In September 2025, at this moment full of uncertainty, the global economy is undergoing an unprecedented test. Ahead of the important milestone in November, the economic and trade game between China and the United States has escalated once again. On October 10, local time, U.S. President Trump announced on social media that starting from November 1, 2025, an additional 100% tariff will be imposed on all goods imported from China, along with export controls on all critical software. The sudden events have significantly disturbed major global assets, and as the storm has not yet settled, further developments need to be closely monitored.

As a result of the aforementioned events, global equity assets and commodities have generally declined, while U.S. Treasury bonds and gold have risen. Specifically, last Friday, the Nasdaq index fell by 3.6%, and the S&P 500 index dropped by 2.7%, marking the largest single-day decline since April 10. Chip stocks like AMD and Qualcomm led the declines, and the VIX index surged; last Friday, China's Sci-Tech Innovation 50, ChiNext Index, and Hang Seng Tech Index fell by 5.6%, 4.6%, and 3.3%, respectively; the European Stoxx 600 index closed down 1.25%, with major European country indices also closing lower; in terms of commodities, U.S. oil and New Copper fell by 4.8% and 3.7%, respectively, with intraday declines exceeding 5%; the yield on the 10-year U.S. Treasury bond plummeted by over 10 basis points, while New York gold futures rose nearly 2%.

It is worth noting that the "reciprocal tariff" suspension agreement initiated by the Trump administration in April will also expire on November 10, and subsequent developments need to be closely monitored.

With the new round of reciprocal tariffs coming into effect, the flow of capital is no longer simply moving from one traditional market to another, but is surging towards an emerging digital safe haven—cryptocurrency—with a posture of "defense plus offense." We will comprehensively analyze the logic behind the new capital flow from four dimensions: macro uncertainty, geopolitical financial risks, regulatory evolution, and investment strategies.

I. Tariff Uncertainty: The "Bridging" Mechanism from Physical Trade to Digital Hedging

Since the reciprocal tariffs took effect on August 7, the "pull effect" of global trade has completely faded. U.S. imports have significantly decreased, and the global manufacturing PMI has entered a contraction zone, indicating that the real economy is facing challenges. However, it is noteworthy that the "trade diversion" effect caused by tariffs is becoming apparent: while China's exports to the U.S. have declined, exports to ASEAN are rapidly increasing.

This uncertainty is amplifying the pressure of capital outflow, mainly reflected in the following aspects:

- Price and Consumption Transmission:

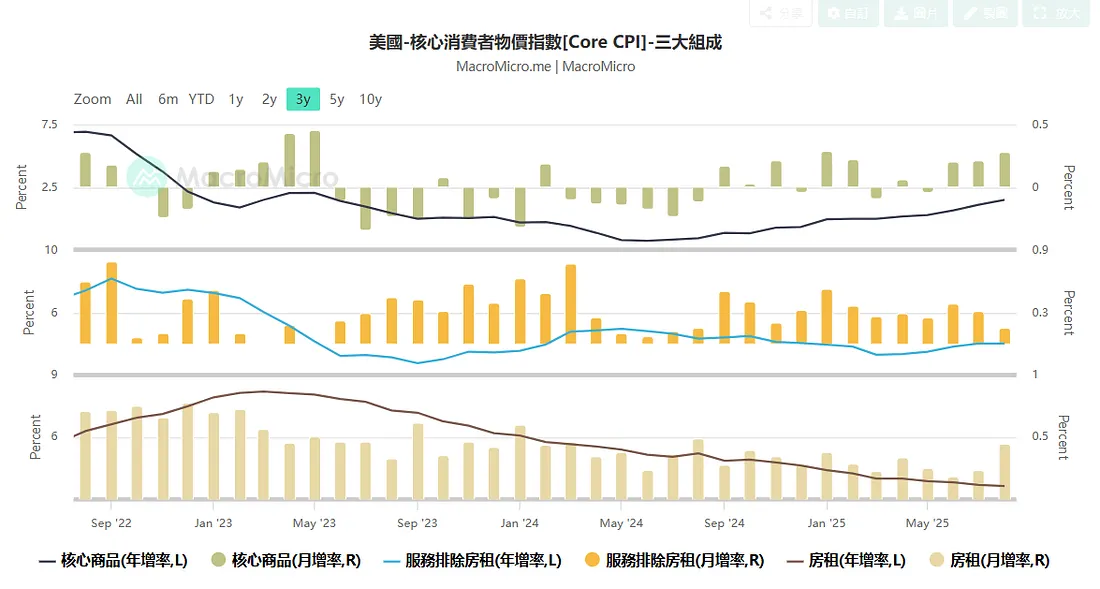

- Although the overall U.S. CPI remains stable, the core CPI is rising, with particularly noticeable increases in the prices of imported goods. The pharmaceutical tariffs set to take effect on October 1 (with rates as high as 100%) are expected to further push up the prices of related goods and exert pressure on consumer spending.

