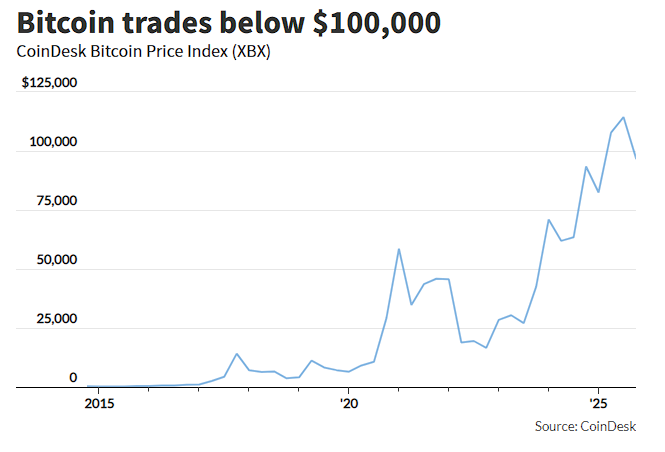

Compared to the capital bottom-fishing in tech stocks and the rebound in gold after a sharp drop, Bitcoin was a clear exception in the market on Friday: it fell 5% against the trend, hitting a six-month low, and has now declined for three consecutive weeks. This contrast reveals the unusual situation of the Bitcoin market: while maintaining a high correlation of 0.8 with the Nasdaq 100 index, Bitcoin exhibits an asymmetric characteristic of "larger declines and weaker recoveries." Meanwhile, multiple factors, including intensified whale sell-offs and concentrated selling by long-term holders, are collectively suppressing Bitcoin.

While tech stocks welcomed bottom-fishing capital and gold rebounded after a sharp decline, Bitcoin sank alone, "unable to recover." What exactly happened behind this? Why has the once-glorious cryptocurrency market become "tragically unbearable"?

On Friday (November 14), the U.S. stock market experienced a dramatic reversal. After a panic sell-off at the market's opening, capital began bottom-fishing in tech stocks, leading the Nasdaq and S&P 500 indices to rebound strongly after hitting key technical support levels. Gold, which had plummeted by over $150 during the session, also rebounded to around $4080, but Bitcoin became a clear exception: it fell 5% that day, dropping below the $94,000 mark and hitting a six-month low.

This marks Bitcoin's third consecutive week of decline and the fifth drop in the past six weeks. More shockingly, since the flash crash on October 10, the ripple effects in the cryptocurrency market have shown no signs of weakening—total market capitalization losses for all cryptocurrencies have exceeded $1 trillion.

