Compiled by: Jerry, ChainCatcher

Performance of Crypto Spot ETFs Last Week

US Bitcoin Spot ETF Net Inflow of $459 Million

Last week, the US Bitcoin spot ETFs saw a two-day net inflow of $459 million, bringing the total net assets to $11.695 billion.

Last week, 6 ETFs were in a net inflow state, with inflows mainly from IBIT, FBTC, and BITB, which saw inflows of $324 million, $106 million, and $41.6 million, respectively.

Data Source: Farside Investors

US Ethereum Spot ETF Net Inflow of $160 Million

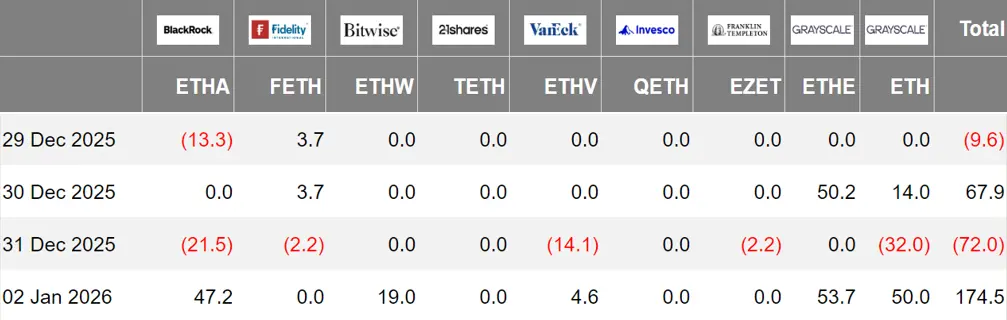

Last week, the US Ethereum spot ETFs recorded a three-day net inflow of $160 million, with total net assets reaching $1.905 billion.

The inflow last week was mainly from Grayscale's ETHE, which had a net inflow of $103 million. 5 Ethereum spot ETFs were in a net inflow state.

Data Source: Farside Investors

Hong Kong Bitcoin Spot ETF Net Outflow of 14.09 Bitcoins

Last week, the Hong Kong Bitcoin spot ETFs experienced a net outflow of 14.09 Bitcoins, with net assets amounting to $33.7 million. The holdings of the issuer, Harvest Bitcoin, decreased to 291.09 Bitcoins, while Huaxia's holdings fell to 2390 Bitcoins.

The Hong Kong Ethereum spot ETFs had a net outflow of 273.34 Ethereum, with net assets of $9.615 million.

Data Source: SoSoValue

Performance of Crypto Spot ETF Options

As of January 2, the nominal total trading volume of US Bitcoin spot ETF options was $1.36 billion, with a nominal total long-short ratio of 2.45.

As of December 31, the nominal total open interest of US Bitcoin spot ETF options reached $27.23 billion, with a nominal total open interest long-short ratio of 1.71.

The market's short-term trading activity for Bitcoin spot ETF options has increased, with overall sentiment leaning bullish.

Additionally, the implied volatility is at 44.21%.

Data Source: SoSoValue

Overview of Crypto ETF Developments Last Week

Bitwise Submits Applications for 11 New Crypto ETFs to the US SEC, Covering Tokens like AAVE and UNI

On December 30, Bitwise submitted applications for 11 crypto ETFs to the US SEC, including the Bitwise AAVE Strategy ETF, Bitwise UNI Strategy ETF, Bitwise ZEC Strategy ETF, Bitwise CC Strategy ETF, Bitwise ENA Strategy ETF, Bitwise Hyperliquid Strategy ETF, Bitwise NEAR Strategy ETF, Bitwise STRK Strategy ETF, Bitwise SUI Strategy ETF, Bitwise TAO Strategy ETF, and Bitwise TRX Strategy ETF.

The trading codes and fees have not yet been announced. The investment strategy for these ETFs is to invest 60% of assets directly in the underlying cryptocurrencies and 40% in ETPs that invest in those cryptocurrencies, and they may also use derivatives to gain investment exposure.

Defiance Launches ETF BTFL Tracking Bitcoin Miner Bitfarms

ETF issuer Defiance announced the launch of the Defiance Daily Target 2X Long BITF ETF (BTFL), which tracks the Bitcoin mining company Bitfarms, primarily aimed at traders seeking to amplify short-term bullish returns on Bitfarms, targeting a return of 200% of Bitfarms' daily price fluctuations.

