Written by: Prathik Desai

Translated by: Chopper, Foresight News

In the past week, the two giants of the prediction market have secured new funding.

The U.S.-regulated prediction market Kalshi announced it has raised over $300 million in new funding, with a valuation reaching $5 billion, led by Sequoia Capital and followed by a16z. This valuation has increased approximately 2.5 times compared to three months ago. This funding comes as Kalshi is significantly expanding its business: its services now cover 140 countries, and internal data shows that its annual trading volume is approaching billions of dollars, marking a significant leap from last year's initial phase.

Meanwhile, the crypto-native prediction market Polymarket revealed that it has received a strategic investment of up to $2 billion from the Intercontinental Exchange, the parent company of the New York Stock Exchange, with a post-investment valuation of $9 billion.

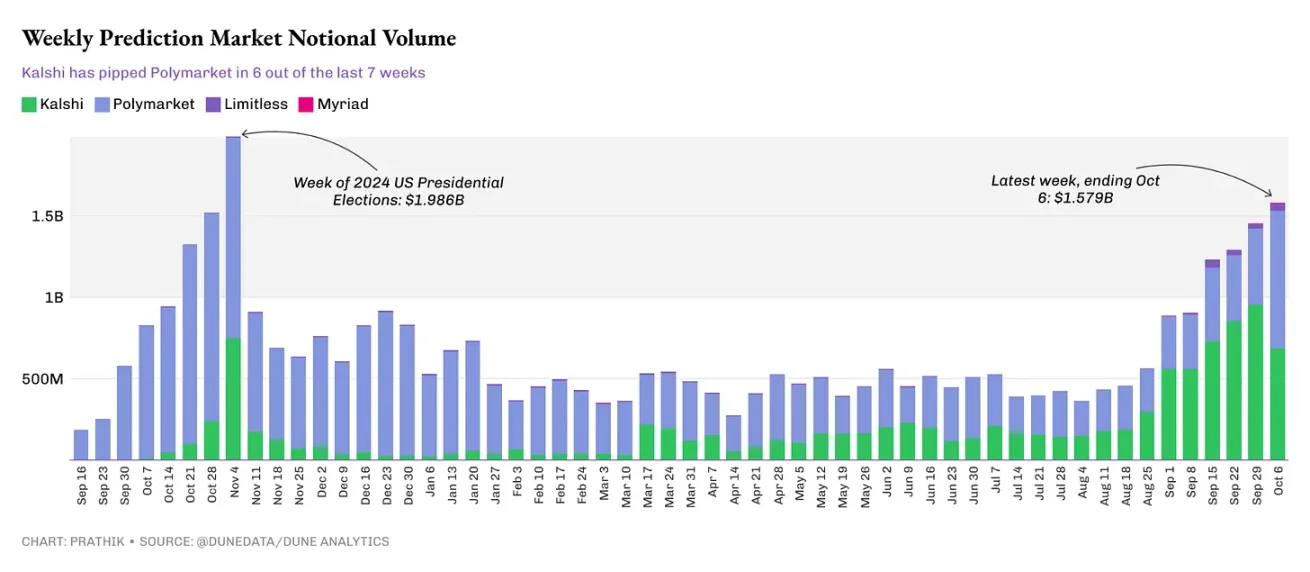

In recent months, Kalshi's trading volume has surpassed that of Polymarket. In the past seven weeks, Kalshi's nominal trading volume (the total value of all contracts in the prediction market) has led Polymarket for six of those weeks.

Since September, the weekly nominal trading volume in the prediction market has steadily increased, with each of the past four weeks exceeding $1.2 billion. Although it has not yet reached the peak levels seen during last year's election, the overall trend is steadily approaching the $2 billion mark.

Currently, Kalshi and Polymarket account for 96% of the total nominal trading volume, holding an absolute dominant position; smaller platforms like Limitless and Myriad Markets are also gradually developing.

In the week ending October 6, Limitless's trading volume exceeded $44 million, while Myriad Markets reached $6 million, growing more than six times compared to a month ago.

Where Does the Heat Come From?

After the election frenzy subsided, traders in the prediction market shifted their focus to other events that capture daily attention.