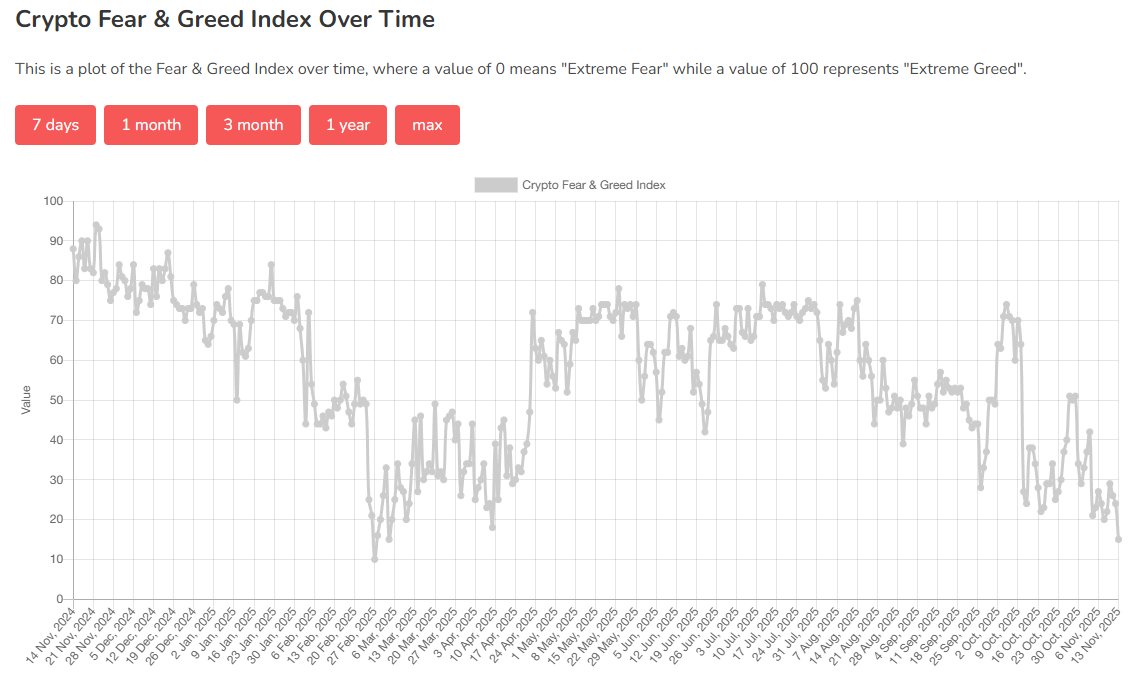

This contrast reveals the unusual situation of the Bitcoin market: while maintaining a high correlation of 0.8 with the Nasdaq 100 index, Bitcoin exhibits an asymmetric characteristic of "larger declines and weaker recoveries." Notably, according to a Wall Street Journal article, the fear and greed index in the crypto space has dropped to 15 points, the lowest level since February of this year, and the last time this index fell below 20 points, Bitcoin plummeted 25% within a month.

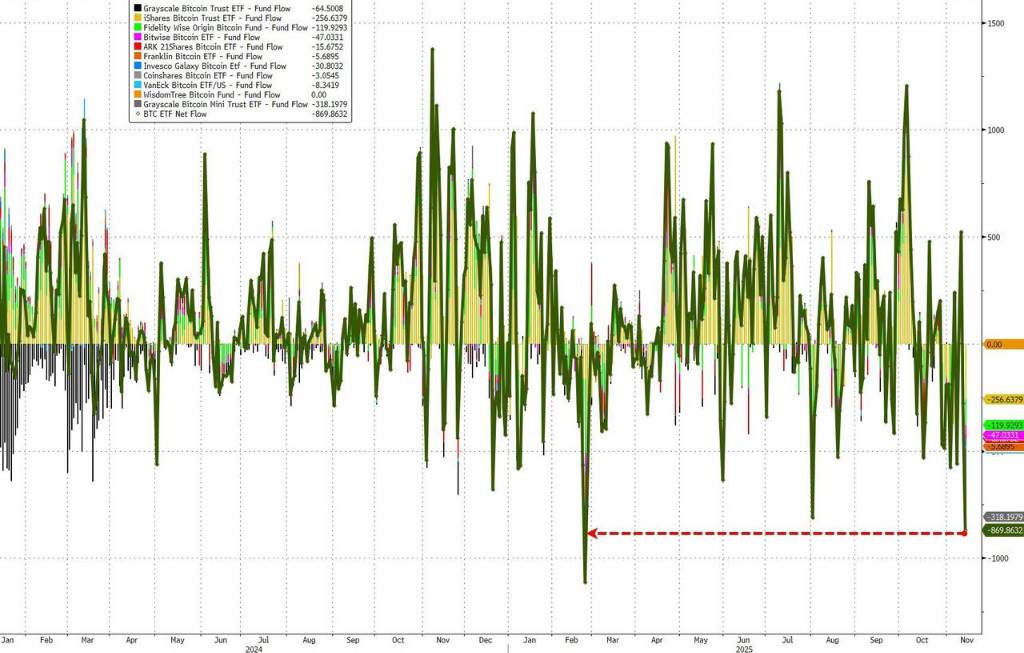

At the same time, multiple factors are collectively suppressing Bitcoin. Long-term holders have sold approximately 815,000 Bitcoins in the past 30 days, marking the highest record since early 2024; market liquidity has dried up, leading to five consecutive weeks of net outflows from Bitcoin ETFs. Even the cryptocurrency-related wealth of the Trump family has not been spared, with their holdings in World Liberty Financial tokens and American Bitcoin stocks both falling about 30% from their peaks.

