Author: Bai Ding, Xian Rang

Blockchain technology is reshaping the global financial system, and RWA has become a bridge connecting traditional finance and DeFi. Once traditional assets such as real estate, artworks, bonds, and gold are converted into on-chain tokens, they can achieve global asset flow and ownership fragmentation, marking an undeniable financial technology revolution.

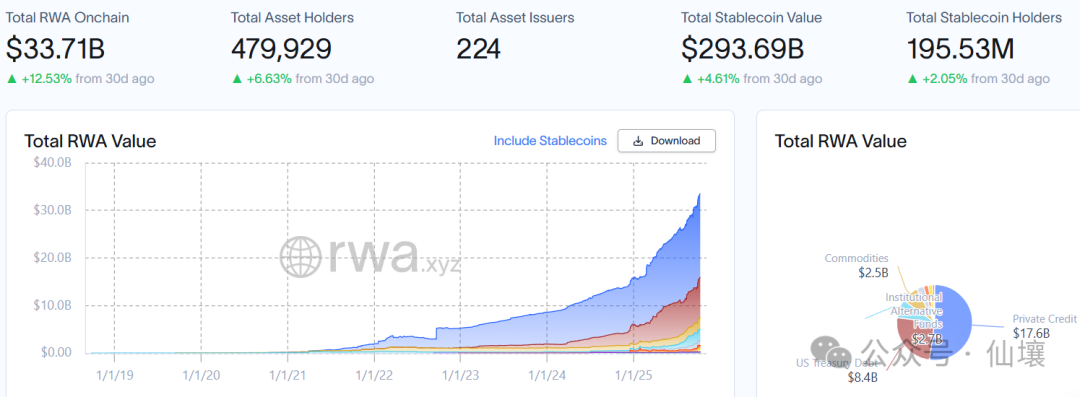

According to current market data, the market capitalization of non-stablecoin RWA has reached $33.7 billion, and it is expected to exceed a trillion by 2030. All these achievements are attributed to the trustless and transparent nature of blockchain in asset custody and circulation. However, it is evident that RWA also faces challenges related to liquidity fragmentation and security.

The concept of RWA originates from the digital transformation of traditional assets through blockchain, mapping physical assets into programmable tokens to absorb global liquidity. According to the latest reports, the RWA tokenization market is expanding at a compound annual growth rate (CAGR) of over 50%, driven primarily by the maturation of DeFi, improvements in the regulatory environment, and the influx of institutional investors.

For companies in traditional industries, issuing RWA has multiple positive implications.

First, it broadens financing channels. Traditional financing methods often rely on bank loans or stock issuance, which have high thresholds and long cycles. Through RWA, companies can tokenize assets such as real estate or intellectual property, directly attracting global investors for low-cost financing. For example, a real estate company can split a property into thousands of tokens, each costing only a few hundred dollars, significantly reducing financing costs.

Second, RWA enhances asset liquidity. Assets like artworks or private equity often have poor liquidity, with transactions taking months from proposal to completion. However, with on-chain RWA tokens, these assets can be traded instantly on the secondary market.

Third, RWA promotes financial innovation and effective risk diversification. Traditional investment institutions can create new financial products through tokenization, such as yield-bearing tokens, allowing token investors to receive dividends from asset earnings. Additionally, the RWA of heavy assets like real estate can fragment ownership to attract diverse investors, effectively spreading risk.

Moreover, RWA enhances the competitiveness of certain companies. In the wave of digital transformation, companies adopting blockchain technology are more likely to gain resources within the Web3 ecosystem and attract the favor of investment institutions. For instance, last August, Longxin Group collaborated with Ant Group to complete the country's first RWA financing based on new energy assets, using some of its charging piles as RWA anchor assets, with financing amounting to 100 million yuan.

Overall, RWA can inject vitality into traditional companies, helping them transition from closed local markets to an open global system. However, despite the significant meaning and rapid development of RWA, a core pain point restricts its growth: in the Web3 world, there are too many public chains, and liquidity is fragmented across hundreds of public chains, leading to severe disconnection.