- Employment and Confidence Spillover:

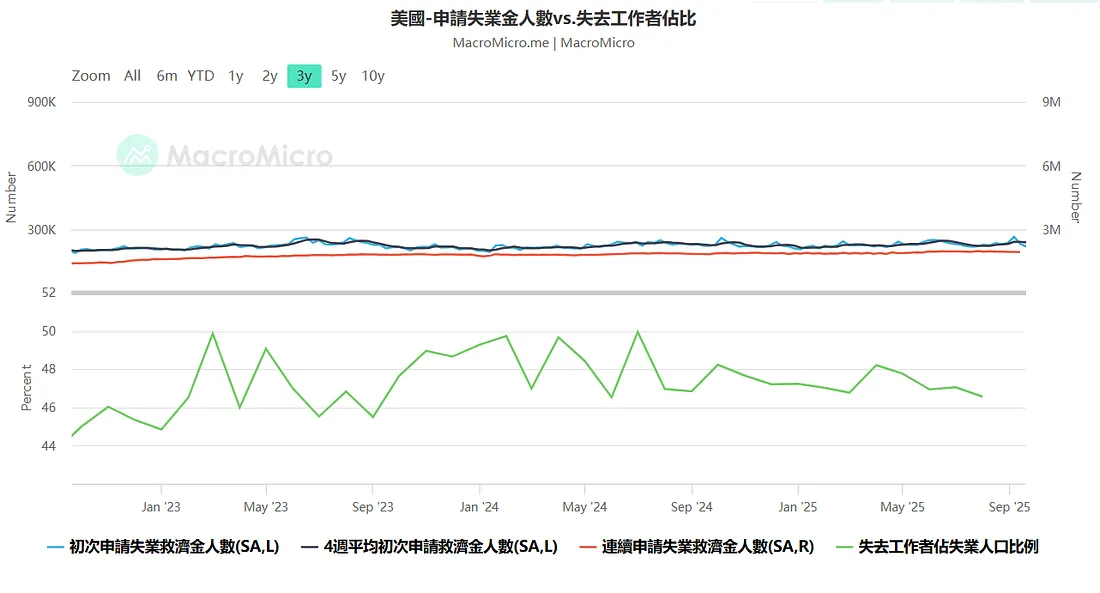

- Although the manufacturing new orders index has slightly rebounded, employment growth is slowing, and consumer confidence indices continue to decline. Concerns over tariffs have become an important factor affecting capital market sentiment, leading to a shift of funds from higher-risk stock markets to high-liquidity assets.

- The "Bridging" Role of Cryptocurrency:

- In the face of payment delays and concerns over dollar depreciation caused by tariff frictions, businesses and investors are accelerating their shift towards cryptocurrency. Stablecoins (such as USDT/USDC) are being used by companies for cross-border trade settlements to avoid exchange rate fluctuations and the limitations of traditional payment systems. Meanwhile, Bitcoin (BTC) is viewed as "digital gold" for hedging against inflation and geopolitical risks.

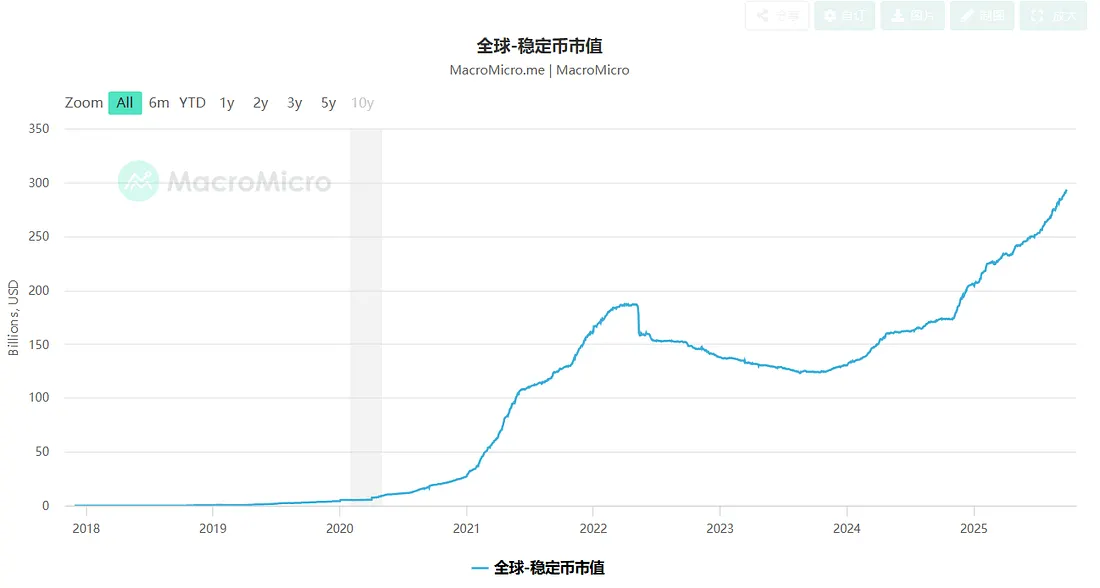

Data from September shows that while the total market capitalization of the crypto market has shrunk, stablecoins saw an inflow of $2.5 billion, and Bitcoin ETFs had a net inflow of $1.5 billion, clearly indicating that capital is making a "defensive" shift rather than a panic sell-off.

