WhiteBIT Study Finds Europeans Prefer Stablecoins for Real-World Transactions

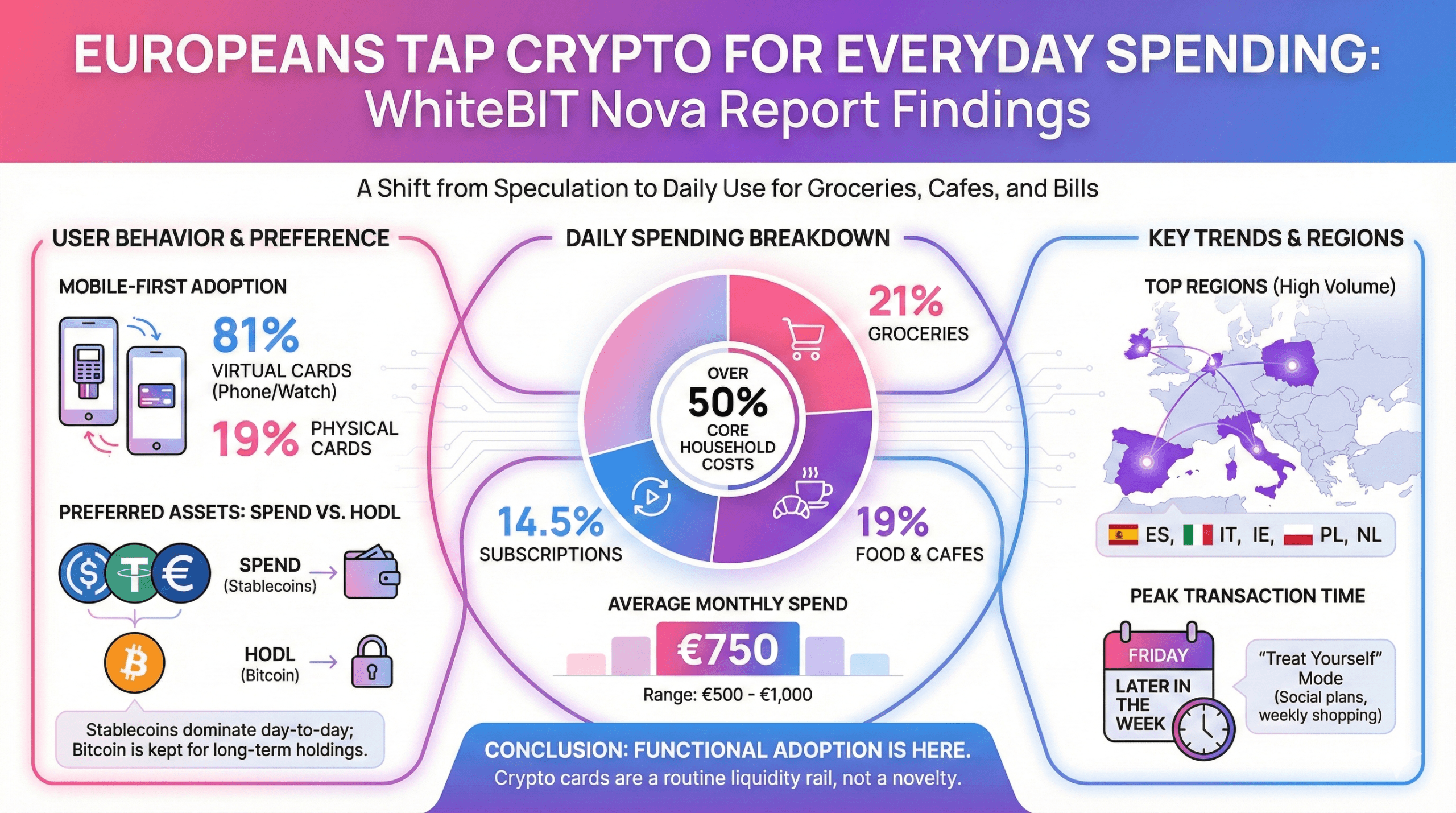

Europeans aren’t just stacking crypto—they’re spending it on groceries, café runs, and their endless carousel of subscription services. Fresh figures shared exclusively with Bitcoin.com News offer a detailed look at spending trends from the WhiteBIT Nova Visa debit card service. The card has processed more than €50 million in transactions to date. Users are spending roughly €500 to €1,000 a month on everyday purchases, with €750 emerging as the regional average.

What stands out in the data is just how ordinary these transactions look. Users are tapping crypto not for luxury buys but for life’s routine demands. Groceries take 21% of spending, food and cafes sit at 19%, and subscriptions claim another 14.5%. That means more than half of all Nova-card activity goes to core household costs—hardly the profile of a niche experiment.

The behavior tracks with broader industry trends. A Changelly–Simple Wallet survey confirms that 60.6 percent of users already rely on crypto cards, with typical European transactions around €40. Nova users lean even smaller, WhiteBIT’s report explains. Sixty percent of newcomers run their first five transactions at or below €20 or €100, suggesting they’re testing real-world reliability before graduating to daily use. It’s a cautious—but confident—embrace.

One of the most revealing insights is that 81% of Nova users never bother with a physical card. They stick to virtual cards embedded in phones, watches, and whatever else can be tapped at a point-of-sale checkout terminal. Only 19% request a plastic, physical version at all. Mobile-first behavior is expected from crypto-savvy consumers, but the near-total abandonment of physical cards implies the European digital-payments evolution is well past its warm-up lap.

Spain, Italy, Ireland, Poland, and the Netherlands lead transaction volume—five regions that already show high comfort levels with digital finance tools. And when these users do spend, they overwhelmingly prefer stablecoins: USDC, USDT, and EURI dominate, with bitcoin trailing as a spending choice, WhiteBIT analysts note.

Read more: Tempo Turns on Public Testnet, Setting Its Sights on Instant Settlement

Users appear intent on keeping long-term holdings untouched while deploying stablecoins for day-to-day expenses. A classic case of “HODL the asset, spend the stable one. Transaction timing also reveals a distinctly human touch. Volume peaks later in the week—especially Fridays—when people migrate from work mode to “treat yourself” mode. This pattern suggests crypto cards are functioning as a just-in-time liquidity rail, topped up right before social plans or weekly shopping.

The takeaway is simple: crypto cards are no longer a futuristic novelty. Europeans are using them the same way they use any other debit card—except the balance happens to live on a blockchain. It’s a quiet but meaningful shift that shows functional adoption is already here, even if no one is shouting about it.

FAQ ❓

- How much do Europeans spend using crypto cards each month?

Europeans average about €750 monthly on everyday expenses using crypto cards. - Which countries lead Europe’s crypto-spending activity?

Spain, Italy, Ireland, Poland, and the Netherlands show the highest transaction volumes. - What do users typically buy with crypto cards?

Groceries, café meals, and subscriptions account for more than half of all spending. - Which digital assets are most used for payments?

Stablecoins like USDC, USDT, and EURI dominate routine spending activity.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。