Accumulation is a continuous process, seizing opportunities.

Author: Alana Levin

Translation: Baihua Blockchain

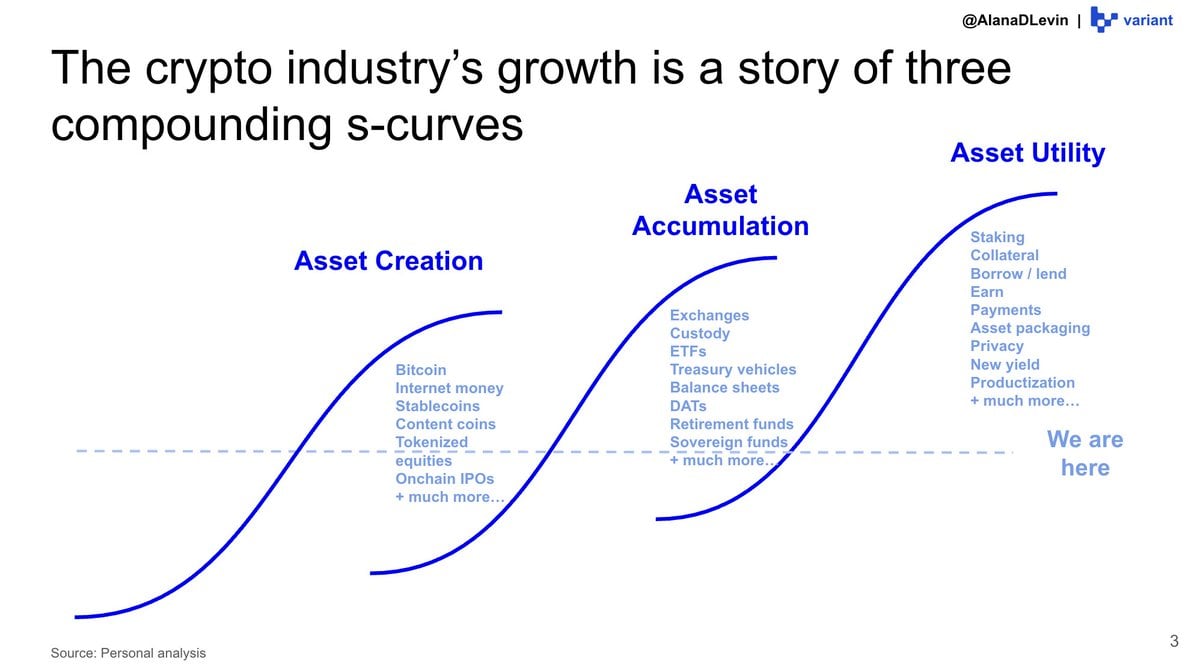

This "Crypto Trends Report" suggests that the growth of the crypto industry can be viewed as a series of three composite S-curves: Asset Creation, Asset Accumulation, and Asset Utilization.

Phase 1 is Creation: Tokenization of Value. The creation phase began with the launch of Bitcoin in 2009. Since then, it has evolved to include Layer-1 currency assets, project tokens, stablecoins, content coins, meme coins, NFTs, tokenized stocks, etc. From 2024 to 2025, the crypto industry climbed the steepest part of the S-curve. We grew from about 20,000 tradable tokens to millions in just a few years. While there is still significant room for growth in innovation and expansion (such as tokenized credit, on-chain products, additional real-world assets, etc.), the most remarkable zero to one moment has already occurred.

Phase 2 is Accumulation: The more existing assets there are, the higher their value, and people want to hold these assets. This provides tailwinds for multiple subfields within the industry: custodial products, trading platforms, and security solutions. Different custodial solutions serve different user groups: applications supporting stablecoins may use Turnkey embedded wallets, institutional investors typically use qualified custodians, while active on-chain users might use Phantom super-app wallets. The growing demand for buying, selling, and holding crypto assets has also facilitated increased distribution. Many existing trading platforms (like Coinbase) have seen a surge in trading volume. Traditional fintech companies (like Robinhood) have intensified access to crypto assets, while newer venues (like Axiom) have also emerged with explosive growth. Asset investors are providing access to crypto assets in retirement accounts, publicly traded companies are starting to hold Bitcoin and stablecoins on their balance sheets, and even some sovereign wealth funds have begun accumulating these assets. We are just beginning to climb the steepest part of the S-curve.

