Author: Nancy, PANews

The long-silent Solana mining protocol Ore has recently returned to the market's attention. Amid a generally sluggish market, Ore has not only reached a new high in price this year, but its daily revenue is also continuously rising, quickly warming up market sentiment. This change is mainly attributed to its newly launched V2 mining protocol, which has undergone a comprehensive upgrade in both mechanism and economic model.

Revenue and Token Price Soar, Ore Launches New Mining Protocol

Recently, the veteran project Ore has regained popularity and received support from the official Solana account, sparking market interest and discussion.

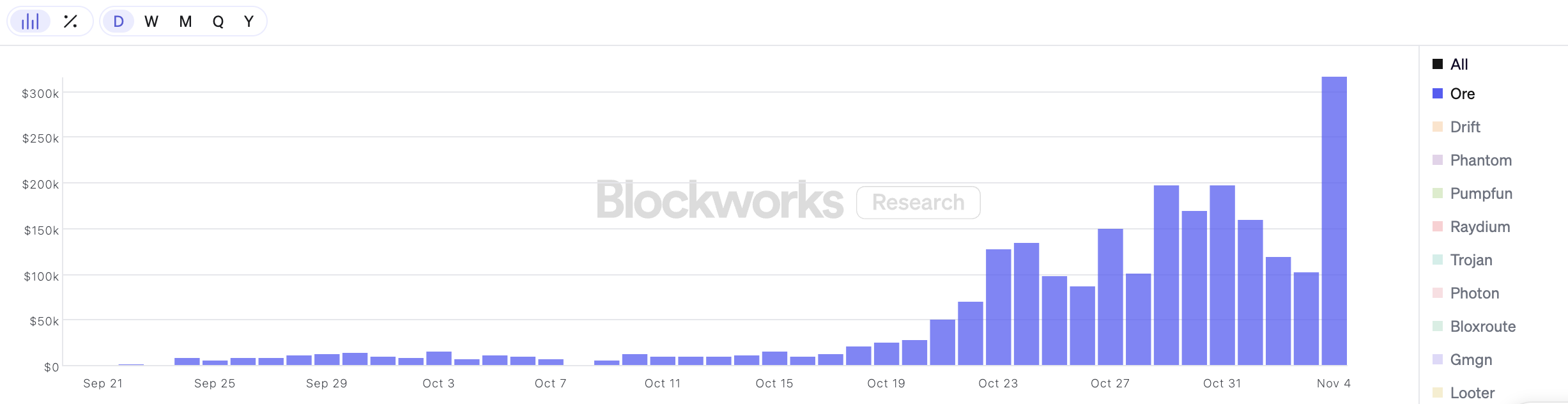

Data confirms this surge in interest. According to Blockworks Research, as of November 6, Ore's cumulative revenue has surpassed $1.689 million. Before mid-October this year, its daily revenue had long hovered at low levels, mostly maintaining around a few thousand dollars. However, starting from October 22, Ore's daily revenue experienced explosive growth, climbing to over $100,000 in just over ten days, with the latest single-day revenue reaching $316,000, an increase of about 576 times compared to its historical low (around $548). The revenue for the past week reached $1.094 million, accounting for 64.7% of the total cumulative revenue.

In tandem with the surge in revenue, the price of the ORE token has also skyrocketed. CoinGecko data shows that as of November 6, the ORE price was approximately $249, with a staggering increase of 2445.2% over the past 30 days, reaching a new high for the year, and the latest market capitalization has exceeded $100 million.

Ore's revival stems from the launch of its new mining protocol on October 22. On that day, Ore's official Twitter account, which had not been updated for months, announced its return to the stage with a brand new mining protocol aimed at achieving a sustainable token economy and protocol value capture mechanism, as well as creating a native value storage asset on the Solana chain.

