Original Author: Trading Strategy

Compiled by | Odaily Planet Daily (@OdailyChina)

Translator | Wenser (@wenser2010)

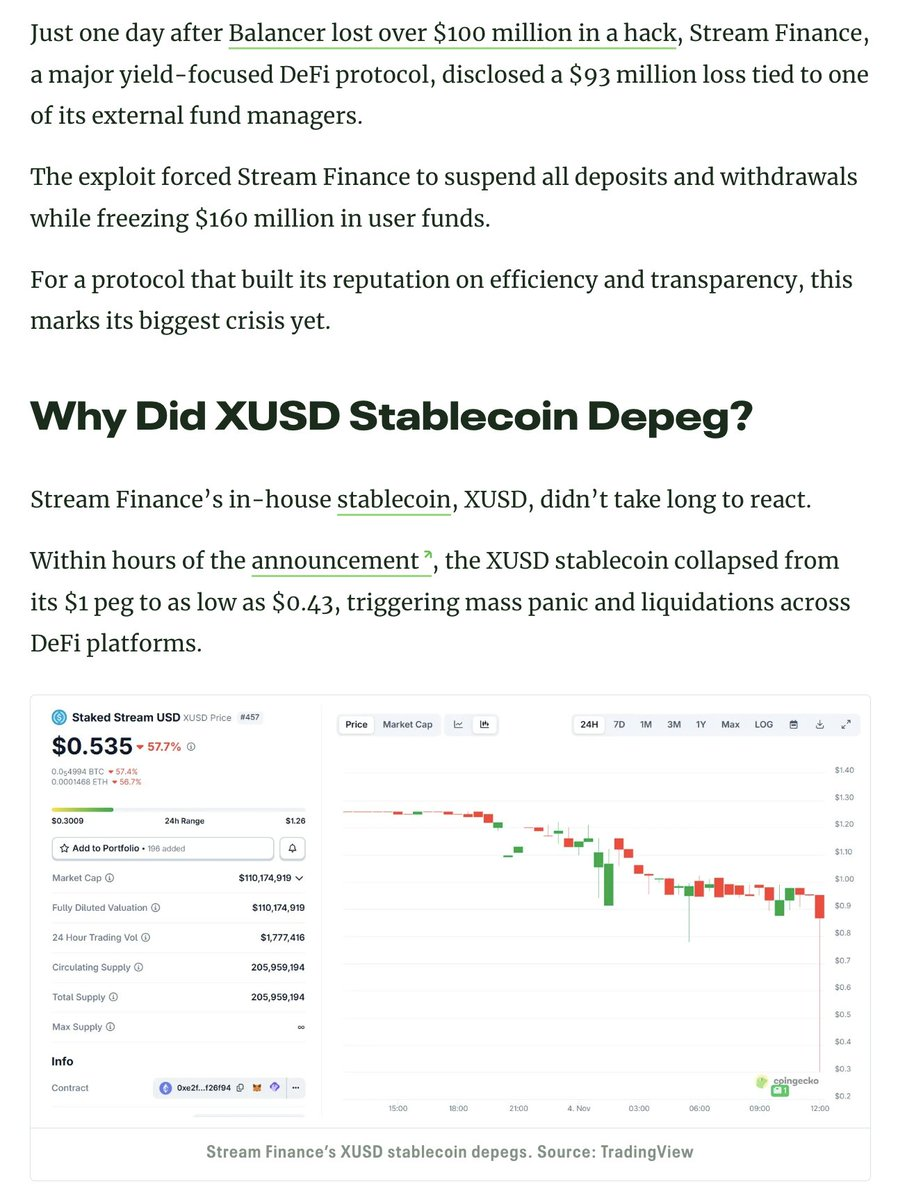

Editor's Note: After 24 days, the xUSD depeg incident has exposed the massive losses of Stream Finance to the public. On November 4, Stream Finance officially announced that an external fund manager disclosed a loss of approximately $93 million in fund assets, and they have hired lawyers from Perkins Coie LLP to conduct a comprehensive investigation. As of the time of writing, the xUSD price has depegged to around $0.14, a drop of about 87%. Even more concerning is that the market has little hope for its re-pegging, which may just be one link in the domino crisis triggered by the "10·11 crash." To uncover the truth behind the xUSD depeg and Stream Finance's massive losses, Odaily Planet Daily has specially compiled the Trading Strategy series investigation as follows for readers' reference.