Grayscale Submits Application for BitTensor Spot ETF

Grayscale has submitted an S-1 filing to the US SEC to launch a spot ETF product tracking BitTensor (TAO), further expanding its crypto asset ETF product line.

Views and Analysis on Crypto ETFs

According to Cointelegraph, Bitcoin's price has risen above $90,000, reaching a near three-week high. Data shows that despite the price rebound, demand for leveraged long positions in Bitcoin remains steady, with the Bitcoin futures basis below neutral thresholds, currently at an annualized premium of 4%.

Additionally, the capital flows in derivatives and spot ETFs indicate that traders remain cautious, suggesting limited confidence in further price increases. Since December 15, Bitcoin spot ETFs have recorded over $900 million in net outflows, while Bitcoin put options traded at a premium on Saturday, indicating increased demand from professional traders for downside risk protection.

Bloomberg Analyst: ETF AUM to Reach $1.48 Trillion by 2025, IBIT Ranks Sixth

Bloomberg's senior ETF analyst Eric Balchunas released data on ETF performance for 2025, showing that last year's ETF assets under management reached a record $1.48 trillion (averaging nearly $6 billion daily), a 28% increase from the previous year.

Among them, BlackRock's Bitcoin ETF IBIT has an asset management scale of approximately $248.44 billion, ranking sixth. However, due to Bitcoin's overall poor performance last year, BlackRock's IBIT was the only ETF among the top 15 to have a negative annual return, with an annual return of -6.41%.

Galaxy Digital's research team released a 2026 forecast indicating that Bitcoin reaching an all-time high in 2026 is still possible. The options market is currently pricing a 50% chance of Bitcoin being around $70,000 or $130,000 by the end of June 2026, and a 50% chance of it being around $50,000 or $250,000 by the end of 2026. These broad ranges reflect uncertainty in the short term. There remains downside risk until BTC firmly re-establishes itself above $100,000 to $105,000. However, it is expected that by the end of 2027, BTC will reach $250,000.

Other predictions include: no Solana inflation reduction proposals will pass in 2026, the current proposal SIMD-0411 will be withdrawn without a vote; the ratio of application revenue to network revenue will double; the SEC will face lawsuits from traditional market participants or industry organizations due to innovation exemptions; a major bank/broker will accept tokenized stocks as collateral; DEXs will account for over 25% of total spot trading volume; Polymarket's weekly trading volume will continue to exceed $1.5 billion; the US will launch over 50 spot altcoin ETFs, along with another 50 crypto ETFs (excluding single-coin spot products); US spot crypto ETF net inflows will exceed $50 billion; and over 15 crypto companies will conduct IPOs or uplist in the US.

Analyst Murphy posted on the X platform analyzing that "ETFs + DAT companies have taken on a total of 12.05 million ETH selling pressure in this cycle. Without them, ETH's price performance would have been much worse. The 'activity' of ancient chips held for over 5 years, with costs below $400, is still very high. Especially when the price approaches or exceeds $4,000. Currently, there are still 20 million such chips, accounting for 17% of the total circulation; similarly, there are 3.79 million BTC chips with costs below $1,000, accounting for 18.9% of the total circulation; but unlike ETH, among these, 1 million belong to Satoshi, and most of the rest have been lost, plus the community consensus is higher, so the 'chip activity' of these ancient BTC is significantly lower than that of ETH.

I personally believe that based on the existing configuration of ETFs + DAT, if we can add some new narratives and innovations to strive to consume half of the remaining 20 million ancient chips, then ETH's price is expected to see a qualitative leap."

Matrixport: Bitcoin Spot ETFs Have Seen Outflows for 9 Consecutive Weeks, Totaling Nearly $6 Billion

Matrixport stated that Bitcoin spot ETFs have experienced outflows for 9 consecutive weeks, totaling nearly $6 billion, with market liquidity and sentiment under continued pressure. After a net outflow of $3.5 billion in November, approximately $1.1 billion has flowed out in December so far. If there is still a net outflow by the end of the month, it will mark the most significant round of capital withdrawal since the ETF's listing in January 2024.

Analyst Markus Thielen pointed out that the market's focus has shifted to January next year, when it will be verified whether this wave of pressure is a short-term disturbance due to year-end rebalancing or if investors' allocation preferences are undergoing a sustained change.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。