The cryptocurrency industry is at a critical stage of deep integration with the core of finance. To seize this opportunity, it is essential to achieve excellence in product quality, compliance, and user-centered design.

Author: Coinbase Institutional

Translated by: Deep Tide TechFlow

Our annual crypto market outlook will delve into the various factors shaping the crypto economy over the next year. From detailed forecasts on BTC (Bitcoin), ETH (Ethereum), and SOL (Solana) to comprehensive analyses of regulatory dynamics, market structure, and the latest developments in tokenization, we cover all important areas. Additionally, we explore the impact of Bitcoin's four-year cycle, the potential risks posed by quantum computing, and the far-reaching effects of significant platform upgrades such as the Ethereum Fusaka hard fork and Solana Alpenglow.

We invite everyone to click the link to download the full report.

Highlights include:

- Cautious Optimism: We hold a cautiously optimistic view of the resilience of the U.S. economy, believing that continuously improving labor productivity can provide some buffer amid overall economic data slowdown. Therefore, we see the crypto market in the first half of 2026 (1H26) more like "1996" rather than "1999," although uncertainty remains high.

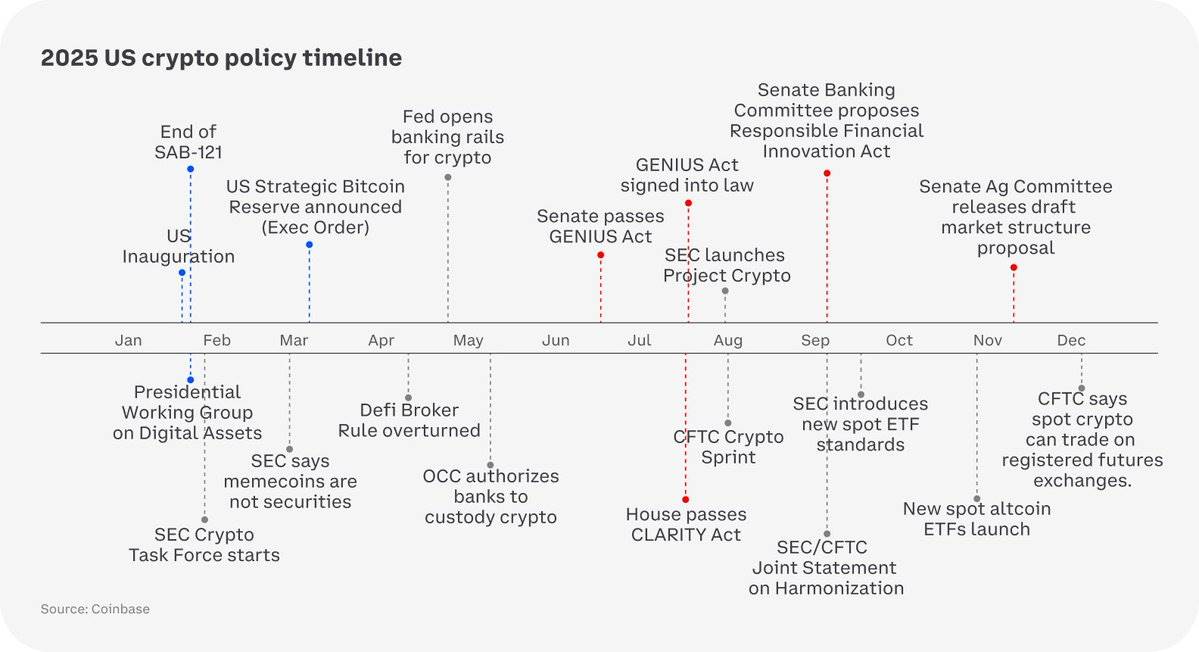

- Regulatory Progress: We anticipate that clearer global regulatory frameworks will change how institutions respond strategically, in terms of risk and compliance, in 2026.

