Last week, the U.S. Federal Reserve trimmed the federal funds rate by a quarter point, and markets are now betting that the January Federal Open Market Committee (FOMC) meeting delivers no adjustment. Attention has since shifted to the Bank of Japan (BOJ), where expectations are building that the central bank will lift its short-term interbank rate next week.

Japan’s central bank is set to convene its Monetary Policy Meeting (MPM) on Dec. 18–19, 2025, with the decision expected on the second day. Markets are bracing for a possible increase to 0.75% from 0.5%, a move that would formally close the chapter on the world’s last remaining negative interest rate regime. When it comes to interest rates, Japan has long stood apart as a global outlier.

The BOJ has persisted with negative short-term rates and tight control over long-term bond yields through its Yield Curve Control (YCC) framework, even as other major central banks moved on to rate increases. Many analysts believe this marks the definitive end of the “Carry Trade.”

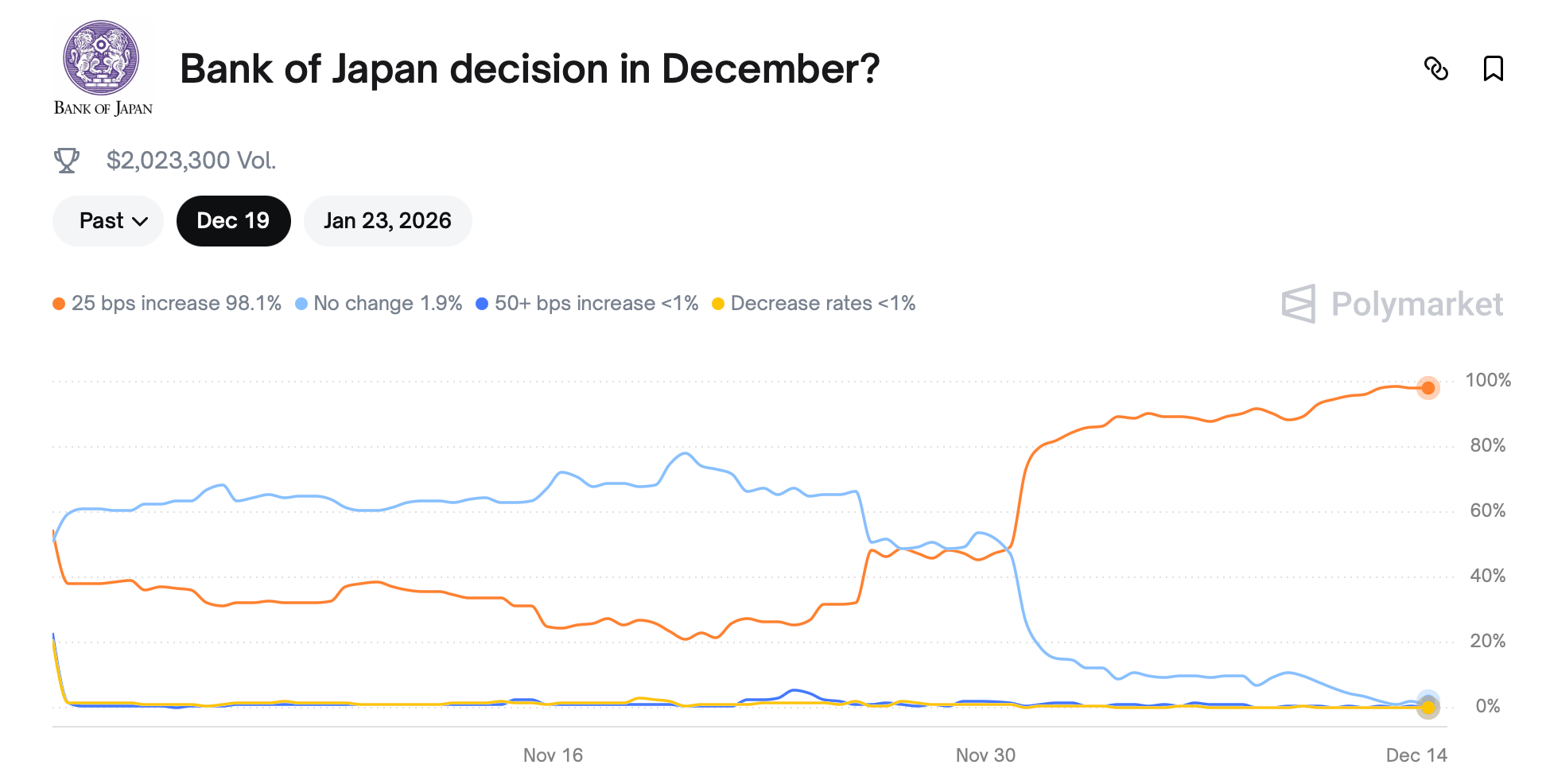

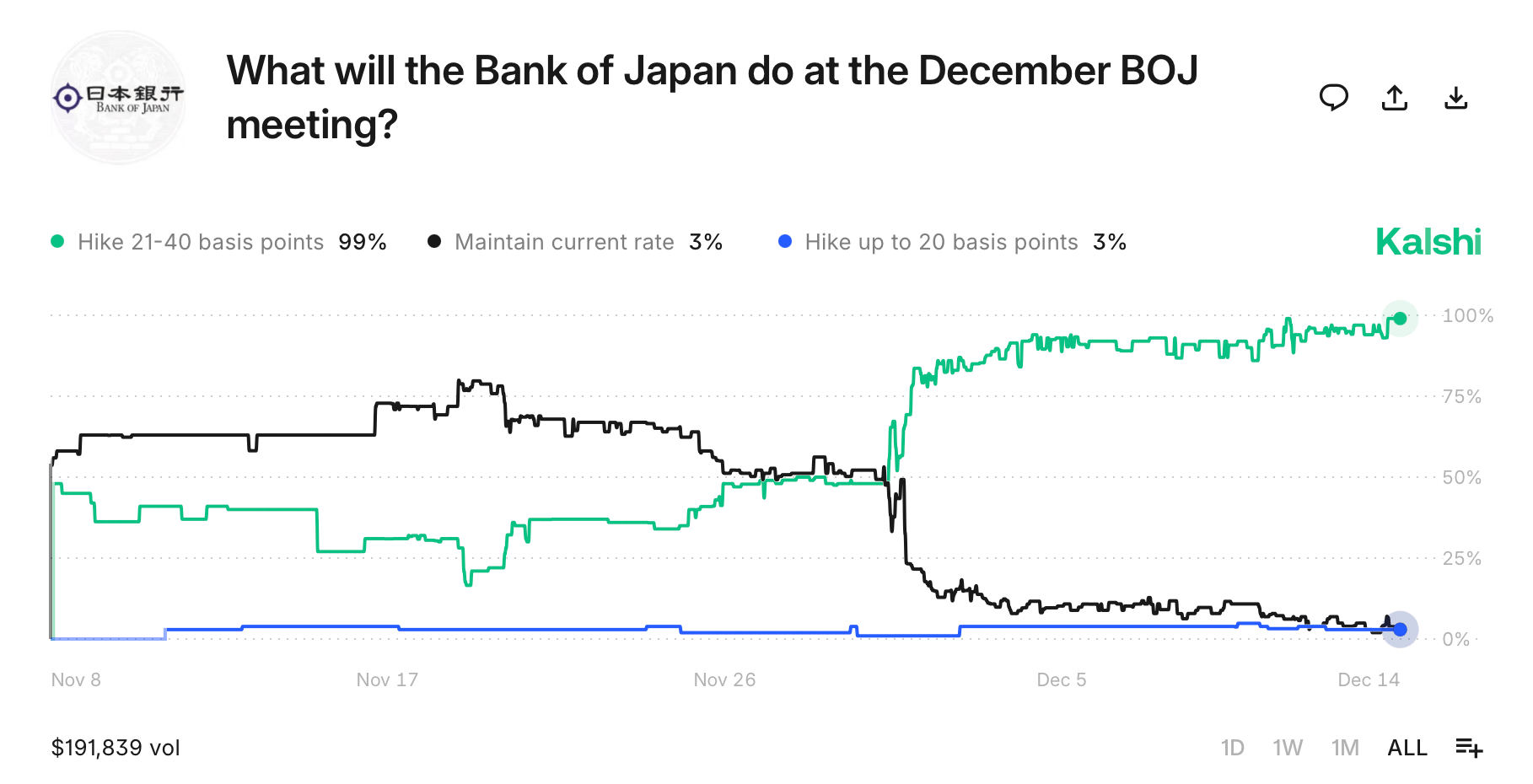

In simple terms, the strategy involved borrowing low-cost yen and deploying it into higher-yielding assets overseas. The trade only holds together as long as yen funding stays exceptionally cheap and the currency remains steady or drifts lower. At present, leading prediction markets Polymarket and Kalshi are signaling strong odds that the BOJ will deliver a 25 basis point (bps) increase.

Polymarket traders are overwhelmingly penciling in a quarter-point rate increase from the BOJ, with probabilities hovering near 98%. Every other scenario — no change, a larger move, or a cut — has been largely cast aside, each sitting at 2% or lower, reflecting a near lock that a quarter-point step is the market’s central expectation.

Kalshi traders echo that conviction. A 21–40 basis-point hike at the BOJ meeting next week carries roughly 95% odds, while the chances of no change rest near 2% and a cut barely registers at under 1%. In plain terms, the market is wagering that Japan’s central bank is ready to act. For Federal Reserve rate decisions, traders can lean on the CME Fedwatch tool to gauge expectations ahead of each meeting, while there is no comparable tool for tracking BOJ rate moves.

Also read: Brazil’s Largest Bank Updates Bitcoin Portfolio Recommendations

However, to estimate the odds of a BOJ hike, individuals or institutions can look to futures pricing — specifically 3-Month TONA futures, which capture how traders are wagering on future interest rates. At present, the implied average rate blends the current 0.5% for the early part of the period with the possibility of a higher level later on.

When that figure is weighed against today’s rate and adjusted for timing, the calculation points to roughly an 89% chance of a quarter-point increase.