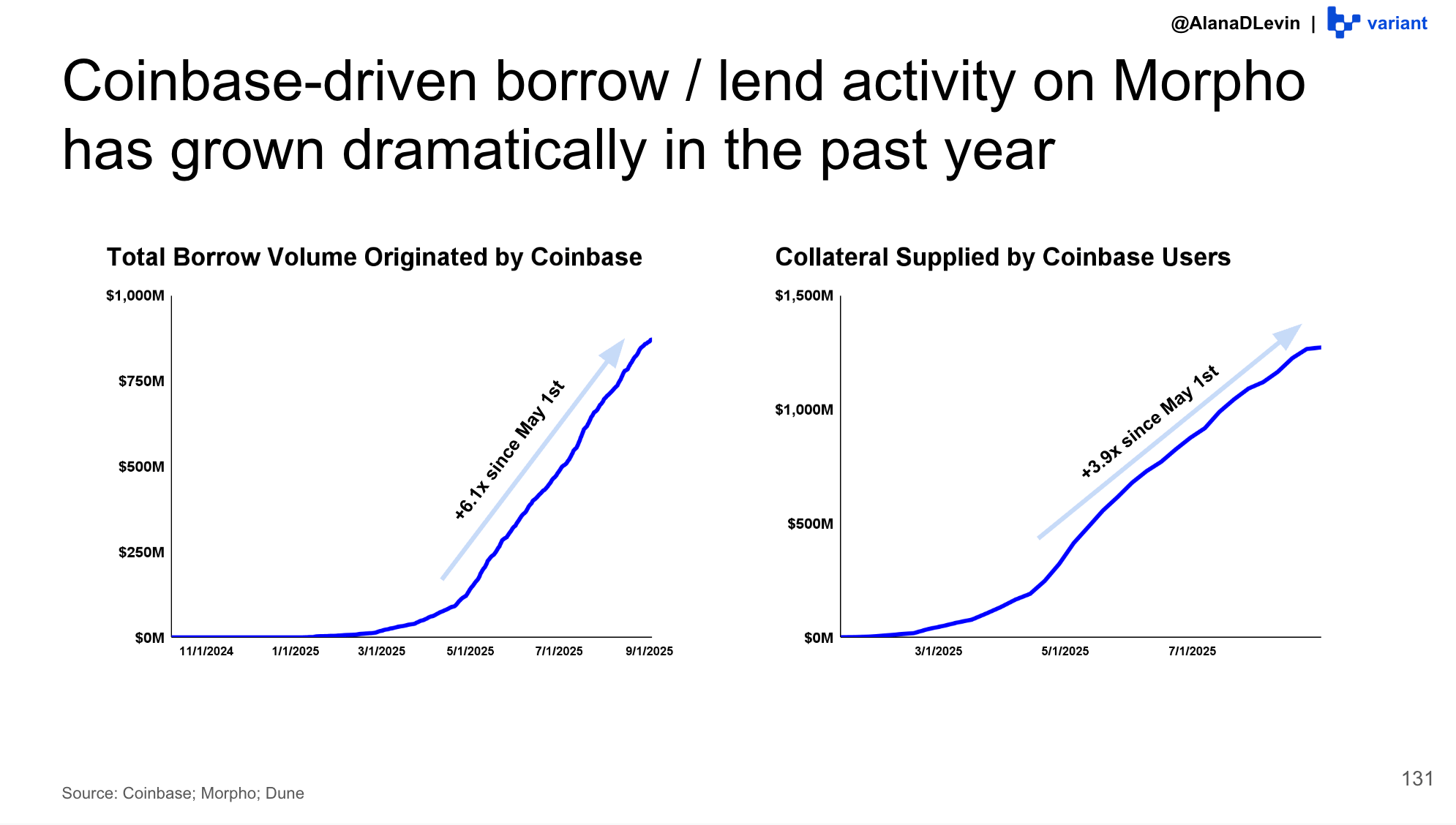

Phase 3 is Utilization: Putting Assets to Work. Once they hold assets, they will want to start using them. Crypto assets are the first financial assets that offer composability, accessibility, and scalability. Some exciting and stable examples have begun to emerge: stablecoin payments, providing and borrowing capital on protocols like Morpho, providing liquidity to on-chain trading platforms, and network staking. However, we are still in a very early stage regarding the different ways tokenized assets can and will be used; we have barely begun to climb the S-curve. I believe that expanding and enhancing the effective design space of assets is one of the biggest and most exciting blue ocean opportunities in the coming years.

The report is divided into five main categories: Macro, Stablecoins, Centralized Trading Platforms, On-Chain Activity, and Next Steps. Each section adopts the framework of three composite S-curves to help contextualize the major trends and opportunities present in the crypto industry.

I have read the full report. But if you have time to focus on the highlights, here are some of the main trends we see today in the crypto space:

