Article Author: Prathik Desai, Article Compiler: Block unicorn

As we move through the three quarters of 2025, I think it’s time to reflect on how funds are flowing into the crypto ecosystem.

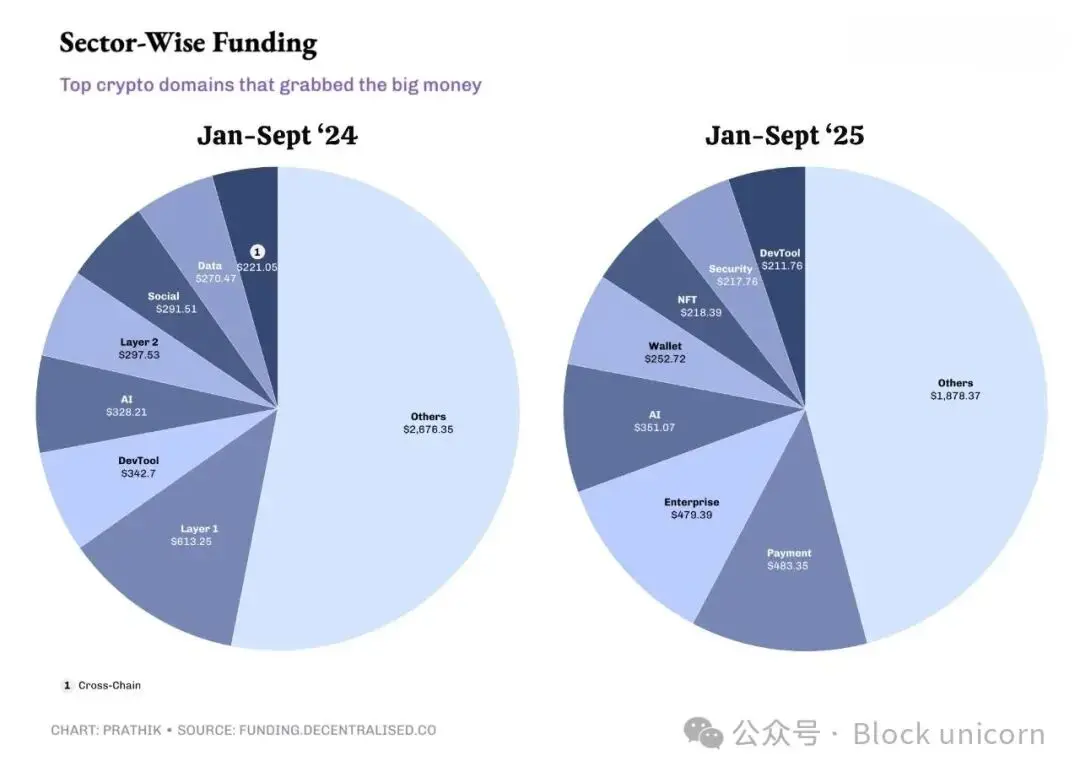

While 2024 saw a significant influx of capital into Layer 1 and Layer 2 projects, developer tools, and AI products, this year's funding has primarily supported payment and enterprise-level infrastructure.

Funds that chased all the hot ideas last year have become more selective, focusing on a few specific areas. The result is a decrease in the number of deals, but with more substantial funding, the venture capital market seems to have a clearer view of where the value lies in the cryptocurrency space.

Despite a year-on-year decline in overall funding through September, the data suggests that this may not be a bad signal for projects being built in this field.

Alright, now let’s get to the point.

From January 1 to September 30, crypto venture capital totaled $4.09 billion across 463 rounds of financing, with 392 rounds disclosing check amounts. According to funding tracking data from Decentralised.co, this represents a 19% decrease compared to the same period last year. The total funding for the same period in 2024 was $5.04 billion across 980 deals, with 725 disclosing funding amounts.

Although total funding has decreased, the average deal size for disclosed rounds surged by 50%, reaching $10.4 million, while the median check amount rose from $3 million to $4 million in 2025. Thus, the market appears calmer than the previous year, but with a higher capital density.

