Original|Odaily Planet Daily Wenser

The year 2025, belonging to cryptocurrency, has already passed. This year, in addition to a series of favorable policies, the development of on-chain ecosystems has been even more rapid.

From the meme coin craze sparked by Pump.fun, to the on-chain Perp DEX trend led by Hyperliquid, and the stablecoin and PayFi financial wave driven by the listing of Circle (CRCL), many public chains' on-chain ecosystems have entered a period of explosion. Among them, Solana, with its ecological vitality, underlying infrastructure construction, and "application-first" internet-style capital network positioning, has surpassed Ethereum to become the "new king of on-chain networks of the year."

Odaily Planet Daily will sort out the Solana on-chain ecosystem in this article, attempting to explore the "best business model" in the current cryptocurrency market _ (Note from Odaily: Data sources vary, and statistical criteria differ, for reference only)._

Solana's On-Chain Revenue Exceeds $600 Million, Outperforming Ethereum and TRON to Become the "Strongest Public Chain"

Solana's "year-end report card" begins with public chain revenue. Although the price of SOL has fallen since it surged to nearly $300 last year, with the highest rebound not reaching $270, from the perspective of public chain operations, its revenue-generating ability has clearly "broken through the first tier."

Solana's On-Chain Fee Revenue Exceeds $600 Million in 2025

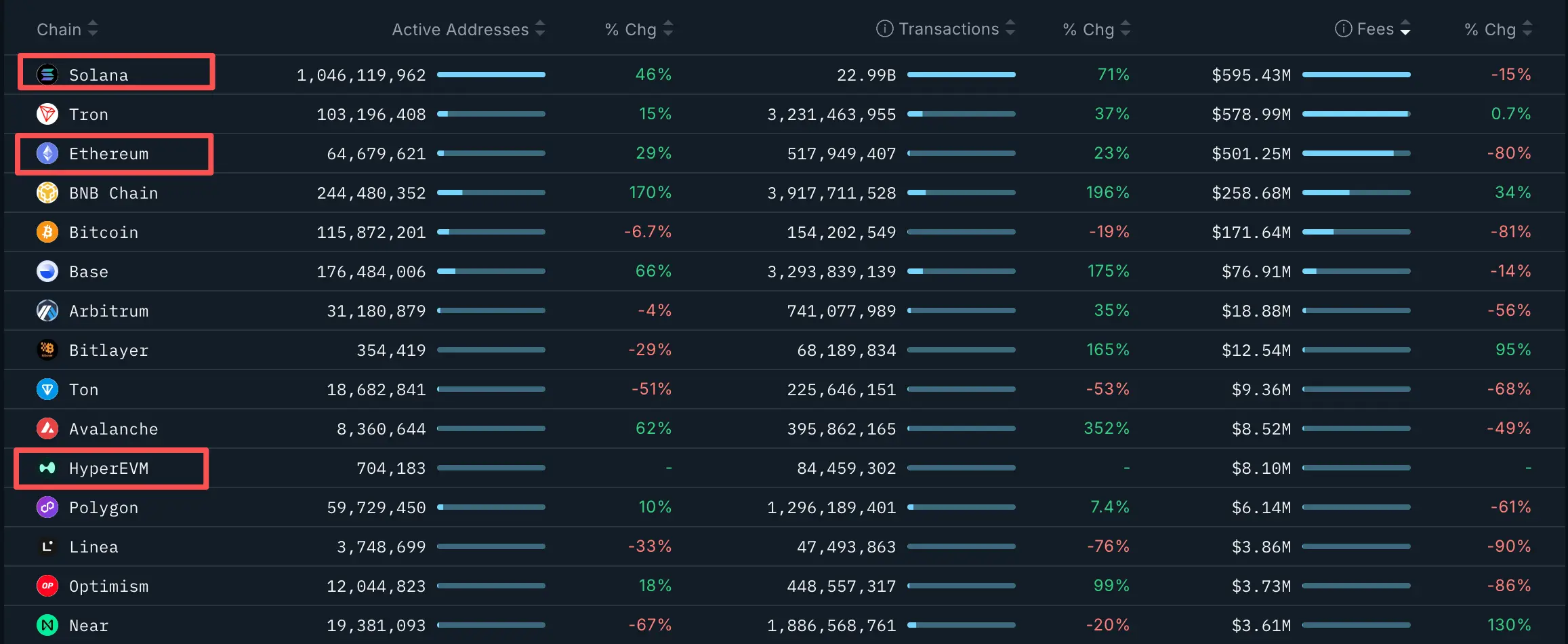

On January 2, Nansen data showed that Solana's on-chain fee revenue exceeded $600 million in 2025, surpassing TRON and Ethereum to rank first. The top five blockchains in on-chain fee revenue last year were:

- Solana ($603 million);

- TRON ($581 million);

- Ethereum ($514 million);

- BNB Chain ($259 million);

- Bitcoin ($172 million).

In addition, Solana has over 1.05 billion active addresses on-chain, with approximately 23.01 billion transactions, all higher than Ethereum, Bitcoin, TRON, and other public chains.

Latest data shows that as of the time of writing, Solana has maintained the top position in active addresses, transaction counts, and revenue fees over the past year.

Solana's Annual Revenue Exceeds $1.5 Billion in 2025, Surpassing the Combined Revenue of "Hyperliquid + Ethereum"

According to Blockworks Research data, Solana's total revenue in 2025 exceeded $1.5 billion, leading all public chain networks, with Hyperliquid following closely behind at $780 million; Ethereum generated $690 million during the same period, both lagging behind Solana. Notably, Solana achieved this revenue milestone while maintaining a median transaction fee of less than 1 cent.

