Author: Tuo Luo Finance

After the record drop on October 11, although many cryptocurrencies have warmed up again, it must be acknowledged that the entire market has suffered a huge blow in terms of sentiment. This blow is not just about price liquidation, but fundamentally a collapse of trust in the crypto space. Stablecoins can decouple at any time, market makers can withdraw liquidity at any moment, and altcoins can be pinned to zero at any time. Even mainstream currencies can easily experience a significant drop with just a light comment from the macro environment. Indeed, in such a market, it is hard to talk about guarantees.

In the market, although discussions about whether a bull market is coming continue, the low sentiment is visibly apparent, and the volume on social media is predominantly negative. In this context, exchanges, as the front line for users, directly bear the negative energy from users. Of course, tracing back, the generation of this negative energy is closely related to the exchanges themselves.

Among them, Binance stands out the most. The recent Binance can only be described as a target of public criticism.

Previously, in the review of the market crash, it was mentioned that due to market makers withdrawing liquidity, the cryptocurrencies on Binance exhibited extreme price behavior, with USDe, WBETH, and other coins completely decoupling. Coupled with Binance's critical downtime, many users found it difficult to complete account deposits and withdrawals, further triggering widespread liquidations.

In this context, user complaints were rampant, and social media was filled with criticisms of Binance. In response, Binance issued a statement after the incident, explaining that certain functional modules on the platform indeed experienced brief lags, and some financial products decoupled due to severe market fluctuations. However, due to the decoupling of certain financial products (such as USDE, BNSOL, and WBETH), the losses from liquidations in contracts, leverage, and lending positions would be fully borne by Binance. Compensation was distributed in two batches, totaling approximately $283 million.

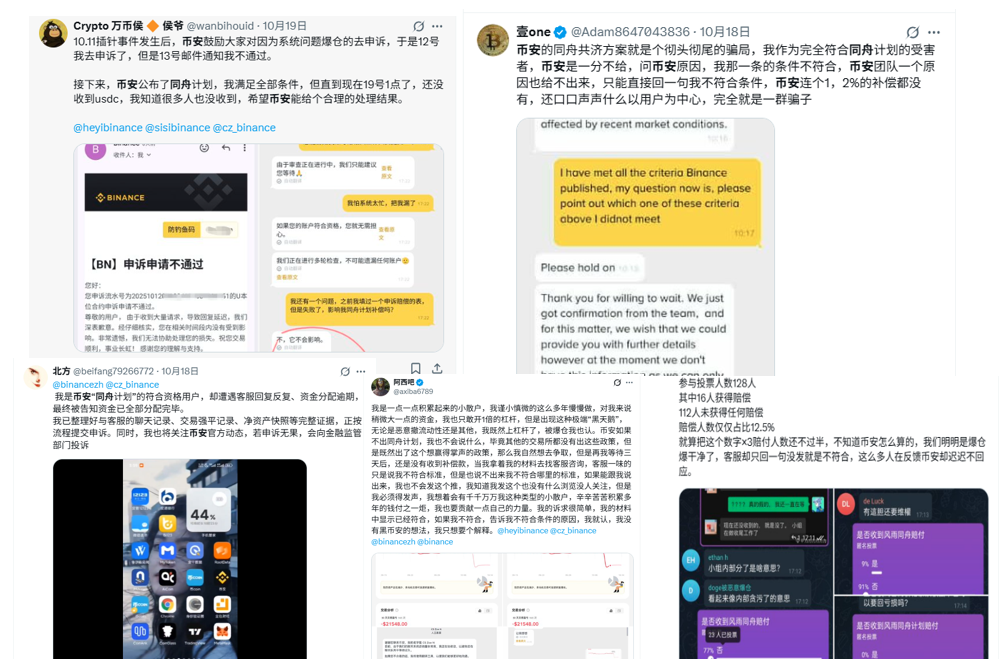

While it seemed that compensation was provided, the fierce criticism from users did not cease. Multiple users stated that they had not received any compensation, while many prominent figures on social media had already taken sides, pointing out that the compensation funds had become exclusive to these influencers, making it difficult to protect the rights of ordinary users. Interestingly, the previously mentioned issue of inconsistent quotes between Binance and Binance US during the crash had not been resolved, and Binance made an even more confusing move.

