Original Title: Betting on Prediction Markets Is Their Job. They Make Millions.

Original Author: Benjamin Wallace, The New York Times

Original Translation: Luffy, Foresight News

Rhythm BlockBeats Note: With the rise and popularity of prediction markets, a new breed of professional players has emerged: they navigate between probabilities and odds, making a living by predicting the future. In the hands of these professional traders, everything from geopolitical shifts to the wording of politicians' speeches is transformed into profits in their accounts.

The New York Times recently interviewed several full-time traders who make a living from prediction markets, revealing how they convert vast amounts of information into real wealth. The birth of this profession marks our entry into a new phase of "cognition as currency," where a group of sharp young individuals has taken the lead, attempting to dissect every fragment of the future using data and logic. Below is the original content:

26-year-old Joel Holsinger quit his job as a corporate accountant and has been fully engaged in prediction market trading for just two months, steadily moving towards his first profit goal of $100,000. It was the Tuesday before Thanksgiving last year, just before noon, and President Trump was about to hold his annual turkey pardon ceremony.

At that time, Joel Holsinger wagered $700 on whether Trump would say two specific words. The two major prediction market platforms, Kalshi and Polymarket, had both launched "mention markets" betting products, allowing users to bet on whether the president would say a dozen words and phrases, including "hottest," "big beautiful bill," "radical left/far left," and "rigged election/stolen election."

He bought 500 shares of the "stuffing" no contract at 86 cents and 500 shares of the "cheaper" no contract at 70 cents. These betting choices were almost entirely based on his research into the frequency of word usage in Trump's past speeches.

Joel Holsinger stated that Trump would almost certainly discuss topics related to affordability, but he has always preferred to use "lower" rather than "cheaper"; since August of last year, Trump has not used the word "cheaper," and in previous turkey pardon speeches, he has never mentioned "stuffing."

Even so, Joel Holsinger remained extremely cautious with his betting amounts. "The sample size is only four times," he referred to Trump's four Thanksgiving speeches during his first term, "I wouldn't make any crazy moves."

On the Kalshi platform, which Joel Holsinger preferred, the odds for Trump not saying "stuffing" had dropped to 81 cents, while the market's expectation that he would say the word continued to rise.

"Does anyone have an exclusive advantage on this 'stuffing' bet?" Joel Holsinger asked into his headset. He was dressed in sweatpants and a T-shirt, sitting cross-legged in an office chair in a four-story walk-up apartment in South Williamsburg, Brooklyn, live-streaming to over 1,000 viewers who tuned in to hear the commentary of the blogger known as PredictionMarketTrader. He and his fiancée had recently moved here from Los Angeles, and there were still Home Depot boxes piled in the corner of the room.

What he was eagerly anticipating was which of the two turkeys would receive the ceremonial pardon, Gobble or Waddle? Joel Holsinger bet $2,500 on Gobble.

He hadn't originally planned to place a bet, feeling that it was a shot in the dark and had not found any clues that could form a betting advantage. He had even told his audience, "I really don't see any bullish reasons for Waddle," and "There are many supporters for Gobble, but I might just be trapped in an information bubble."

But just 30 minutes earlier, his friend discovered a new video from the Associated Press that seemed to confirm Gobble as the winner: during a White House press conference, a voiceover stated that although "both turkeys will receive pardons," Gobble "will be the official Thanksgiving turkey of the United States."

This subtle difference in wording would go unnoticed by the average person, but for traders, it was invaluable information. The settlement criteria for betting projects on leading platforms are often hidden in the fine print, scrutinizing every word to the extreme. Other traders seemed not to have discovered this video, and the contract betting on Gobble's victory was still selling for about 82 cents. Joel Holsinger immediately bought 2,475 shares; if he was right, he would earn about $425.

In the live broadcast from the Rose Garden, a turkey appeared on camera, its flesh wobbling at the beak, looking comical. "Is that turkey on stage Gobble?" Joel Holsinger asked loudly, facilitating discussion among the viewers in the live chat, "Can someone find a photo to compare?"

Trump's speech meandered, mentioning several words that traders had bet on, including "affordable," "Walmart," and "egg."

"Now, let's grant Gobble a pardon. By the way, Waddle is absent, but that's okay; we'll just pretend it's here…" Trump said.

Joel Holsinger's eyes widened instantly. He made a profit betting on Gobble's victory and earned $250 betting that Trump would not say "stuffing" and "cheaper," as the president indeed did not mention either word.

However, at the end of the 55-minute live stream, Joel Holsinger felt a deep sense of regret, wishing he had had the conviction to increase his bet.

"I am too addicted to the internet; I don't even recognize my own neighborhood anymore. I might spend 16 hours a day on the computer. I should get out more," Holsinger said.

"At least we predicted correctly and got in early enough. But ultimately, we still got in too early; I really should have increased my position. But everyone, this week is off to a good start; from Sunday until now, we've made $1,300."

Will This Be a Defining Profession of the 2020s?

Before 2020, the only platform available for making a living by predicting current events was New Zealand's PredictIt, which set a maximum individual bet limit of $850 and restricted the number of traders participating in a single market. However, with the rise of Kalshi and Polymarket in the United States, everything changed.