In response, Solana co-founder Anatoly Yakovenko acknowledged this achievement and pointed out that capacity growth and cost efficiency are the core driving forces. He believes that network scale, rather than high fees, supports sustainable revenue expansion.

Solana's On-Chain Spot Trading Volume Reaches $1.6 Trillion in 2025, Surpassing All CEXs Except Binance

Recently, The Kobeissi Letter reported that Solana's on-chain spot trading volume officially reached $1.6 trillion in 2025, surpassing all centralized exchanges except Binance.

According to data from JupiterExchange, since 2022, Solana's on-chain trading volume as a percentage of total trading volume has grown from 1% to 12%. In 2025, Solana's total trading volume officially exceeded Bybit, Coinbase Global, and Bitget, second only to Binance.

Meanwhile, Binance's market share has dropped from 80% in 2022 to 55%. This also indicates that activities within the cryptocurrency industry are rapidly shifting on-chain.

Revealing the Composition of Solana's On-Chain Revenue: Four Major Components Supporting Over $600 Million

Based on existing information, Solana's network revenue mainly comes from on-chain transaction fees. Unlike Ethereum and others, its fee mechanism design places more emphasis on deflation and validator incentives. The total fee revenue of $603 million in 2025 is composed as follows:

First Revenue: Base Fees

- A fixed low base fee (approximately 5000 lamports) is charged for each transaction.

- This portion of the fee is entirely burned, not allocated to validators, directly reducing the total supply of SOL, creating deflationary pressure.

- It accounts for a significant proportion of total fee revenue, especially in 2025 when transaction volume exploded, the burning mechanism significantly enhanced the scarcity of SOL.

Second Revenue: Priority Fees

- Additional fees that users can choose to pay to expedite transaction confirmation.

- During high congestion periods (such as meme coin booms, large DEX transactions), priority fees increase significantly, becoming a major source of revenue growth.

- This portion of the fee is allocated to block producers (Leaders) and stakers, serving as the main reward source for validators.

Third Revenue: MEV (Maximum Extractable Value) Related Revenue

- Through MEV clients like Jito, tips paid by searchers further supplement revenue.

- In 2025, MEV revenue share increased, closely related to complex arbitrage opportunities in DEX and meme coin trading.

Fourth Revenue: Other Minor Sources

Such as account rent (storage fees), voting fees, etc., which account for a smaller proportion.