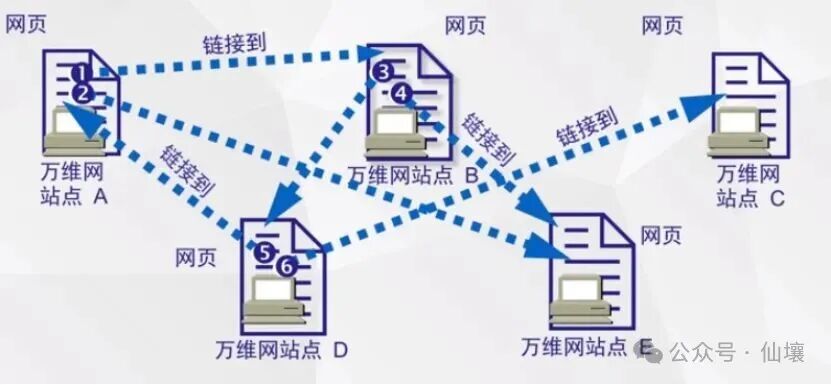

Similar phenomena are not uncommon in the traditional internet field. Before the World Wide Web (WWW) became the mainstream text data transmission protocol, there were several competitors, such as Gopher, Archie, WAIS, Usenet, and BBS. These systems or protocols could provide file retrieval, forum communication, or file transfer functions, but due to various limiting factors, they ultimately operated independently without establishing a unified and efficient consensus.

After Tim Berners-Lee proposed the concept of the World Wide Web in 1989, it rapidly gained popularity due to hypertext links, multimedia support, and user-friendliness. By 1995, the World Wide Web had basically established its dominant position, ending the chaotic and incompatible state of internet text transmission protocols and achieving a unified, open, and inclusive global network system.

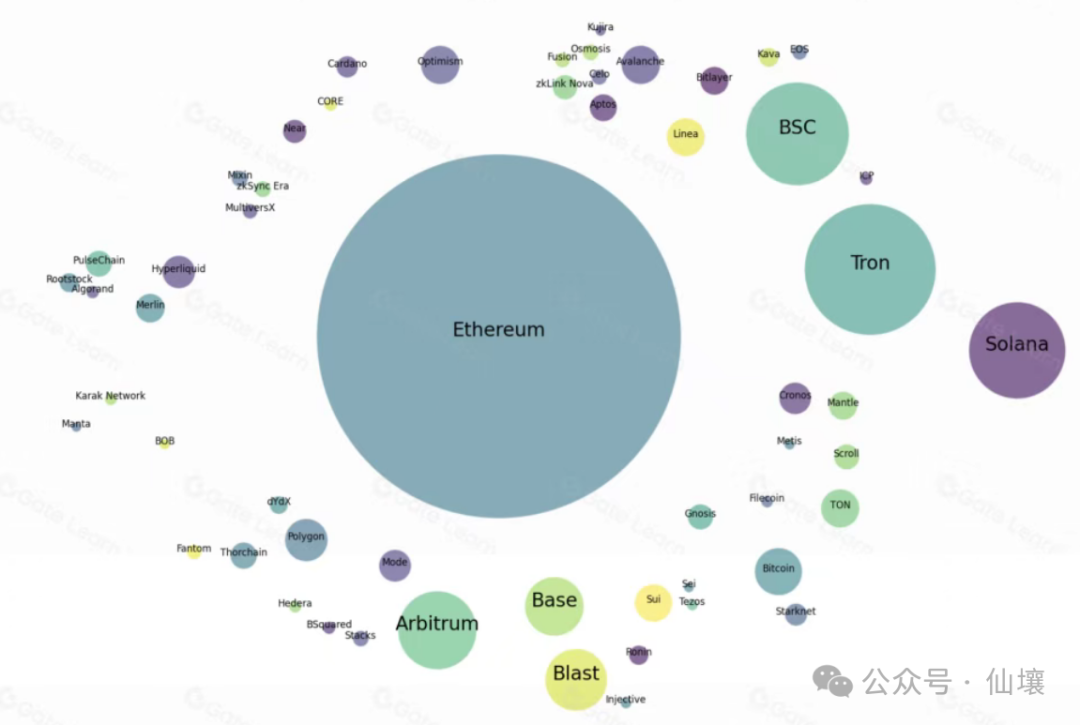

Compared to the traditional internet, blockchain has long lacked a unified standard due to its deep ties with financial capital and geopolitical factors. Moreover, since everyone wants to create a public chain, even after more than a decade of development, it has yet to achieve the same level of technical standardization as the traditional internet, remaining in a multipolar state to this day. Many public chains have their own technical standards and independent ecosystems, leading to a serious problem—liquidity fragmentation:

Different public chains like Ethereum, Solana, and Sui each have their advantages, but assets cannot flow seamlessly across chains, forcing traders to be limited to specific chain liquidity pools.

