The market's recovery requires the joint efforts of exchanges and retail investors.

Written by: WhiteRunner

The "1011" incident ignited the entire cryptocurrency market, with a staggering $19.2 billion in liquidations in the futures market overnight, setting a historical record. In the following weeks, Bitcoin plummeted below $100,000, leading to widespread despair—meanwhile, mainstream exchanges continued to take a series of actions.

Review of the "1011" Incident: The Largest Liquidation in Crypto History

October 11, 2025, will undoubtedly be recorded in the annals of the industry. The global cryptocurrency market experienced the darkest six hours in history. Following U.S. President Trump's announcement of a 100% tariff on Chinese goods, the market fell into a panic sell-off, triggering a chain of liquidations. Within 24 hours, the liquidation amount in the futures market reached $19.2 billion, setting a record for the largest liquidation in cryptocurrency history. This not only surpassed the $3 billion record of the "312 disaster" in 2020 but also exceeded the total of several previous large liquidation events. In a short time, Bitcoin dropped by about 13.5%, many altcoins crashed, and some small-cap tokens nearly went to zero. After several weeks of volatility, the market again saw a significant drop on November 4, with Bitcoin falling below the $100,000 mark, hitting a nearly five-month low, reigniting despair among retail investors. These events shook the market's trust in the safety and compliance mechanisms of exchanges, prompting a significant flow of funds to leading platforms in search of higher transparency and risk protection.

In the aftermath of the "1011" incident, mainstream exchanges Binance, Bitget, OKX, and Bybit almost simultaneously initiated response measures. As market confidence gradually warmed, the "listing rhythm" became an important signal for exchanges to demonstrate trust and execution capability. Each platform conveyed its stability and selection criteria through different strategies, but with a common goal: to rebuild user trust through transparency, project quality, and risk control systems. The listing activities during this period also shifted from "traffic competition" to a competition of risk control capabilities and ecological resilience, marking the cryptocurrency space's entry into a new phase centered on "compliance, stability, and value selection."

This article will analyze the underlying causes, strategic differences, and potential impacts of this series of activities, attempting to restore the framework of exchange competition behind the events for readers and provide key indicators for future observation.

Overview of Mainstream Exchanges

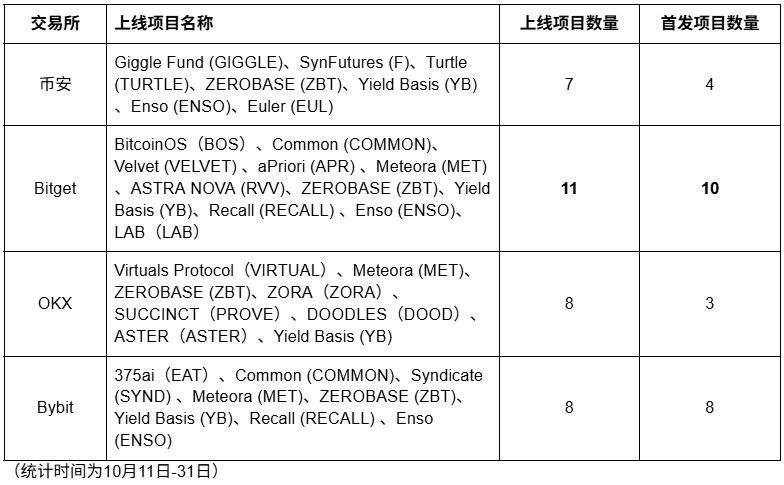

From a data perspective, from October 11 to 31, 2025, the four major exchanges launched more than 30 projects, setting a new high for the year. This not only reflects the speed at which exchanges are regaining confidence but also reveals the differentiated strategic directions of each platform.

