Since the article "Where Should the Chinese Prediction Market Explore?" was published, prediction markets have entered the global mainstream and gained significant visibility. Drawing on Bitcoin and stablecoins, crypto products that achieve Product-Market Fit (PMF) are recognized by the market as new tracks and receive continuous funding injections.

Thanks to the natural platform monopoly effect of prediction markets, surrounding services have become a consensus within the community, aiming to cultivate them into natural incubators for capturing external ecosystems, thereby constructing a layered ecology of core—periphery—outer.

After outlining the basic pattern and direction of prediction markets, let’s attempt to analyze the existing surrounding services. Besides imitation trading, tools, and rebates, what other directions can support high market cap peripheral business forms?

Mature Prediction Markets

The world may end, but progress marches on.

Prediction markets are highly certain uncertain markets. For events like the World Cup, the date and participating teams are highly controllable for participants, as are the midterm elections and presidential elections in the United States.

However, the champion team of the World Cup cannot be predetermined; otherwise, it would be a conspiracy, making it an uncertain information game that continuously changes its fundamental appearance with the addition of current information factors.

For instance, during the 2024 U.S. presidential election, a significant amount of betting occurs within five days before the deadline, and in on-chain transactions, users' bullish or bearish sentiments directly affect the bullish and bearish markets, converging into a self-fulfilling prophecy.

Current prediction markets are developing in this direction, such as when the CEO of Coinbase noticed that people were predicting his statements, thus "cooperating" with the eventual outcome.

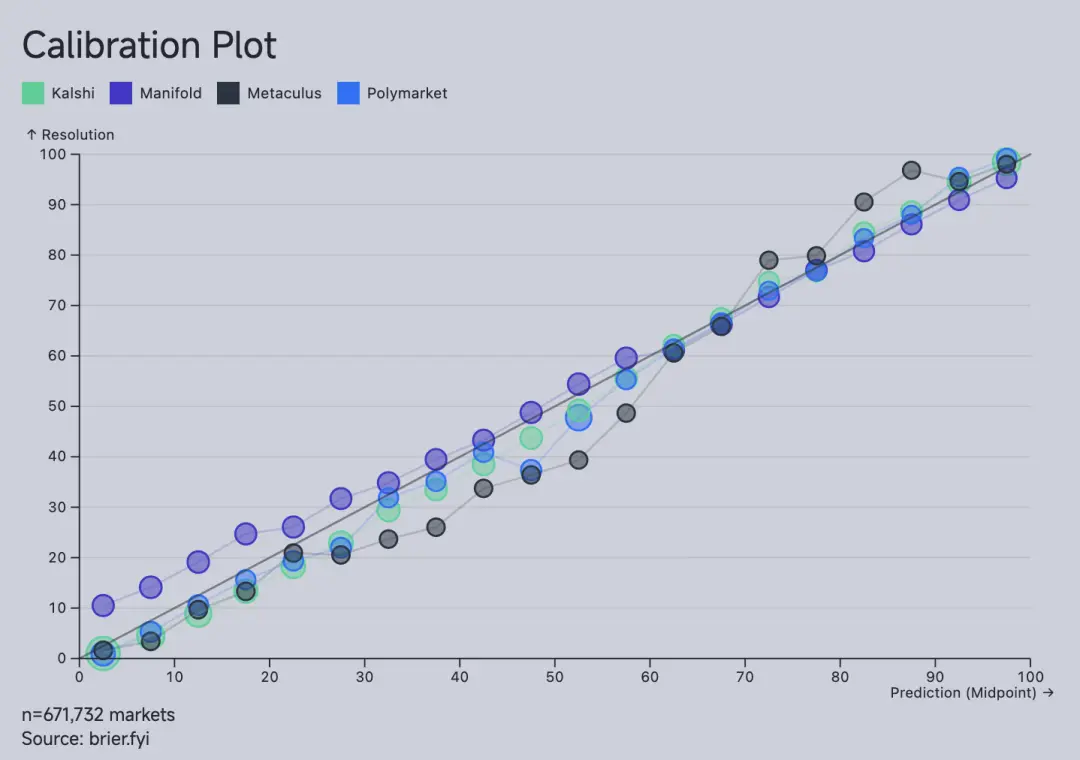

Image description: Prediction requires data Image source: https://brier.fyi/

Before prediction markets, polls and media played this role. It was not that polls tested voters' tendencies, but rather that polls guided people's choices. Therefore, in a Western context, prediction markets are viewed as informational tools, layered with functions like insurance, hedging, and taxation.

