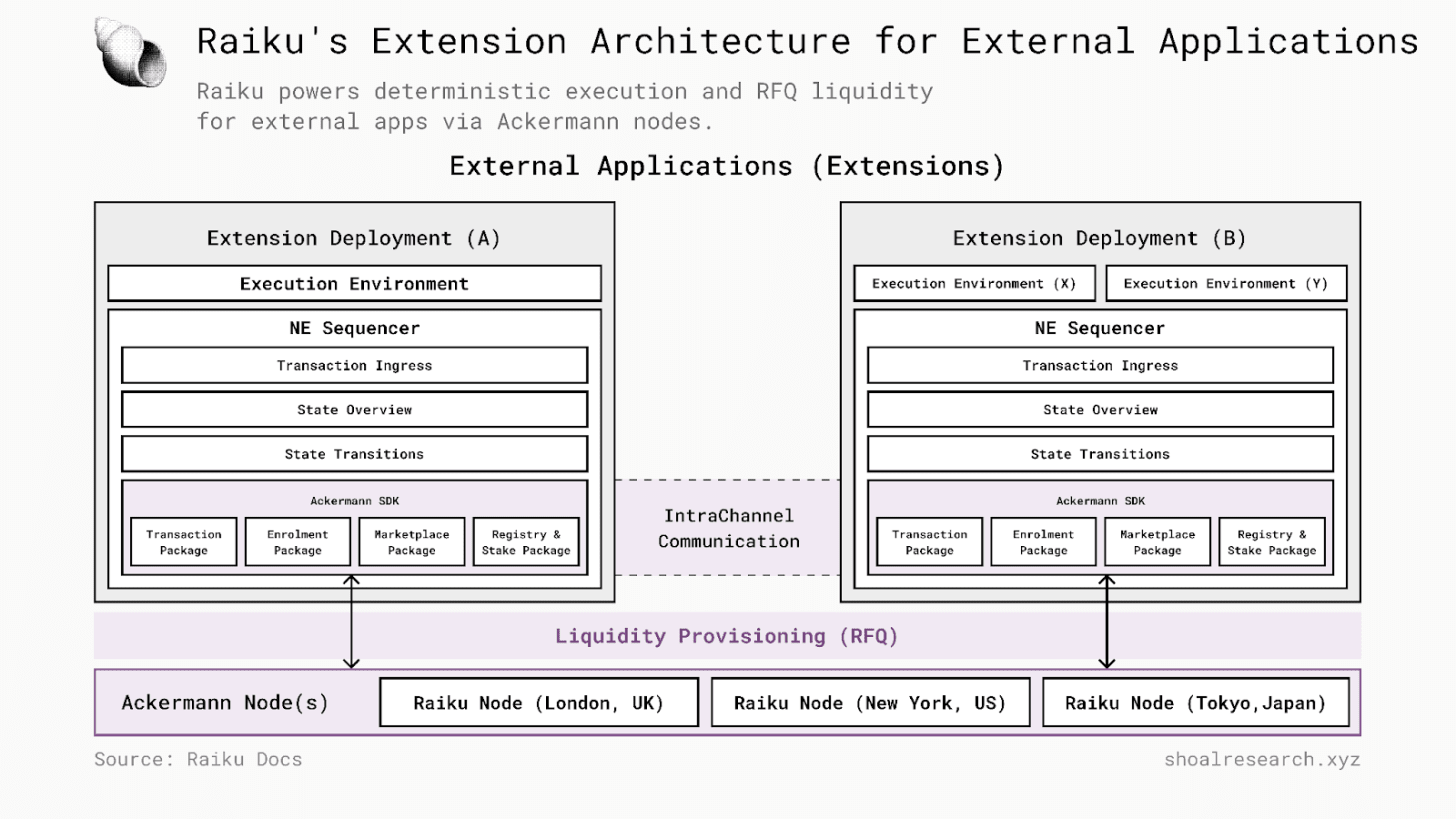

Crucially, Raiku's architecture retains the goals of security and sovereignty pursued by both L1 and L2. Each Raiku extension environment possesses execution sovereignty, meaning application developers can customize execution logic, virtual machines, and parameters according to their needs (in this sense, it is their "own chain"), but they do not need to build a new set of miners or validators from scratch. Raiku leverages a network of validators that work in sync with the Solana validator set. In practice, Raiku validators will be Solana validators that choose to run Raiku software (the Sidecar of the validator client) and may earn additional fees as a result. This means that from day one, security is specialized and robust, with a group of experienced validators at the helm, and there is no need to use separate tokens for security.

By separating consensus (still responsible for final blocks by Solana's PoH/PoS mechanism) from execution (handled by Raiku's scheduling and validator network), throughput is significantly enhanced. Solana no longer needs to personally execute every instruction of every program; it can outsource the execution of certain programs to Raiku extensions, only needing to validate the results or proofs.

