For two straight weeks, the stablecoin economy has chipped away at its own size, and since our Nov. 15 report, another $840 million has vanished from the tally.

On top of that, trading activity has been sparse over the past week, and when you stack a shrinking stablecoin supply on top of weak volume, the result is liquidity so fragile it might as well be wrapped in tissue paper.

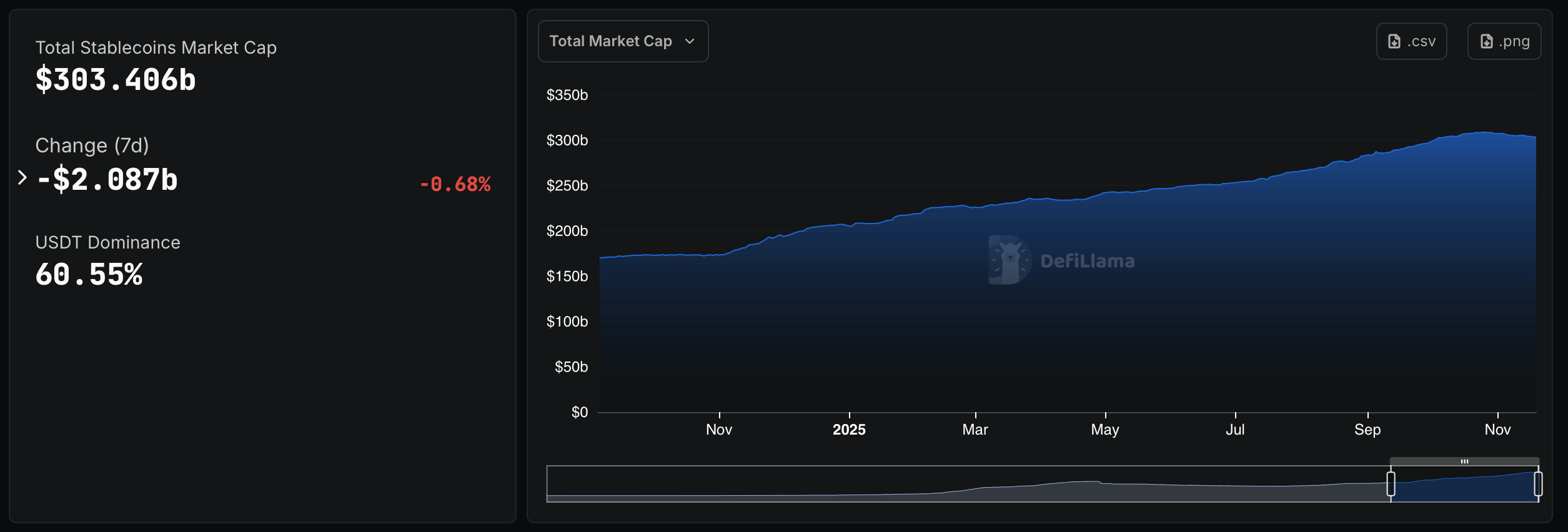

Saturday’s metrics showed the stablecoin sector sitting at $304.246 billion after shedding $1.244 billion since Nov. 8. As of now, stablecoin data from defillama.com puts the sector’s total at $303.406 billion.

Stablecoin economy according to data pulled from defillama.com.

Tether’s USDT shed $224 million over the past 24 hours but remains ahead by $157 million for the week. Circle’s USDC notched a $19 million lift in the same period, yet it has slipped by $1.13 billion over the last seven days, dating back to Nov. 12.

Ethena’s USDe trimmed $29 million since Nov. 18, sank $577 million since the 12th, and has tumbled a hefty $4.25 billion over the past 30 days. In fact, while payment-focused stablecoins are holding their ground, yield-bearing tokens have taken the brunt of the hit — with a few outright casualties this month.

Also read: Bitcoin Hashprice Hits Record Low as Miners Grapple With Shrinking Margins

Yield-bearing stablecoin data from stablewatch.io shows csUSDL logged a steep 71.6% drop in market cap this week. Another, srUSD, watched its market cap fall 60%, and web3 dollar, or USD3, slipped by 26.8%.

