Author: Aki Wu on Blockchain

At the end of October 2025, Nvidia's stock price reached a new all-time high, with its market capitalization surpassing the $5 trillion mark, making it the first company in the world to cross this valuation threshold. Since the launch of ChatGPT at the end of 2022, Nvidia's stock price has increased more than 12 times. The AI revolution has not only driven the S&P 500 index to new heights but has also sparked discussions about a technology valuation bubble. Today, Nvidia's market capitalization even exceeds the total size of the entire cryptocurrency market. In terms of global GDP rankings, Nvidia's market value is second only to the United States and China. It is remarkable that this super star of the AI era once had a "honeymoon period" in the cryptocurrency field. This article will review the tumultuous past of Nvidia and the cryptocurrency mining industry, as well as why it chose to pivot towards its core AI business.

The Cryptocurrency Bull Market Frenzy: Gaming GPUs Turned into "Money Printing Machines"

Looking back at Nvidia's history is like a legendary tale of the continuous evolution of technology narratives. Founded in 1993, Nvidia made its mark by inventing the GPU (graphics processing unit), riding the wave of the PC gaming boom in the late 1990s, with its GeForce series of graphics cards achieving great success, quickly rising to dominance in the graphics card market. However, as the gaming market gradually saturated and growth slowed, Nvidia faced challenges with unsold inventory. Fortunately, opportunities always favor the prepared—one significant turning point was the cryptocurrency boom.

In 2017, the prices of cryptocurrencies like Bitcoin and Ethereum skyrocketed, igniting a "mining" frenzy. Since GPUs are highly suitable for parallel computing for mining, global miners scrambled for graphics cards, turning GPUs into money printing machines, with soaring prices and high demand. Nvidia became one of the biggest winners behind this cryptocurrency bull market, reaping substantial profits from card sales.

Starting in the second half of 2020, the cryptocurrency market made a comeback after two years of winter. Bitcoin's price surged from under $15,000 mid-year to over $60,000 at the beginning of 2021, while Ethereum rose from a few hundred dollars to over $2,000. This new round of soaring coin prices reignited the graphics card mining frenzy. Miners rushed to buy the new generation of GeForce RTX 30 series graphics cards, leading to a shortage of high-end cards originally intended for gamers, and the market fell into a "supply-demand imbalance" frenzy once again. When the RTX 30 series was launched, its high performance and cost-effectiveness delighted gamers, but as Ethereum mining profits skyrocketed, the actual prices of these graphics cards were pushed to outrageous levels, with the suggested retail price of the RTX 3060 at 2,499 yuan being traded at 5,499 yuan in the market, and the flagship RTX 3090 even reaching nearly 20,000 yuan.

However, the ongoing shortage of graphics cards brought the conflict between gamers and miners to the forefront. Nvidia chose a "dual-track" response, reducing the Ethereum hash rate for the GeForce cards aimed at gamers (starting with the RTX 3060), but it was later discovered that this was merely a temporary fix. Miners found that by plugging a "dummy HDMI" into the RTX 3060, it tricked the card into thinking other GPUs were also functioning as display adapters, thus bypassing the hash rate limits in multi-card setups and allowing for full-speed mining.

Andreas demonstrated this on his Twitter

On the other hand, Nvidia launched the Cryptocurrency Mining Processor (CMP) series specifically for miners, attempting to "divert" the demand. The official blog stated: "GeForce is born for gamers, CMP is born for professional mining." CMP would eliminate display outputs and open up the design to improve airflow in densely packed mining rigs, while lowering peak voltage/frequency for stable energy efficiency. However, due to CMP's lack of display output and shorter warranty period, it was harder for miners to exit, while GeForce cards could both mine and be refurbished for resale to unfortunate gamers, offering better residual value and liquidity. Ultimately, this project made a lot of noise but had little impact, fading from public view.

According to Nvidia's financial reports, in the first quarter of 2021, graphics card sales for "mining" accounted for a quarter of the season's shipments, with sales of cryptocurrency-specific chips (CMP series) reaching $155 million that quarter. Boosted by the cryptocurrency boom, Nvidia's revenue for the entire year of 2021 soared to $26.9 billion, a 61% increase from the previous year, and the company's market capitalization briefly surpassed $800 billion.

However, this good fortune did not last long. On May 21, 2021, the Financial Stability Committee of the State Council of China proposed a crackdown on Bitcoin mining and trading activities. Subsequently, mining operations in Xinjiang, Qinghai, Sichuan, and other regions were shut down, and the mining business quickly "hit the brakes." Between that month and the next, Bitcoin's hash rate and price came under pressure, forcing miners to relocate or liquidate their equipment. By September 24, the central bank and multiple departments issued a joint notice categorizing all virtual currency-related transactions as illegal financial activities and called for an "orderly exit from mining" nationwide, further tightening policies.

