Source: Alea Research

Compiled by: Zhou, ChainCatcher

Yieldbasis may be one of the most anticipated DeFi projects of the fourth quarter.

The project was created by Curve Finance founder Michael Egorov, aiming to transform constant-product AMM liquidity pools into "arbitrage trading" that is resistant to impermanent loss (IL), starting with Bitcoin. YieldBasis does not accept the premise that LPs must inevitably bear IL, but instead maintains a constant 2x leveraged position in the BTC/stablecoin pool, tracking BTC's price at a 1:1 ratio while still earning trading fees.

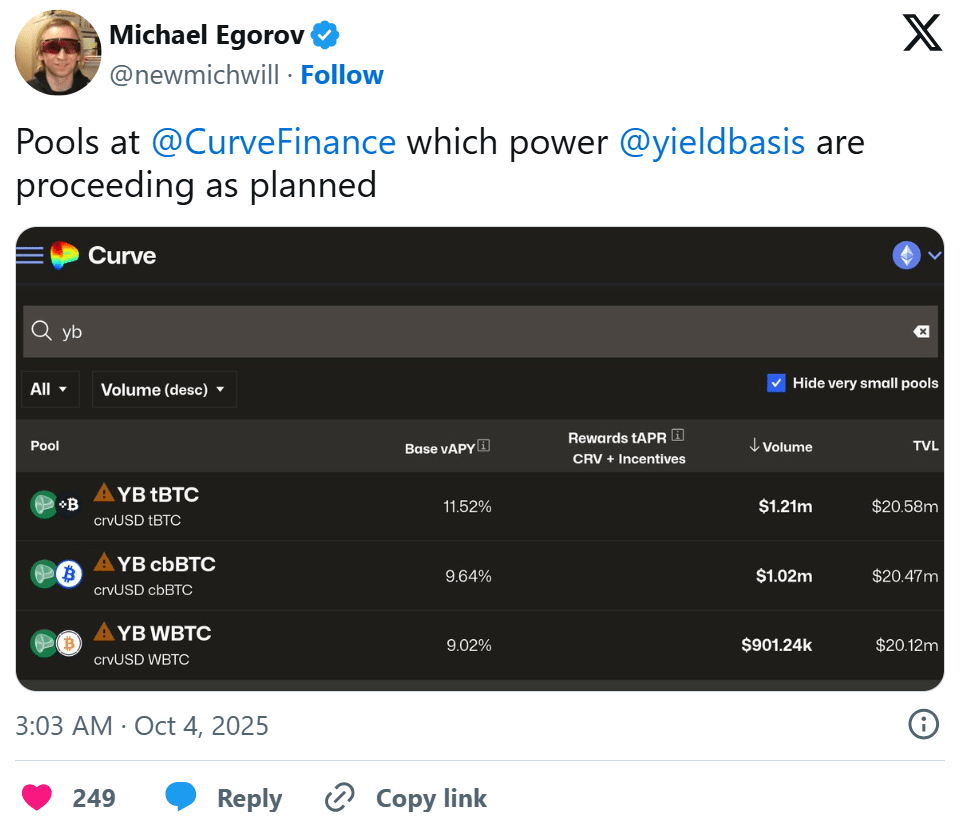

Curve has provided a $60 million crvUSD credit line to launch three BTC pools, using the same dynamic fee-sharing and governance mechanism inspired by Curve's veCRV model.

This article will explore how YieldBasis eliminates impermanent loss, its leveraged liquidity engine and fee design, as well as the recent Legion sale, which raised nearly $200 million in FDV through performance-based allocations.

Eliminating IL with Liquidity Leverage

Impermanent loss has been a burden for providing liquidity to DEXs. Projects like Uniswap v3 offer concentrated liquidity to mitigate impermanent loss, while others subsidize liquidity providers (LPs) through token issuance.

YieldBasis addresses the IL issue by transforming dual-asset AMMs into single-asset arbitrage trades, ensuring that the liquidity pool always holds a 100% net exposure to BTC (through 2x leverage), while borrowing stablecoins to fund the other side. This approach is similar to basis trading in TradFi, where users borrow cash to purchase futures or spot and profit from the funding spread and price fluctuations.

Key Concepts:

Deposits and Borrowing: When users deposit BTC, the protocol quickly borrows an equivalent amount of crvUSD and adds both assets to the Curve BTC/crvUSD pool. The resulting LP tokens are used as collateral to borrow crvUSD and repay the flash loan, maintaining a 50% debt/50% equity position (2x leverage).

