Original | Odaily Planet Daily (@OdailyChina)

This column aims to cover low-risk yield strategies primarily based on stablecoins (and their derivative tokens) in the current market (Odaily Note: code risks can never be completely eliminated), to help users who wish to gradually increase their capital through U-based financial management find more ideal earning opportunities.

Past Records

New Opportunities

Reflect Early Bird Deposit Opened (Full)

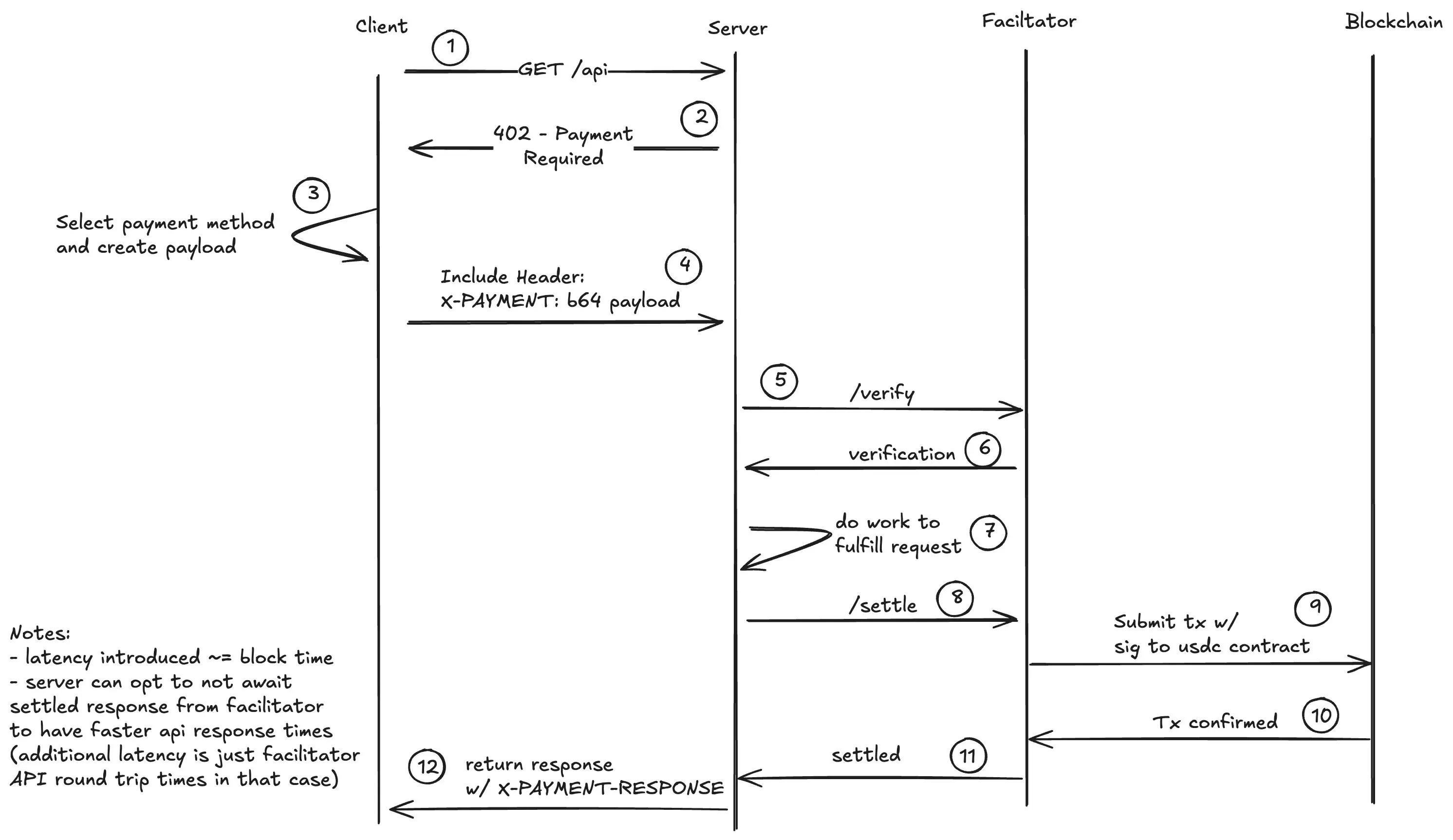

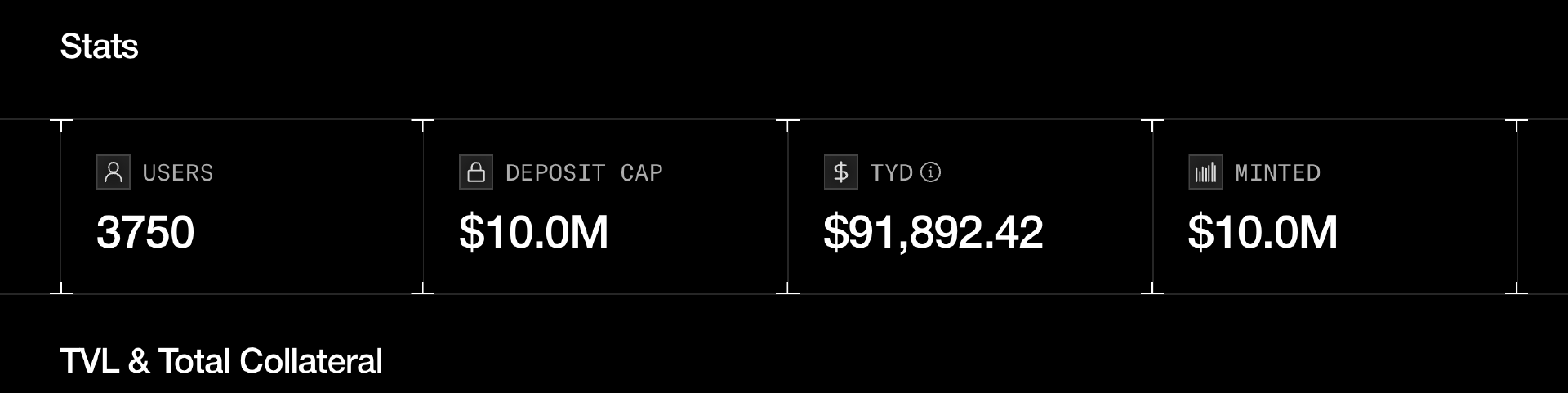

The stablecoin project Reflect (Portal) opened its first USDC+ pool deposit early this morning, with a limit of $10 million — when I started writing, it seemed there was still some quota left, but by the time I finished, it was already full, which is a bit awkward…

At the beginning of September, Reflect announced the completion of a $3.75 million seed round financing, led by a16z crypto's CSX accelerator, with participation from Solana Ventures, Equilibrium, BigBrain Holdings, and Colosseum.

Currently, the APY for depositing USDC as USDC+ in Reflect is approximately 7.6%, but early deposit users are clearly more focused on the potential airdrop benefits associated with points, especially in the current phase where competition is relatively small.

It is worth mentioning that Reflect's deposits require an invitation code, and since each code can only be used once, this is also a major reason why many users were unable to deposit. Interested users can try the following codes (first come, first served), set up an account in advance, and prepare for the next opening.

- UOJDPE5V

- 0DKDADE3

- KLDWH42M

- 7BXFINIP

Perena Season 1 Launch