For miners in Huaqiangbei, the cycles of boom and bust have become commonplace. Those who experienced the "mining disaster" collapse in early 2018 still remember it vividly; some exited quietly, while a few persevered through the winter, putting unsold mining machines into self-operated mining farms, waiting for the next market cycle. It turned out that the bull market of 2020-2021 allowed those who held on to turn their fortunes around.

In September 2022, a milestone event occurred in the cryptocurrency industry when the Ethereum blockchain completed its "merge" upgrade, transitioning from a proof-of-work (PoW) mechanism to a proof-of-stake (PoS) system, eliminating the need for large numbers of GPUs for mining. This marked the end of the GPU mining era that had lasted for years. With the special demand from cryptocurrency miners gone, the global graphics card market quickly cooled down, directly impacting Nvidia's performance. In the third quarter of 2022, Nvidia's revenue fell 17% year-on-year to $5.93 billion, with net profit dropping 72% to $680 million. Nvidia's stock price fell to around $165 in 2022, nearly halving from its peak, and the previous cryptocurrency windfall quickly turned into a burden on performance.

Drawing the Line: Nvidia's Breakup with the Mining Industry

Faced with the frenzy of the mining sector and complaints from gamers, as well as the issues brought about by cyclical profits, Nvidia gradually realized that it needed to seek balance amid the cryptocurrency mining wave and timely "draw the line" with it. With the bubble concerns brought on by soaring coin prices, the company also faced challenges in financial compliance. The U.S. Securities and Exchange Commission (SEC) later investigated and found that Nvidia had failed to adequately disclose the contribution of cryptocurrency mining to the revenue growth of its gaming graphics card business for two consecutive quarters in fiscal year 2018. This was deemed improper disclosure. In May 2022, Nvidia agreed to settle with the SEC and pay a $5.5 million fine. This incident prompted Nvidia to reassess its delicate relationship with the cryptocurrency industry; while the mining boom brought considerable profits, its volatility and regulatory risks could also backfire on the company's reputation and performance.

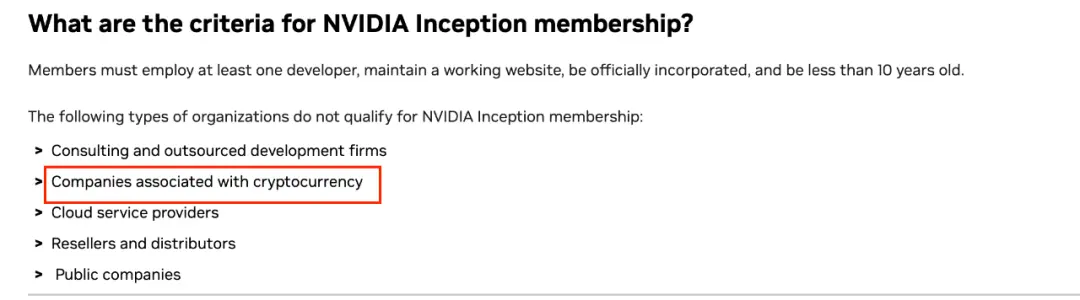

After Ethereum transitioned to PoS in 2022, the demand for GPU mining plummeted, and Nvidia's gaming graphics card business quickly returned to normal supply and demand. Jensen Huang has repeatedly emphasized that the company's future growth drivers will mainly come from artificial intelligence, data centers, and autonomous driving, rather than relying on speculative businesses like cryptocurrency. It can be said that after experiencing a peak and cooling of the "mining card craze," Nvidia decisively drew a line with this highly volatile industry, channeling more resources into the broader and more socially valuable AI computing landscape. Additionally, Nvidia's latest website for the AI startup Inception program clearly lists "ineligible organization types," including "companies related to cryptocurrency," indicating that Nvidia explicitly wishes to distance itself from its past cryptocurrency acquaintances.

So, after fully embracing the AI industry, is there still an intersection between Nvidia's chip business and the cryptocurrency sector? On the surface, since Ethereum bid farewell to the "mining era," the connection between GPUs and traditional cryptocurrency mining has significantly weakened. Mainstream cryptocurrencies like Bitcoin have long used dedicated ASIC mining machines, and GPUs are no longer the "hot commodity" they once were among cryptocurrency miners. However, the two fields are not entirely disconnected, and new points of convergence are emerging in different forms.

Some companies that once focused on cryptocurrency mining are shifting their business focus to AI computing services, becoming new customers for Nvidia. Moreover, traditional Bitcoin mining companies are beginning to explore using surplus electricity and space resources to undertake AI computing tasks. Some large mining companies have recently replaced some of their mining-specific chips with GPU hardware for training AI models, as they see AI training as a more stable and reliable source of income compared to the turbulent cryptocurrency mining.

