Overall, projects that are predatory and speculative seem to be gradually heading towards collapse.

Author: washed

Translation: Deep Tide TechFlow

The Retreat of Short-Term Speculation?

First, let me clarify that this article is written from the perspective of someone who loves speculation. I am an avid cryptocurrency and real-world betting enthusiast, as well as a sports betting player, crypto trader, and so on. These activities have accompanied my life since I can remember, and they may continue in a more responsible manner in the future. However, I am not someone who has lost everything in the past month, so this article is not born out of resentment, but rather a sense of fatigue? This fatigue does not stem from losing money, but from other factors.

Since 2020, it feels like we have been in a speculative bull market, and "memecoins" seem to have become the perfect pinnacle of this period. It can be said that this form of speculation is one of the most profitable ways to make money so far, and one of the few means that can completely change your life in a relatively short time with a high hit rate.

I believe part of the appeal of speculation lies in its rebellious nature—doing something that is usually scoffed at by others. However, in the past few years, this attitude has undergone a 180-degree shift. Speculation has quickly transformed from a behavior to be avoided to a ubiquitous phenomenon. Nowadays, we are basically being "force-fed" speculation, and naturally, its appeal is not what it used to be, as it now feels like no longer a choice but a forced acceptance.

Cryptocurrency / Stock Market

While writing this article, I saw a tweet from TJR that aligns with my viewpoint. I see short-cycle trading styles (whether in stocks or cryptocurrencies) as a way to chase quick money, and a rough means of making money. Recent market fluctuations (which can be described as a "market shock") have opened many people's eyes, and we are starting to see the outcomes of these short-term games. For more than the past three years, we have been in a "far-left curve" market (note: referring to an extreme market where even "mindless" operations can be profitable), where "novice" investors often perform better than experienced investors. But perhaps it is time for truly capable individuals to regain control of the market? Like the model of Julian Petroulas? For those who have not yet succeeded and whose capital is not sufficient to achieve significant returns, this trend may be bad. But overall, the atmosphere I sense is that the market is moving in this direction.

Prediction markets can also be included in this discussion, as they are built on cryptographic technology. Overall, I feel that prediction markets are overhyped. However, I do like Polymarket and am not too concerned about other overly marketing-focused versions (such as some unmentioned projects). It may be more meaningful to bet through Polymarket than through traditional sports betting platforms.