Thus, prediction markets are far more sensitive than trading tools. Just as TikTok is not facing bipartisan encirclement due to trivial entertainment, prediction markets cannot naturally fragment:

Information discovery needs to be based on real-time data for the game to enhance final accuracy, as information promotes more concentrated traffic;

The U.S. election market is highly mature, requiring a Western context to achieve a non-destructive struggle with the political system, becoming a new information channel.

Based on this, Polymarket and Kalshi will be "mature from birth" information aggregation points, which is also the fundamental reason why U.S. capital continues to push up the valuations of the two, rather than adopting a horse racing mechanism like Binance.

Of course, all of this is irrelevant to us; what matters to us is how to ride the wave of the crazy prediction market FOMO.

Image description: Surrounding prediction markets Image source: @zuoyeweb3

Overall, the market has evolved into four models:

Imitation trading platforms outside of Polymarket and Kalshi require investments at the level of Perp DEX, along with subsequent high compliance costs in the U.S. market, leading to a trajectory towards TGE with almost no real adoption rate;

Innovations in the asset layer of existing prediction platforms:

DeFi-ifying betting assets on prediction markets, such as Gondor allowing them to be used as collateral for loans, and Space providing 10x leverage, overall violently integrating DeFi factors;

The emergence of innovative assets like 42 Space, which generate prediction topics directly from social media information streams, attempting to differentiate from existing platforms;

Mainstream Web3/2 financial trading Super Apps like Coinbase/Robinhood, filling in their own trading types.

Custom tools for specific groups and needs in prediction markets, such as high-frequency trading, multi-platform arbitrage trading, or aggregation trading terminals, LP mining, or small fee tools, as well as platforms for aggregating and analyzing prediction market data and information.

KOL and rebate platforms, such as mobile trading platforms like Based and Phantom Wallet, and various social media-driven rebate KOLs or communities.

In the above paradigms, the investment in the core of prediction markets is too large, and due to political considerations, there is almost no prospect for new forces to achieve high valuations. Secondly, tools and rebates will present cyclical changes with the influx of funds into prediction markets and shifts in hotspots.

The only worthwhile business investment can only be the DeFi-ification of prediction platform assets. While waiting for results, the betting assets remain in a stagnant state, which may be the most noteworthy quality asset in DeFi.

A Win-Win Cross-Market Arbitrage Mechanism

Use a Taobao traffic station approach to do DeFi, don’t use a DeFi approach to do DeFi.

Facing the traffic services provided by giants is always a dance on the knife's edge. On one hand, the giants need third parties to enhance platform traffic; on the other hand, they do not want third parties to develop brand effects.

This is the dilemma faced by early e-commerce traffic stations. They must maintain good relationships with platforms, sellers, and buyers. Sellers need third-party traffic stations to enhance competitiveness, while buyers hope to get discounted prices.

Image description: Third-party services Image source: @zuoyeweb3

Traffic stations approach from the rebate perspective, with platforms developing corresponding sharing/purchasing/rebate tools. As long as the final seller receives more natural traffic after exposure than promotional discounts, the entire business can operate sustainably.

Sellers need to rely on platforms to capture natural traffic, as self-operated brands and channel costs are too high.

Buyers need platforms to provide after-sales service and protection of rights, and the payment process also requires platform guarantees.

Referring to the three-way competition of e-commerce platforms like Taobao—JD—Pinduoduo, the market for new e-commerce platforms is overly narrow. The e-commerce market inherently needs to satisfy the dual pattern of "brand merchants + long-tail traffic," and newcomers capturing brand merchants or focusing on niche markets cannot generate scale effects.

Ultimately, Taobao relies on differentiating Tmall to retain high-end customers, while Pinduoduo uses the national-level application WeChat to drive traffic from rural China to the world, leaving only JD, which focuses on brands, in a precarious position.

