As of today, the U.S. federal government "shutdown" has entered its 35th day, tying the historical record of 35 days from late 2018 to early 2019, making it the longest government shutdown in U.S. history.

This political deadlock began on October 1, triggered by the Senate's failure to pass a temporary funding bill, and so far, the temporary funding bill has been rejected 14 times in the Senate.

1. Shutdown Breaks Records, Economic and Livelihoods Impacted

This shutdown has dealt a substantial blow to the U.S. economy. The Congressional Budget Office estimates that based on the duration of the shutdown, the annual growth rate of U.S. real GDP in the fourth quarter will decline by one to two percentage points. KPMG Chief Economist Diane Swonk vividly described, "The negative impact of the shutdown will accumulate rapidly over time, like a snowball rolling down a hill, getting faster and larger."

The impact on livelihoods is particularly significant:

● Food Assistance: The federal food relief program, the "Supplemental Nutrition Assistance Program," has suspended the distribution of relief funds since November 1, marking the first time in its 60-year history that funds have been halted. Although the Trump administration agreed to use emergency funds to maintain half of this month's relief distribution after federal judges intervened, some states may take weeks or even months to resume.

● Healthcare Coverage: The new enrollment period for the Affordable Care Act has begun, but due to the two parties' failure to reach an agreement on government subsidies, premiums for the 2026 plan year may rise significantly, affecting about 24 million enrollees.

● Air Traffic: Tens of thousands of air traffic controllers and security personnel are forced to work without pay, leading to staff shortages that have caused numerous flight delays or cancellations. U.S. Newsweek pointed out that this will further impact the tourism industry, business travel, and air freight.

2. Political Deadlock Continues, Both Parties Blame Each Other

The core reason for the prolonged shutdown is the deadlock between the two parties over healthcare welfare spending, while both sides are using the shutdown to advance their political agendas.

● On the Republican side, The Washington Post noted that the Trump administration hopes to use the shutdown to push for federal workforce reductions, close "Democrat-led agencies," and achieve the goal of "streamlining government" while expanding executive power.

● The Democrats, on the other hand, hope to strengthen party cohesion through a tough stance and shape healthcare welfare issues as a key topic for next year's midterm elections.

Both parties are shifting blame, with Trump stating he will not accept the Democrats' "extortion" and making it clear he has no intention of negotiating. Senate Democratic Leader Chuck Schumer criticized that in this shutdown dispute, "children, the elderly, the disabled, and working-class parents are being used as political pawns," and "hunger is being used as a weapon."

3. Analysis of Impact on the Crypto Market — Liquidity Drain and Structural Shock

The U.S. government shutdown is no longer just a political event; it has evolved into a systemic risk affecting the structure of the crypto market. From liquidity withdrawal to regulatory stagnation, the market is facing multidimensional stress tests.

Liquidity Crisis: The "Vampiric" Effect of TGA Accounts and Market Response

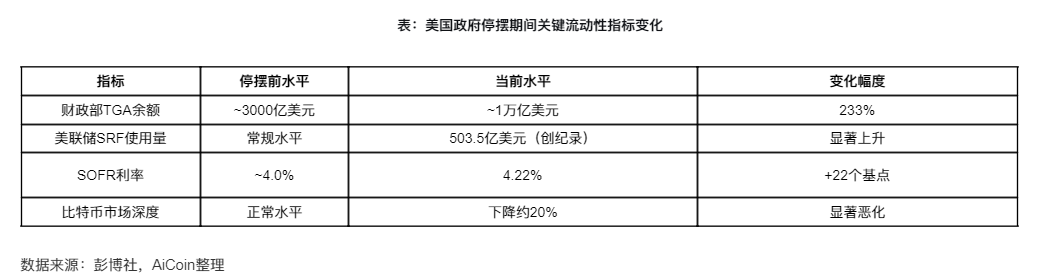

● TGA Account Expansion Drains Liquidity: Reports indicate that the Treasury General Account (TGA) balance has surged to $1 trillion during the shutdown, equivalent to about $700 billion in liquidity being drained from the market. This effect of fiscal tightening is comparable to multiple interest rate hikes, directly leading to capital outflows from risk assets.

● Financing Pressure Soars: The usage of the Federal Reserve's Standing Repo Facility (SRF) has reached record levels, indicating a dollar shortage among financial institutions. The secured overnight financing rate (SOFR) briefly soared 22 basis points to 4.22%, far exceeding the Federal Reserve's target rate range, causing actual financing costs to rise rather than fall.

● Bitcoin Liquidity Indicators Deteriorate: Although on-chain fundamentals remain stable, secondary market liquidity indicators such as market depth and bid-ask spreads have significantly worsened, exacerbating price volatility.

Price and Trading Aspects: Technical Breakdown and Derivatives Liquidation Wave

● Key Technical Levels Breached: Bitcoin has fallen below the 200-day moving average (109,380 USD) and is currently trading around 101,600 USD, down over 18% from the historical high in October.