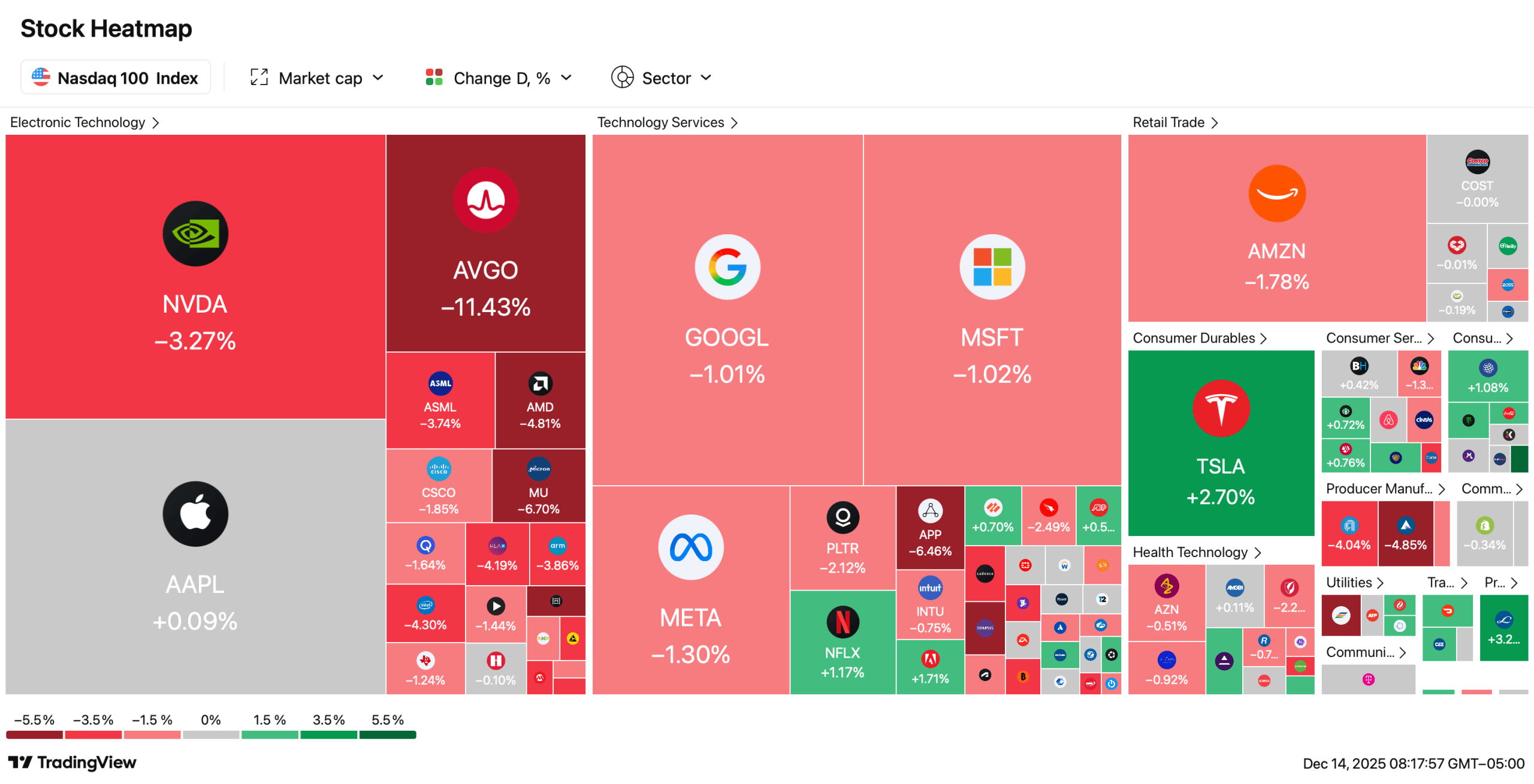

Many believe this particular rate increase may affect equities and crypto assets. U.S. stocks ended lower on Friday across the board, led by a sharp Nasdaq drop of nearly 400 points. The Dow, S&P 500, and NYSE Composite also closed in the red.

In Japan, data shows the Nikkei closing near 50,800 and the Topix around 3,420, pointing to broad gains after a session that opened with uneven trading. Some observers now expect bitcoin to retreat on a BOJ rate hike, a view gaining traction on X as users circulate the theory. “Bank of Japan is set to hike rates +25 bps on Dec 19. Japan = largest holder of US government debt,” one user wrote. “Every BoJ rate hike → Bitcoin dumps over 20%+”

Another user, sharing a chart, added: “Japan rate hikes’ effect on bitcoin—The next one is most likely on Friday, 19th.” That view has fueled speculation that the move could act as another trigger pushing BTC toward the $75,000 range. Whether that scenario plays out remains an open question and will not be answered until the BOJ makes its move. BTC is already down 29% from its $126,000-plus all-time high, and another hit to its valuation could prove painful.

Theories like these are scattered widely across X and other social media platforms. For now, markets remain in wait-and-see mode, with the BOJ holding the final card. Prediction markets, futures pricing, and social media chatter all point to a rate hike, but conviction does not equal certainty. If Japan does move, global ripples are likely, testing everything from equity momentum to bitcoin’s resolve.

Until that decision lands, traders are left navigating probabilities, not outcomes, and positioning for a moment that could reset expectations fast.

- When is the Bank of Japan’s next rate decision?

The BOJ is scheduled to announce its policy decision on Dec. 19 following its two-day Monetary Policy Meeting. - What rate hike is the market expecting from the BOJ?

Markets are largely pricing in a 25-basis-point increase from the current 0.5% level. - Why is a BOJ rate hike significant for global markets?

A hike could mark the end of Japan’s ultra-low-rate era and ripple across currencies, bonds, and risk assets. - How could a BOJ rate hike affect bitcoin?

Some traders believe tighter Japanese policy could pressure bitcoin, though outcomes remain uncertain.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。