In the overall distribution mechanism, about 50% of fees indirectly benefit all SOL holders through the burning mechanism (deflation); about 50% is directly allocated to validators and stakers, incentivizing network security. Unlike Ethereum's ecosystem protocol revenue fees primarily belonging to validators, Solana's burning mechanism gives its network revenue greater long-term value capture ability, which is also key to maintaining low fees under high transaction volumes.

Overview of Cryptocurrency Revenue Models: Public Chains, Perp DEX, and Launchpads Remain the Most Profitable Tracks, Second Only to Stablecoins

Finally, based on the current market information, public chains (Solana, Ethereum, TRON), on-chain perp DEXs (such as Hyperliquid, Aster, etc.), and on-chain launchpads (such as Pump.fun) remain the most profitable tracks in the cryptocurrency industry, second only to stablecoin projects that earn interest and have stable issuance.

Although we previously analyzed the awkward survival state of current public chain projects in the article “Only 10 Public Chains Have Weekly Revenues Exceeding $100,000: Collective Naked Swimming After the Tide Goes Out”, the existence of public chains like Solana, Ethereum, TRON, Base, etc., tells us that public chains are still the most profitable cryptocurrency track, perhaps even without exception.

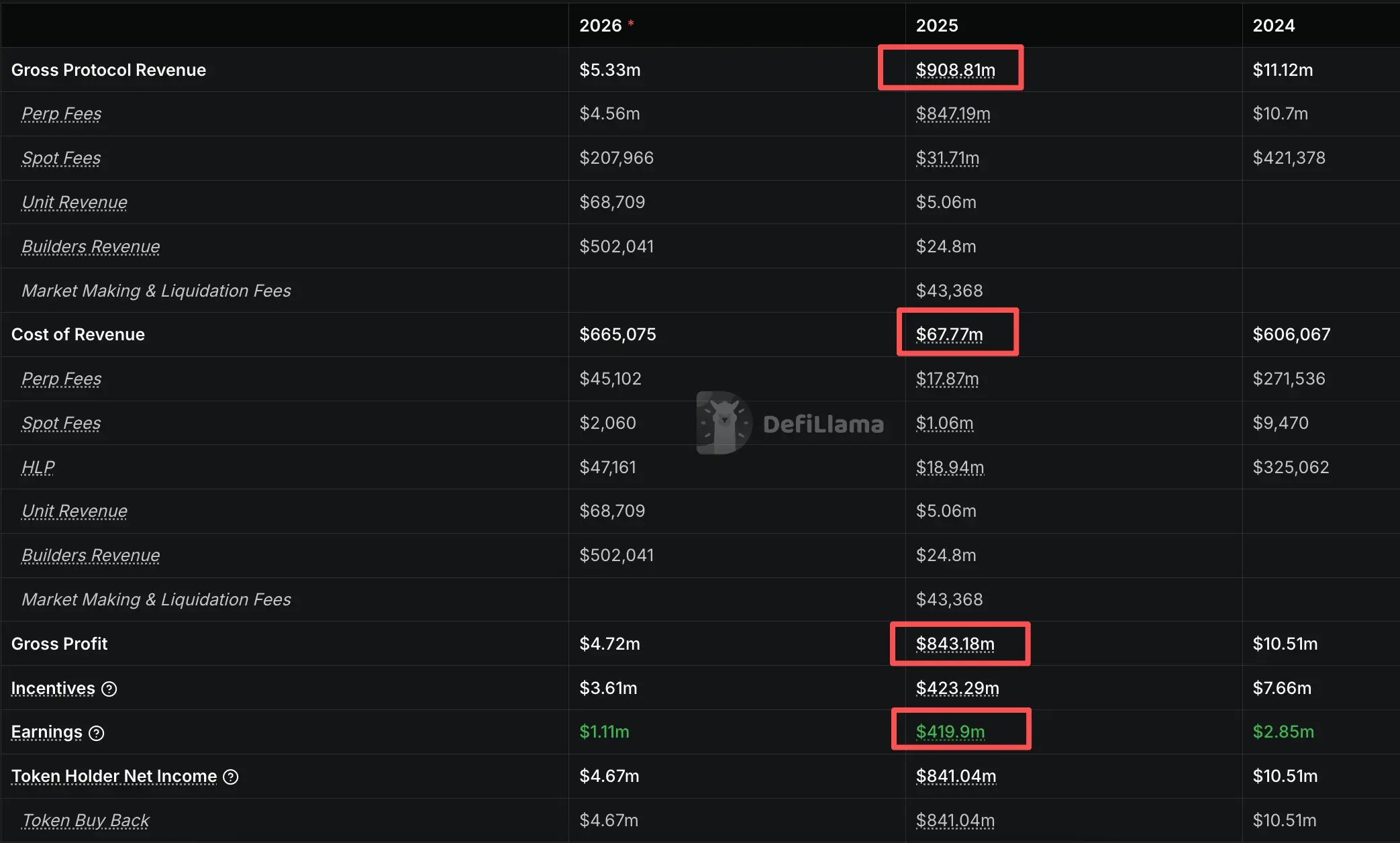

According to DefiLlama data, Hyperliquid's revenue in 2025 is $908 million; its revenue cost is approximately $67.77 million, with an annual net profit of about $843 million. Excluding incentive expenditures, the net profit attributable to the platform in 2025 is as high as about $420 million.

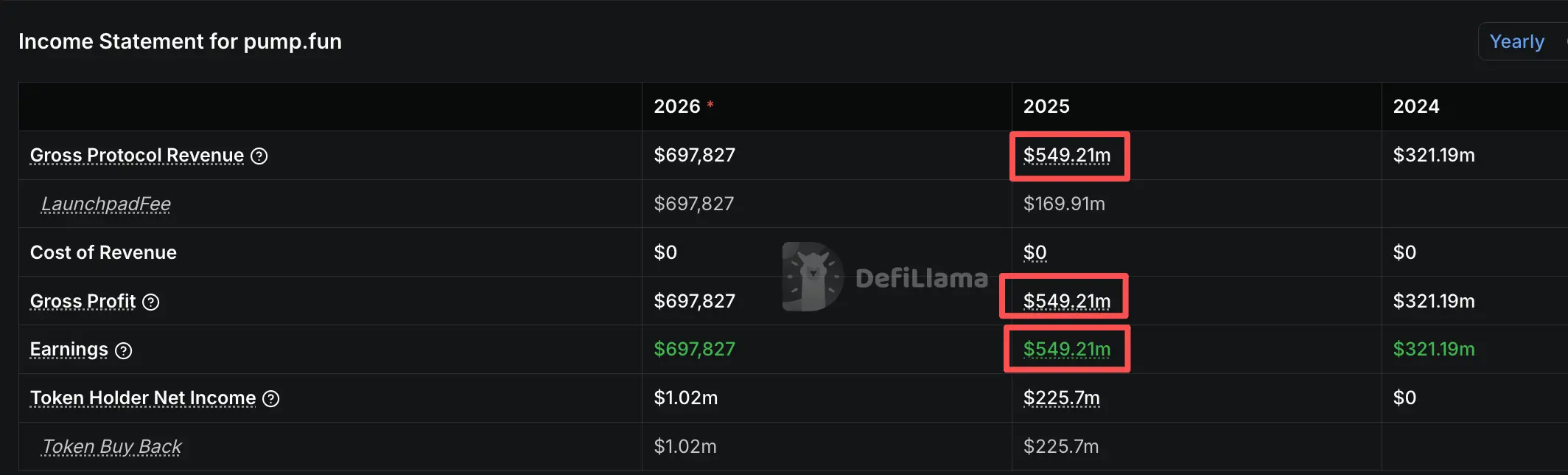

According to DefiLlama data, Pump.fun's annual revenue in 2025 is approximately $550 million. Unlike on-chain perp DEX platforms like Hyperliquid, as a "one-click token issuance platform," Pump.fun does not need to spend incentive fees, so its annual net profit is approximately equal to its annual revenue, which is $549 million.

In summary, the industry's mainstream revenue-generating machines remain public chains, on-chain Perp DEXs, and launchpad token issuance platforms, second only to stablecoins (for example, Tether's net profit related to the stablecoin sector alone is expected to reach $7.43 billion in 2025).

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。