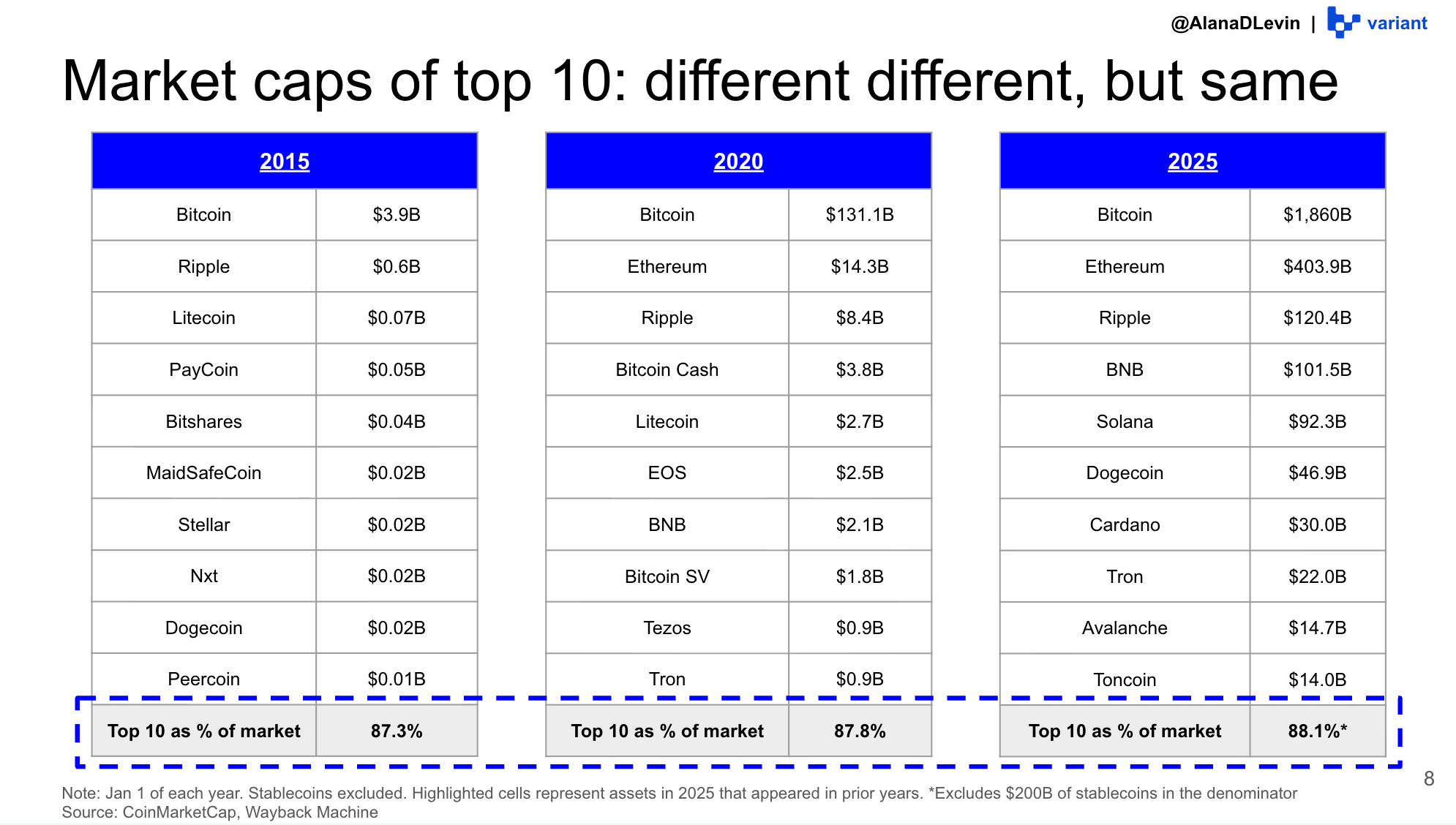

Major crypto assets continue to grow. Even as the total market capitalization of cryptocurrencies has increased, the concentration among the top 10 crypto assets remains remarkably consistent. The entry of new assets into the top five has also been consistent. Many cryptocurrencies exhibit a real Lindy effect and mimetic power.