Here is an overview of the overall data:

It can be seen that Bitget stood out with 11 projects launched, 10 of which were new listings, with an average market cap of $280.6 million for the new projects, making it the most prominent performer. Although Binance had fewer new listings, its projects generally possessed BSC ecological attributes, reflecting a strategic focus. OKX mostly chose high FDV projects, such as ZORA and SUCCINCT, representing its continued strengthening of its position as a "high-end project aggregation hub." Bybit, on the other hand, adopted a strategy of maximizing the number of new listings to capture market attention, but the market cap of its projects fluctuated significantly.

The listing landscape during this phase essentially reflects the accelerating formation of "differentiated positioning" among exchanges: Binance maintains its ecological moat; Bitget focuses on the quality and speed of new listings; OKX emphasizes stability and brand trust; Bybit pursues traffic and short-term effects.

Therefore, in the coming period, investors need not only to "find projects" but also to choose "which platform to find the right projects."

Binance: Seeking Change Amid Stability and Ecological Construction

Binance maintained its consistent steady pace. From October 11 to 31, Binance launched a total of 7 projects, of which 4 were new listings, with an average market cap of $267.3 million for the new projects.

Binance's logic for selecting new listings is significantly different from other exchanges: it prioritizes projects with a high correlation to the BSC ecosystem, such as Giggle Fund (GIGGLE) and SynFutures (F), both closely linked to its on-chain ecosystem, aiming to strengthen its ecological moat and consolidate the long-term value system that the BSC chain is striving to build.

Although Binance's performance in October was not spectacular, it was steady and precise, representing a typical form of a mature exchange: it prefers to list fewer projects but ensures that each new listing aligns with its ecological goals. For investors, choosing new projects on Binance may not yield as rapid returns as Bitget, but it offers higher certainty, lower volatility risk, and stable long-term value.

Bitget: Building a High-Quality New Listing Moat

If the listing battle in October was a contest among heroes, then Bitget was undoubtedly the protagonist of the month. From October 11 to 31, Bitget launched 11 projects, 10 of which were new listings, covering multiple sectors—from DeFi, AI to GameFi.

At the same time, the quality and market cap levels of Bitget's new listings far exceeded those of its peers. Its new projects had an average FDV of $280.6 million, with a stable overall distribution: 5 projects had a market cap exceeding $200 million, and all remaining projects were above $80 million, with no "air coins" or low market cap tokens. Thus, Bitget not only leads in quantity but also performs strongly in quality.

Bitget's strategy is also very clear:

Prioritize launching high-potential projects to capture the first wave of market traffic;

Bitget Onchain challenge mechanism provides a secondary listing channel for quality projects;

Bitget spot 100% lists on Binance Perp, becoming the "front station for Binance Perp."

For investors, this strategy means a stronger price discovery effect and safety margin. Once a project can launch on Bitget, it has essentially passed dual verification from the market and risk control. This is why, starting in late October, Bitget can be said to be a "new generation quality project incubator."

OKX: Focusing on Completing Ecological Integrity

OKX launched a total of 8 projects, of which only 3 were new listings. Although it does not have an advantage in quantity, from the project perspective, OKX's selection criteria mainly focus on high FDV and high recognition, such as ZORA, SUCCINCT, and Virtuals Protocol. This reflects OKX's emphasis on maintaining brand quality and ecological integrity. For example, SUCCINCT (PROVE) corresponds to Layer 2, while DOODLES and ZORA correspond to NFTs, echoing OKX's recent expansion strategy into the Web3 ecosystem.

OKX is attempting to build its unique competitiveness in an ecological manner.

Bybit: Pursuing Diversity and Short-Term Volatility

Bybit launched 8 projects, all of which were new listings. However, the data shows that there is a significant disparity in the market caps of Bybit's new projects— the highest, Yield Basis (YB), has an FDV of $573 million, while the lowest, 375ai (EAT), is only $36 million, a difference of nearly 16 times. This huge gap indicates that Bybit places more emphasis on diversity and potential explosiveness in project selection rather than stability.

Bybit's strategy shares similarities with Bitget: attracting short-term funds and high-risk preference investors through a large number of new listings, which is a "traffic-oriented listing logic." However, among Bybit's new listings, small-cap coins exhibit significant volatility, requiring investors to be relatively cautious.