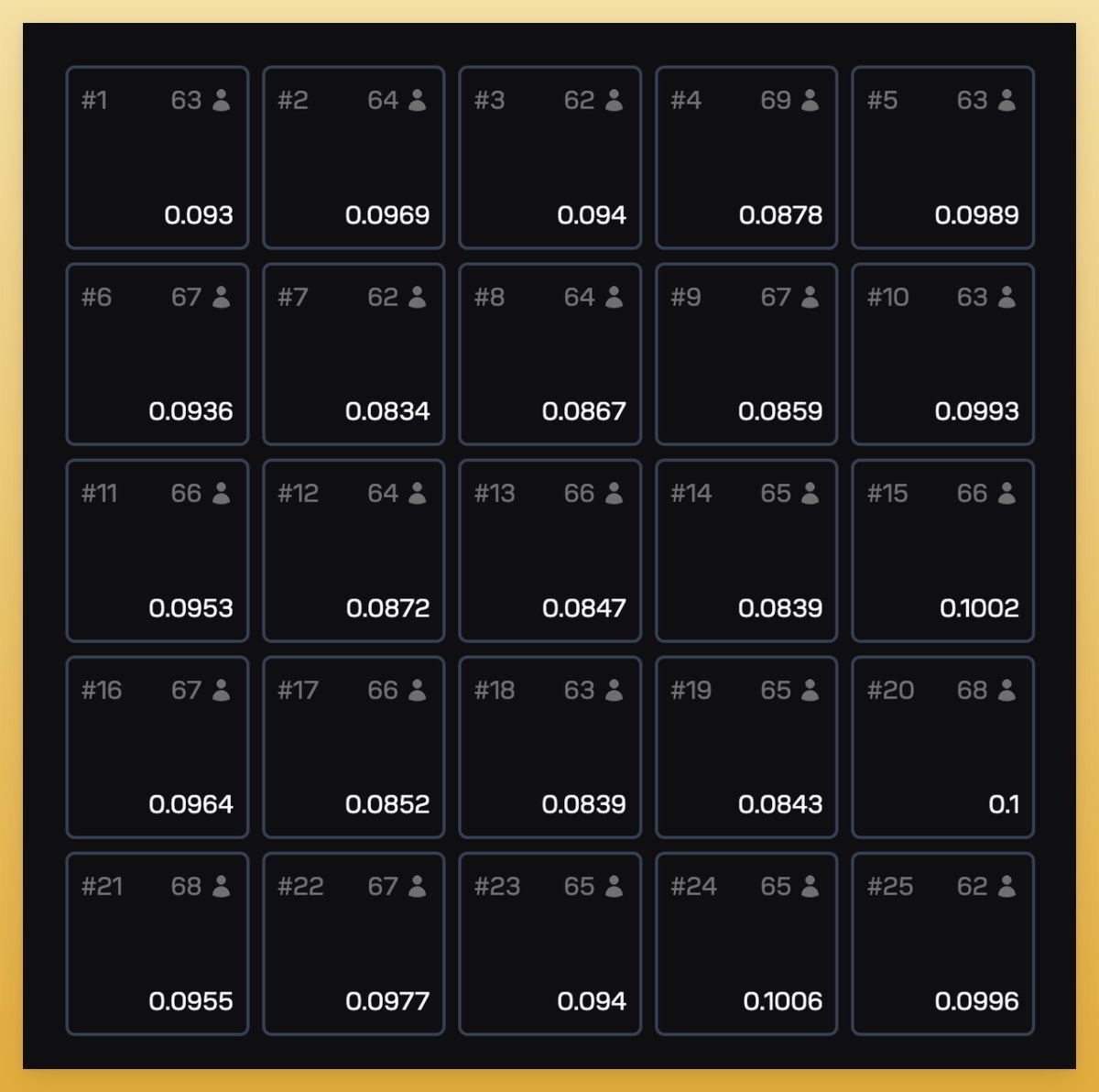

The new mining mechanism resembles an on-chain gaming experience. The system consists of a 5×5 grid with a total of 25 blocks, with each round lasting 1 minute. Miners can "occupy space" on the grid by staking SOL tokens. At the end of each round, the system randomly selects a winning block, and all SOL from the other 24 non-winning blocks will be proportionally distributed to the miners in the winning block, with the distribution ratio depending on the size of their occupied space in that block. Additionally, one lucky miner in the winning block will receive an extra ORE as a reward (approximately every three rounds, there will be a special round).