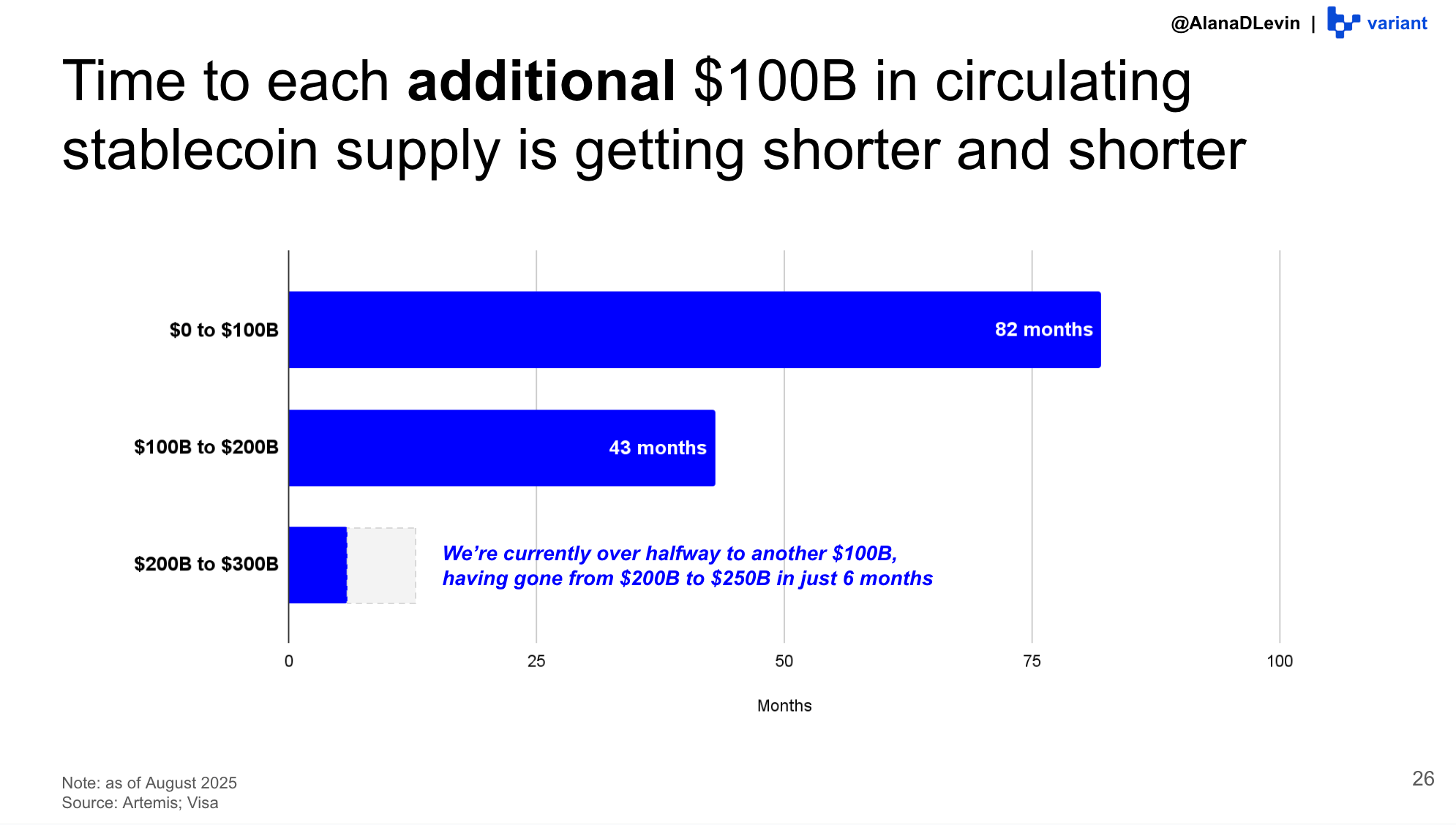

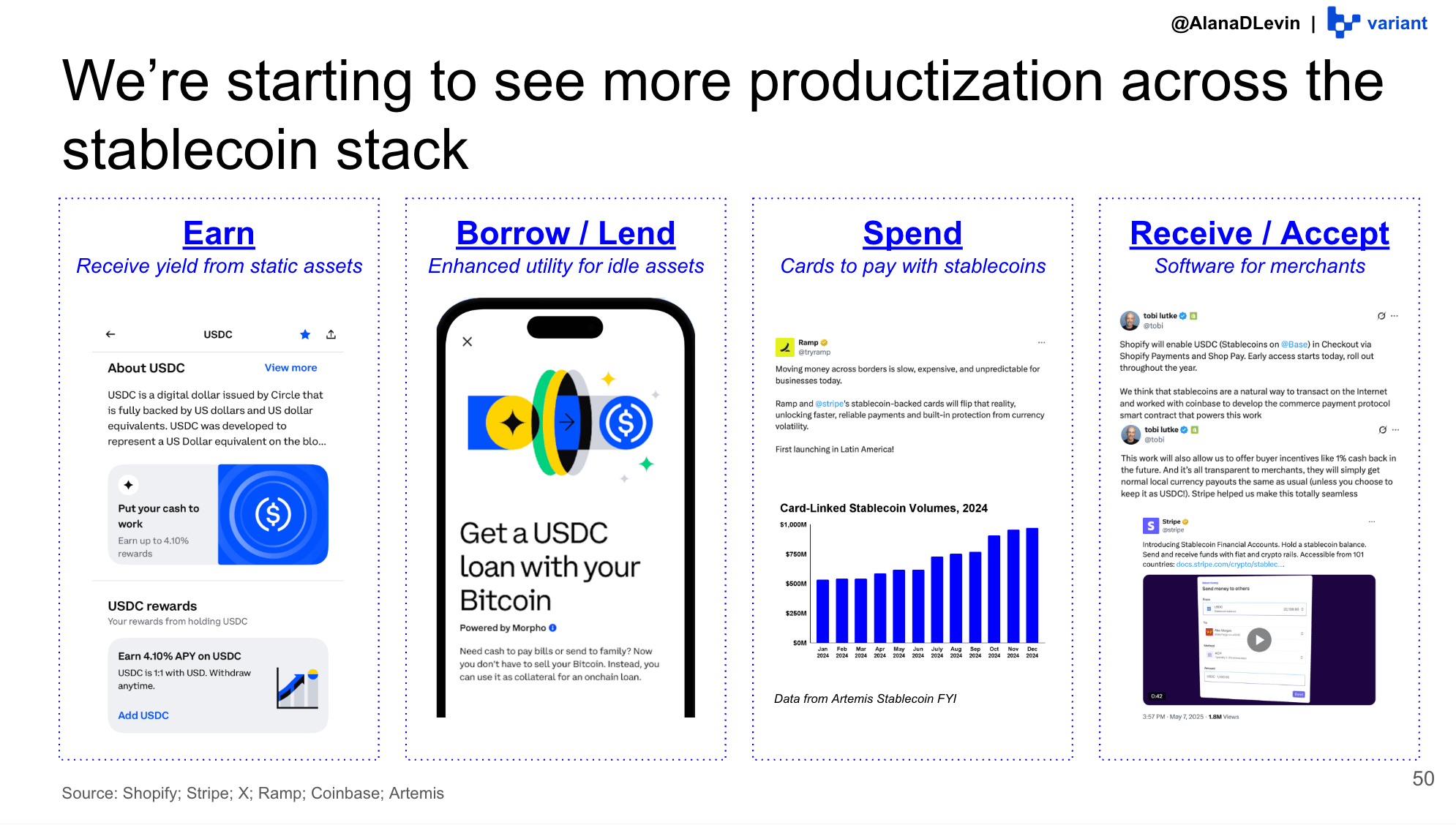

Stablecoins. Stablecoins have experienced explosive growth, covering all three S-curves: new issuances (Asset Creation) are occurring at a record pace, with many new deposit channels (Accumulation), and we are seeing more and more ways to utilize stablecoins (Utilization). There are strong network effects within this category: the more stablecoins in circulation, the more we perceive them as useful. Similarly, the more entities that hold stablecoins, the stronger the ability to build products and services around these assets becomes. Several areas currently benefiting from the productization of stablecoin payments include stable products (like protocols) and trading platforms. However, we believe there is innovation space across all three S-curve giants.