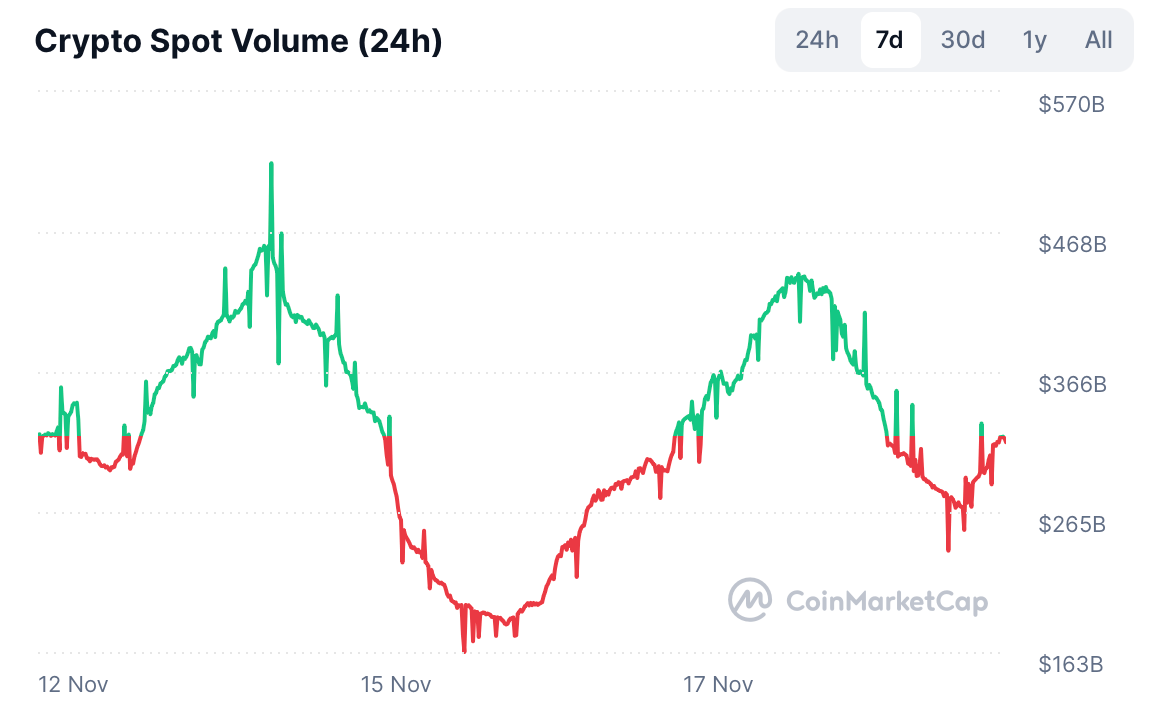

Alongside this, the crypto market’s volume has mostly drifted lower over the past seven days. When that happens, order books start resembling a ghost town — and the spookiest part is that low volume often shows up hand-in-hand with low realized volatility.

Spot crypto volume across the last seven days.

Essentially, without the cushion of stablecoins and healthy volume, you get an environment where almost any selling pressure — no matter how small — can cause outsized damage. All told, the market is moving through a stretch where liquidity feels more decorative than functional.

Still, these phases rarely last forever. As capital rotates, supply rebuilds, and activity finds its footing, liquidity tends to thicken again — sometimes gradually, sometimes all at once. For now, though, the market is running light, and every ripple looks a little louder than usual in an ecosystem that’s waiting for its next gust of momentum.

- Why is crypto liquidity weakening?

Liquidity is thinning due to declining stablecoin supply and consistently low trading volume across major markets. - How much has the stablecoin sector lost recently?

Since Nov. 15, the sector has seen roughly $840 million drain from fiat-pegged tokens. - Which stablecoins saw the largest declines?

Ethena’s USDe, csUSDL, srUSD, and USD3 posted the steepest drops in market cap this month. - How does low volume affect price movement?

Sparse activity makes order books fragile, allowing even small sell-offs to cause outsized price swings. - Will the holiday season affect liquidity further?

With Thanksgiving and Christmas approaching, trading desks often quiet down, which can make liquidity even thinner.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。