Regarding tokens like ATOM and IOTX that were pinned to zero, Binance surprisingly modified their historical K-line data, readjusting their lowest zero prices. This action once again sparked a media frenzy, with many users publicly stating that blatantly modifying K-lines is an extreme manipulation by the exchange and should not be supported; otherwise, the accuracy of exchange data would be difficult to guarantee. As user dissatisfaction grew, Binance subsequently restored the K-lines and provided a report on the zeroing issue, stating that the reason for the zeroing was due to historical limit orders on the platform that had existed for years, which the system would automatically match. After the crash, these became the bottom support prices, leading to the pinning, while some trading pairs had prices that were too small after the crash, causing the front-end system to display them as zero.

He Yi also responded to the K-line issue, stating, "If you have traded on Binance, you can compare the liquidation prices of the same project. Binance contracts take the marked price, which is the weighted average price after excluding extreme prices from multiple platforms. You are welcome to verify it yourself. Historically, some platforms take their own prices, and users can easily be liquidated by the spot price fluctuations, leading them to believe the platform is malicious; therefore, one of the innovations of Binance contracts is to take the marked price for liquidations to avoid extreme prices from a single platform. There was no motive or reason behind the K-line issue; it was simply someone on the team getting overly excited, thinking the announcement had explained it clearly. The only impact was that apart from the market vacuum, a user’s historical order from years ago made a few dozen dollars."

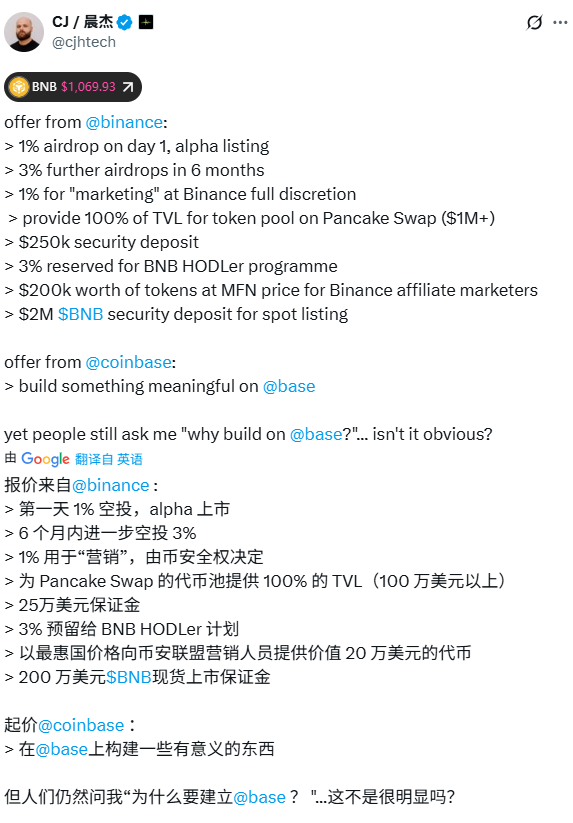

Just as one wave subsided, another rose. On October 14, rumors about listing fees on Binance sparked discussions again. CJ, the founder of Limitless, published data regarding Binance's listing requirements, stating that Binance requires a 1% Alpha airdrop + 3% additional airdrop + 1% marketing + 1M + Pancake TVL + 250k margin + 3% BNB Holder rewards + 2M spot margin. Upon this revelation, the Western community, led by Base, immediately launched attacks on Binance, with The Block, BORED, and 1confirmation all exposing or supporting the claims.

Subsequently, Binance officially announced that it does not charge listing fees. Zhao Changpeng and He Yi came forward to extinguish the fire again, with the former stating that if project parties complain about listing airdrops or fees, they can choose not to pay these fees, and the latter also mentioned that the listing margin would be refunded, and Binance would provide a complete report of all activities on the platform to the project parties.

As events unfolded, user dissatisfaction with Binance continued to grow, with many angry users stating they would fully boycott Binance. Perhaps in an effort to salvage its reputation, or perhaps out of a genuine sense of industry responsibility, on the same day, Binance launched the "Same Boat Plan," providing relief to affected users and institutions. They initiated a "300 million user seed plan" to distribute a total value of $300 million in USDC vouchers to users who suffered forced liquidations exceeding $50 or a loss ratio greater than 30% in contracts or leverage, and would establish a $100 million special low-interest borrowing program to help severely affected institutional users restart, aiming to promote industry recovery and rebuild confidence.