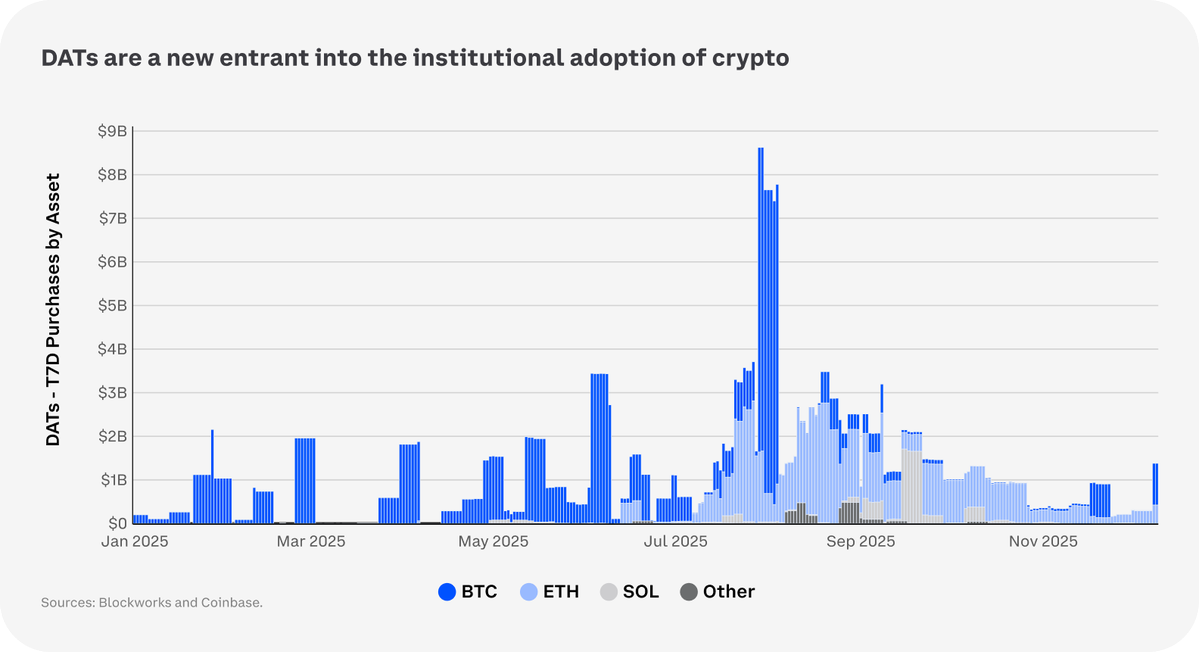

- Institutional Adoption: We predict the emergence of a "DAT 2.0" model in 2026, which will go beyond simple asset accumulation to focus on professional trading, storage, and procurement in sovereign blockchain spaces, viewing them as vital resources in the digital economy.

- Token Economics 2.0: As protocols gradually tilt towards value capture, we observe an emerging shift from purely narrative-driven high volatility models to sustainable models linked to revenue.