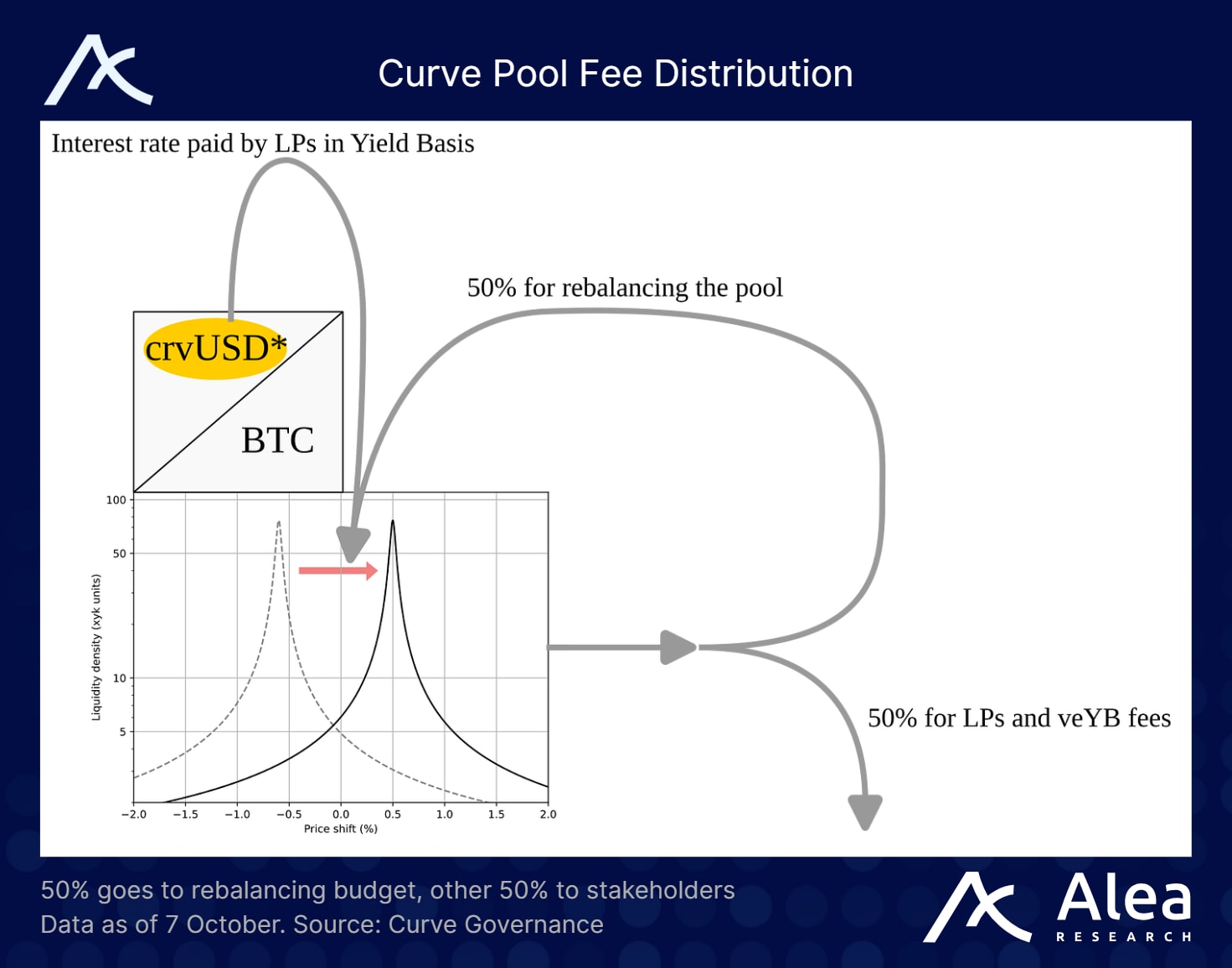

Rebalancing AMM and Virtual Pools: As BTC prices fluctuate, rebalancing the AMM and virtual pools exposes slight price differences, incentivizing arbitrageurs to restore the 2x leverage. When BTC prices rise, the system mints more crvUSD and LPs; when BTC prices fall, the system repays debt and burns LPs. Arbitrageurs earn the spread, aligning their incentives with the health of the pool.

Linear Exposure: By maintaining a constant 2x leverage, the positions of liquidity providers (LPs) will grow linearly with BTC prices, rather than being proportional to the square root. This means that the exposure of liquidity providers (LPs) will match BTC prices at a 1:1 ratio while still earning Curve trading fees.

Curve Flywheel

The design also fully leverages the Curve ecosystem flywheel. YieldBasis borrows crvUSD directly from Curve's credit line (if approved).

