Original | Odaily Planet Daily (@OdailyChina)

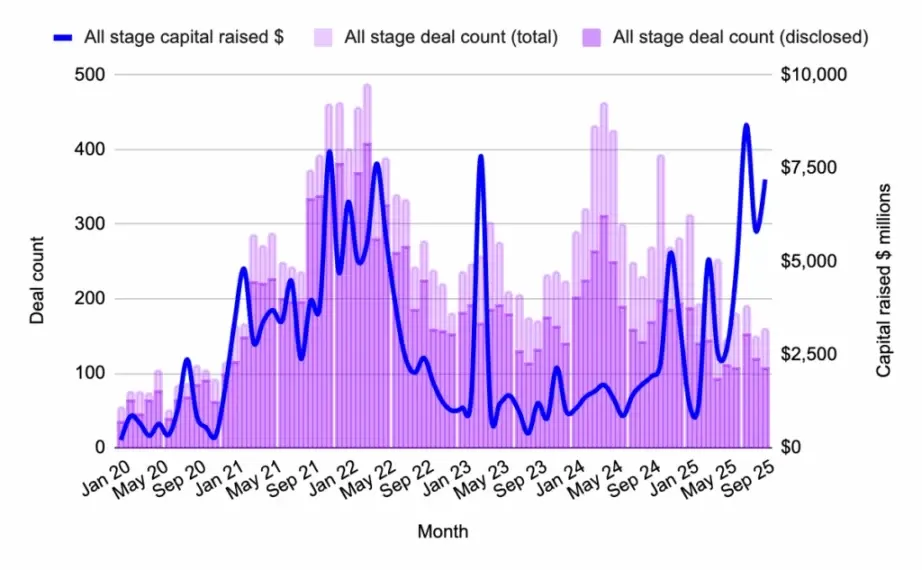

In the landscape of crypto narratives in 2025, RWA (Real World Assets) has transitioned from a marginal concept to a "cash flow engine" jointly bet on by institutions and on-chain funds. It is no longer an empty slogan of "tokenizing everything," but a compliant runway where traditional finance and blockchain truly intersect. Over the past two years, the entry of traditional financial giants like BlackRock, Goldman Sachs, and Fidelity has provided real support for this experiment. The launch of BlackRock's BUIDL fund and Goldman Sachs' on-chain bond pilot signifies that core assets of traditional finance are being systematically moved on-chain. RWA is no longer just a testing ground for Web3 but has become a formal battlefield actively engaged by traditional capital.

In this trillion-dollar race to bring assets on-chain, Ondo Finance has emerged as one of the most certain and representative players. To date, Ondo has managed over $1.8 billion in on-chain assets, offering 5%+ annualized returns, and has built an institutional-grade compliance framework through FinCEN registration, Reg D exemption, and SEC registered ATS (Oasis Pro). This means it is not only telling the story of RWA in the on-chain world but also providing a trusted source of returns under regulatory scrutiny.

On October 29, Ondo announced that its core product Ondo Global Markets (OGM) has officially integrated with BNB Chain, marking an important step in bringing tokenized stocks and ETFs into the BNB ecosystem on a large scale. In terms of technology, compliance, and ecological cooperation, this move signifies that Ondo is pushing "institutional-grade tokenized assets" into the on-chain market with a vast retail user base.

Stablecoins to USD, OGM to US Stocks

Ondo Global Markets (OGM) is a global tokenized securities platform launched by Ondo Finance in September 2025. Its emergence is almost a response to a long-standing question: "Why can the crypto world trade 24/7, while Wall Street's assets are still limited by time zones, identities, and borders?"

The goal of OGM is to break down the "time and identity" barriers, allowing globally compliant investors to access U.S. publicly traded securities around the clock on-chain. The core concept of OGM is described as: "Stablecoins to USD, OGM to US stocks." In other words, OGM attempts to replicate the success of stablecoins in the currency market for the stock market: through tokenization, enabling U.S. stocks to achieve 1:1 price tracking + automatic dividend distribution, while also providing programmable, composable, and high liquidity with no slippage. Users can simply exchange stablecoins with one click to freely use these tokenized stocks in DeFi protocols. From now on, "holding Tesla" no longer requires a securities account, just an on-chain wallet.