Technological Transformation

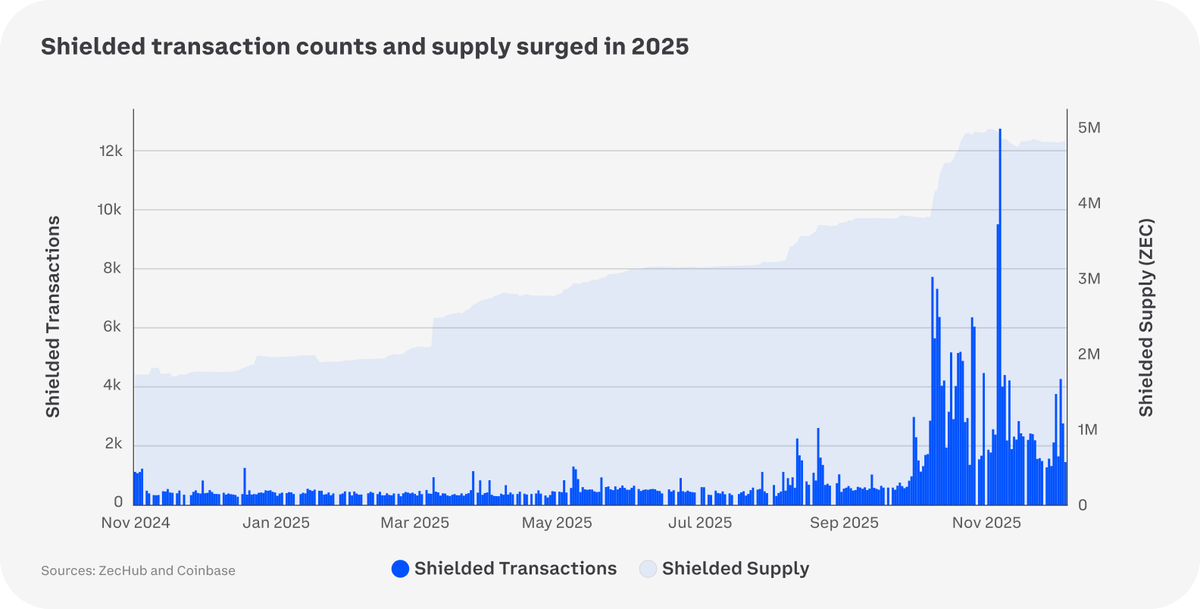

Privacy Demand: With increasing institutional adoption, we expect technologies such as zero-knowledge proofs (ZKPs) and fully homomorphic encryption (FHE) to continue to develop, while the use of on-chain privacy tools will also see significant growth.

AI × Cryptocurrency: Autonomous trading smart agent systems require open and programmable payment methods. Protocols like x402 can facilitate high-frequency microtransaction settlements and support smart agents that can initiate, govern, and protect on-chain services.

Application-Specific Chains: Although the surge of dedicated blockchain networks is reshaping the competitive landscape of crypto infrastructure, we believe the ultimate direction will be a networked architecture with native interoperability and shared security, rather than an endless network of isolated systems.

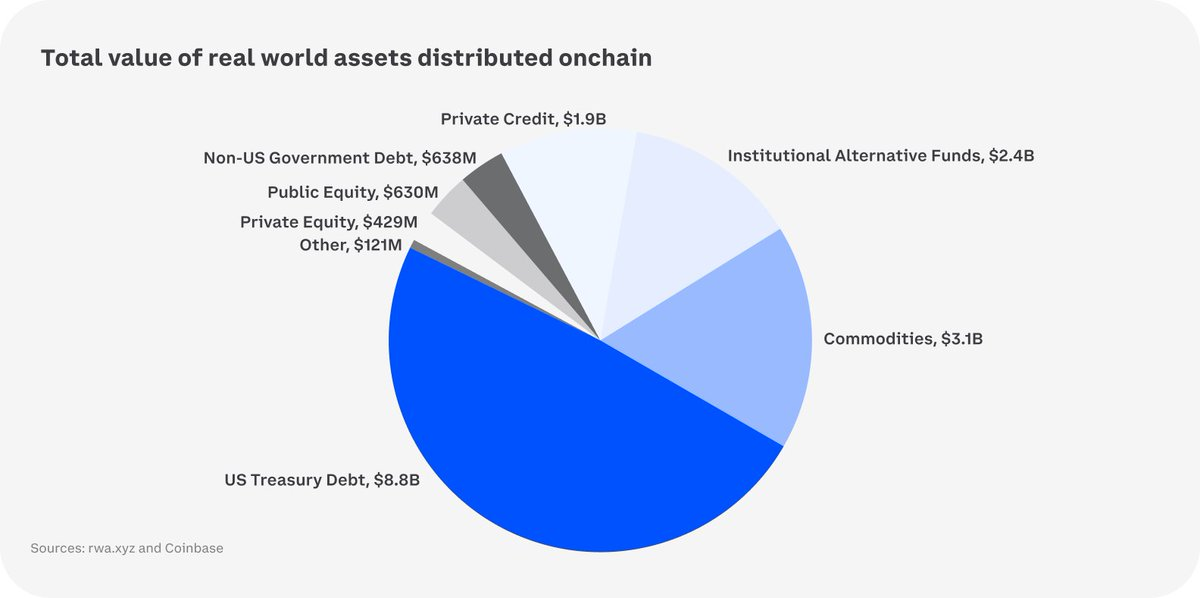

Tokenization: The advantages of atomic composability make the rapid growth prospects of tokenized stocks highly attractive. In many cases, the loan-to-value (LTV) ratios in this model are significantly higher than traditional margin frameworks.