Therefore, for ordinary investors, Bybit is suitable for a "short-term speculative" strategy—quickly discovering hotspots, participating in short-term rallies, and strictly implementing profit-taking and stop-loss measures.

Three Key Indicators for Investors to Focus On

In today's cryptocurrency landscape, relying solely on "hearing news" or "chasing trends" is no longer sufficient to judge the quality of projects. Understanding the listing logic and project data behind exchanges is key to reducing risks and increasing returns. The following three indicators are the most worthy of attention for investment reference after 2025:

FDV: FDV represents the total valuation of a project after all tokens are fully released. A high FDV means limited short-term growth potential, while a low FDV may reflect a lack of market trust in the project. It is recommended to prioritize medium-sized projects with an FDV between $100 million and $400 million, as they offer the best balance of risk and potential.

Balance of New Listing Quantity and Quality: Frequent new listings often indicate that an exchange is in an expansion cycle, but project quality remains important. It is advisable to pay attention to the "new listing density to project quality ratio" of exchanges; be cautious of high-density listings with low market caps.

Subsequent Completeness and Ecological Support: Non-new listing projects often reflect the completeness of an exchange's ecosystem. For example, OKX and Binance enhance their project ecosystem (NFTs, DeFi, AI, etc.) to provide users with a multi-layered asset experience. It is recommended to prioritize investments in exchanges that maintain a stable rhythm of ecological completeness and can interact with other leading exchanges.

In summary, investors should replace "emotion-driven trend chasing" with "data-driven rational decision-making." Only by understanding the strategic direction and listing standards of exchanges can one find stable income anchors amid volatility.

Data Trend Forecast: Three Major Directions Likely to Continue in Q4

Based on the new listing data and market feedback from October, it is expected that the exchange landscape in Q4 will continue the following three major trends:

Binance may strengthen its ecological listing strategy: As the activity on the BSC chain rebounds, Binance is likely to list more projects linked to the BSC ecosystem, such as GameFi and AI interactive assets. Its strategy will shift from "defensive repair" to "ecological expansion."

Bitget's leading position in new listings will be further strengthened: The Onchain challenge mechanism has attracted a large number of quality project applications for listing qualifications. It is expected that in November, Bitget will maintain a rhythm of 1-2 new listings per week, continuing to consolidate its position as the "king of new listings."

Bybit and OKX will compete in the non-new listing market: Bybit may begin to fill in some high FDV projects to enhance platform credibility, while OKX may moderately accelerate its new listing pace in an attempt to regain topicality. This cross-competition will bring more vitality to the market in November.

Overall Judgment: Q4 of 2025 will be a phase of "parallel new listings and completions, mutual progress of trust and ecology." The listing strategies of exchanges are becoming more rational and systematic, and short-term speculation in the market will gradually give way to structural investment opportunities.

Opportunities in Crisis: Rebuilding Trust and Order Amidst Turbulence

The sharp decline since the "1011" incident has plunged the market into despair, with many retail investors losing confidence amid continuous volatility. However, it is precisely this reflection and adjustment during a crisis that provides new opportunities for the market. Exchanges are gradually shifting from "speed competition" to "quality and structural competition," leading the market towards rationality and balance, and offering more choices for investors with different risk preferences.

The market recovery following the "1011" incident is a critical period for rebuilding trust. Although the crash has shaken investors, the market has not completely collapsed; instead, it has ushered in a window for rebirth. If investors can understand the listing strategies of exchanges and align them with their own risk preferences, there are still opportunities to achieve stable returns in future structural markets.

However, this is not solely the responsibility of exchanges. The market's recovery requires the joint efforts of exchanges and retail investors. Exchanges must enhance compliance and risk control to provide safer platforms, while the rationality and patience of retail investors are equally important. Only by maintaining confidence and working together can the cryptocurrency space emerge from the trough and embrace a more stable future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。