Here, we compare the rebate mechanism of exchanges. Rebate KOLs and exchanges pursue the number of retail investors following trades, and the profits and losses of retail investors do not affect the following mechanism, which is inconsistent with e-commerce rebates. Users have an initial demand for purchasing goods, and providing discounts benefits the promotional effects of traffic stations and sellers.

From this perspective, the Builder mechanism of Hyperliquid and Polymarket does not solve the above issues; the growth it promotes can only be an increase in trading volume.

This does not mean that the increase in trading volume is unimportant, but it still leads to wasted stagnant funds, and the more trading volume there is, the more stagnant funds will accumulate, which is not a good thing for the financial industry that pursues capital efficiency.

If we cannot break free from the constraints of CEX/DEX growth logic, then prediction markets will quickly reach their peak, as the public events available for trading are ultimately limited, and smaller, more instantaneous events will favor the house advantage, leading to a true shift towards the exchange track.

Information games are the essence of prediction markets. In the process from betting to expiration, funds will be stagnant. How to "effectively utilize" stagnant funds is the underlying driving force for the mutual pursuit of prediction markets and DeFi.

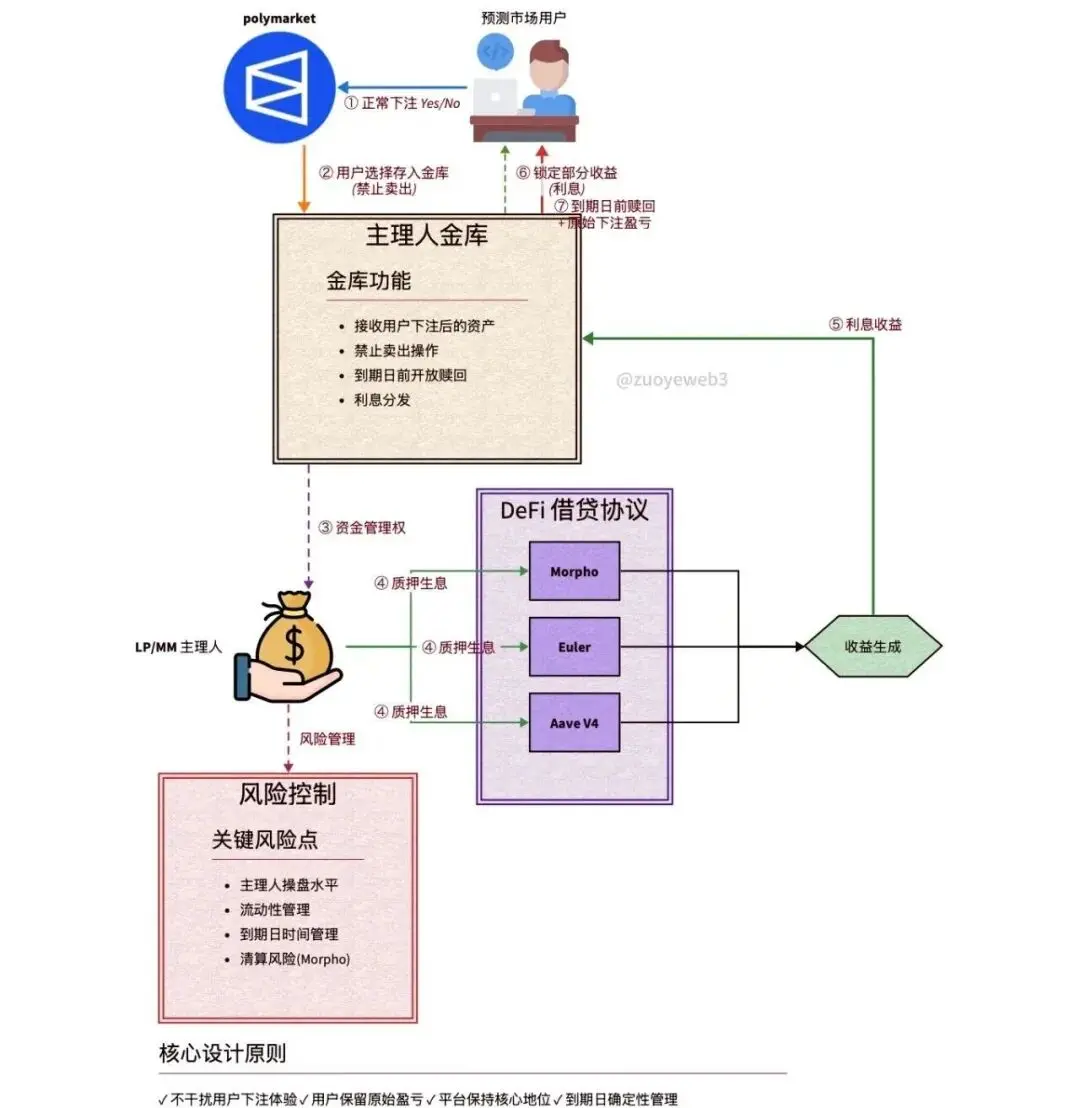

Image description: Leveraging prediction assets Image source: @zuoyeweb3

Do not attempt to interfere with users' normal betting experience. In the current discussions about leveraging in prediction markets, there are mainly two trends:

The interception operation represented by Gondor allows users to deposit their positions into DeFi staking after betting, and regardless of liquidity management and APY calculation, simply changing the user's purpose has already doubled the difficulty, easily leading to a path of high-interest savings.

Kaleb Rasmussen from Messari attempts to price the "Jump Risk" of prediction market prices. As mentioned earlier, the price changes in prediction markets can instantaneously revert to 1 or 0. While the mathematical discussion is fascinating, the practical financial engineering implementation is quite challenging.

Based on existing practices, I boldly propose a simpler way to implement DeFi transparent leverage without interfering with user experience, which I suggest for founders to consider: a cross-market arbitrage mechanism modeled after Taobao's affiliate marketing, arbitraging between the audience of prediction markets and DeFi.

The platform provides a prediction market order placement service, allowing users to place orders for 0 or 1 positions at a discounted price, obtaining better market prices, while the platform secures lower financing costs, and prediction markets like Polymarket gain more traffic;

