Author: Eric, Foresight News

On December 17, the Ethereum block space futures market ETHGas announced the completion of a $12 million financing round, led by Polychain Capital, with participation from Stake Capital, BlueYard Capital, Lafayette Macro Advisors, SIG DT, and Amber Group. Founder Kevin Lepsoe stated that ETHGas had previously completed an undisclosed Pre-Seed round of approximately $5 million in mid-2024.

Additionally, Lepsoe mentioned that Ethereum validators, block creators, and relay nodes have committed around $800 million to support market and product development, but this is not a cash investment; rather, it is in the form of providing liquidity to the ETHGas market through Ethereum block space.

Although the project is defined as a block space futures market, its true vision is to achieve "Real-Time Ethereum."

Order of Blocks

Ethereum co-founder Vitalik Buterin proposed the concept of a gas futures market at the beginning of the month, primarily to address the volatility of Ethereum gas fees. Similar to the logic of commodity futures in the current market, locking in future gas costs through futures contracts serves to make gas expenses predictable and controllable.

This way, DApps can lock in gas costs before events such as users claiming token airdrops and design activities to subsidize users. L2 can also buy futures when gas fees are lower to stabilize the costs of packaging and submitting data to L1, thus serving businesses that require advance cost calculations, such as tokenization of U.S. stocks.

According to the documentation, ETHGas will also launch a no-code tool called Open Gas specifically for DApps to help them provide gas subsidy programs, allowing users to claim the gas fees consumed on the ETHGas platform after using the DApp.