For example, an RWA token issued on Ethereum may not be easily transferred to Solana. This pain point amplifies into a systemic issue.

First, insufficient liquidity leads to significant price volatility. The trading volume of single-chain RWA is often limited and easily manipulated by large holders, exposing investors to high slippage risks.

Second, the opportunity cost is high. Users need to switch wallets and assets across multiple chains, increasing operational complexity and security risks.

Third, from an ecological perspective, single-chain issuance hinders the deep integration of RWA with DeFi, preventing the full utilization of cross-chain DeFi yield acquisition or lending opportunities.

This is the "island effect" of blockchain, where the consensus mechanisms and token standards (such as ERC-20 and SPL standards) of different chains are incompatible, and asset transfers rely on cross-chain bridges, which are often the weakest links in the system. Cross-chain bridges not only affect the development of RWA but also limit the growth of the entire blockchain industry.

Current Cross-Chain Technology and Its Pain Points

To address the blockchain island problem, various cross-chain technologies have emerged, but most solutions fail to perfectly achieve the transfer of multi-chain liquidity, especially since many cross-chain bridges do not support RWA assets. To this day, the simplest and most straightforward multi-signature cross-chain bridges still dominate, but this solution has encountered countless failures. As of June 2025, losses from cross-chain bridge hacks exceeded $2.8 billion, with the vast majority being multi-signature cross-chain bridges.

For RWA, any security vulnerability could lead to significant losses due to the involvement of high-value physical assets, making it far more complex and difficult to resolve than simple Web3 issues. Therefore, the cross-chain problem has become one of the bottlenecks for RWA development, and how to efficiently mobilize liquidity within a multi-chain ecosystem is a serious issue.

Another significant pain point of traditional cross-chain bridges is excessive latency. Multi-signature bridges require consensus from multiple nodes for verification, and transferring assets from Ethereum to Solana may take several minutes to half an hour, which is clearly unacceptable for those accustomed to instant payments in the traditional financial system. In high-frequency trading scenarios, high latency severely restricts the circulation efficiency of RWA, especially during market fluctuations, where even second-level delays can lead to substantial losses.

The operational experience of cross-chain bridges is another major bottleneck. For example, if an ordinary user wants to use token B on chain A to purchase token D on chain C, the so-called "ABCD transaction," they must go through cumbersome steps: first exchanging on-chain DEX for an asset common to both chains, then transferring it to chain C via a cross-chain bridge, and finally completing the transaction on chain C's DEX.

The entire process requires users to manually complete tasks in at least three dApps, involving multi-chain wallet switching, gas fee payments, and understanding the operational logic of bridging protocols. Non-expert Web3 users find it extremely difficult to navigate, and potential Web3 users abandon participation in on-chain interactions due to the complexity of cross-chain operations, accounting for over 95%, severely limiting the popularity of RWA and the expansion of the Web3 ecosystem.

The Rise of Chain Abstraction and Case Studies

Based on the analysis above, the limitations of traditional cross-chain bridges in terms of security, speed, and user experience can no longer meet the demands of RWA's rapid growth and the expansion of the Web3 ecosystem. Centralized risks, transaction delays, and cumbersome operational processes not only hinder the full-chain liquidity of RWA assets but also restrict the participation of non-expert users, dragging down the popularization of Web3.

In this context, chain abstraction has gradually gained attention as an emerging concept, providing a new perspective for solving cross-chain interoperability.

Chain abstraction is a grand vision for Web3, referring to the ability to shield users from various complex operational details and cumbersome components through a single user interface, allowing them to interact with different public chains and liquidity pools without awareness. It enables users to automatically acquire liquidity within different public chain ecosystems on a single platform through a one-click cross-platform transaction, providing the best trading experience through the process of "interpreting user intent → splitting orders → routing → completing transactions."