The platform or prediction market LP/MM acts as the treasury manager, and after users place bets, they deposit into a cooperative treasury with the prediction market, such as Morpho, to earn DeFi stack returns.

In the above process, there is no interference with the user's betting experience. As long as the platform's discount cost is less than the returns in the DeFi stack, economies of scale will take effect. Users will ultimately still receive their betting losses or profits, but unlike the trading rebate mechanism, users place orders based on their own judgment.

Unlike the infinite issuance of xUSD that triggers leverage, Polymarket's USDC genuinely exists, and the only risk point is the operator's management level.

Prediction market platforms: Embed themselves into a broader DeFi stack, increasing platform trading volume without compromising user experience;

Treasury managers + LP/MM: Effectively utilize stagnant funds, and with a defined expiration date, can construct a new model that transcends short-term arbitrage;

Just like the rebate system of third-party e-commerce traffic stations, buyers will still generate any transactional relationship with the platform and sellers. The Yes/No betting parties in prediction markets will also have transactional relationships with Polymarket, unrelated to the treasury managers.

Moreover, Polymarket remains at the core of the entire trading process. Thanks to Morpho's open architecture, even if bad debts occur, they will follow the normal liquidation process, minimizing the platform's liability.

(The above model is just a preliminary view; friends with thoughts on this are welcome to discuss privately.)

Conclusion

Use DeFi thinking to leverage "traffic," not traffic thinking to buy DeFi volume!

The true value of prediction markets lies in the stagnant funds, with a clear expiration date and corresponding asset reserves. If Polymarket wants to outperform Kalshi in capital efficiency, its scale expansion has already reached a phase limit.

In other words, compared to trading assets, Wall Street and the crypto circle are currently in an irrational frenzy regarding information pricing. Whether it’s TGE or IPO, whether issuing stablecoins or building L1/L2, these are all expected routine actions.

Before the uncertain dates of TGE/IPO, Polymarket needs to strengthen its ecosystem through surrounding services to boost trading volume and counter Kalshi. The programmability and composability of funds on-chain are the solutions for Polymarket's external traffic.

The biggest financial opportunity in 2026 will be the cyclical fluctuations of the midterm elections and the World Cup, with FIFA catering to the Trump base and regulators allowing DeFi and gambling, making it undoubtedly a financial banner year.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。