Tech Stocks Make a Comeback, Bitcoin Plummets Against the Trend

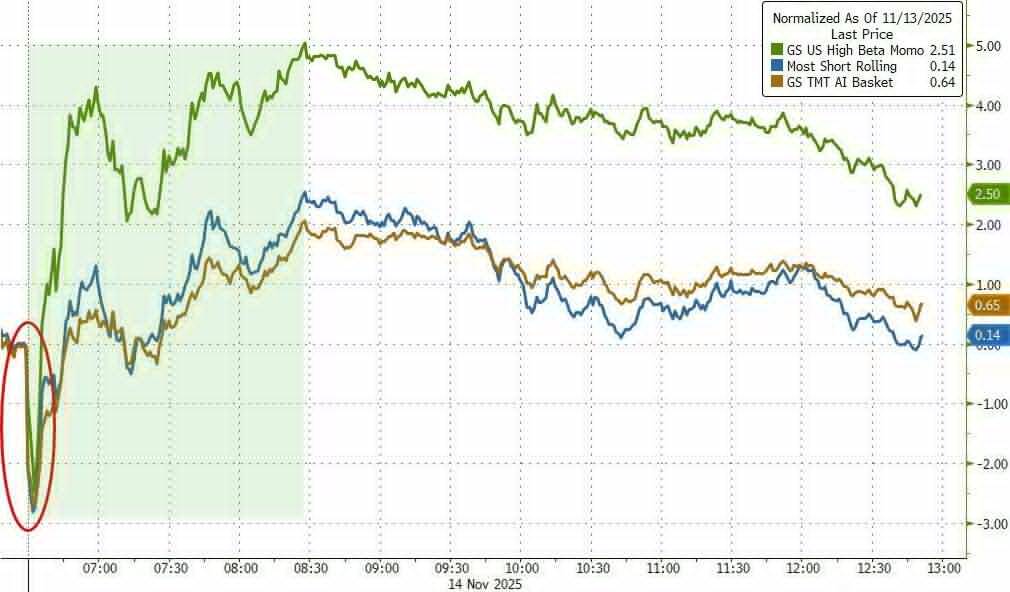

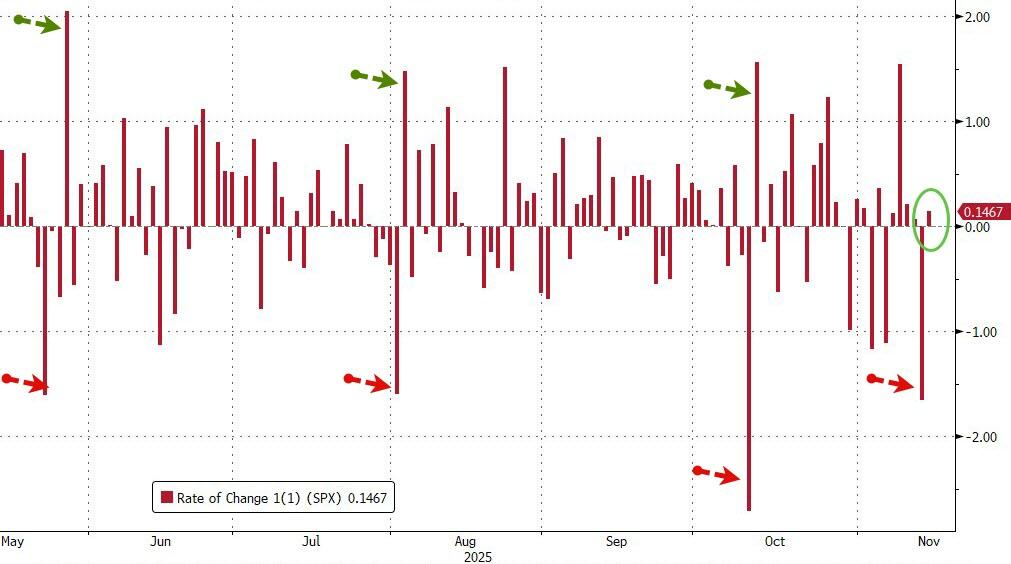

The market performance on Friday can be described as "ice and fire." The Nasdaq 100 index and S&P 500 index quickly rebounded after hitting the 50-day moving average support level, and small-cap stocks found support at the 100-day moving average. According to Goldman Sachs trader Scott Rubner, market sentiment experienced a dramatic shift from "absolute panic" (4 AM to 9:30 AM) to "strong recovery" (10 AM to 11 AM).