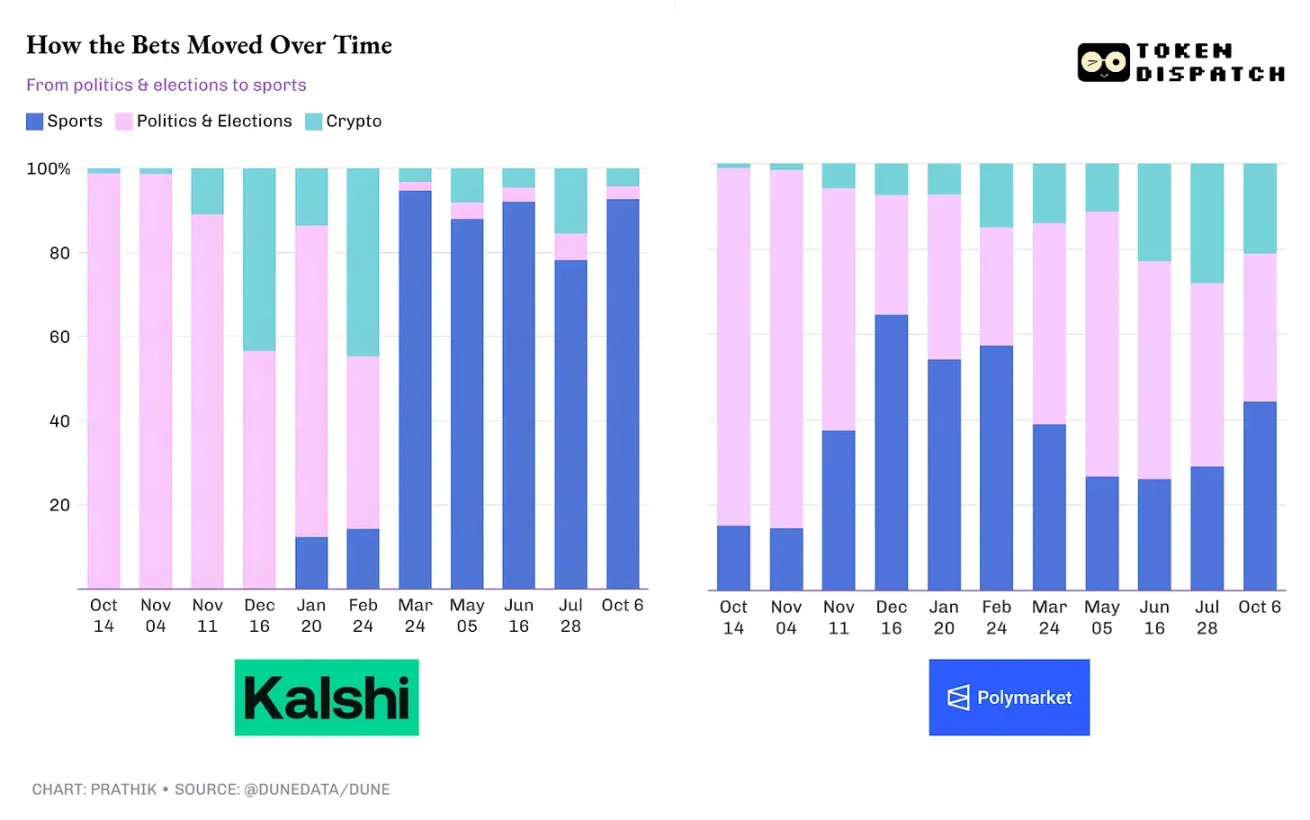

In October 2024, over 95% of Kalshi's and 83% of Polymarket's trading volume was related to politics and elections; however, this structure has gradually shifted towards sports.

Both platforms have seen sports betting volumes dominate. This shift stems from the nature of human behavior: people tend to focus on high-frequency, short-cycle events.

The sports field has a plethora of short-cycle events: game outcomes, player lineups, injury statuses, individual performances, etc., all of which can generate countless micro-events, providing rich scenarios for betting.

This shift is most evident in Kalshi: in December 2024, sports trading accounted for less than 5% of Kalshi's weekly nominal trading volume; by February 2025, it rose to 15%; in March, it surpassed 90%; and in most weeks thereafter, this proportion has remained above 80%.

On the other hand, Polymarket's sports trading proportion has also doubled, rising from about 15% last year to 40% now.

Cryptocurrency still holds a place in the prediction market. Although it does not account for a large trading volume, events related to cryptocurrency prices and ETF issuance still provide ample opportunities for speculation, particularly evident on Polymarket. However, on Kalshi, cryptocurrency-related trading has struggled to reach 15% in most months.