Traditional Speculation

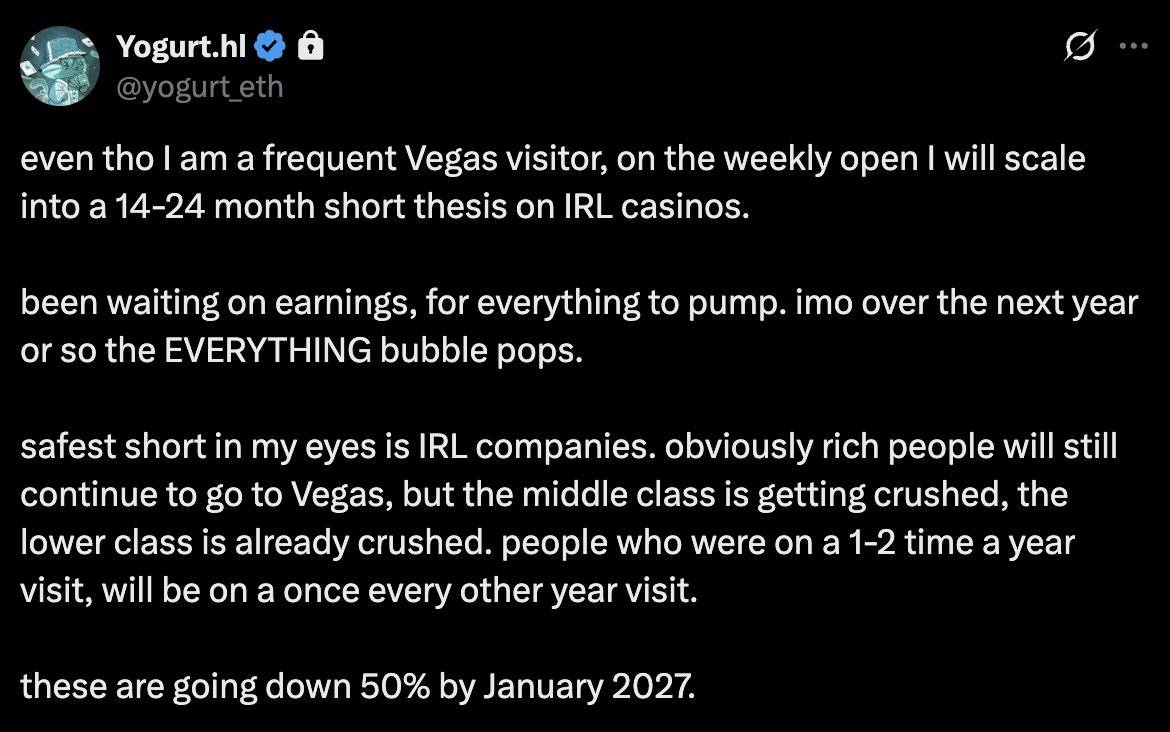

A brilliant long article by Yogurt aligns perfectly with my viewpoint. I won't go into detail about the real casino part here, as he has explained it more thoroughly than I could. If you follow him, I highly recommend reading that article.

As for online betting, crypto casinos, and sports betting, they all seem to have peaked for similar reasons. The prosperity of crypto casinos usually relies on the performance of the cryptocurrency market; when the crypto market is doing well, gamblers have disposable income for entertainment speculation. However, the overall market condition for cryptocurrencies is not optimistic right now, so I expect that if the crypto market enters a bear market, crypto casinos will also fall into a trough.

On the attention level, I don't see how sports betting can further scale or attract more users. They have already forcefully "shoved" sports betting into everyone's lives through various possible channels—basically, everyone who wants to participate is already participating. Although users are still addicted and will continue to bet, I expect this trend to gradually weaken. Users will either exit due to boredom or only place trivial bets for entertainment.