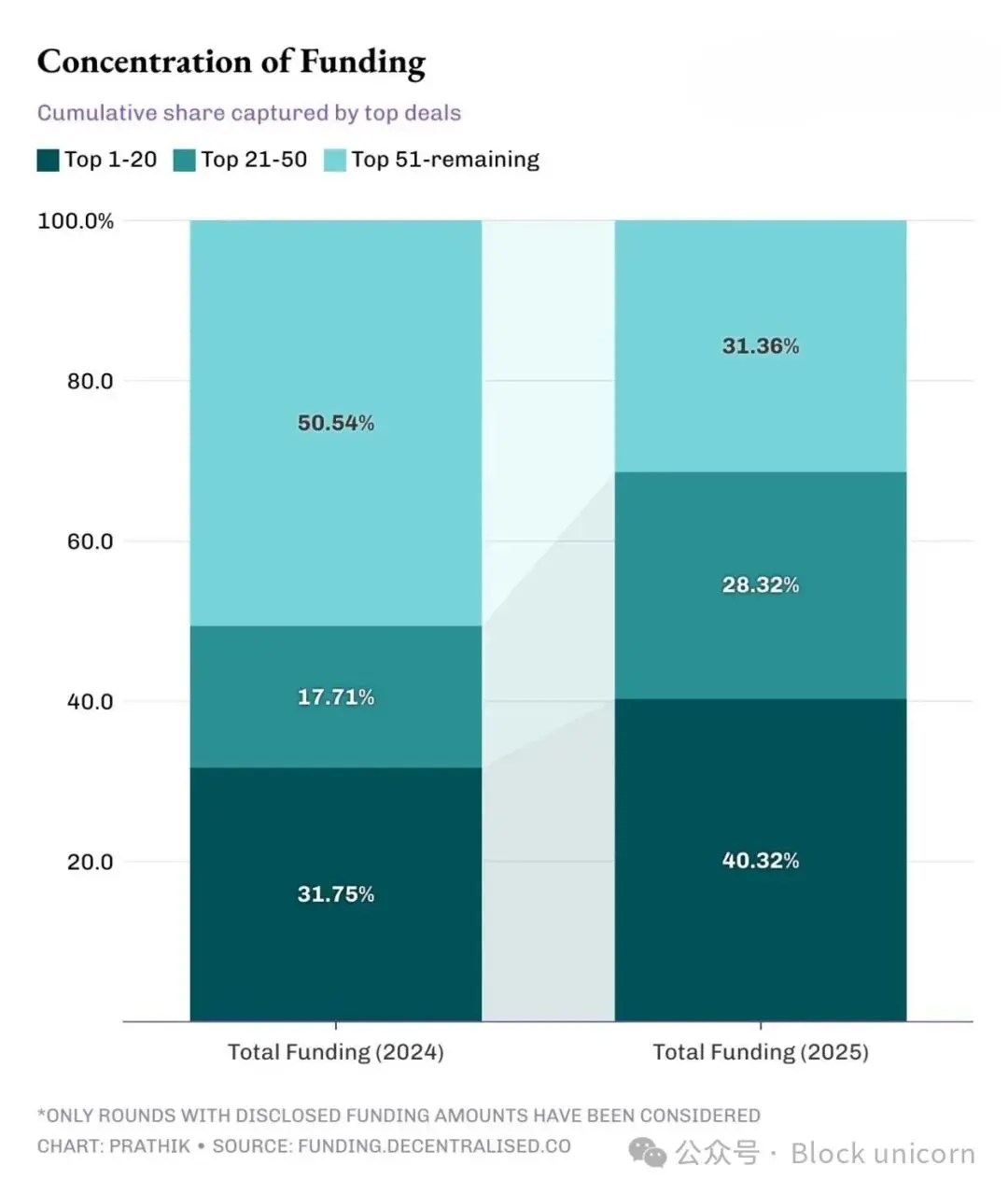

The top 20 rounds in 2025 accounted for 40% of all funding, compared to 32% in 2024. When expanded to the top 50 rounds, this proportion grew from 49% in 2024 to 69% this year.