The Biggest Beneficiary of the AI Gold Rush—Nvidia Selling "Shovels"

In November 2022, OpenAI's ChatGPT burst onto the scene, creating a huge sensation globally with AI large models. For Nvidia, this undoubtedly represents another "once-in-a-century" opportunity bestowed by fate. The world suddenly realized that to power these "compute-hungry" AI monsters, Nvidia's GPU hardware support is indispensable.

After the explosive popularity of ChatGPT, major tech companies and startup teams flocked to the "large model" track, leading to an explosive growth in the computing power required to train AI models. Nvidia keenly captured this essence: no matter how technology changes, computing power will always be the foundational currency of the digital world.

Currently, Nvidia holds over 90% of the market share for large model training chips. The A100, H100, and the new generation Blackwell/H200 GPUs have become the industry standard for AI accelerated computing. Due to demand far exceeding supply, Nvidia possesses extraordinary pricing power and profit margins on high-end AI chips. According to Goldman Sachs, from 2025 to 2027, the capital expenditures of just five major cloud service providers—Amazon, Meta, Google, Microsoft, and Oracle—are expected to approach $1.4 trillion, nearly tripling compared to the previous three years. These substantial investments solidify the foundation behind Nvidia's sky-high market value.

However, there was a "cost reduction and efficiency improvement" shockwave in the AI field—the explosive popularity of the open-source large model DeepSeek. The DeepSeek project claimed to have trained the DeepSeek V3 model, which performs comparably to GPT-4, at an extremely low cost of approximately $5.576 million, followed by the launch of the ultra-low inference cost R1 model.

At that time, the industry was in an uproar, with many predicting doom for Nvidia, believing that the emergence of such low-cost AI models meant that small and medium-sized enterprises could deploy large models with fewer GPUs, potentially impacting the demand for Nvidia's high-end GPUs. "Will the demand for AI computing power be replaced by an efficiency revolution?" became a hot topic of discussion. As a result of these expectations, Nvidia's stock price plummeted, closing down about 17%, evaporating approximately $589 billion in market value in a single day (one of the largest single-day market value losses in U.S. stock market history).

However, just a few months later, it was proven that this concern was a case of missing the forest for the trees. The impact of DeepSeek did not reduce the demand for computing power; rather, it triggered a new surge in computing power demand. Its technological approach essentially achieved "computing power equity"—by innovating algorithms and model distillation, it significantly lowered the hardware threshold for large models, allowing more institutions and enterprises to afford AI applications. On the surface, it seemed that due to improved model efficiency, "less computing power was needed"; but in reality, the DeepSeek phenomenon greatly popularized AI applications, leading to an exponential increase in computing power demand. Numerous enterprises rushed to integrate DeepSeek, sparking a wave of AI applications, with inference computing quickly becoming the new mainstay of computing power consumption. This validated the famous "Jevons Paradox"—that improvements in technological efficiency can actually accelerate resource consumption. DeepSeek lowered the barriers to AI, leading to a surge in applications, resulting in even greater shortages of computing power resources.

It has been proven that whenever a new AI model is born, it often means a new wave of GPU orders follows. The more AI innovations there are, the stronger Nvidia becomes, and this was once again validated during the DeepSeek incident. Nvidia's financial report released in February 2025 showed that its data center business significantly exceeded expectations. More fundamentally, DeepSeek's success was not a threat to Nvidia; rather, it indicated that "cost reduction and efficiency improvement" would lead to larger-scale application expansion, thereby increasing overall demand for computing power. This time, DeepSeek became the new fuel for Nvidia's computing power empire.

As AI pioneer Andrew Ng said, "AI is the new electricity." In an era where AI is akin to electricity, computing power suppliers like Nvidia undoubtedly play the role of power companies. Through vast data centers and GPU clusters, they continuously supply "energy" to various industries, driving intelligent transformation. This is also the core logic behind Nvidia's market value soaring from $1 trillion to $5 trillion in just two years—there has been a qualitative leap in global demand for AI computing power, with tech giants around the world competing to invest in a funding arms race for computing power procurement.

After reaching a market value of $5 trillion, Nvidia's influence and scale have even surpassed that of many national governments in economic terms. Nvidia is no longer just a "graphics card" manufacturer that makes game graphics smoother; it has transformed into the fuel of the AI era, becoming the recognized "shovel seller" in this gold rush. As its scale increases, the wealth creation myth surrounding Nvidia employees continues to circulate in the industry, with many Nvidia employees' stock holdings even surpassing their annual salaries. Nvidia itself has achieved repeated self-leaps by continuously "telling" new technological narratives; gaming graphics cards opened the first door for it, the mining boom provided a second growth spurt, and AI has taken Nvidia to its true pinnacle.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。