The Rise and Fall of xUSD Depeg: When DeFi Curator is Shot in the Forehead

According to existing information, the xUSD issued by Stream Finance is a "tokenized hedge fund" disguised as a DeFi stablecoin, claiming to operate a delta-neutral strategy for investment. Now, Stream has fallen into a whirlpool of public opinion.

In the past five years of the crypto industry, several crypto projects have operated under this script, attempting to boost their token development through income generated from delta-neutral investments. Some successful examples include: MakerDAO, Frax, Ohm, Aave, Ethena.

However, unlike many true DeFi competitors executing this strategy, Stream Finance's strategy and positions lack transparency. Of the claimed "up to $500 million TVL," only $150 million in assets are visible on-chain (for example, can be checked via @DeBankDeFi). Now, the truth is revealed: Stream invested part of its funds in off-chain trading strategies operated by independent traders, some of whom faced liquidation, leaving a nominal loss of $100 million.

Initially, @CCNDotComNews reported in detail on the "xUSD depeg incident" as a starting point for this event here.

It is important to emphasize that the Balancer hack incident is only an introduction and is unrelated to this matter.

According to rumored information (which we cannot yet confirm as Stream has not made an official disclosure), the off-chain trading strategy involving "selling volatility" is also implicated. In quantitative finance, "selling volatility" (also known as "shorting volatility") refers to a trading strategy that profits when market volatility decreases, remains stable, or when actual volatility is lower than the implied volatility priced into financial instruments. If the price of the underlying asset does not change significantly (i.e., low volatility), options may expire worthless, allowing the seller to keep the premium as profit. However, this method carries significant risks, as a sudden spike in volatility can lead to massive losses—often described as "picking up pennies in front of a steamroller" (Note from Odaily Planet Daily: the original phrase is "picking up pennies in front of a steamroller."). More information about selling volatility can be found here.