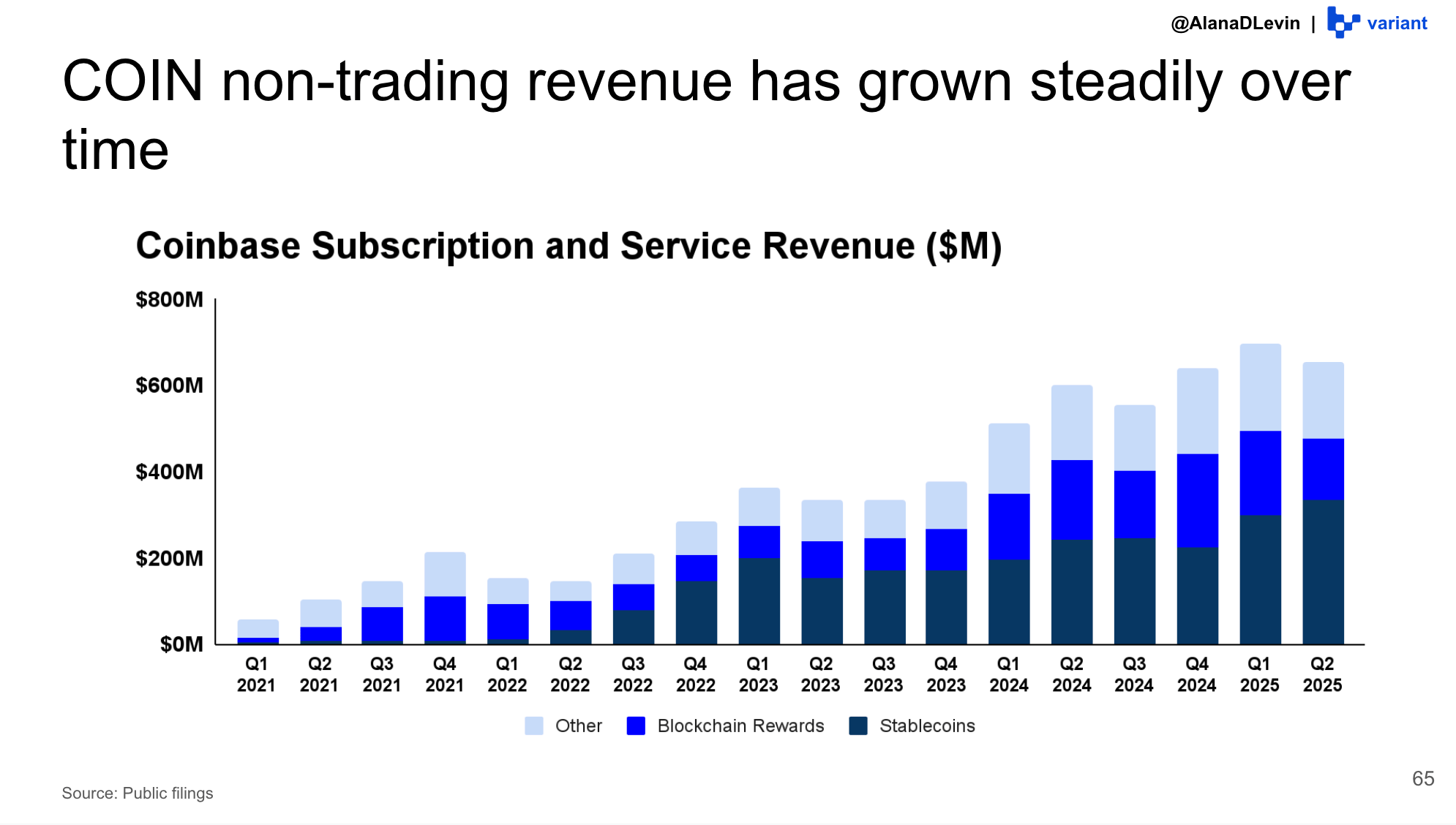

Centralized Trading Platforms: Centralized trading platforms are one of the most obvious profit-makers in the "Accumulation" phase. Trading volume and revenue have both significantly increased over the past five years. The secondary effect of trading growth is that users hold these assets on trading platforms—enabling trading platforms to offer a suite of extended utilities (such as staking, rescue, and fire products). Many new ways to utilize crypto assets will ultimately be built directly on-chain, but may find strong distribution channels through centralized trading platform integration.