Differentiated Strategies of Leading Platforms

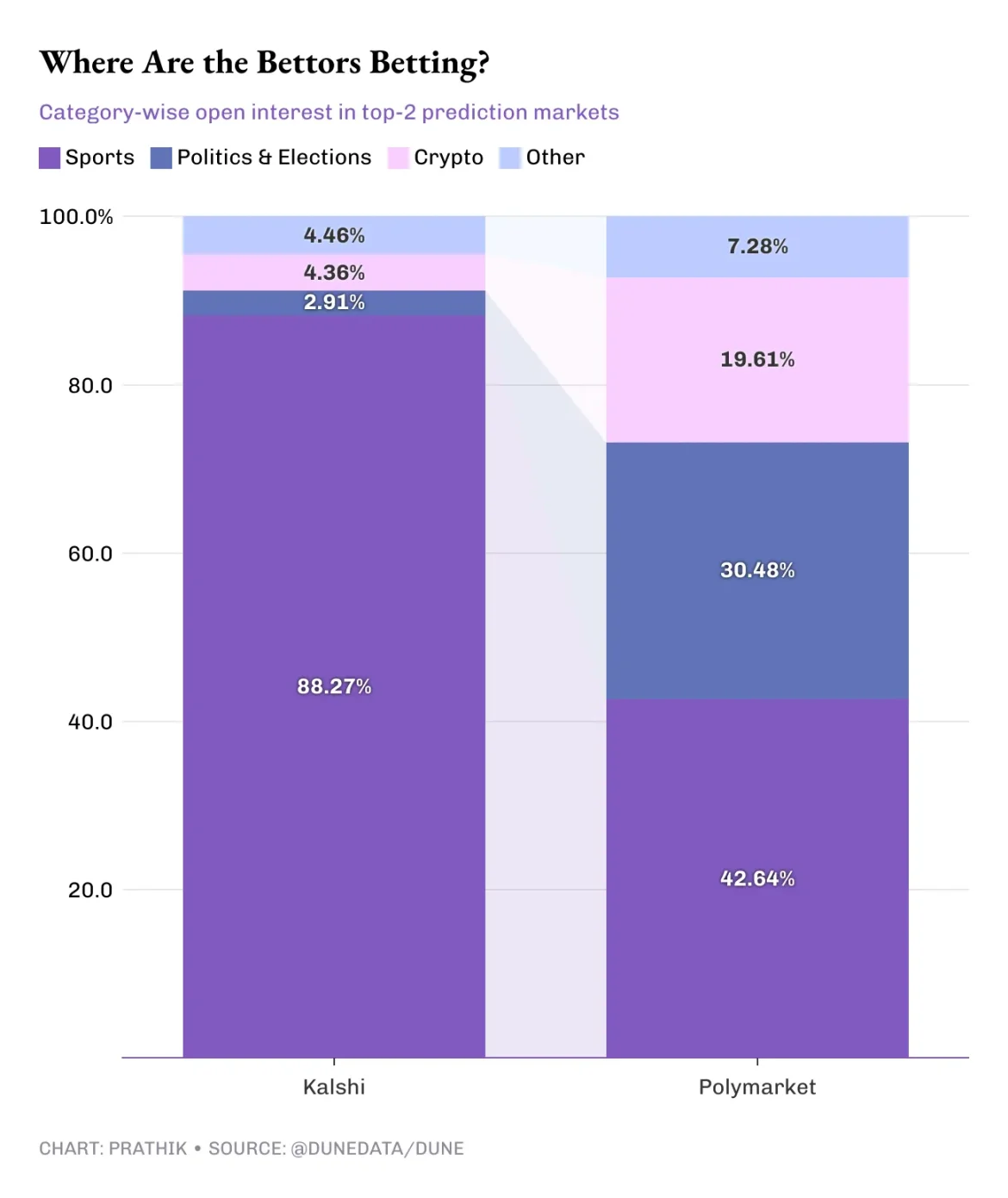

From the latest trading category proportions of the two leading platforms, Kalshi and Polymarket are following distinctly different strategies.

Kalshi's trading core is heavily skewed towards sports, followed by politics and cryptocurrency. This reflects the platform's positioning: focusing on retail speculation needs, which require a standardized, rule-driven market. For example, layering events like weather, energy, and interest rate cuts on top of sports ensures there are continuous betting opportunities every week.

In contrast, Polymarket's trading categories are built around three pillars: sports, politics, and cryptocurrency. The proportions of these categories adjust according to current news events and industry dynamics to fit mainstream market narratives.

From the chart data, it is clear that after the election frenzy last year, the liquidity in the prediction market did not disappear but was redistributed to categories that traders deemed valuable.

These categories help the platform build a sustainable business model, maintaining activity even during off-peak trading seasons. However, politics may still be one of the core areas, as events like elections, debates, and government policies, even if seasonal, can trigger sudden spikes in trading volume.

Cryptocurrency, along with economic and financial-related markets, plays an important supplementary role. Trading around price fluctuations, ETF announcements, Federal Reserve meetings, and policy-making attracts both aggressive traders who thrive in fast-paced markets and macro enthusiasts who wish to price economic narratives.

When different types of traders coexist in the speculative market, the betting categories become richer and more in-depth. Imagine: betting on the NFL on a Sunday could be paired with weather forecasts and natural gas price trades; NBA player injury odds could be combined with predictions for the Consumer Price Index (CPI) range and campaign fundraising amounts.

If the prediction market can make checking prices as habitual as checking sports scores, the platform's user retention rate will significantly increase. And whether in the crypto market or traditional markets, retention rates are key to breaking the dependency on seasonal cycles.

If this goal can be achieved, public perception of the prediction market will shift. It will no longer be seen as a platform focused solely on special events but will become a barometer reflecting the probabilities of everyday events.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。