The U.S. Federal government machinery whirred to life after a record 43-day shutdown, and now key macroeconomic data, though somewhat stale, is beginning to trickle in. Thursday saw the U.S. Bureau of Labor Statistics (BLS) finally deliver its highly anticipated jobs report for September, showing the U.S. economy added 119,000 jobs, but also that unemployment crept up to 4.4% from 4.3%. Bitcoin dipped on the news, entering $86K territory for the first time since April 2025.

Reactions were mixed after the report was released. On one hand, economists were expecting a mere 50,000 additional jobs, so today’s numbers outperformed significantly. Average hourly earnings increased, and a separate weekly report from the Department of Labor shows a reduction in unemployment claims for the week ending November 15.

Read more: Bitcoin Dips After Powell Says a December Cut ‘Is Not a Foregone Conclusion’

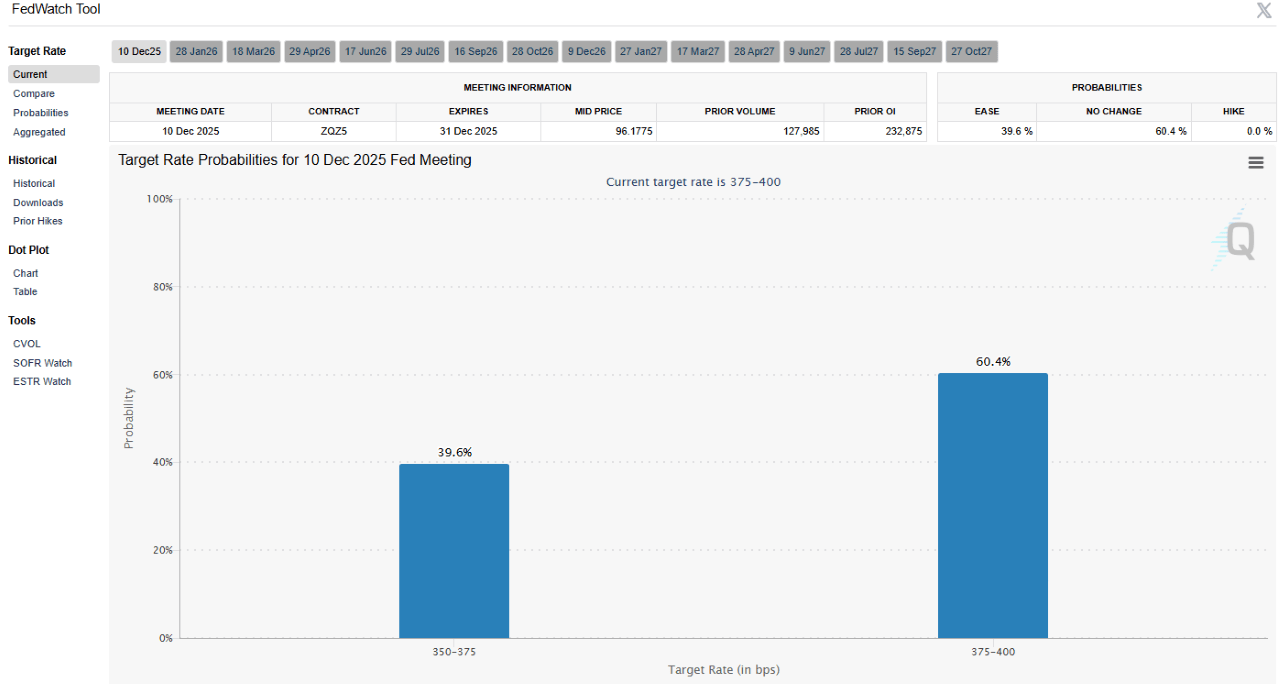

But on the other hand, the slight bump in the unemployment rate may have been unsettling to some. Especially given that today’s report is not current. The last BLS jobs report was published on September 5, more than two-and-a-half months ago. The uncertainty has led many to conclude that the Fed won’t cut rates in December. Both Polymarket and the CME Fedwatch Tool predict with a 60% likelihood that rates will be held steady. The overall hawkish sentiment appears to have sent both bitcoin and stocks lower.

(Most economists now predict the Fed will hold rates steady at the upcoming meeting in December / cmegroup.com)

“Investors expected a 25-basis point lowering in the target range for the federal funds rate at the October meeting and another 25-basis point lowering at the December meeting,” Joshua Gallin, secretary of the Federal Open Market Committee (FOMC) wrote in the minutes from the Fed’s October meeting released on Wednesday. “Some uncertainty around the December meeting was evident in responses to the Open Market Desk’s Survey of Market Expectations,” Gallin added.