The Next Big Trend

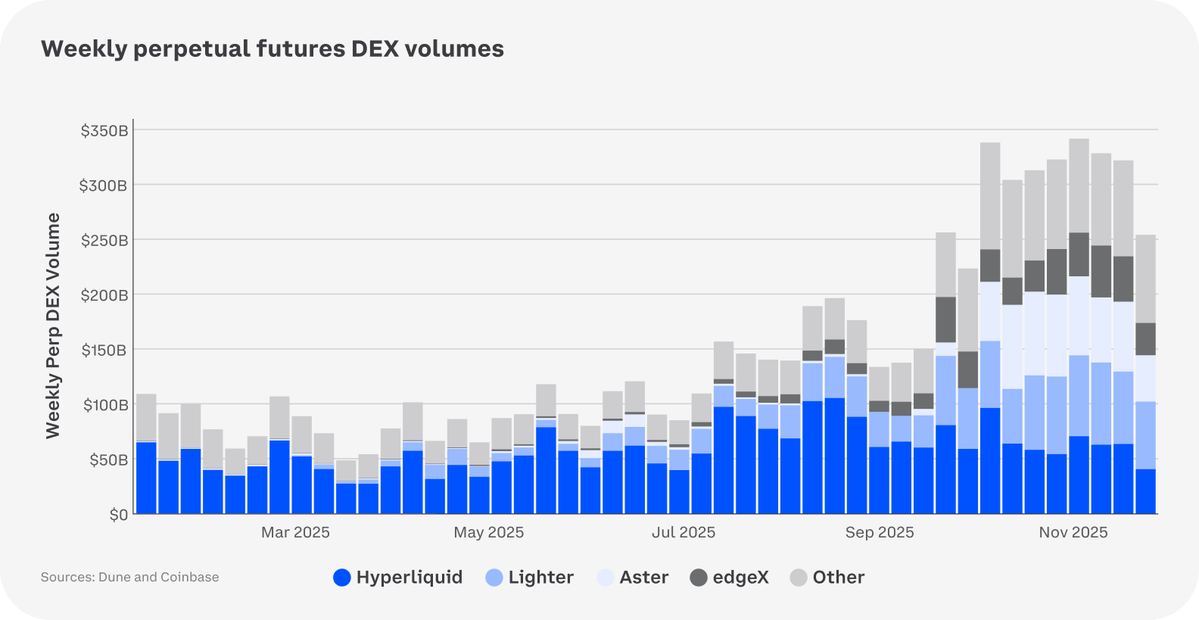

Composability of Crypto Derivatives: As the trend of global retail investors participating in the U.S. stock market continues to rise, we believe equity perpetual contracts (equity perps) may become the preferred choice for a new generation of retail traders, combining the convenience of around-the-clock trading with capital efficiency.