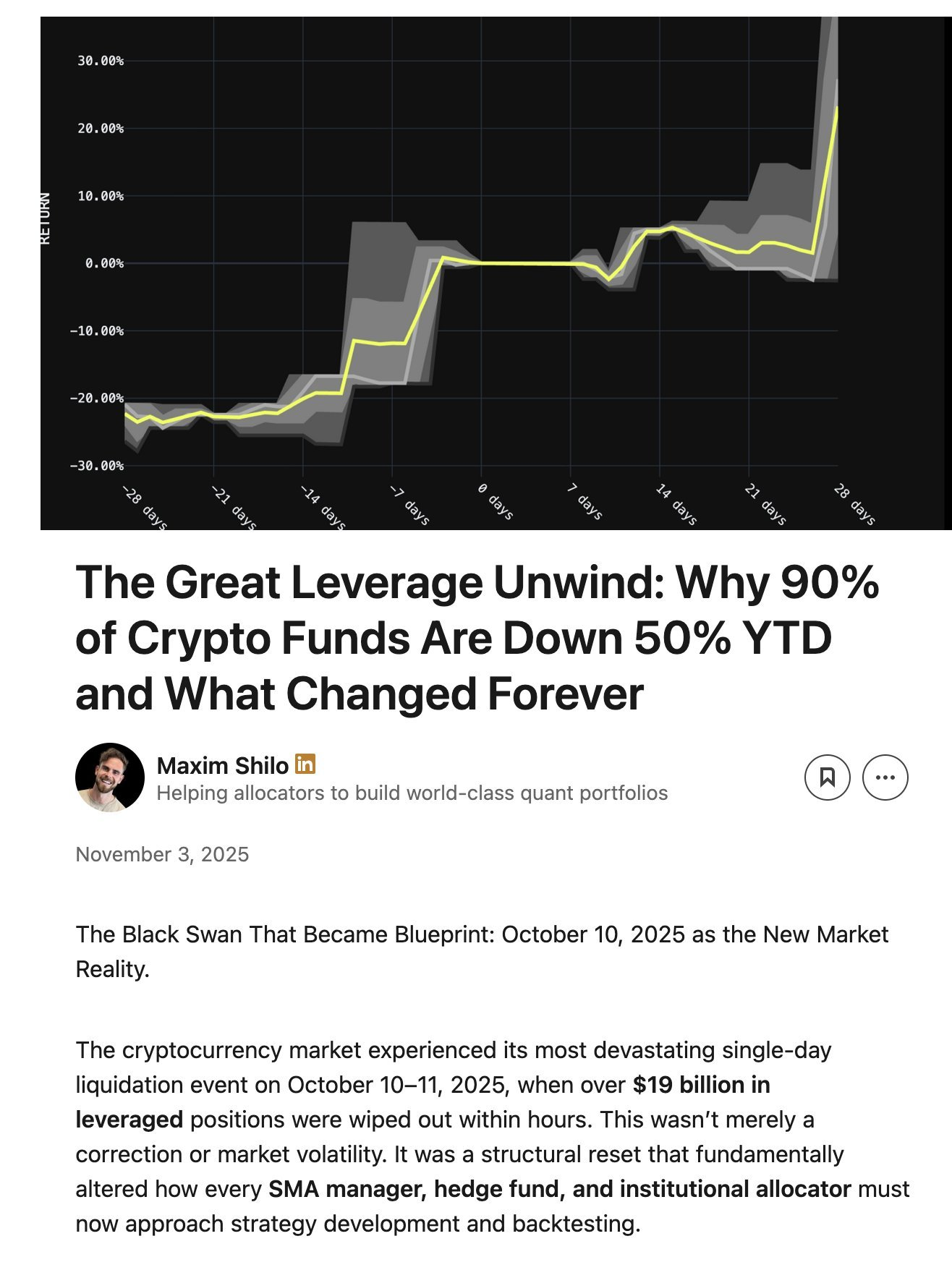

During last month's "Red Friday" (Note from Odaily Planet Daily: referring to the massive crash on October 11, Beijing time), the crypto market experienced such a "spike in volatility." Over time, under Trump's "strong push" this year, the cryptocurrency market accumulated a significant amount of systemic leverage risk. When Trump announced new tariff policies on the afternoon of October 10 (which was early morning on October 11, Beijing time), all capital markets felt immense panic, which quickly spread to the cryptocurrency market. In extreme panic, it is understandable that participants first chose to sell off guaranteed assets (i.e., their leveraged assets); this sell-off led to subsequent secondary liquidations.

Due to the long-term accumulation of leverage risk, systemic leverage rose to high levels, and the perpetual futures market lacked sufficient depth to smoothly close and liquidate all leveraged positions. In this situation, the automatic deleverage (ADL) system began to take effect, leading to the amplification of losses for market participants with some profit margin. This further squeezed an already frantic cryptocurrency market. For more information about automatic deleverage (ADL), see here.

The market volatility caused by this event is a once-in-a-decade occurrence in the cryptocurrency market. Although not widely known, such a crash had occurred as early as the 2016 early cryptocurrency market. Unfortunately, we do not have complete data from that era, so most quantitative traders' strategies are based on recent "smoothed volatility" data. In other words, since we have not experienced such a spike in volatility in recent years, even a mere 2x leveraged position was directly liquidated in this crash.

Maxim Shilo detailed in a previous article what this event meant for quantitative traders and what kind of permanent changes cryptocurrency trading might undergo after "Red Friday" here.

Now, we see the first batch of "corpses" surfacing from the "Red Friday" event, and Stream is one of them.

The requirement for a delta-neutral fund is that you cannot lose money. If you lose money, by definition, you do not belong to a delta-neutral strategy. Stream promised to maintain delta neutrality, but behind their fund allocation, they invested in proprietary, opaque off-chain trading strategies. Delta-neutral strategies are not always black and white, and it is easy to make judgments in hindsight. Many experts may believe that these off-chain trading strategies are too risky to be considered true delta-neutral strategies. Because these strategies can backfire, reality has validated this claim.

When Stream lost principal in these poor trades, the ultimate result was insolvency.

There is no doubt that DeFi is not without risks, and some loss of funds is permissible. You can still recover assets to 100% if you can achieve a 10% annual return, so a one-time 15% drawdown is not catastrophic.