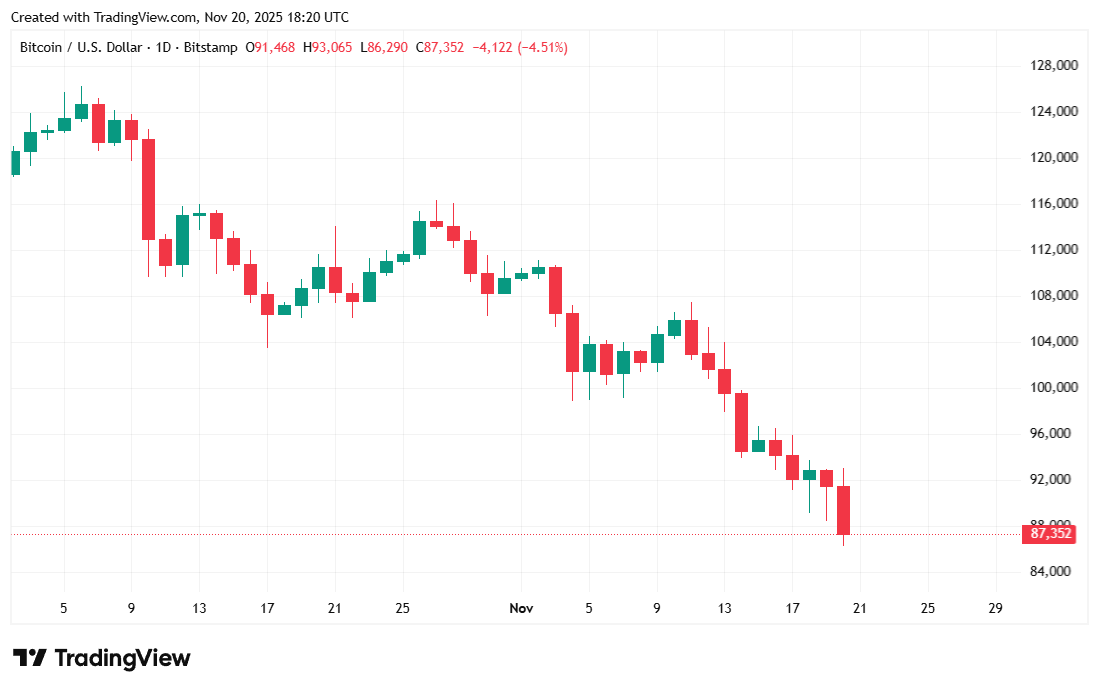

Bitcoin was trading at $87,281.06 at the time of writing, down 2.08% over 24 hours and 11.94% since last week, according to Coinmarketcap data. The digital asset has fluctuated between $86,345.15 and $93,025.07 since Wednesday.

( BTC price / Trading View)

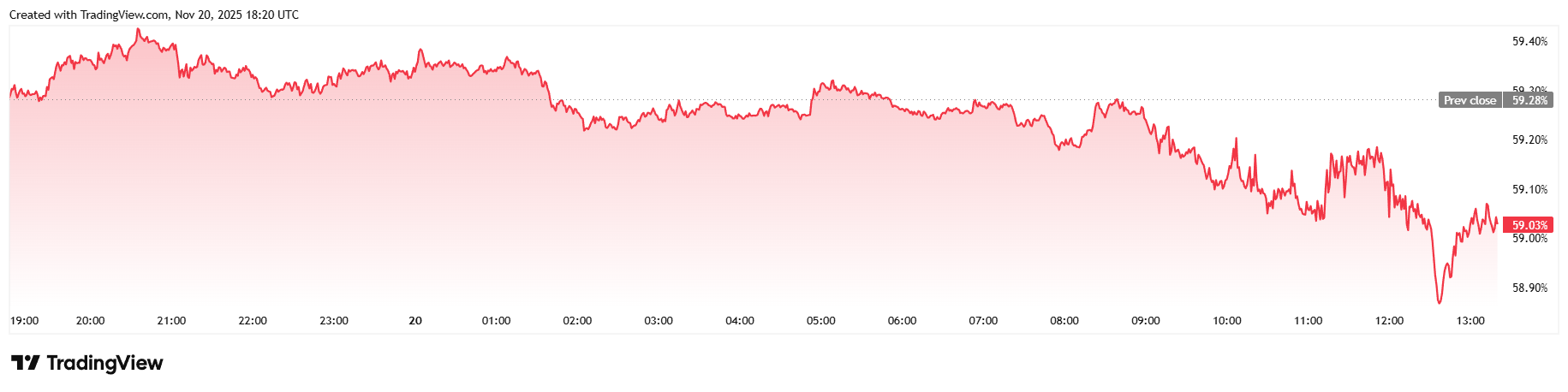

Daily trading volume climbed 37.71% to $95.25 billion and market capitalization fell to $1.73 trillion. Bitcoin dominance eased 0.44% to reach 59.04%, as several altcoins outperformed the flagship cryptocurrency.

( BTC dominance / Trading View)

Total bitcoin futures open interest was largely muted, dipping slightly by 0.63% to $64.88 billion, according to Coinglass data. Liquidations jumped once again, reaching $368.69 million in total, following bitcoin’s drop to $86K. As expected, most of that came from long investors who lost $325.18 million in liquidated margin. Short sellers completed the liquidation picture with $43.52 million in losses.

- Did unemployment data really push bitcoin down to $86K?

Markets reacted to a slight uptick in the jobless rate to 4.4%, fueling fears the Fed won’t cut rates soon. - Why was the report so impactful?

It was the first U.S. jobs data released after a 43-day shutdown, making the numbers both stale and uncertain. - How did traders interpret the mixed signals?

Strong job gains but higher unemployment led markets to price in a more hawkish Fed for December. - How is bitcoin performing now?

BTC is hovering near $87K after a sharp drop, with liquidations surging to more than $368 million in 24 hours.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。