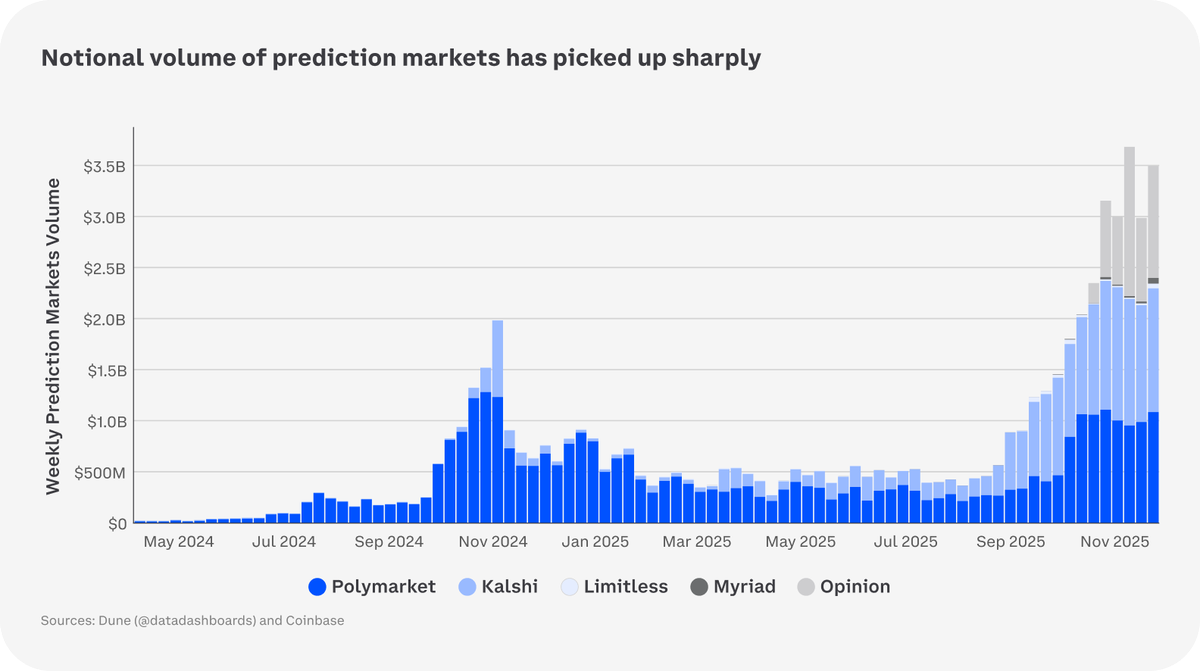

Prediction Markets: With anticipated changes in U.S. tax policy, trading volumes in prediction markets are expected to grow further in 2026, potentially attracting more users to these markets linked to derivatives. We believe prediction market aggregators may become the dominant interface layer.

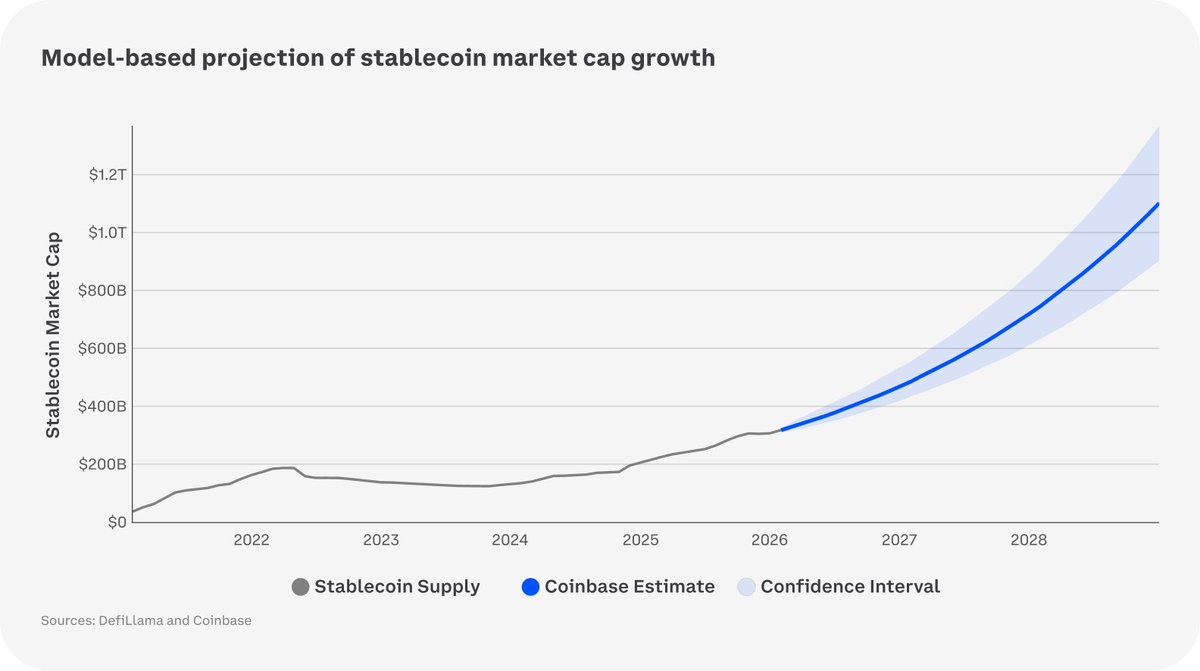

Stablecoins and Payments: Our stochastic model predicts that by the end of 2028, the total market capitalization of stablecoins could reach a target range of $1.2 trillion. The application of stablecoins is expected to grow further in emerging use cases such as cross-border transaction settlements, remittances, and payroll payment platforms.

We believe the cryptocurrency industry is at a critical stage of deep integration with the core of finance. To seize this opportunity, it is essential to achieve excellence in product quality, compliance, and user-centered design. By focusing on these areas, we can ensure that the next wave of innovation benefits everyone globally, providing convenience anytime and anywhere.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。