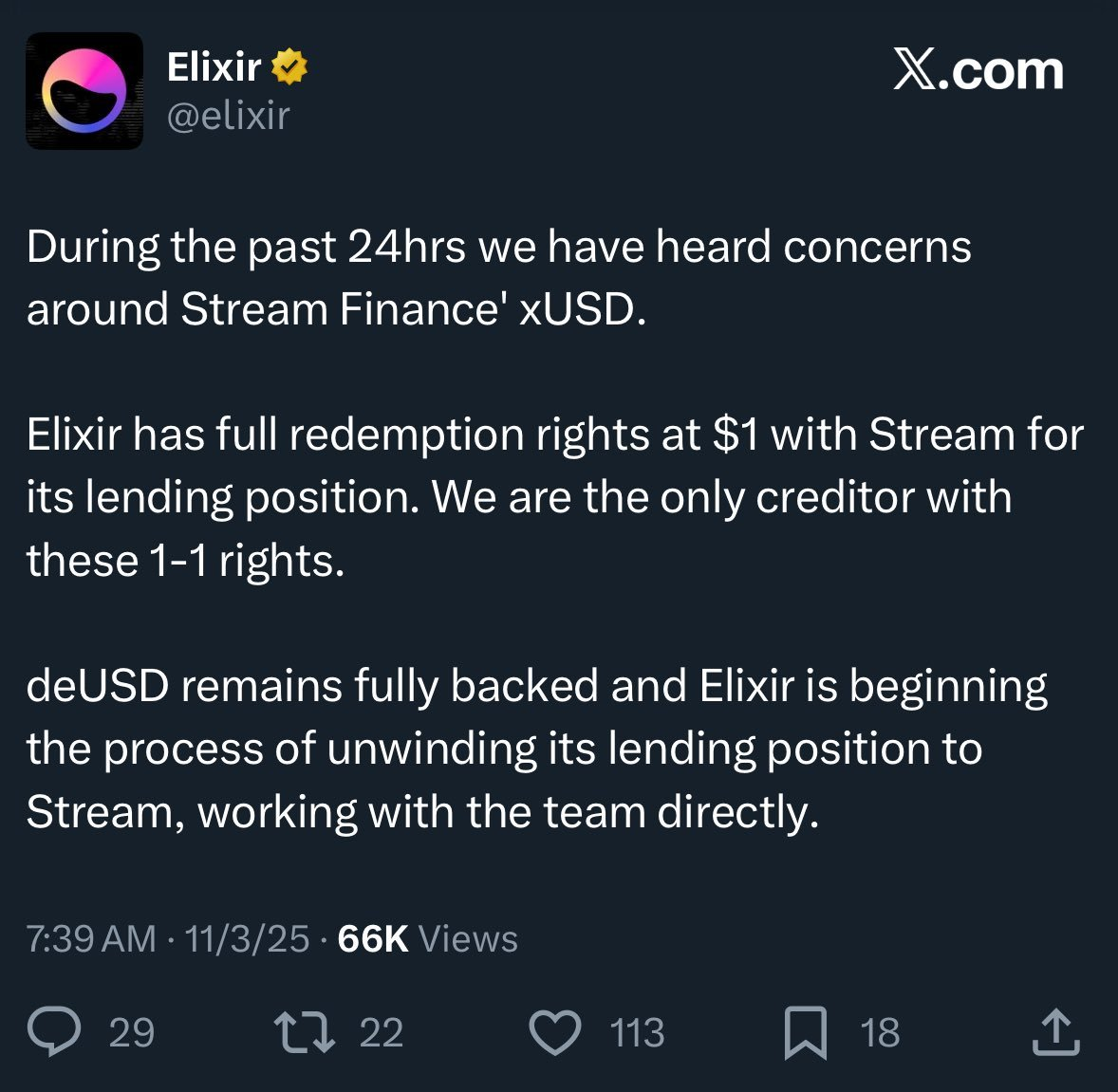

However, in the face of such losses, Stream also leveraged its funds by executing a "recursive looping" lending strategy using another stablecoin, Elixir. For more information on recursive looping, see here. This led to the creation of more leverage. (For how Stream leveraged and the extent of the leveraged positions, see this article).

To make matters worse, Elixir claims that "cooperative assets" are generated based on a bilateral off-chain agreement, so that in the event of Stream's bankruptcy, its principal can be recovered. This means that Elixir will receive more funds in compensation, while other DeFi investors in Stream will receive less (or none) of the compensation funds.

Due to the lack of transparency, recursive looping, and proprietary strategies, we do not actually know the losses suffered by Stream platform users. The current trading price of the Stream xUSD stablecoin is $0.60 (around 4 AM on November 5).

Because Stream has not disclosed this information to these DeFi users, many users are now very angry with both Stream and Elixir: they not only have to bear asset losses but are also uncertain about how much of the remaining funds will be confiscated to ensure profits for the wealthy from Wall Street.

The incident also affected other lending protocols and their Curators (DeFi curators). As Rob from @infiniFi stated: “Those who thought they were engaging in 'collateralized lending' on Euler were actually 'indirectly participating in uncollateralized lending.'” (Note from Odaily Planet Daily: This means you thought your funds were lent to collateralized borrowers, but in reality, your money was borrowed by uncollateralized borrowers.)