This V-shaped reversal is not coincidental. Goldman Sachs data shows that after the S&P 500 index falls at least 1.5% in a single day, it averages a rebound of 1.1% the next day.

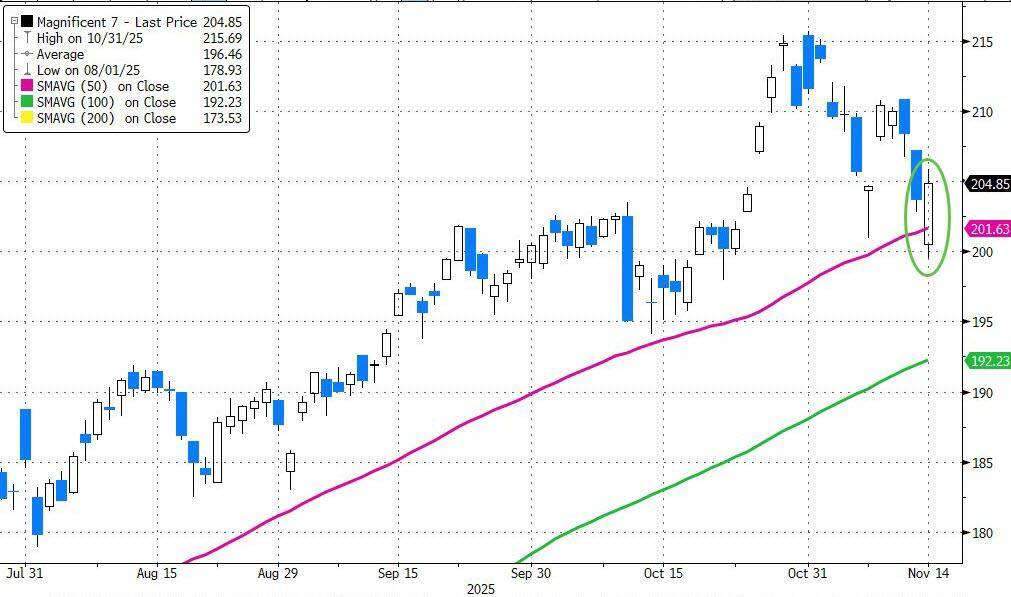

ETF trading activity became the main force behind the early session's bottom-fishing, accounting for 37% of the day's trading volume, significantly higher than the 27% average for the year. The tech stock giant Mag7 index rebounded strongly after hitting the 50-day moving average, remaining flat for the week, with hedge fund short-covering demand at the 96th percentile.

However, Bitcoin completely missed out on this rebound feast. On Friday, Bitcoin fell 5%, hitting a low of $94,519, the lowest point since May 6, with a weekly decline of 9.14%, marking the worst weekly performance since the week of February 28. Since reaching an all-time high of $126,272 on October 5, Bitcoin has cumulatively dropped about 25%.

This divergence is particularly striking against the backdrop of improved market liquidity. Goldman Sachs traders noted:

Hedge funds are buying across the board, with demand at the 96th percentile; high-beta momentum stocks, the most shorted stocks, and AI-leading stocks rebounded from a 3% drop at the open to close up 3%. But the Bitcoin market continues to be under pressure, indicating it is experiencing a different predicament from traditional risk assets.