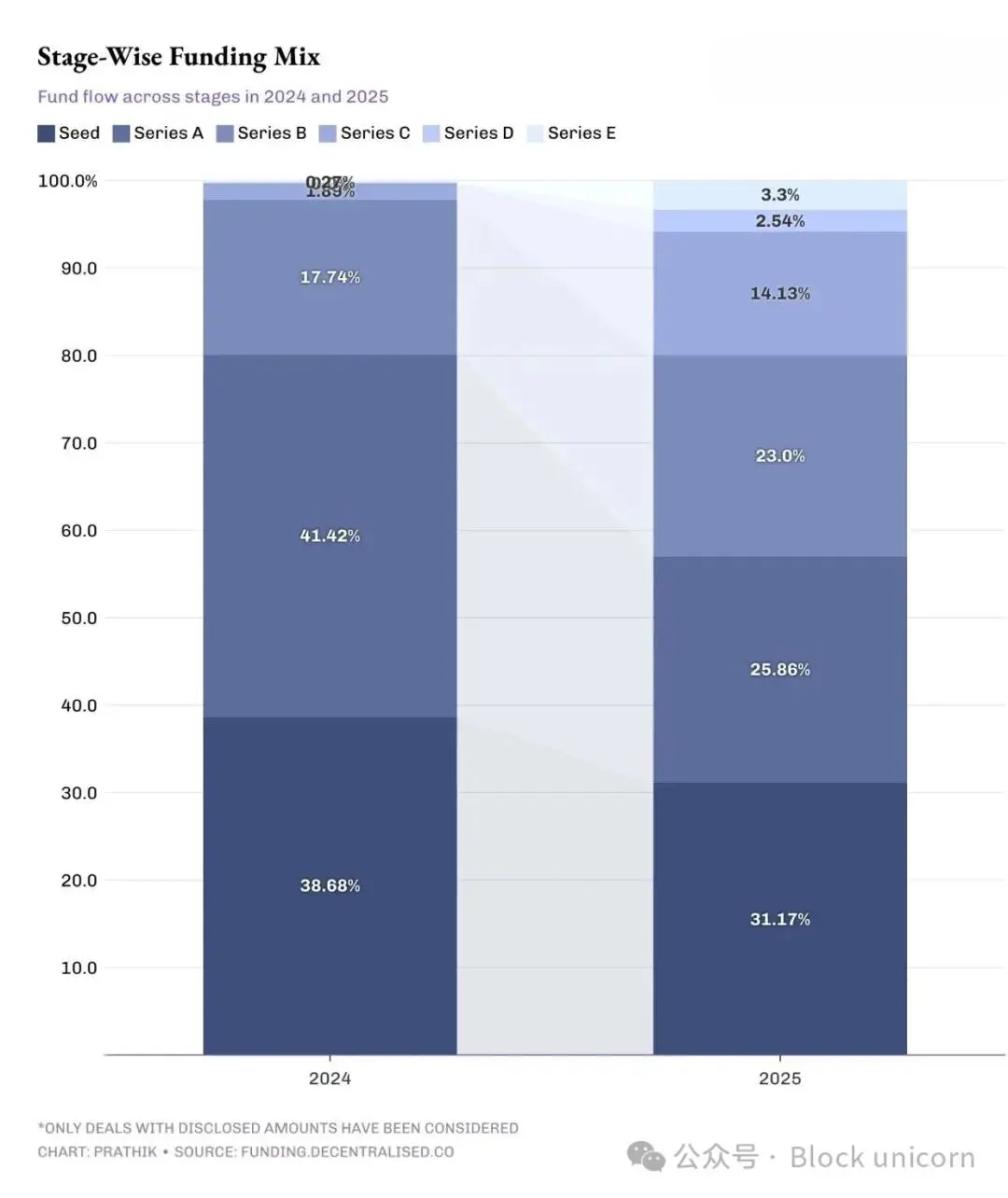

This year’s funding flow indicates that the financing stages are also upgrading.

The share of seed and Series A rounds has decreased, while the share of later-stage financing has increased. About 57% of funds were invested in the early stages of crypto projects (seed and Series A), compared to 80% in the first nine months of 2024.

This suggests that investors are shifting risk from the idea stage to the execution stage.

Today, venture capitalists require evidence before investing in projects. They choose to double down on those with established distribution systems and clear regulatory status rather than newcomers.

Investing more in later stages means fewer failures and fewer opportunities for sudden wealth. Returns tend to stabilize, relying more on cash flow support. On the other hand, this may narrow the creative pipeline for 2026. If activity in Series A and seed rounds does not recover quickly, it could lead to reduced venture capital interest in emerging fields.

The concentration of funding flow indicates a shift in venture capitalists' expectations regarding sources of value.

Industry data shows that the only areas consistently favored by investors in 2024 and 2025 are AI. The top five funding sectors in 2024 failed to attract the same level of investor interest in 2025.

For founders, this means that if you are starting a business in AI, payments, enterprise infrastructure, and real-world asset tokenization (RWA), funding is available. Outside of these areas, funding for sectors like Layer-1 and Layer-2 infrastructure, developer tools, and social platforms has dried up, which were the industry highlights in 2024.

All of this conveys several key messages.

First, the capital structure is leaning towards fewer but deeper dominant investors. This is often seen in mature industries. As the industry accumulates experimental experience in its lifecycle, more cautious and calculated investments emerge. This brings structural stability to the ecosystem, benefiting later-stage projects but leaving little room for small funding for newcomers.

Second, price discovery is shifting from hype cycles to metric-based volatility. Investors are now betting only when they see profits, rather than chasing hype.

Third, the pace is slowing. Fewer new experiments are receiving funding, meaning there are fewer innovations testing market demand in new fields. New products will still emerge, but they are more likely to come from established companies or self-sufficient projects, such as Aster (BNB Chain) and Hyperliquid (non-venture-backed projects).

This new approach rewards meaningful metrics, such as revenue generation and enterprise-level narrative capability. It can also reveal optimistic biases by highlighting the fragility of ideas. Overall, the venture capital market will become more stable after shrinking in size.

We may hope to restore some aspects of 2024, such as a more even distribution of investment across stages and a thicker middle layer. But before that, we must accept the reality of fewer investments and larger funds.

That concludes our discussion; see you in the next article.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。