In summary, Raiku is neither an independent L1 nor a typical L2; it is the execution layer of Solana, introducing:

- (a) Separation of execution from consensus (liberating applications from L1's throughput constraints),

- (b) Predictable inclusion and scheduling (eliminating probabilistic mempool games), and,

- (c) Strong fault isolation (a problem in one extension does not threaten the whole).

It transforms Solana from a single-layer network into a multi-layer system: a foundational layer for consensus and global state, and an upper layer for high-performance application-specific execution.

Inside the Raiku Tech Stack: Deterministic Settlement and Modular Execution

To deliver on its promises, Raiku introduces several novel components and transaction types. These components and transaction types can be seen as building blocks of infrastructure that work together to enhance Solana. Let’s analyze the key elements of the Raiku tech stack:

1. Pre-Block Auctions and Inclusion Signals:

At the core of Raiku is a brand-new way of managing block space. Raiku discards the temporary first-come-first-served mempool model and instead implements a slot auction market. Applications or users can bid in advance for upcoming slots on Solana (or more precisely, for the scheduling scheme coordinated by Raiku), ensuring priority for their transactions. The winning bidders receive "inclusion signals" in advance, which essentially guarantees that their transactions (or transaction bundles) will be included in specific future blocks or block sequences. These auctions are stake-weighted and atomic, meaning the scheduling follows the distribution of Solana's stakes (validators with more stakes have greater capacity to include reserved transactions, thus coordinating the incentive mechanism), and transactions can be reserved in bundled form and executed in order without interruption. The result is that Raiku users can now receive confirmations faster because their execution "tickets" are secured.

Comparing this to the traditional experience: on Ethereum, you send a transaction and hope miners pick it up as soon as possible (if you are in a hurry, you might raise the fees), and even on Solana, you might send multiple transactions to ensure one gets through during congestion.

With Raiku, the entire process is akin to reserving a train seat in advance, eliminating the need to jostle on a crowded platform. This system significantly reduces transaction failure rates and uncertainty, and one of Raiku's core goals is to guarantee transaction execution.

Streaming Proofs: Unlocking Large Payload Execution through Sequential Block Space

One fundamental limitation of Solana currently is the strict block data constraints designed to ensure fast block propagation. For applications that need to submit a large number of state updates (such as settlement engines or ZK rollup proofs), this can become a bottleneck.

Raiku addresses this issue through sequential block space reservations, a concept realized by its ahead-of-time (AOT) block auction model. By reserving a series of upcoming block spaces, applications can reliably transmit large proofs or payloads in smaller, verifiable block forms without hitting Solana's single-block capacity limit.

The idea is to break down large transactions or proofs into smaller blocks for streaming and verification across multiple time slots, thereby circumventing Solana's strict per-block data limits. In practice, this means applications can submit very large state updates or proofs (e.g., zero-knowledge proofs or a batch of hundreds of transactions) through Raiku, which will input this data into Solana in forms that validators can handle.

Applications can schedule and transmit structured data across multiple slots, while validators process and verify it in a controlled manner, rather than submitting large transactions that carry risks of failure or bloat.

2. Fast and Deterministic Settlement ("Guaranteed Execution"):

Many next-generation applications that Solana aims to support, such as high-frequency trading platforms, real-time gaming systems, and institutional payment networks, require strict guarantees that transactions can land accurately at the expected time and place. In these areas, execution uncertainty is not just a user experience flaw; it is a transaction failure.

Unpredictable network congestion and transaction pool dynamics can lead to transaction failures, reordering, or delays. For advanced use cases like automated liquidations, synchronized asset exchanges, or arbitrage strategies, this unpredictability can result in missed opportunities and inefficient capital.

Raiku addresses this issue by guaranteeing transaction inclusion through ahead-of-time (AOT) and instant (JIT) reserved time slots. For example, bots operating based on real-time price changes may prefer JIT inclusion, while external systems may opt for pre-scheduled AOT slots. In both cases, users need to pay for the precision of timing and bandwidth (using a combination of Raiku tokens and SOL).

When a guaranteed inclusion transaction is submitted through Raiku, it is assigned a reserved execution window to ensure it is processed at the scheduled time and will not be lost or reordered due to validator behavior or network congestion. While only the slot leader can include transactions, all validators running the Raiku Sidecar will propagate and confirm the transaction arrangements in advance. Raiku uses a pre-consensus scheduling system to coordinate transaction plans, which are then executed by the slot leader during block production.

By reserving block space in advance and allocating deterministic execution time slots, Raiku can mitigate peak failure scenarios, where the historical failure rate for high-frequency users on Solana has exceeded 90%. Even during extreme load periods, it can provide guaranteed bandwidth, precise latency, and predictable settlement.

The guaranteed execution mechanism is also designed to introduce MEV resistance. Since transactions are scheduled in advance and confirmed across the network, it reduces front-running and offsets sandwich attacks by incorporating expected value extraction into the auction mechanism itself. Private order flow trading that previously operated outside the protocol is no longer necessary. Instead, the inclusion of order flow will be conducted transparently through fair scheduling auctions or reservation systems.

