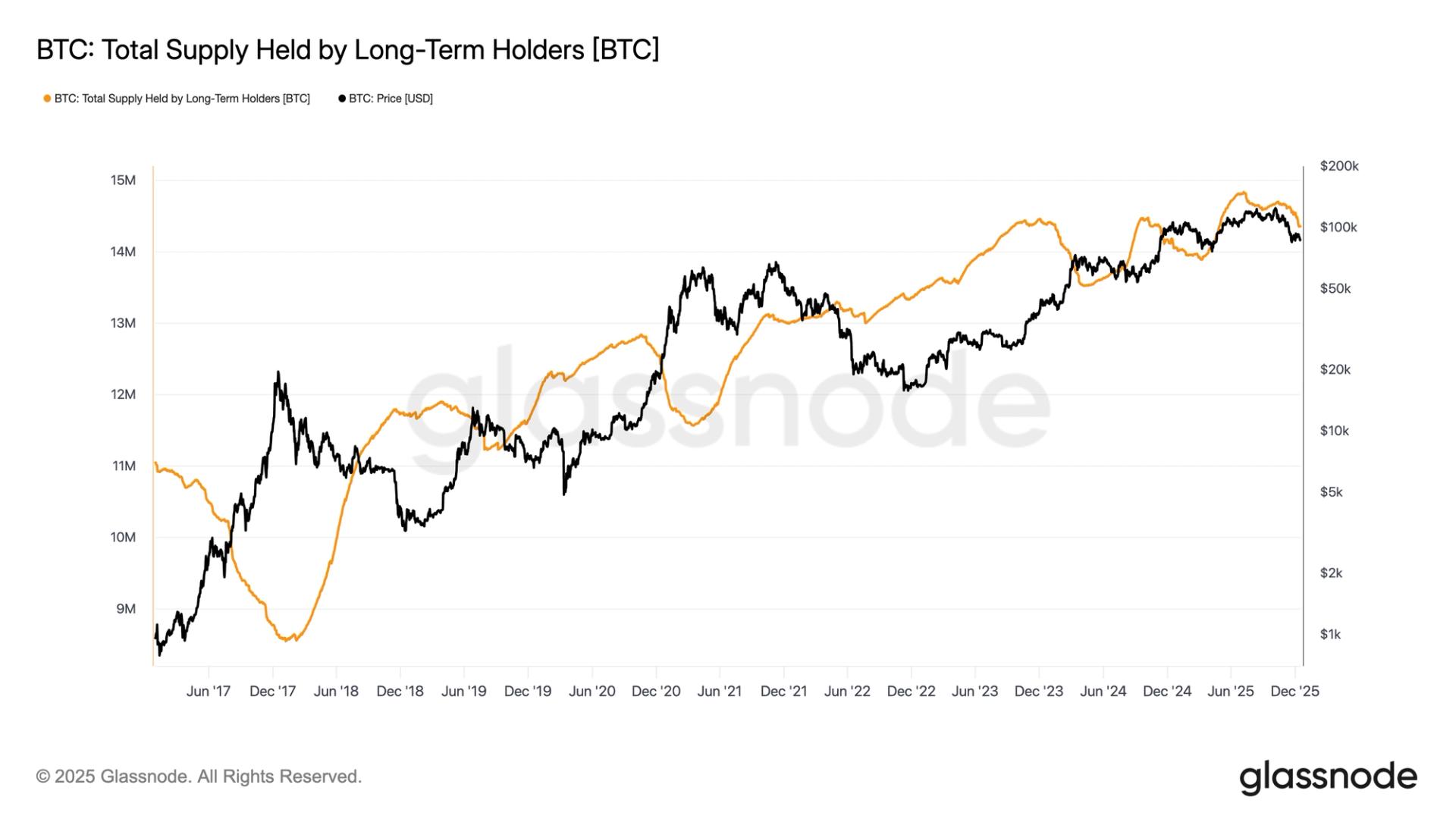

What to know : Bitcoin long-term holder supply has fallen to 14.34 million BTC, its lowest level since May, marking the third wave of long term holder selling this cycle after earlier distribution around ETF approvals and the move to $100,000 after President Trump's election win. Unlike prior bull markets that saw a single blow off distribution phase, this cycle is characterized by multiple LTH sell waves that have been absorbed by the market.

Bitcoin long term holder (LTH), supply has fallen to an eight month low of 14,342,207 BTC, a level last seen in May, which has coincided with bitcoin falling almost 40% from its October all-time high.

Glassnode defines a long term holder as an entity that has held bitcoin for at least 155 days, placing the current cohort cutoff around mid July, so any buyer then and has held would be classified as a LTH.

This decline marks the third distinct wave of LTH distribution in the current cycle since early 2023.

The first wave occurred from late 2023 into early 2024 following the launch of U.S. spot bitcoin ETFs, when LTH's sold into strength as bitcoin rallied from roughly $25,000 to a peak near $73,000 by March 2024.

The second wave emerged later in the year when bitcoin ran towards $100,000, driven by optimism surrounding President Trump’s election victory. The market is now experiencing a third iteration of LTH selling as bitcoin remained above $100,000 for much of the year.

Why This Cycle is Different?

This behavior stands in contrast to prior bull markets in 2013, 2017, and 2021, where LTH supply typically followed a single boom and bust pattern, bottoming near euphoric cycle peaks before gradually recovering.

Instead, this cycle has seen repeated waves of distribution without a clear blow off top, a dynamic highlighted by Alec, co-founder of Checkonchain, who noted that bitcoin LTH spending this cycle is unlike anything seen in recent history, with the market absorbing a third sell wave remarkably well.

LTH distribution remains one of the largest sources of sell side pressure in bitcoin and has been a key contributor to the nearly 40% correction from October's all-time high.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。