On this basis, the system introduces the Motherlode prize pool mechanism, where each round of mining injects 0.2 ORE into the prize pool, with a 1/625 chance of triggering an additional grand prize. If not triggered, the prize pool continues to accumulate; once a win occurs, all accumulated rewards will be distributed to the winners based on their contribution ratio. This design is similar to a cumulative jackpot, enhancing random incentives and long-term participation motivation.

When miners withdraw mining rewards, they need to pay a "refining fee" of 10%, which will be automatically redistributed proportionally to miners who have not yet withdrawn their rewards. This means that the longer the holding time, the higher the earnings, thereby encouraging long-term holding and reducing selling pressure.

In addition, Ore will automatically collect 10% of the SOL mining rewards as protocol income, of which 90% will be burned, and 10% will be distributed as earnings to stakers. This means that,

Furthermore, according to official disclosures, the maximum supply cap of the ORE token remains at 5 million, with a stable issuance rate of 1 ORE per minute. However, due to the introduction of protocol income and an automatic buyback mechanism, the net issuance can dynamically balance between inflation and deflation. If protocol income is sufficient, ORE may enter a deflationary phase. Dune data shows that in the past 7 days, ORE has been in a deflationary state, with a total reduction of 400 tokens.

It is evident that compared to the earlier PoW mining model, Ore's new mining protocol has undergone multiple optimizations in mechanism design, incentive structure, and economic sustainability.

Once Caused Congestion on Solana, Version Update Still Struggles to Reverse Popularity Decline

Ore was initially an innovative POW mining protocol on Solana, developed by Regolith Labs, led by the anonymous developer Hardhat Chad, and launched as the champion project of the Solana Renaissance hackathon. Public information shows that Regolith Labs completed a $3 million seed round of financing in September 2024, with investment institutions including Foundation Capital, Colosseum, and Solana Ventures.

The project's goal was to introduce a Bitcoin-style mining mechanism to the Solana network, achieving fair and non-pre-mined token distribution. Users do not need specialized ASIC mining machines; they can participate in mining using ordinary devices like computers, tablets, or smartphones by solving cryptographic puzzles. This low-threshold design quickly attracted a lot of attention, making Ore a popular project in the Solana ecosystem.

After Ore v1 went live, the influx of users was astonishing, and it once became the highest trading program on Solana, generating about 1 million transactions per hour at its peak. Some users even earned thousands of dollars daily during peak periods, further stimulating participation enthusiasm and driving the ORE price from an initial $93 to a peak of $3,786.

However, the v1 algorithm had issues that could be gamified, with some miners submitting transactions at high frequency to increase their "hit rate," leading to a massive amount of junk transactions that severely congested the Solana network. As a result, Ore had to suspend mining. Hardhat Chad explained that it would take several weeks to assemble a team, research, and launch the v2 version, and this adjustment also helped ORE's price recover.

In August 2024, Ore v2 restarted mining, introducing several improvements to address the pain points of v1, including optimizing anti-witch attack strategies, adjusting mining difficulty, and introducing a staking mechanism. However, due to mining rewards not meeting expectations, the ORE price continued to decline, and its popularity also waned.

The latest mining mechanism of Ore combines GameFi and DeFi gameplay, breaking away from the previous simple "mine-sell-withdraw" model. Through a delayed redemption mechanism, miners need to continuously participate to achieve maximum rewards. Currently, this only occurs when the reward pool approaches the staking pool or triggers a redemption wave. Meanwhile, the protocol has enhanced the sustainability of the economic model, making ORE more aligned with the market's preference for deflationary narratives. However, whether this mining craze can be sustained remains to be seen.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。