Furthermore, due to the lack of transparency regarding Stream's positions and profit and loss, users began to suspect that Stream fraudulently misappropriated user investment profits for the management team after these events occurred. The Stream xUSD stakers relied on the "oracle" reported by Stream to obtain "paper profits," and third parties could not verify whether any profit and loss calculations were accurate or fair.

How can this issue be resolved?

Events like Stream's are actually avoidable, especially in a nascent industry like DeFi.

The rule of "high risk, high reward" always applies. However, to profit from this rule, you must first understand the risks: not all risks are equal, and some risks may be unnecessary. There are several reputable liquidity mining, lending, and stablecoin protocols as tokenized hedge funds, whose risks, strategies, and positions are transparent.

For example, @aave founder @StaniKulechov recently posted discussing DeFi curators and when high-risk events might occur, and he also mentioned recent DeFi risk events.

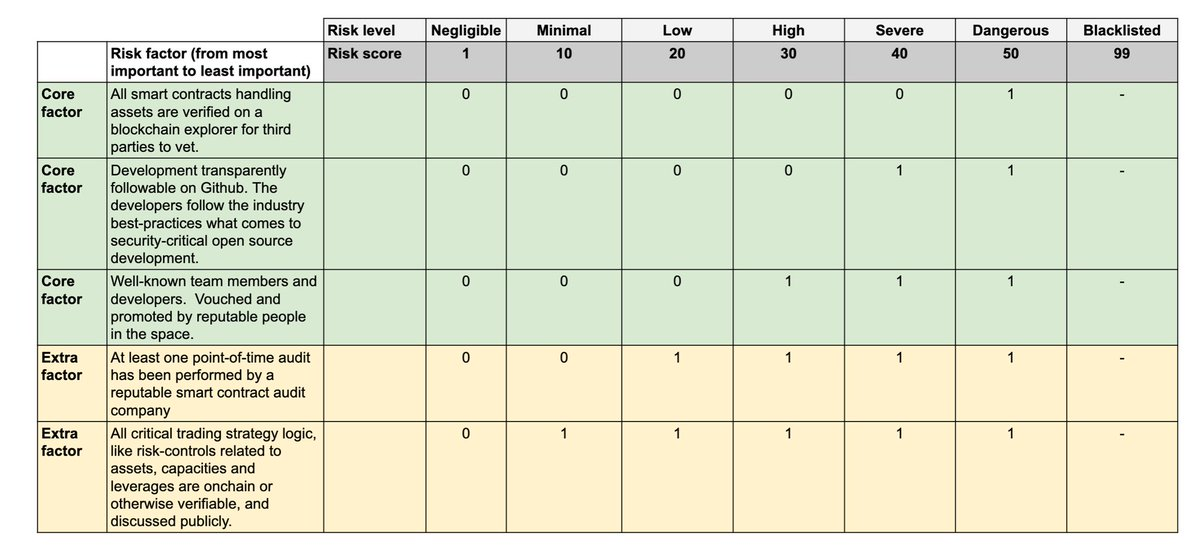

To make the distinction between "good vaults" and "bad vaults" more apparent, we have begun publishing technical risk assessment scores for vaults in our "DeFi Vault Report," see here.

According to several different dimensions, technical risk refers to the possibility of losing funds invested in DeFi vaults due to poor technical execution. The vault technical risk framework provides a simple analytical tool primarily used to categorize DeFi vaults into high-risk and low-risk categories. It is worth emphasizing that the technical risk score does not eliminate market risks such as bad trades and risk transmission; its value lies in allowing third parties to assess these risks (to decide whether to invest in them).

As DeFi users gain access to more comprehensive and sufficient information, capital allocation will shift towards projects that comply with rules and operate transparently, and future incidents like Stream's will not result in such severe losses and impacts again.

Additionally, another good suggestion for addressing vault management issues is to increase the capital investment of DeFi curators in the vaults. Many traditional financial copy trading services typically display the amount of capital traders have invested in their trading strategies (such as dollar value and percentage).

Finally, a serious reminder and warning: vaults holding leveraged Stream xUSD now offer an enormous APY of over 50%; however, the vault's capital utilization rate is 100%, meaning the vault's funds are locked in lending positions and cannot be closed because the protocol has paused operations or the lending positions are underwater, lacking sufficient funds for withdrawal. If you deposit funds into these vaults, there is a high probability of losing your capital, so please do not take the risk.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。