Perena (Portal) is an old project that has been promoted many times. The project was founded by Anna Yuan, the former stablecoin head of the Solana Foundation, and completed approximately $3 million in Pre-Seed round financing at the end of last year, led by Borderless Capital, with participation from Binance Labs, Primitive Ventures, ANAGRAM, Maelstrom, Breed VC, Temporal, ABCDE Labs, SevenX Ventures, Pivot Global, Miton, Graph Ventures, and others.

On October 23, Perena officially announced the launch of the Season 1 points activity. To briefly explain the gameplay, by using stablecoins to mint USD* on the Perena front end and holding it, users can accumulate points while earning approximately 13.33% APY. Users can also explore more earning possibilities by forming LPs through RateX, Exponent, or buying YT.

It is worth noting that users who participated in Perena Season 0 and the Pre-Season phase did not retain their points; instead, they were uniformly converted into badges. The official mentioned that Season 1 would have a greater airdrop weight, which has sparked considerable controversy within the community — users need to assess the protocol's credibility before deciding whether to participate.

Two Small Alarms: Stable, Neutrl

Additionally, there are two other high-profile deposit projects that require timely attention to official announcements.

One is the popular stablecoin public chain project Stable, which currently has potential yields that will not be low, but due to market heat and team structure issues, it is very difficult to deposit (see details in "Stable's First Round of $825 Million Pre-Deposits Sold Out in Seconds, Releasing $700 Million First Before Tweeting?"). You can turn on notifications and wait for a chance.