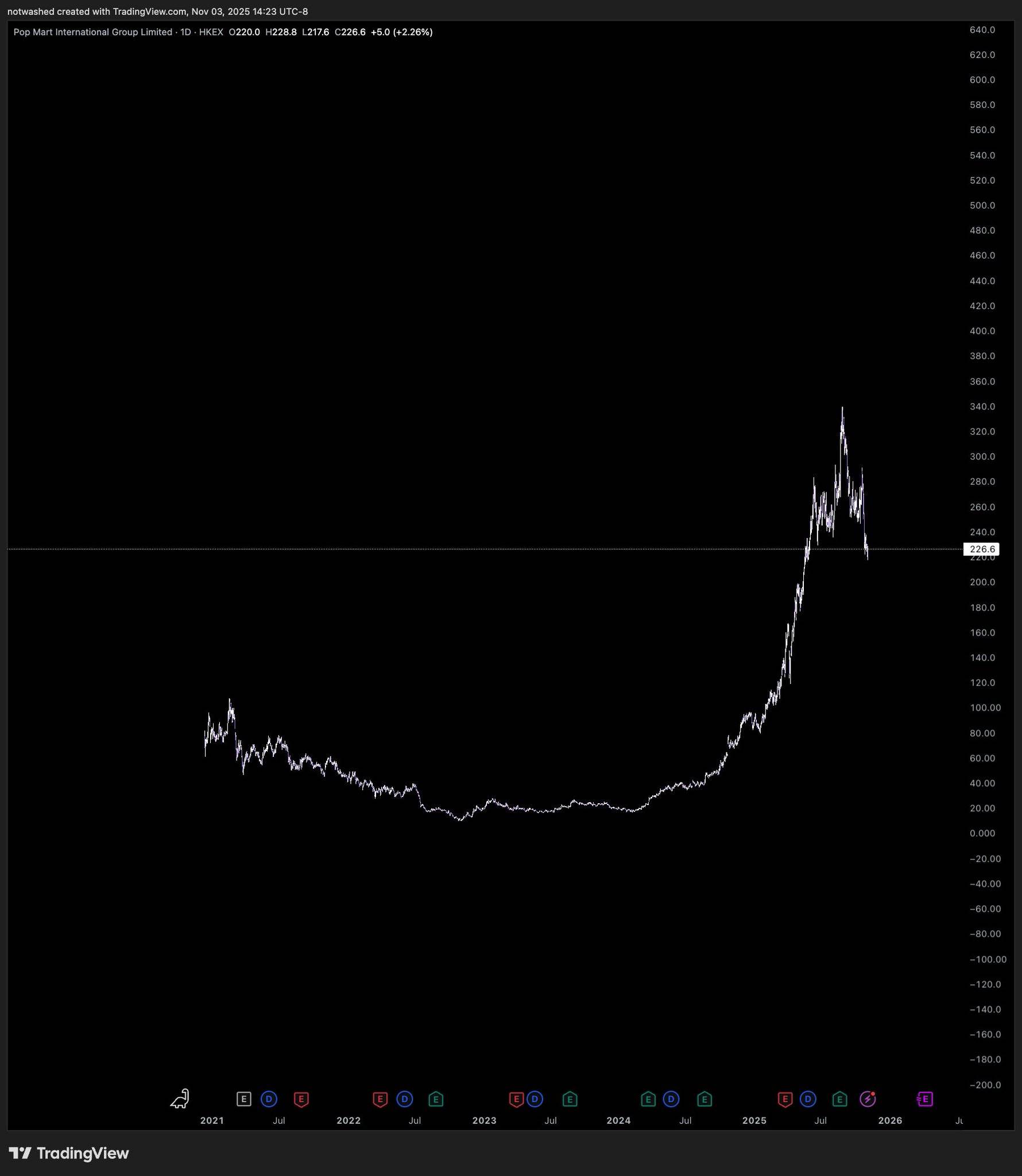

Invisible Speculation

I categorize trading card games (TCGs), Labubus, etc., as forms of invisible speculation—these things are essentially speculative but not so obvious, mainly targeting unsuspecting groups. This summer, Labubu reached its "bubble peak," but I have hardly heard anything about it since then. I don't think Pokémon has peaked yet, but it may reach a local high during the holiday season. Pokémon is a unicorn-level entity, so I wouldn't short it regardless. There may be new hotspots emerging in the coming years, as in the past, but overall, this field seems to have peaked with the "retreat" of Labubus.

Overall, projects that are predatory and speculative seem to be gradually heading towards collapse. This is actually an extension of a tweet I posted a few days ago. Although the title was just to attract attention, I did not intend to short any of the mentioned items—instead, I am more inclined to shift my focus towards long-term investments, supporting the "good people" who are truly creating interesting things, or striving to become one of them.

Legitimate products and teams like Hype, Robinhood, and Polymarket, I believe will still be the big winners—and in a beautiful way. What truly sets these "good people" apart is their clear intentions: they are completely different from those projects that only want to empty your wallet. Although Robinhood faced criticism due to the GME incident, it seems they have improved their behavior now. Hype can be seen as the on-chain version of Robinhood (though this analogy is somewhat broad). As for Polymarket, it seems to be challenging the "old money" of traditional sports betting.

On the other hand, I hold a pessimistic view of projects like Pump. These projects continuously launch new speculative products, lacking sustainability, with the ultimate goal of emptying your money to fill their own pockets. However, I am an optimist, believing that consumer wisdom is often underestimated by businesses. Over time, consumers will gradually move away from those predatory and speculative products.

Perhaps my current viewpoint is too ahead of its time, so I will continue to participate in speculation with smaller amounts of capital. After all, it would be foolish to miss out on current opportunities due to my long-standing biases against the market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。