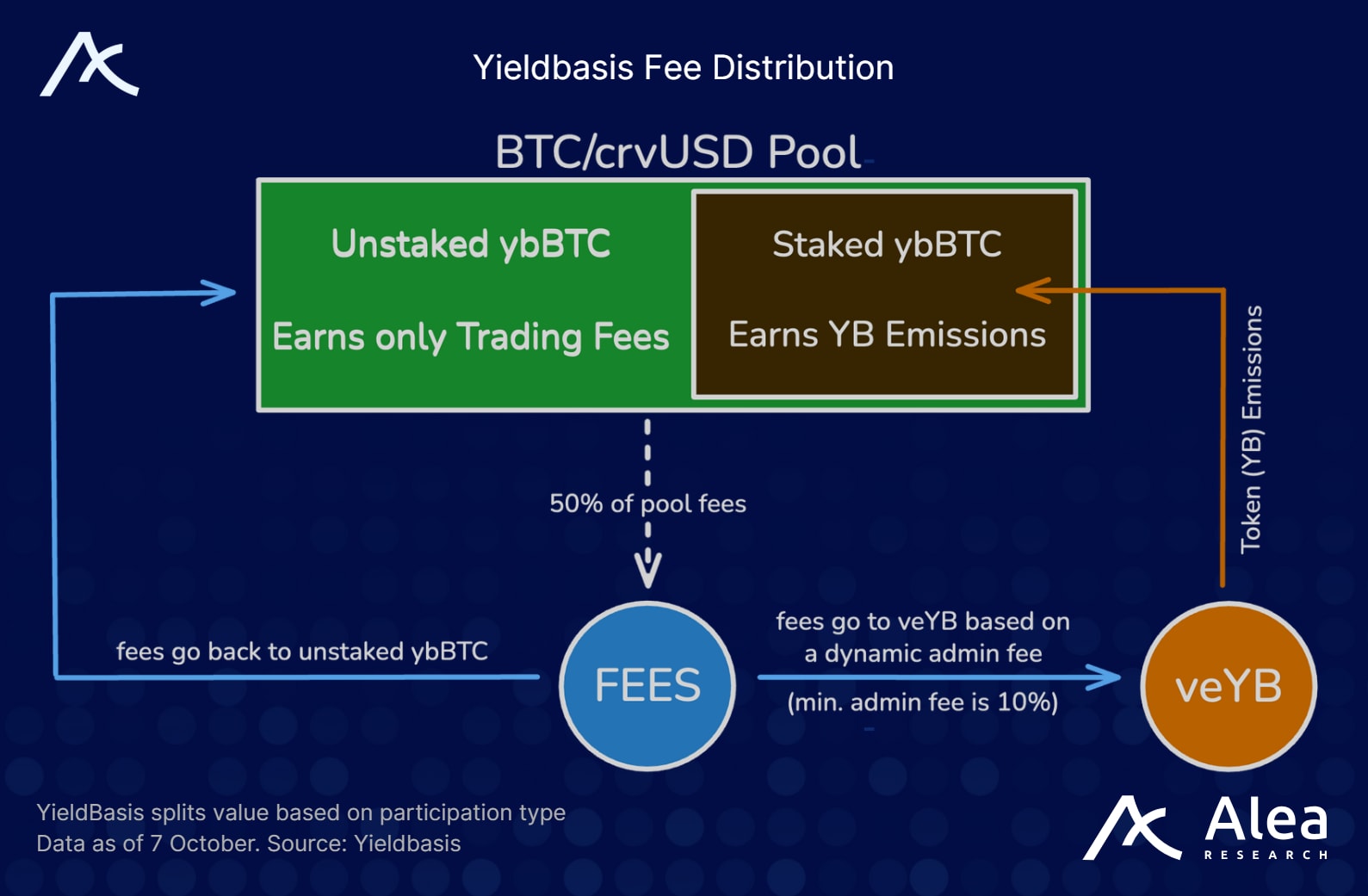

The trading fees from the BTC/crvUSD pool are provided to YieldBasis liquidity providers (LPs) and veYB holders in the form of dynamic management fees. Of these fees, 50% is used for rebalancing, while the remaining 50% is distributed between unstaked liquidity providers (LPs) and veYB based on their staked share of ybBTC. If many liquidity providers (LPs) stake to earn YB issuance, the management fee increases, thus paying more fees to veYB. However, if the staking amount is low, liquidity providers (LPs) will receive more BTC-denominated fees.

This mechanism balances incentives and rebuilds Curve's measurement system.

$5 Million Legion and Kraken Launch Financing

Yieldbasis recently completed $5 million in financing through Kraken and Legion (representing 2.5% of the total supply), with an FDV of $200 million. Of this, $2.5 million was allocated to Legion's "contribution-based" public sale, and $2.5 million was allocated to Kraken Launch. These tokens are 100% unlocked at TGE.

The public sale is divided into two phases:

Phase 1: Reserve up to 20% of the tokens for users with high credit scores on Legion (based on on-chain activity, social contributions, GitHub contributions, etc.).

Phase 2: Open the remaining allocation simultaneously on Kraken and Legion, first come, first served.

The Legion sale achieved 98 times oversubscription. The final processing included the exclusion of bots and witches, adopting a "two-end weighted" allocation approach:

Allocating more funds to top contributors (those who can increase TVL, bring visibility, contribute to the codebase, etc.);

While also allowing thousands of other companies to receive some allocation, combining the advantages of angel round financing with broad distribution.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。