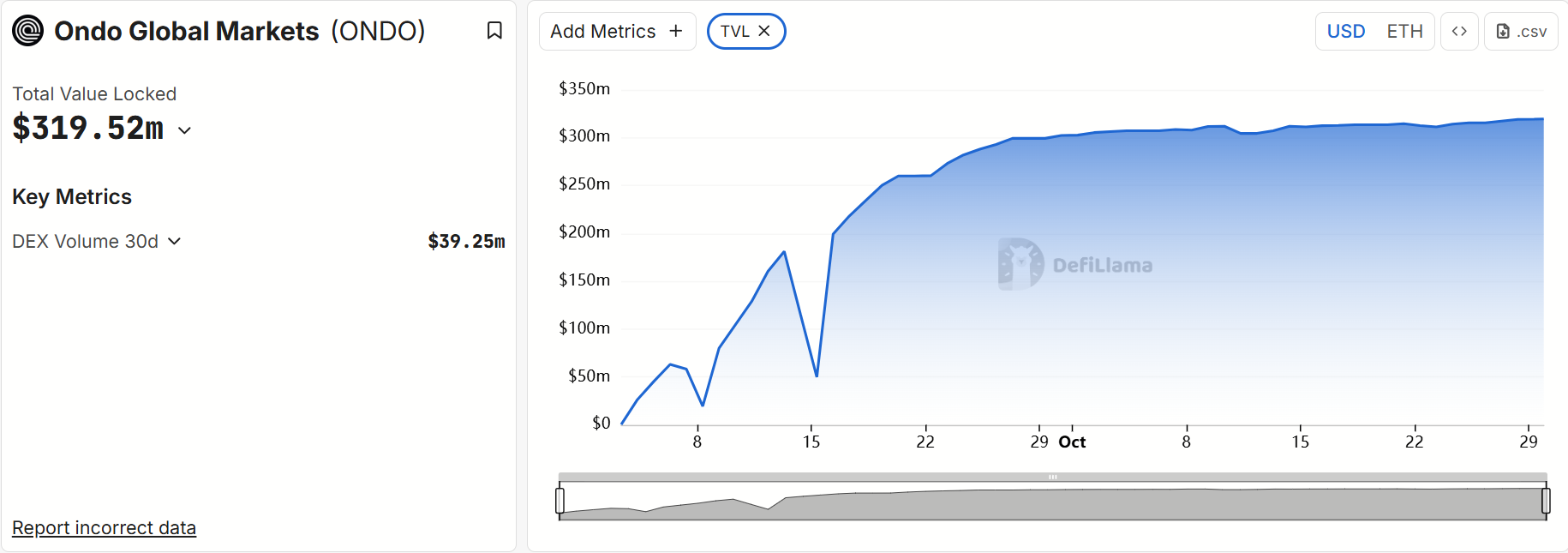

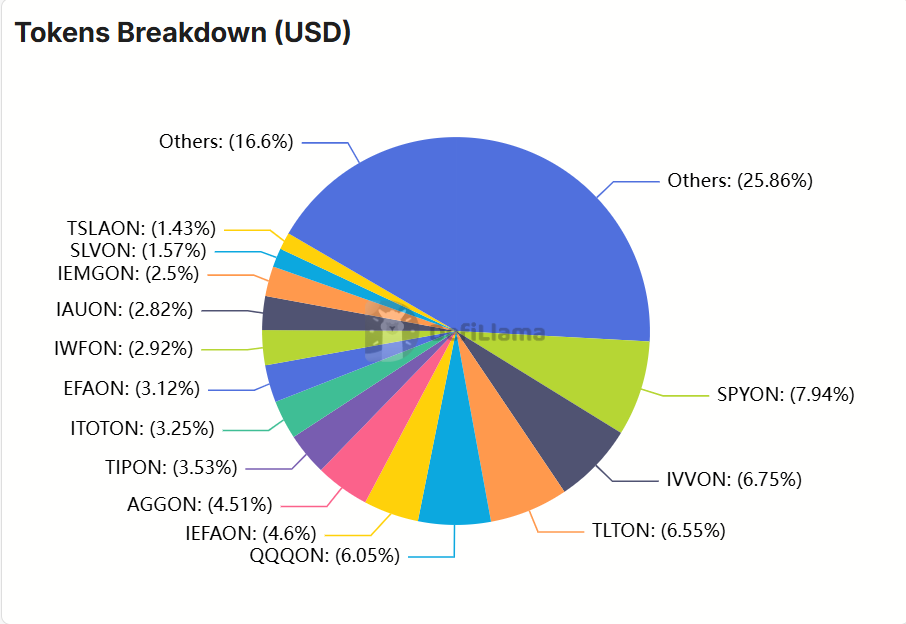

According to data from defillama.com, just 9 weeks after its launch, OGM's total locked assets (TVL) surged to $320 million, with cumulative on-chain trading volume exceeding $669 million, supporting over 100 tokenized U.S. stocks or ETFs, including the most representative assets like SPY, Apple, Tesla, NVIDIA, and QQQ.

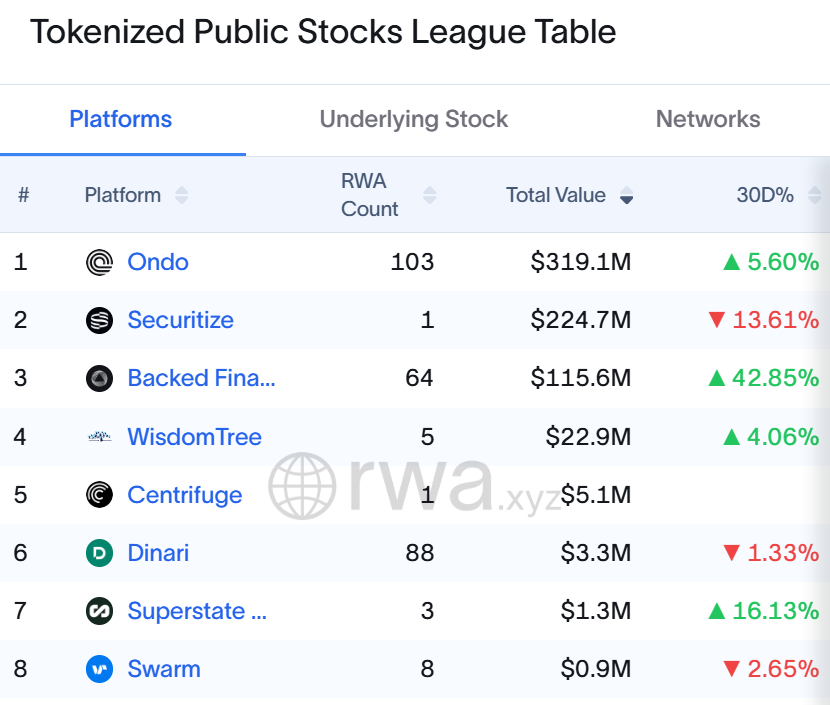

At the same time, according to data from rwa.xyz, OGM ranks first in the stock tokenization sector in terms of asset quantity, funding scale, and market influence, becoming a core sample of the entire RWA narrative.

Born on Wall Street, Leading to the On-Chain World

Ondo's rapid growth is no coincidence. Its birth is a fusion of finance and crypto.

Founded in 2021, Ondo Finance has raised over $40 million, backed by traditional giants like BlackRock, Fidelity, and JPMorgan, as well as well-known crypto capital like Pantera and Coinbase Ventures. This not only provides financial support but also forms key complements in talent and business compliance pathways.