What was intended as a goodwill relief plan, however, encountered issues in execution. Users once again voiced their concerns on social media, stating they met the plan's requirements but had not received any compensation, with some users bluntly calling it a superficial "facade project." Yesterday, He Yi responded to this matter again, emphasizing that the Same Boat Plan is a relief fund logic, not compensation, and those who meet the conditions but have not received compensation can contact customer service to await review.

Looking back at the entire incident, Binance indeed made mistakes. The platform's mechanism issues ultimately made users pay the price, which is clearly untenable. However, to say that it is entirely Binance's fault would also be biased. The market is unpredictable, and one must take responsibility for oneself; this is a principle that must be upheld when entering a high-risk market. What is particularly special is that unlike the traditional financial world, which has a multi-entity system of checks and balances, a single entity only fulfills a single responsibility. In the crypto space, exchanges are both the apex of power and the execution department of the front-line market; in other words, they are both the referee and the athlete. In this context, it is akin to traditional markets where any issue leads to seeking the enforcer; naturally, the problems in the crypto space ultimately fall on the exchanges. The difference is that while issues with enforcers can be escalated, in the crypto space, exchanges are usually the final safety net.

This is also why, after the incident, the market was extremely dissatisfied with Binance. As the largest exchange globally, Binance inherently bears industry responsibility, but it not only exacerbated this crash but also showed indifference in the aftermath. However, from the perspective of the exchange's role, it is merely one player in the industry chain; even if it holds more weight, it is still just a market operator that needs to operate and profit, with social responsibility being merely an adjunct to its operations, not an obligation.

As He Yi mentioned in another comment, "It's like someone asking me, some people are currently making noise, trying to blame the market drop on Binance, looking for you to stir up trouble, hoping to distribute based on the noise. Your 'Same Boat Relief' is foolish; giving cash only tells others to open positions and seize the opportunity, right? Wouldn't it be better to give contract experience vouchers? Why help someone who didn't hit you? This is just Binance 'colliding with something else'; we think we should lend a hand, that's all."

In essence, the current conflict between exchanges and users stems from this. As the network effect gradually diminishes, the system shifts from open to closed, and users and platforms transition from mutual growth to a zero-sum effect. Platforms, driven by profit needs, will overlook user interests within a certain range. In traditional financial exchanges, after setting clear and transparent listing standards, what is provided is trading services, with the core profit being transaction fees. After development, they usually do not need to consider other issues. The crypto space is different; with limited liquidity, there is a constant need to attract new users, drive traffic, and even induce users to engage in undesirable behaviors in contracts, and even leading exchanges are no exception.

This is not to criticize Binance; it is a common issue among exchanges. The main contradiction in the current market is between the industry's growing profit demands and the imbalanced and insufficient liquidity, with leading exchanges being the epitome of both. This contradiction is almost unsolvable unless masked by the high growth of a bull market. Additionally, completely deconstructing the crypto market into traditional finance could alleviate some issues, but achieving transparency of information, clear authority, and distinct users would not only shatter the idea of decentralization but also make it difficult to transfer power from vested interests. Interestingly, under the high entry barriers in the crypto space, as outsiders continue to flood in, exchanges are moving towards becoming "super apps," with the vast majority of new entrants unlikely to expend energy on learning. The lifecycle of trading is built around exchanges, and their status is likely to become even more important in the future.

To wear the crown, one must bear its weight. Users are evidently very harsh on exchanges, with conspiracy theories emerging endlessly. Even when the market is poor, they will angrily curse the exchange for manipulating the market, using it as a way to shift the pain of personal decision-making errors. From a certain perspective, criticizing exchanges has become a form of political correctness. After the crash, the market's cursing of Binance, while understandable, clearly also contains an element of emotional venting; after all, believing in the disruption caused by "bad actors" is much easier than blaming oneself.

On the other hand, it must be mentioned that Binance seems to have formed a magical public relations mechanism where when the team executes poorly, it is always the boss who pays the price, and wherever there is controversy, the boss must appear to extinguish the fire. When problems are few, this approach can be lauded as timely resolution, with the founder taking responsibility. However, when problems occur too frequently, and the founder has to extinguish fires too often, it becomes a depletion of brand power and the founder's credibility. In this regard, what Binance needs to correct is not external public opinion, but rather its internal team.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。