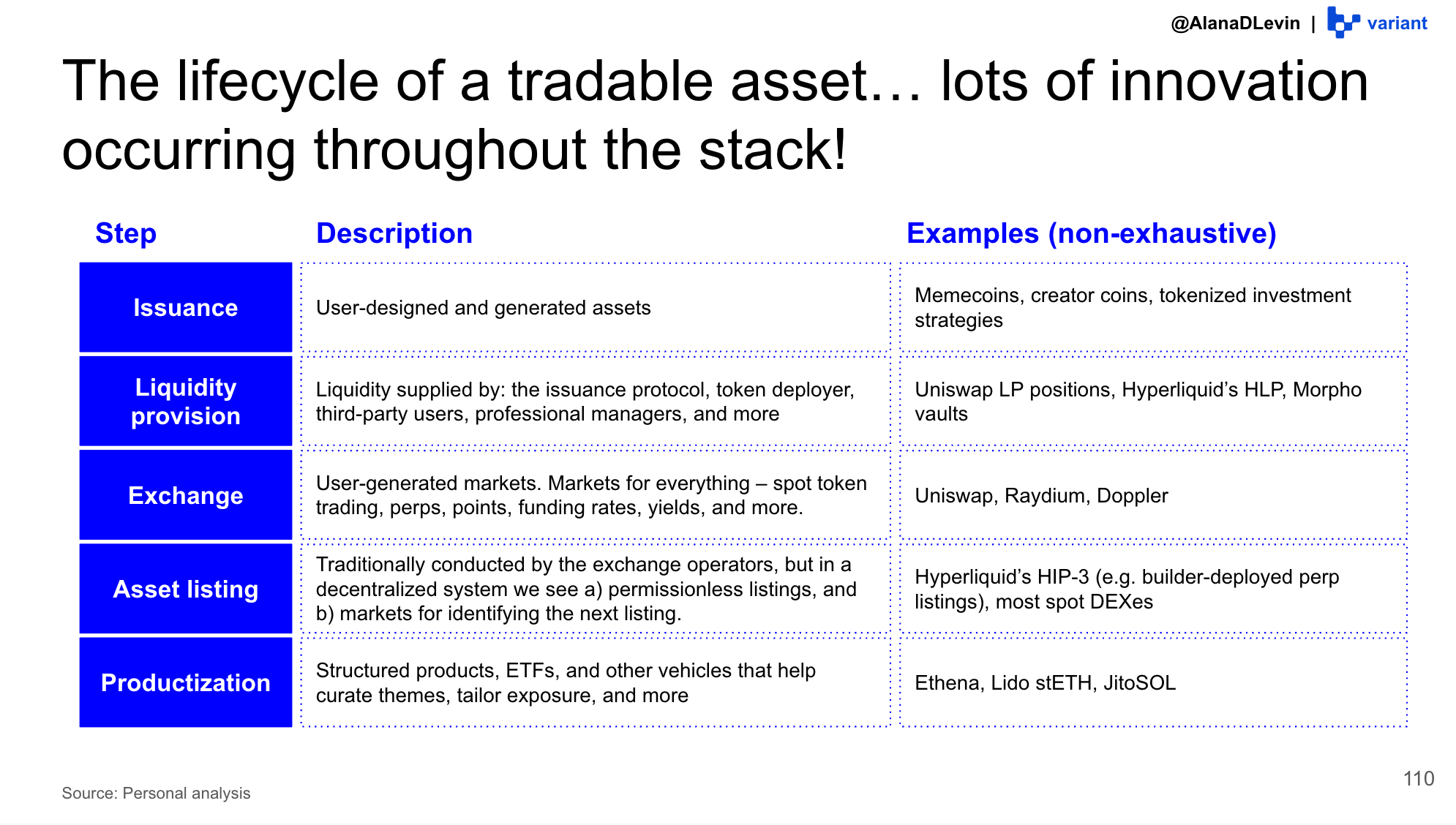

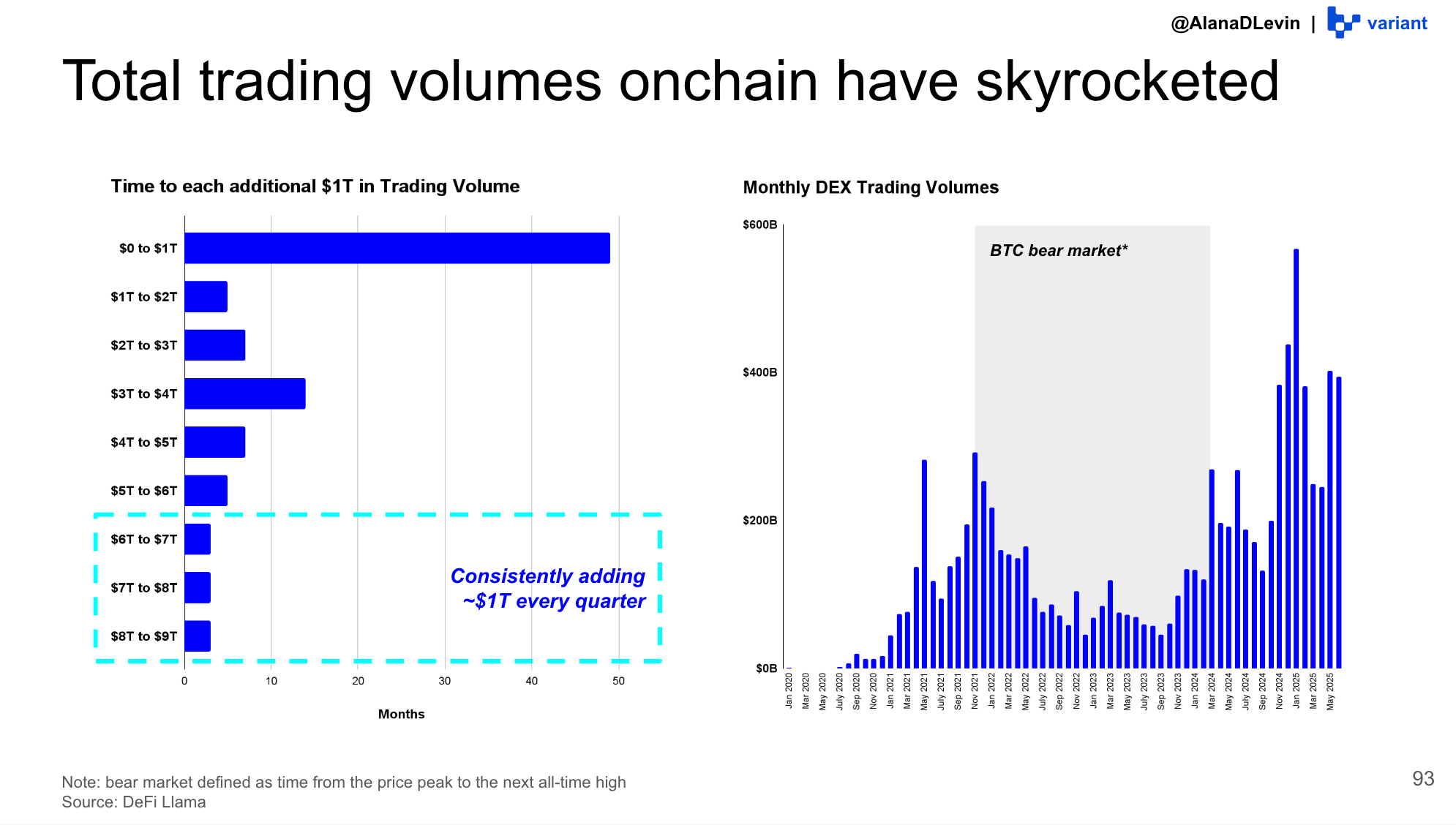

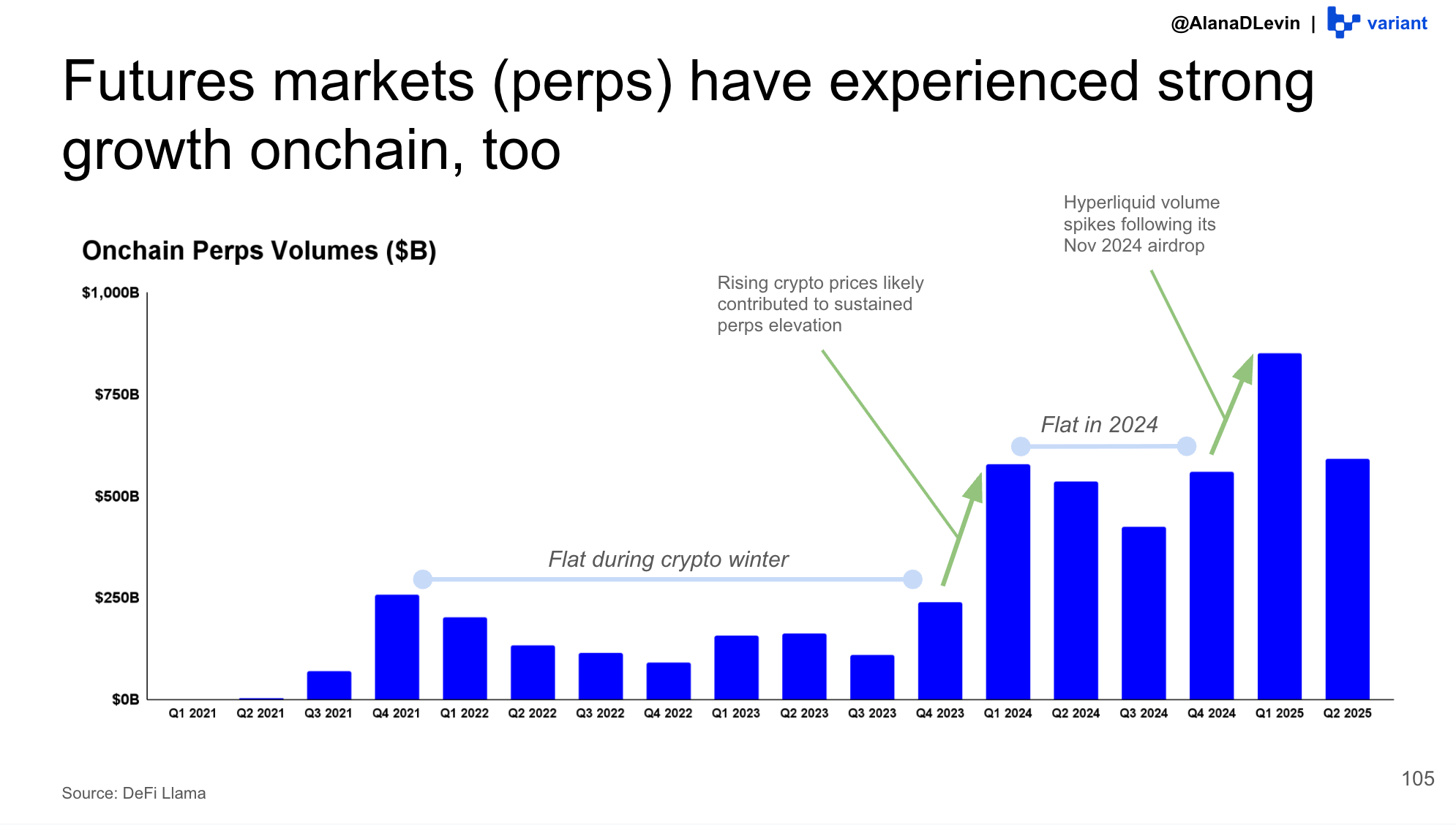

On-Chain Activity: Surprised by the novel ways to utilize crypto assets? Then look to on-chain. This is a hotbed of experimentation. Every element of the asset lifecycle—issuance, liquidity provision, trading, listing, and productization—is permitted and open on the blockchain, while each step in traditional finance is restricted. This setup greatly expands the design space