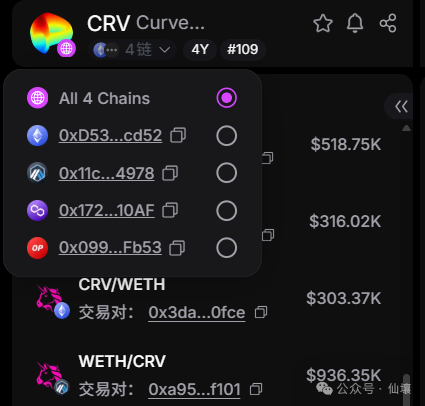

For example, on the UniversalX platform, we can see the liquidity distribution of CRV tokens across four public chains. The platform can automatically split a user's large buy order into multiple smaller buy orders, interacting in different pools to achieve minimal slippage. To achieve this effect, there must be a mature full-chain interaction system behind it.

In addition to UniversalX, other cutting-edge projects have begun to explore the potential of chain abstraction and intent platforms, attempting to reshape the issuance and circulation model of RWA through bridge-less interoperability and unified settlement mechanisms.

Taking PicWe as an example, this solution aggregates full-chain liquidity through omni-chain infrastructure and enables one-click issuance of RWA, raising $1 million for the Isfayram Phase I small hydropower station of AK BUURA Energy Group through RWA public fundraising. Surrounding PicWe's full-chain RWA solution, we can gain a deeper understanding of the impact of chain abstraction on RWA.

PicWe has built a full-chain swap system for RWA assets in IRO (Initial RWA Offering) using stablecoin WEUSD as the exchange medium and user intent as the guiding principle, focusing on eliminating reliance on traditional bridging. This design shields the complexity of inter-chain operations, optimizing liquidity and security.