3. Global Account Model and Unified State:

One of the most groundbreaking aspects of Raiku is its global account module. This component (set to launch in V2 alongside streaming proofs) directly addresses the issue of state fragmentation. The idea is to allow users and applications to maintain a unified identity and state across multiple execution environments.

In practice, users will still have a Solana wallet/address for the main Layer 1 and any Raiku extensions they interact with. Assets and data can move seamlessly between the main chain and extensions without the need for traditional "bridging." The global account model will enable composability across extensions, allowing two Raiku extensions to interoperate or access shared user states as needed.

This is a significant departure from typical L2 systems. In a typical L2 system, each rollup acts like a closed garden, requiring bridges to transfer assets, and account/contract addresses may only be specific to certain chains. Raiku's extensions are more like "regions" within the Solana ecosystem, thus maintaining a consistent user experience. Developers can deploy within the extension environment and still easily integrate with Solana's native programs or account sets.

For example, thanks to the unified account, orders placed in a Raiku-driven order book extension can settle into the user's Solana main wallet or be recognized by programs on Layer 1. Technically, this can be achieved by allowing Raiku to share Solana's account address space and signature verification or by establishing a mechanism for synchronizing state roots between the extension and Layer 1.

The end result is the resolution of the state fragmentation issue, yielding a single composable state that encompasses multiple execution environments. As the Raiku team describes, this achieves composability across extension environments, something that Ethereum Layer-2 (where all Layer-2s operate independently) and early Solana Rollup attempts could not accomplish. This is a first-principles approach designed to ensure that scaling does not lead to fragmentation of user bases or liquidity.

The global account module also supports multi-VM functionality. Raiku is not limited to Solana's native virtual machine (SVM); it can also host different virtual machines under the same coordination framework. In fact, Raiku is designed to support EVM-compatible extensions, allowing projects from the Ethereum world to deploy their Solidity code as Solana extensions.

The mention of projects like "Arbitrum Orbit deploying on Solana" indicates that Ethereum L3 or custom chains can effectively connect to Solana through Raiku. This is significant: it means Ethereum dApps can enjoy Solana's performance and user base without having to abandon their codebase. All of this is made possible by the global account, allowing users to interact without switching wallets or bridging tokens; EVM extensions will recognize the same wallet (potentially through address derivation or mapping) and can utilize Solana's native assets.

This indicates that Raiku has a certain degree of layered node architecture: ordinary users/applications communicate with Ackermann nodes (or clusters), which then interact with validators to arrange execution. This is an interesting design that can scale input processing capabilities and ensure the system can handle burst transactions by effectively distributing transactions among validators.

Summary

The emergence of Raiku marks a turning point for Solana and the entire blockchain architecture. It showcases a vision where decentralized networks can achieve reliability, speed, and flexibility—domains that were once exclusive to Web2 cloud or traditional financial systems. By introducing a coordination engine with deterministic execution, Raiku enables Solana to transcend the label of "just another L1" and become a truly mission-critical, high-performance application platform.

Consider what this means for developers: building on Solana with Raiku is akin to building on scalable cloud services.

- Need more throughput? Just launch an extension and reserve the required slots.

- Need custom execution logic or different virtual machines? Insert it as an edge computing area.

- Concerned about user experience during peak times? Provide guaranteed transaction inclusion so users will never see failed transactions again.

The developer experience is significantly enhanced. Developers can build with confidence, knowing that the infrastructure can meet the demands of their applications rather than the other way around. The Solana base chain serves as a stable infrastructure, while Raiku provides flexible, programmable scaffolding to help them push boundaries.

This not only has the potential to attract crypto-native developers but also those Web2 developers with strict performance requirements. They can confidently use Solana without worrying about network slowdowns. In fact, Raiku can position Solana as the preferred platform for any application requiring decentralization and high throughput.

At the institutional level, Raiku may be the key to serious adoption of Solana by enterprises. Banks, hedge funds, gaming companies, and social media newcomers can all build on-chain with confidence, as they have the performance and control they need. Solana has already become one of the more institution-friendly blockchains (with companies like Jump investing in its technology); Raiku promises fine-grained execution control and high reliability, further enhancing Solana's appeal. Institutional-grade means 99.999% uptime, transaction deadlines, necessary privacy protections, compliance hooks—all of which Raiku can deliver (through isolated extensions, scheduling, etc.).

The journey has just begun, with Raiku currently in the testnet phase and the mainnet planned for launch by the end of 2025, but the infrastructure and solutions are already in place. It addresses the pain points we listed at the beginning: scaling limitations (solved by increasing modular throughput), MEV exploitability (minimized through predictable ordering and auction mechanisms), re-staking challenges (avoided through more controllable means), fragmented state (resolved through global accounts), and performance issues (addressed through guaranteed inclusivity and fault isolation). Thus, Raiku is a holistic solution rather than a patchwork fix.

Click to learn about job openings at ChainCatcher

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。