"Greater Declines, Weaker Recoveries" - A Distorted Correlation

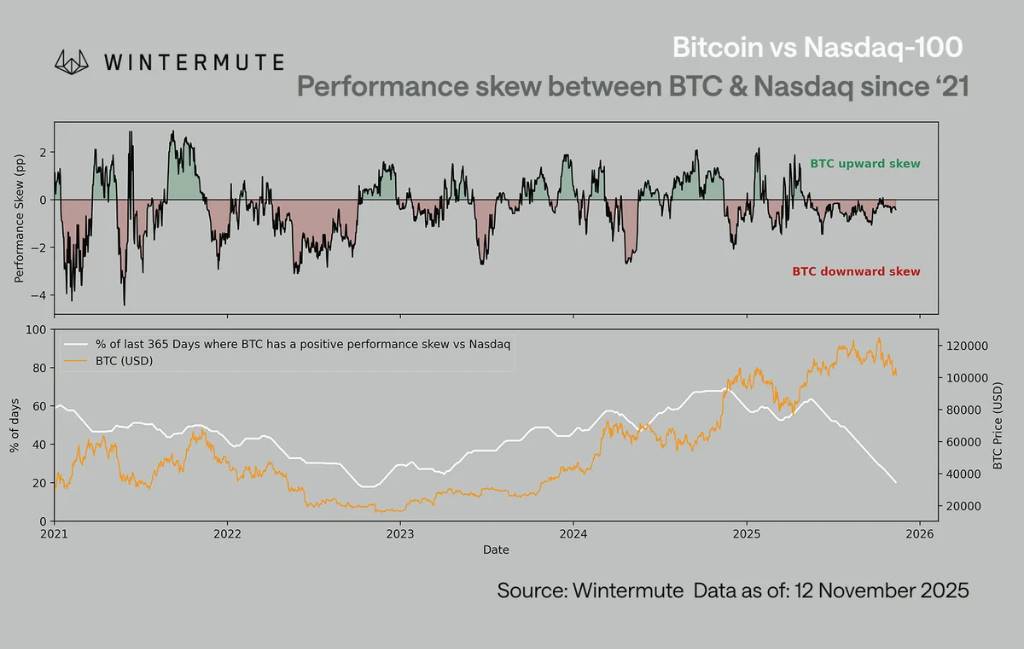

The correlation between Bitcoin and the Nasdaq 100 index remains around 0.8, but this correlation exhibits a distorted state—Bitcoin only synchronizes with the stock market during declines, while it reacts sluggishly during increases.

Data shows that the performance skew between Bitcoin and the Nasdaq has been significantly negative this year:

When the Nasdaq rises, Bitcoin's gains are noticeably smaller; when the Nasdaq falls, Bitcoin declines even more sharply. This is not a collapse of correlation but a manifestation of asymmetry—Bitcoin absorbs downside risk but cannot share upside gains.

Moreover, this negative skew has reached its highest level since the end of the 2022 bear market on a rolling 365-day basis—this was precisely the period when Bitcoin peaked a year after the last cycle.

Historical experience shows that such a scale of negative asymmetry typically appears during periods of extremely weak market sentiment and when prices are close to the bottom, rather than during high periods. What is the logic behind this abnormal phenomenon?

The key factor is the shift in market attention. In 2025, the narrative capital that was originally flowing in the cryptocurrency space—new token issuance, infrastructure upgrades, retail participation—has shifted to the stock market.

Large tech stocks have become magnets for institutions and retail investors seeking high-beta growth. Compared to the frenzy of 2020-2021, the marginal increase in risk appetite is now flowing more towards the Nasdaq rather than digital assets.

This means that Bitcoin retains its high-beta attribute when macro risk assets decline but has lost its narrative premium during increases. It merely reacts as the "high-beta tail" of macro risk rather than being an independent investment theme.

The change in liquidity structure has exacerbated this asymmetry. The issuance of stablecoins has peaked, ETF inflows have slowed, and the market depth of exchanges has not returned to early 2024 levels.

This fragility amplifies Bitcoin's negative response during stock market pullbacks, leading to its downward participation remaining consistently higher than its upward participation.

Crypto Fear Index Plummets to Yearly Low

Market sentiment indicators are confirming this extremely pessimistic atmosphere. According to a Wall Street Journal article, on November 13, the crypto fear and greed index plummeted to 15 points, the lowest level since February of this year.