II. The Dollar's "Offensive Strategy": The New Line of Defense for Stablecoins under the GENIUS Act

In the face of the growing trend of de-dollarization (such as BRICS countries promoting local currency settlements), the U.S. is actively adjusting its strategy. The signing of the GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins Act) marks a "180-degree turn" for the U.S. in the field of stablecoins.

This act aims to regulate stablecoins under a federal framework and requires them to be pegged 1:1 to the dollar/U.S. Treasury bonds, transforming stablecoins from a potential "monetary threat" into a "digital defense line" that reinforces dollar hegemony.

- Details of the Regulatory Framework:

The GENIUS Act places stablecoins under the more lenient regulation of the CFTC and prohibits the Federal Reserve from issuing CBDCs (central bank digital currencies) to protect privacy and promote innovation in the private sector. This provides a clear compliance path for companies like Circle and attracts traditional financial giants like JPMorgan and Citigroup to explore tokenized deposits.

- Tariff Synergy Effect:

The increase in tariffs has accelerated the adoption of stablecoins. Companies using USDC for cross-border payments not only avoid foreign exchange fluctuations but also bypass the cumbersome processes of the traditional SWIFT system. On social media, many view the combination of "tariffs + GENIUS Act" as the ultimate strategy to solidify "digital dollar hegemony."

This act is not a zero-sum game with gold or emerging sovereign currencies, but rather aims to attract traditional capital into the crypto space by providing clear regulations, further solidifying the global position of the dollar.

III. Defense and Offense in Tandem: The "Dual Anchor" Strategy of Gold and Cryptocurrency

Despite the macro uncertainty brought by tariffs, the wave of interest rate cuts by global central banks in the second half of the year, along with the explosion of artificial intelligence (AI), is diminishing its negative impact. This provides a new investment opportunity window, prompting capital to adopt a strategy of "defense and offense in tandem."

1. Defensive Layer: Gold

Gold, as a traditional safe-haven asset, continues to play an important role in the current environment. Although the amount of gold purchased by global central banks slowed in the third quarter, countries like China and Poland are still increasing their holdings to hedge against geopolitical risks. Notably, the executive order on September 5 exempted gold bars from tariffs, further benefiting the physical gold market.

Investment Path: For conservative investors, gold ETFs (such as GLD, IAU) are ideal choices.

2. Offensive Layer: Bitcoin and Stablecoins

In the early stages of the tariff increase, Bitcoin experienced a decline, but the subsequent rebound demonstrated its resilience as "digital gold." With the 401(k) pension plans opening up Bitcoin/Ethereum investments and positive regulatory signals such as Ripple's victory, the crypto market is attracting a broader range of capital.

- The explosion of artificial intelligence (AI) has also injected new vitality into the crypto market. NVIDIA and other AI giants received tariff exemptions, driving up the prices of related crypto tokens (such as FET). Trump's "Crypto Project" also hints at the potential for more on-chain applications.

October Capital Flow "Pyramid"

IV. Investment Strategies and Risk Management: Tracking High-Frequency Indicators to Capture Q4 "Risks"

In the face of market complexity, investors need a clear strategy.

- Defensive Strategy: It is recommended to allocate 40% of the portfolio to gold ETFs to hedge against rising prices and geopolitical risks. Pay attention to changes in global central bank gold reserves, especially movements in emerging economies like China.

- Offensive Strategy: Allocate the remaining 60% of the portfolio to crypto assets. Of this, 30% can be invested in stablecoin infrastructure (such as payment networks like Circle) to bet on its application in cross-border trade;

- The other 30% can be used for Bitcoin and AI-related crypto tokens, seizing growth opportunities brought by interest rate cuts and technological upgrades in the second half of the year.

Risks: Despite the optimistic outlook, risks still exist. The implementation of tariffs in October may increase the probability of recession, and market volatility remains high. It is advisable to set stop-loss points and maintain diversified positions, with no single investment exceeding 10% of the total portfolio.

Tracking Tools: Closely monitor monthly gold purchase reports from central banks, Bitcoin RSI, and other high-frequency indicators to capture the latest market dynamics.

V. From the "Post-Dollar Era" to "Digital Anchoring"—Strategic Opportunities in Cryptocurrency

Although the increase in tariffs has amplified global economic uncertainty, as data shows, capital has not completely fled the dollar system but has found a new home in a "digital anchoring" manner. In the short term, gold and Bitcoin provide necessary hedging functions; in the medium to long term, stablecoins and AI crypto tokens are becoming new engines for betting on future growth.

As the "risk season" of the fourth quarter approaches, the dual catalysts of interest rate cuts and emerging technologies will further reduce recession risks, and the crypto market is expected to become the "new anchor" for the global economy in the second half of the year. The ultimate direction of capital flow is likely to point towards a new era dominated by digital assets, transcending traditional financial frameworks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。