for creation and utilization. Additionally, several classes of on-chain protocols have begun to maturely provide robust fundamentals for real businesses. Decentralized trading platforms, blockchain platforms, token launch platforms, and perpetual contract trading platforms have all shown exciting product-market fit.

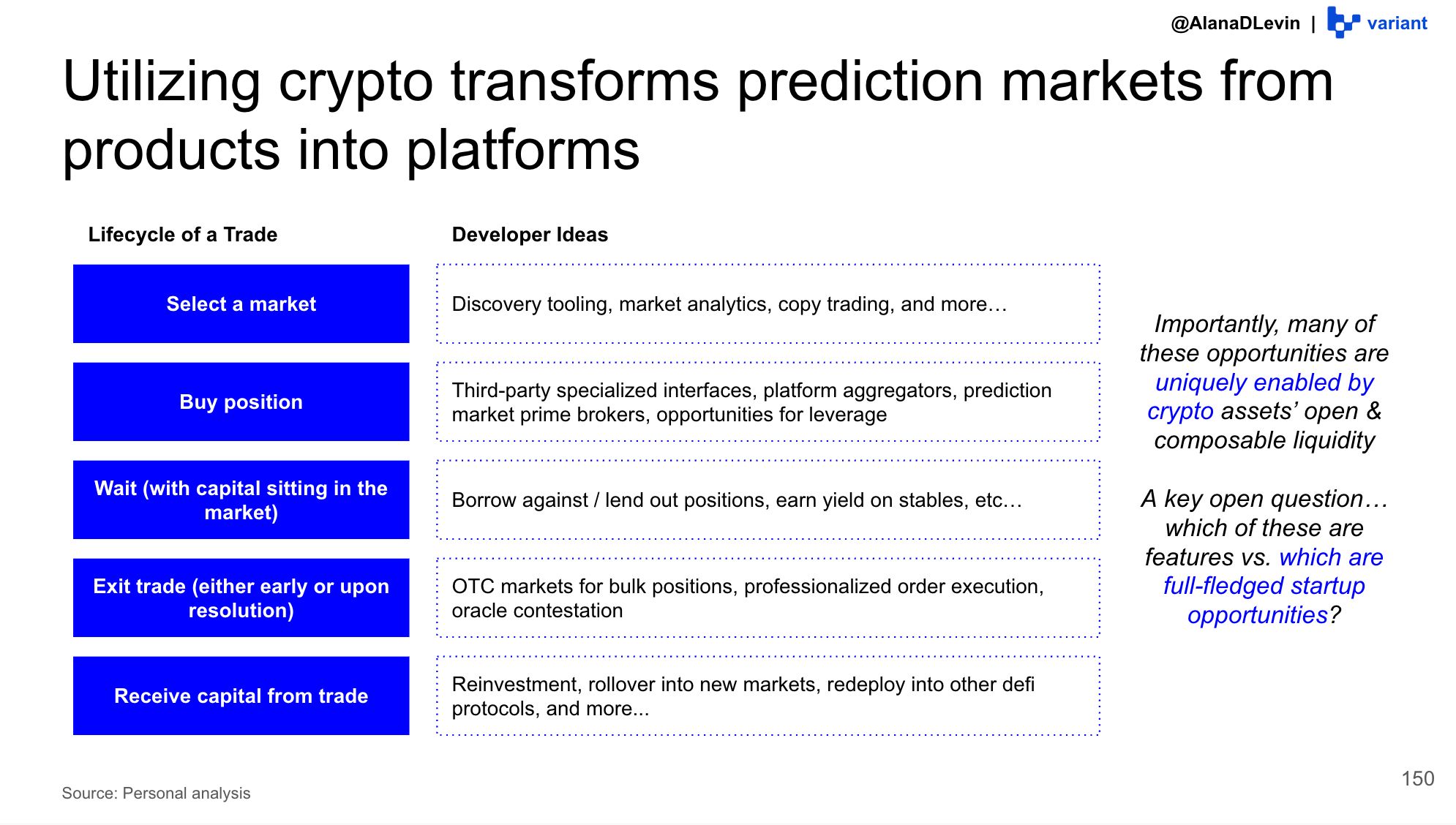

Next Steps: Building on the crypto track to transform products into platforms. This section uses the growth of prediction markets as a typical example of a new market targeted by the crypto track. It also summarizes the variations we are looking for in entrepreneurial opportunities (non-dramatic!).

In these three composite S-curves (Asset Creation, Asset Accumulation, and Asset Utilization), a lot has already been built, but there is much more to build.

Link to the article: https://www.hellobtc.com/kp/du/11/6134.html

Source: https://blog.variant.fund/2025-crypto-trends-report

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。