Co-founder Nathan Allman previously worked as a fixed-income trader at Goldman Sachs, deeply understanding the operational logic of traditional capital markets; over 80% of the team members come from institutions like Goldman Sachs, JPMorgan, and BlackRock, which ensures that Ondo can align its product design, custody and brokerage connections, and KYC/AML processes with the expectations and regulatory requirements of traditional markets.

This "dual lineage" means that Ondo emphasizes process, compliance, and auditability when advancing on-chain innovation: from custody arrangements and clearing connections to investor access thresholds and compliance reporting mechanisms, every step Ondo takes must establish verifiable links between "on-chain operability" and "off-chain compliance." This approach may slow down product iteration in the short term, but significantly reduces institutional risk in the long term, making institutional funds and regulated participants more willing to experiment and scale.

BNB Chain: From Retail Paradise to Compliant RWA Hub

For a long time, BNB Chain has been associated with a large number of daily active users, low transaction costs, and an active DeFi ecosystem. These characteristics have made it the preferred "traffic hub" for global retail investors, but they also mask a key shortcoming—insufficient compliance capacity for institutional-grade assets. Large-scale traffic and decentralized application ecosystems do not inherently equate to the institutional trust foundations and partner endorsements required for regulated securities (such as U.S. stocks and ETFs).

Now, Ondo Global Markets' choice to integrate with BNB Chain is not just a routine technical integration but a narrative complement: institutional assets and retail traffic finally meet in the same system. BNB Chain boasts over 3.4 million daily active users, and the ecosystem contains deep trading scenarios and decentralized exchanges (like PancakeSwap), which can quickly accommodate the liquidity paths for tokenized securities, rapidly pushing "compliant targets" to a broader global retail user base.

Notably, BNB Chain has listed RWA as one of its strategic priorities for its ecosystem in 2025 and has launched incentive and technical support programs for RWA projects, covering compliance guidance, liquidity incentives, and market promotion. Ondo's entry may serve as a "demonstration sample" for this plan. It allows BNB Chain's RWA ecosystem to transition from concept to substance and opens a direct channel for global retail investors to access U.S. stocks.

The Inclusiveness of RWA: From Silicon Valley to Emerging Markets

For Ondo, choosing BNB Chain is also a strategic turning point from high-end institutional services to the global retail market. A significant proportion of daily active users on BNB Chain come from emerging markets in Asia and Latin America—where retail users are often limited by domestic market access, brokerage thresholds, and cross-border settlement costs. For them, OGM offers not just a flashy experience of "buying a share of Tesla," but an operational channel with low barriers to participate in global assets.

The significance of RWA here is not just "assets on-chain," but making "financial participation rights" inclusive—allowing shareholding to no longer depend on geography, identity, or thresholds, enabling anyone globally to become part of the capital market.

From a branding and growth perspective, this step will significantly enhance Ondo's brand recognition: it will no longer just be synonymous with "compliant RWA in Silicon Valley," but has the opportunity to become a representative platform for "bringing Wall Street assets to ordinary users worldwide."

Conclusion: RWA, More Than Just Assets on Chain

When we look back at this wave, it is not hard to find that when people talk about RWA, they always focus on "what assets to move on-chain." But the real revolution lies not in "transportation," but in "reconstruction."

RWA redefines the underlying logic of the financial system: ownership can be divided, returns can be automatically distributed, and liquidity can be more efficiently bridged across multiple markets and protocols. More importantly, it has the potential to transform the capital market from a system constrained by trading hours, settlement cycles, and geographical limitations into a more continuous, composable, and globally accessible network.

Ondo Finance may be becoming one of the most symbolic names in this transformation. It serves as both a bridge and a testing ground—seeking a new balance between compliance and decentralization, between institutions and retail. And when it partners with BNB Chain, this balance is pushed to a larger dimension: RWA is no longer just a tokenized container for institutional assets but a new entry point for global capital flow.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。