This "extreme fear" reading is alarming— the last time this index fell below 20 points was on February 27, after which Bitcoin's price dropped 25% to $75,000 within a month.

Reports from market sentiment analysis platform Santiment show that negative discussions about Bitcoin, Ethereum, and XRP have surged, with the positive/negative sentiment ratio significantly declining, and sentiment levels far below normal.

This indicates that negative discussions are dominating the market narrative, and investor confidence remains low.

Since the large-scale liquidation event on October 11, key sentiment indicators have shown that market sentiment has not recovered and has further deteriorated.

Although Santiment interprets this extreme negative sentiment as a potential bullish signal indicating a local bottom, the current price trend has clearly not shown any signs of a definitive reversal.

Intensified Whale Sell-offs, Concentrated Selling by Long-term Holders

As Bitcoin remains "unable to recover," multiple factors are collectively suppressing it.

Reports indicate that behind Bitcoin's drop below the $100,000 key milestone, the sell-off by "whales" (large holders with over 1,000 Bitcoins) and long-term holders has become a significant driving force.

Blockchain data shows that in the past 30 days, long-term Bitcoin holders have sold approximately 815,000 Bitcoins, marking the highest sell-off activity since early 2024. More critically, whale wallets holding Bitcoin for over seven years have been selling at a rate of over 1,000 Bitcoins per hour.

This sell-off exhibits characteristics of "sustained, staggered distribution" rather than sudden coordinated selling. Analysis shows that many early holders view $100,000 as a psychological threshold—this is the profit-taking level they have been discussing for years. Since Bitcoin first broke through $100,000 in December 2024, the sell-off by long-term holders has begun to accelerate.

Cory Klippsten, CEO of Swan Bitcoin and a veteran in the Bitcoin industry, stated:

"Many early holders I know have been talking about the $100,000 figure since I entered this field in 2017. For some reason, this is the level at which people have always said they would sell some."

However, what is truly concerning is not the sell-off itself, but the market's diminishing ability to absorb these sell-offs. At the end of last year and the beginning of this year, when long-term holders sold Bitcoin, other buyers would step in to support prices, but this dynamic seems to have changed.

ETF fund flows confirm the weak demand. As of Thursday, Bitcoin ETFs experienced a net outflow of $311.3 million this week, marking the fifth consecutive week of outflows, the longest streak since March 14. The cumulative outflow over the past five weeks has reached $2.6 billion, second only to the $3.3 billion outflow that ended on March 28.

Even the Trump family's wealth has not escaped heavy losses.

As the cryptocurrency market experiences turmoil, the wealth gained by President Trump’s family from cryptocurrencies is also shrinking.

In the month since Bitcoin reached a high of $126,272 on October 5, the stocks and tokens related to cryptocurrencies held by Trump and his family have significantly declined.

The Trump family's cryptocurrency portfolio includes Trump Media & Technology Group, as well as the blockchain company World Liberty Financial and the Bitcoin mining company American Bitcoin. The World Liberty Financial tokens, along with American Bitcoin and DJT stocks, have all dropped about 30% since Bitcoin's peak in October.

According to Trump's government financial disclosure form from mid-June, the president indirectly holds nearly 115 million shares of DJT through a revocable trust in the name of his son Don Jr., which is valued at approximately $1.3 billion based on Friday's price, a significant decrease from nearly $2 billion in early October.

The World Liberty website shows that Trump and his family hold about 22.5 billion World Liberty Financial tokens, valued at approximately $3.4 billion based on Friday's price, down from a peak of $4.5 billion. Eric Trump holds a 7.5% stake in American Bitcoin, which is currently valued at about $340 million, down from a peak of $480 million.

Despite the Trump administration's numerous efforts to promote the cryptocurrency industry—including establishing a Bitcoin "strategic reserve" and the U.S. Securities and Exchange Commission withdrawing lawsuits against companies like Coinbase and Binance—these favorable policies have not prevented a significant correction in the cryptocurrency market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。