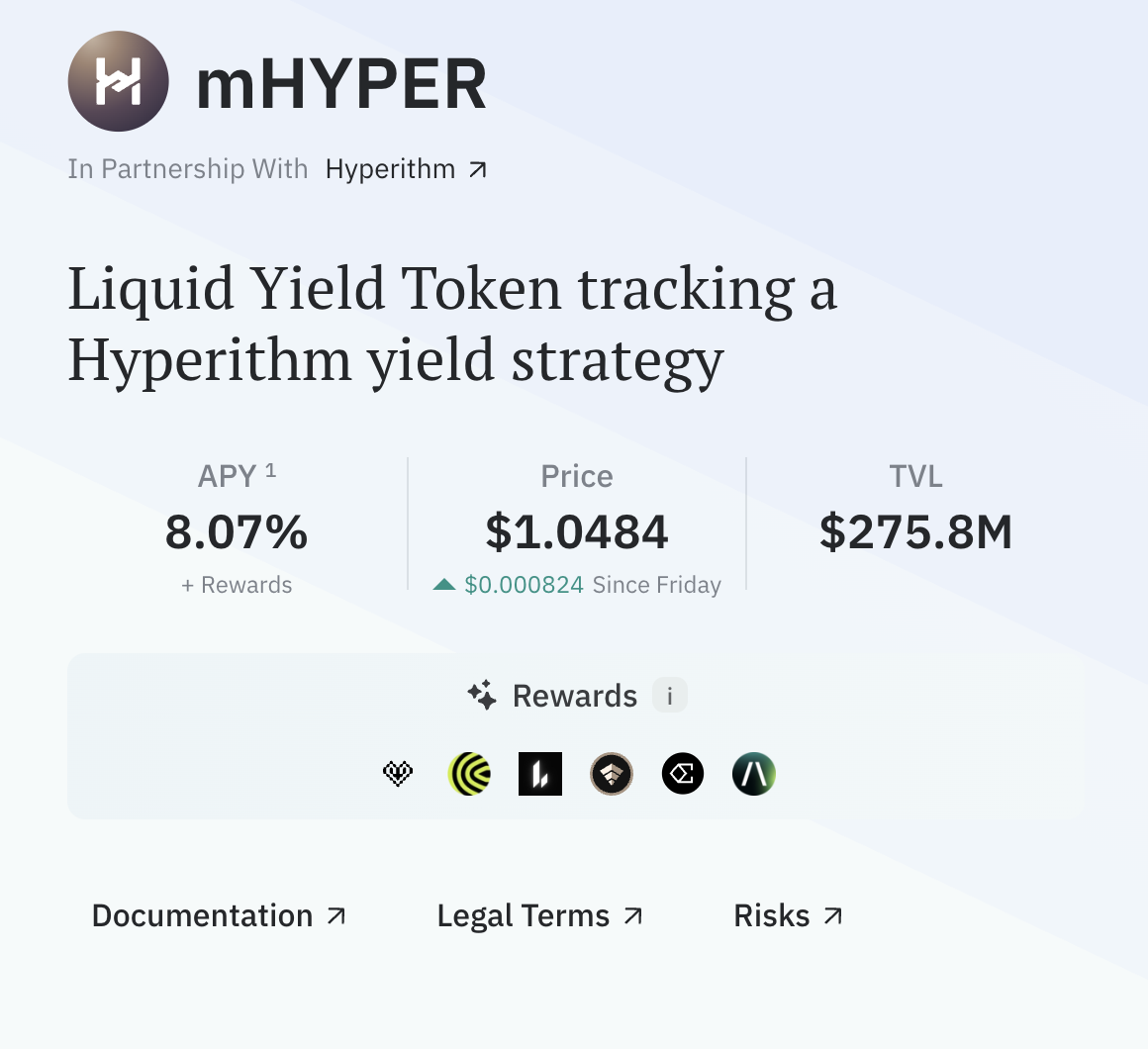

If you really can't deposit into Stable, you can consider indirectly participating using Midas's mHYPER (Portal) — mHYPER has indirectly invested $25 million into Stable's pre-deposit by lending to Hyperithm, and funds deposited into this pool can share the earnings. Currently, the APY for the mHYPER treasury is approximately 8.07%, and there are also certain exposure opportunities for popular protocols like Cap, Lighter, USDai, Ethena, Almanak, etc.

The other is Neutrl, which previously raised $5 million and focuses on off-exchange altcoin hedging arbitrage agreements. This project has opened two batches of quotas ($50 million and $25 million), both of which were basically filled within an hour. This is definitely easier to deposit into compared to Stable, so you can consider participating as appropriate.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。