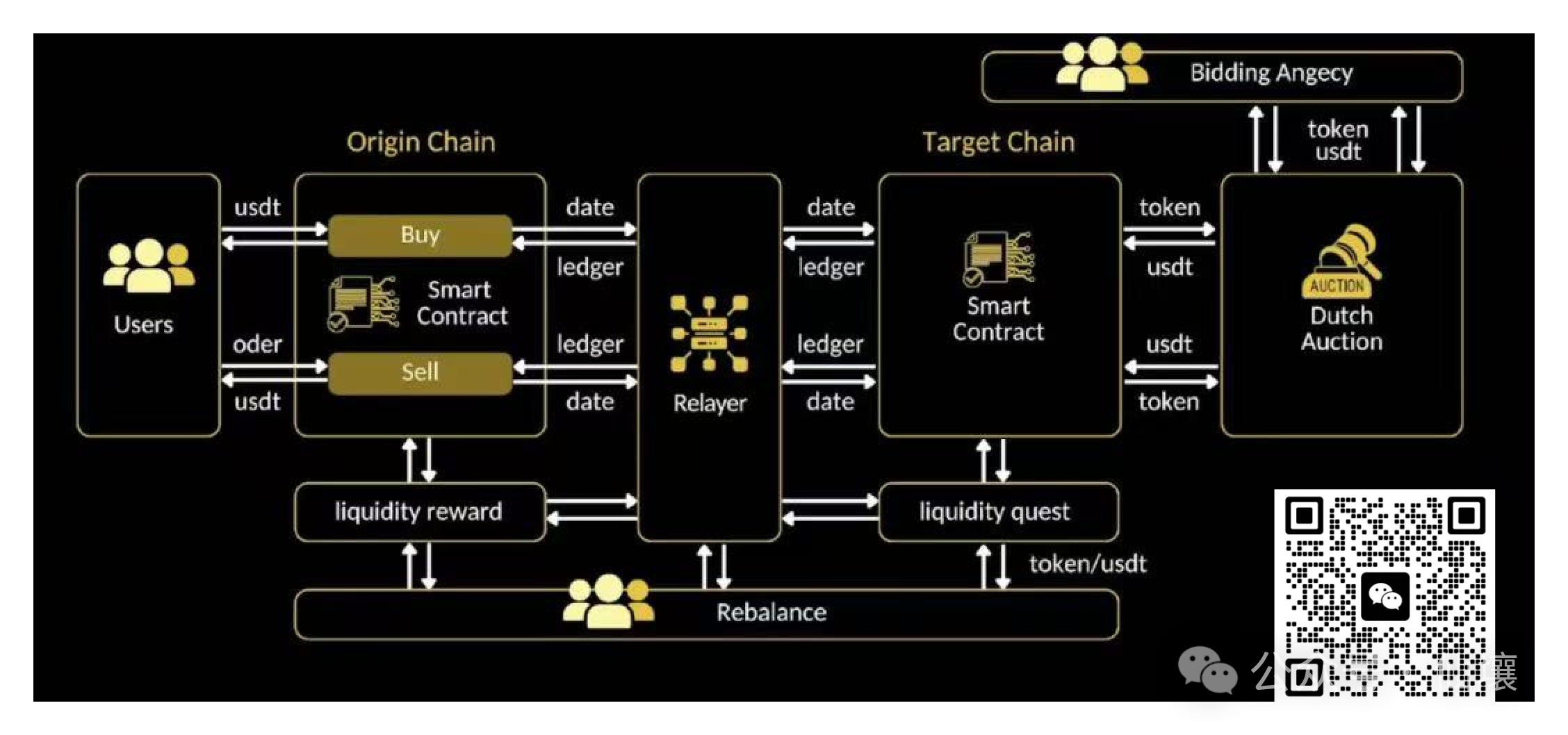

The chain abstraction of PicWe is centered around the Chain Abstract Transaction Model (CATM). This model is essentially a distributed transaction coordination framework that deploys standardized contracts on each chain connected to PicWe, which act as state synchronization and execution nodes. Unlike traditional cross-chain solutions that rely on intermediary bridges' "locking-minting" processes, CATM adopts intent-driven execution logic:

Users submit transaction intentions on the source chain, and the system automatically matches and settles through a contract network without requiring manual intervention for inter-chain transfers. This abstraction layer treats multiple chains as a logical unity, with users perceiving only a single transaction entry point, while the underlying contracts handle verification, routing, and release, ensuring that intentions are executed atomically across multiple chains.

The key technology supporting CATM is the Omni-Chain Permissionless Bidding Orchestration Protocol (OPBOP), an open bidding coordination protocol that allows any liquidity provider (LP) to participate in cross-chain order matching without permission. OPBOP operates similarly to a decentralized auction market:

When a user initiates a cross-chain purchase intention, the protocol broadcasts the order details to the contract pool on the target chain, and LPs bid to provide the required assets based on real-time quotes. The bidding process incorporates a time decay mechanism—initial quotes are high, and as more LPs respond, the price gradually decreases until an optimal match is reached.

This not only achieves low-threshold liquidity injection but also encourages LPs to actively bridge supply gaps through economic incentives, avoiding the static locking of traditional bridges.

If OPBOP is the technical foundation for PicWe to complete chain abstraction swaps, the stablecoin WEUSD is an important medium in this process.

WEUSD is minted at a 1:1 ratio by users collateralizing USDC and can be redeemed at any time. In the specific process of the aforementioned "ABCD transaction," token B on chain A is first swapped for WEUSD on chain A, then automatically converted by PicWe's smart contract into WEUSD on chain C, and finally swapped for token D. This entire process is completed with one click in the PicWe exchange, and users are completely unaware of the existence of cross-chain bridges and WEUSD, as if their token B was directly exchanged for token D.

In DeFi, WEUSD will serve as collateral for lending, enabling multi-chain yield farming; on the RWA platform, it bridges TradFi assets such as bonds or real estate tokens, ensuring compliant circulation and handling the yield settlement of RWA assets; in cross-chain payments, WEUSD becomes the medium for all-chain exchanges.

As PicWe connects to more chains, potentially all public chains, WEUSD will become the settlement layer for the entire blockchain ecosystem, supporting DeFi, RWA platforms, and cross-chain payments. If this process can be effectively advanced, we may see the emergence of a standardized RWA full-chain liquidity protocol.

Conclusion

The rise of RWA opens up vast prospects for connecting traditional finance with decentralized ecosystems in Web3, but the fragmentation of cross-chain liquidity, security risks, and the complexity of user experience remain core pain points that constrain its potential. The island effect caused by single-chain issuance, the high costs and delays of traditional cross-chain bridges, and the participation barriers for non-expert users collectively suppress the global circulation of RWA and the innovative vitality of Web3.

Chain abstraction, as an emerging paradigm, shields the complexity of multi-chain operations and provides the possibility for seamless asset flow. Chain abstraction not only holds the promise of breaking the cross-chain interoperability dilemma but also endows RWA with higher capital efficiency and security. Perhaps when the technology of chain abstraction matures, the cross-chain issues will truly be resolved, paving the way for RWA to transition from a hundred billion to a trillion market, achieving a deep integration of traditional and digital finance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。