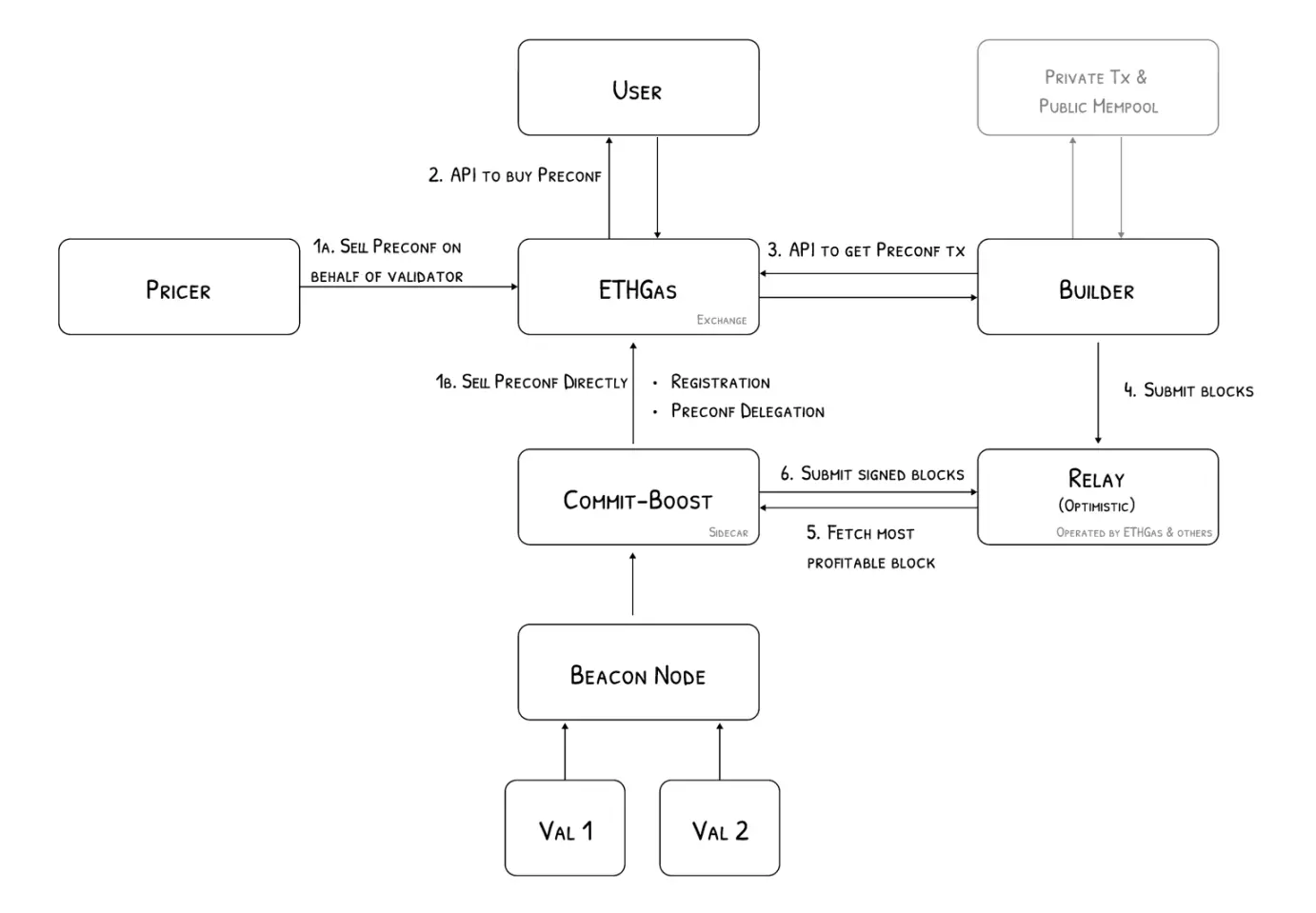

The design and development of the gas futures market are not particularly difficult; it essentially requires establishing an on-chain futures trading market with sufficient liquidity. ETHGas's "trump card" is the block space auction market.

This auction market, named Blockspace, allows Ethereum validators, block creators, and relay nodes to auction space in subsequent blocks to ensure that bidders' transactions will be included in the next block, thus guaranteeing the execution efficiency of those transactions. Furthermore, bidders can even bid for an entire block, ensuring it contains only their own transactions or transactions from others that they provide.

Comparing transactions to packages, ensuring that a block includes a transaction is like guaranteeing that a package is loaded onto a transport plane, while ensuring the execution of the transaction is akin to ensuring that the package is delivered on time to a specific recipient. Bidding for a complete block is like renting an entire plane to transport one's packages, but one can also sublet any excess space to other packages.

ETHGas's ultimate goal is to achieve "real-time transactions" on Ethereum through Blockspace. This real-time transaction can only be in quotes because the completion of transactions on the Ethereum mainnet must wait for the completion of block confirmation, but if a transaction can be guaranteed to be included in the next block, it can be considered "completed" to some extent. We can understand ETHGas as an execution layer on top of Ethereum, but how real-time transactions will manifest on the front end still awaits an answer from ETHGas.

The core of ETHGas aims to establish an orderly block space, rather than the current chaotic bidding for block space, which involves a large number of uncontrollable MEV transactions. By attracting infrastructure operators to join Blockspace with predictable returns to create sufficient liquidity for real-time transactions, the resulting efficiency improvements will attract various DApps. DApps will attract users through Open Gas, and users will bring more transaction volume into the ETHGas network, thereby increasing the revenue of infrastructure operators and forming a positive cycle.

Challenges Beneath the Beautiful Vision

For a DApp about to conduct a token airdrop, it is possible to estimate the number of transactions for claiming the airdrop and pre-book n blocks after a certain time, then provide a gas subsidy plan to achieve a controllable budget without causing network congestion during the token claiming activity.

Although such visions are appealing, allowing block space to be auctioned may lead to many foreseeable issues.

First, if institutional users can auction block space without restrictions, they may bid for entire blocks and resell them to retail investors. While this ensures stable and guaranteed earnings for validators, it raises transaction costs for retail investors. In this scenario, retail investors lack the technical capability to compete with institutional users, and even if they can participate in auctions or use the futures market to hedge against rising gas fees, it essentially still increases transaction costs.

Moreover, the futures market could become a tool for market manipulation, where large players deliberately create a significant number of on-chain transactions to raise gas fees and profit in the futures market, potentially leading to increased transaction costs for other users on the Ethereum mainnet. Additionally, as DApp operators are aware of specific time points that may lead to spikes in transaction volume, they could profit in advance through operations in the futures market, turning the futures market into an arbitrage market for those with informational advantages, causing ordinary users who simply use the market for hedging to incur unpredictable losses.

The birth of a new trading market inevitably means the emergence of arbitrage opportunities due to information asymmetry, affecting the market's ability to solve the problems it aims to address. For ETHGas, balancing this issue to prevent the "positive cycle" from turning into a "death spiral" may require some necessary restrictions.

Recommended Reading:

In-Depth Insights: How to Build a GTM Strategy for Crypto Products Using Distribution Advantages

The Hidden Concerns Behind Web3 Super Unicorn Phantom

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。