● Massive Liquidation in the Derivatives Market: In the past 24 hours, over 470,000 people have been liquidated in the cryptocurrency market, with major liquidations occurring in leveraged long positions. This forced liquidation further amplifies downward pressure, creating a negative feedback loop.

● Increased Volatility Expectations: The implied volatility curve in the options market shows a surge in demand for protective put options, indicating that traders are preparing for potential further volatility.

Regulatory Vacuum and Policy Uncertainty

● Regulatory Process Stalled: CoinGecko analyst Bobby Ong pointed out that the shutdown has led to the government "no longer producing positive cryptocurrency news," with recent policy catalysts such as ETF approvals and legislative clarifications all put on hold.

● Data Black Hole Intensifies Uncertainty: Due to the Labor Statistics Bureau's suspension of work, the release of key economic data (such as non-farm payroll reports) has been indefinitely postponed. Federal Reserve Chairman Powell admitted to "driving in the fog," lacking sufficient data for decision-making.

Market Structure Changes: Risk Aversion and the Role of Stablecoins

● Increased Use of Stablecoins: During extreme volatility, the trading volume of USDT and USDC has significantly increased, indicating that investors are using stablecoins as a temporary safe haven.

● Institutional Activity Cooling: Data from regulated exchanges and ETF funds show that institutional participation has noticeably declined during the shutdown, partly due to operational uncertainties (such as the inability to verify bank accounts).

4. Expert Opinions and Market Sentiment

● Bitunix Analyst Team: "Expectations of interest rate cuts are favorable for risk assets, but concerns about bubbles and political risks have intensified short-term volatility. For cryptocurrencies, this brings both liquidity support and increased downside uncertainty. In the medium term, confirmation of rate cuts will improve liquidity and support risk assets. However, in the short term, concerns about bubbles and the risks of government shutdown have heightened vulnerability, making significant 'downward rebounds' more likely."

● Mark Zandi, Chief Economist at Moody's Analytics: "The current U.S. economy is already fragile, so events like a government 'shutdown' could evolve into a larger crisis more quickly than people expect." He added, "When market confidence begins to crack, the overall economy will reach a critical tipping point. When this confidence crisis truly spreads and affects the overall economy, the first to be impacted will be market confidence—consumer confidence, business confidence, and investor confidence will all be affected."

● Joe Brusuelas, Chief Economist at RSM: "This is not just a simple delay or postponement of economic activity; it will cause some economic activities to completely disappear."

Current market sentiment shows a clear divergence, with short-term uncertainty leading investors to remain cautious, but medium-term optimism still exists.

On one hand, the policy uncertainty brought about by the government shutdown and the absence of key economic data make traders inclined to reduce risk exposure; on the other hand, the positive expectations for Bitcoin's traditional performance in the fourth quarter and the anticipation of liquidity release after the shutdown are supporting long-term market confidence.

5. Risk Warnings and Future Dynamics Tracking

● Escalating Liquidity Risk: If the shutdown continues, the Treasury's cash balance may further increase, draining more liquidity from the market. Bank of America liquidity experts warn that this could create a self-reinforcing vicious cycle, potentially triggering a repo crisis similar to that of September 2019 if left unaddressed.

● Regulatory Risk Delayed Release: Currently, SEC investigation activities are frozen due to the shutdown, but once the government restarts, regulatory agencies may act swiftly to strengthen regulatory scrutiny in areas such as digital asset fiscal strategies, potentially issuing subpoenas within 1-2 months.

● Market Confidence Collapse Risk: Mark Zandi of Moody's Analytics warned that if the shutdown continues past Thanksgiving, "the economy will struggle to recover quickly." When market confidence begins to crack, the overall economy will reach a critical tipping point, potentially triggering broader sell-offs of risk assets.

Core Dynamics Tracking:

Government Restart Timeline: Closely monitor whether the Senate can reach a compromise on the temporary funding bill in the coming days. Reports indicate that Senate Majority Leader John Thune has proposed a potential solution that combines a short-term spending bill with a vote on extending subsidies for the Affordable Care Act. Some Republican lawmakers predict the deadlock may end this week.

Federal Reserve Policy Signals: The direction of the Federal Reserve's December policy meeting is crucial. Despite a recent 25 basis point rate cut, Fed Chairman Powell stated that there are "divergent views" in the discussions regarding December's policy direction, and whether further rate cuts in December are "far from certain." Subsequent statements from the Fed will provide clearer directional guidance for the market.

The record shutdown of the U.S. federal government is impacting financial markets on multiple levels, with the cryptocurrency market, as a significant component of risk assets, facing short-term pressures from tightening liquidity while potentially benefiting from liquidity release after the shutdown ends.

The current market is in a state of high uncertainty, and investors should closely monitor the progress of resolving the political deadlock in Washington and the restoration of key economic data releases, as these factors will provide important signals for market direction.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。