Now, thousands of real-time betting questions are online around the clock, and anyone can choose a side to bet on: Will Iran's Supreme Leader Ayatollah Ali Khamenei resign by the end of July? Will Congress confirm the existence of aliens?

Prediction markets have entered the cultural mainstream. CNN has partnered with Kalshi, and Google Finance has integrated real-time data from Kalshi and Polymarket. This month, during CBS's Golden Globe Awards live broadcast, Polymarket's real-time betting odds were displayed before the awards, and the company's founder and CEO Shayne Coplan attended the ceremony.

The industry has also received a political tailwind. In 2024, Polymarket traders bet over $3.6 billion on the election results between Trump and Harris. By the end of the election voting, prediction markets favored Trump, while the average polling showed Harris with a slight lead. The Trump administration has a friendly attitude towards the industry; Trump's son, Donald Trump Jr., is both an advisor to Kalshi and Polymarket and an investor in Polymarket. Last November, the U.S. Commodity Futures Trading Commission approved Polymarket to operate legally in the United States. Other investment and betting platforms, such as Robinhood and FanDuel, have also entered the prediction market space.

Making a living by betting on prediction markets may become one of the defining professions of this era, much like Wall Street traders in the 1980s, internet entrepreneurs in the 1990s, and influencer bloggers in the 2010s. The various social and cultural backgrounds that have given rise to this profession have previously sparked countless in-depth discussions: an increasing number of young men are addicted to screens and online communities; traditional career paths are collapsing, giving rise to high-risk speculative investments that aim for big profits; in a post-trust, post-expert era, people are more willing to believe in mathematical probabilities and collective wisdom; everything is increasingly exhibiting "casino-like" characteristics. The emergence of full-time prediction market traders may be the intersection of all these trends.

A successful prediction market trader in the industry, who goes by the pseudonym Domer and requested not to disclose his real name, candidly stated that television commentators can speak freely without facing consequences, while prediction markets involve "commentary analysis with real money on the line," as trading results directly affect financial gains and losses. Like Domer, many traders prefer to operate anonymously to avoid scrutiny from the IRS or to prevent losing opponents from seeking revenge. As Domer said, "If I made $2.5 million last year, that means someone lost $2.5 million."

"We are exploring better ways to predict what might happen in the future, and that is crucial," Domer continued.

Prediction markets clearly have a huge appeal for potential insider traders. Last December, an anonymous user on Polymarket made over $1 million in 24 hours, partly because he placed an extremely contrarian bet that the singer D4vd would become the most searched person on Google last year. This month, a mysterious account accurately predicted the timing of Venezuelan President Nicolás Maduro's resignation, earning over $400,000. Domer believes that the probability of the big player who correctly predicted the Nicolás Maduro event being an insider is between 85% and 90%, while the probability for the big player who predicted the Google trending event being an insider is as high as 98% to 99%. Polymarket did not respond to a request for comment.

Most users on the two major platforms are losing money, and betting on sports events has become a new choice for a group of young men. Many of them are unemployed and burdened with student loans or credit card debt, yet they make bets with slim chances of winning on convenient, gamified platforms. You can bet on prediction markets once you turn 18, while most sports betting platforms in the U.S. require users to be at least 21. Additionally, since Polymarket and Kalshi have received federal approval, gamblers can even place bets on events through these two platforms in states where sports betting is prohibited.

"We are creating a generation that will abandon the principles of financial prudence; a wave of personal bankruptcies is inevitable, and the mental health crisis will be even more severe than it is now," commented the CEO of a private lending platform recently. An academic study published last month found a correlation between convenient sports betting channels and significant declines in personal credit scores, rising bankruptcy rates, increased debt, and higher loan delinquency rates.

Those who call themselves "trading experts" are mostly quick-reacting men who are willing to take risks, possess quantitative analysis skills, and have above-average information processing abilities. Today, the trading volume and liquidity in prediction markets are substantial enough that top traders like Domer can earn millions annually by identifying inefficiencies in the prediction markets that provide them with an edge. Full-time traders indicate that the number of full-time professionals in the industry currently ranges from "50 to several hundred." Analysis shows that less than 0.04% of accounts on Polymarket account for 70% of the profits.

High-volume, high-margin betting projects often attract the same group of trading experts. A recent example is: Will Zelensky wear a suit before July last year? The settlement process for this bet was quite tricky because the outfit Zelensky wore at the NATO summit in June appeared to be a suit but did not conform to the standard suit style. Who will win the Romanian presidential election? In this bet, many trading experts wagered on the right-wing candidate, who ultimately lost, resulting in losses for this group of experts, proving that their collective judgment was unreliable.

Ukrainian President Zelensky arrives at the formal dinner before the NATO summit in The Hague.

"This is the worst I've ever lost in my life," said a trading expert who goes by the pseudonym Iabvek. This trader, based in Arizona, lost $350,000 on the Romanian election bet. He requested not to disclose his real name, partly out of fear of being extorted. However, he also revealed that since November 2024, he has earned $2.5 million. His trading career began with a $20 bet in high school when he placed a wager on Liz Cheney's victory in the 2016 Wyoming House election using his mother's account because he was underage.

Finding Niche Markets

Every trading expert has their own winning strategy. Many of them could have made a name for themselves on Wall Street but find prediction markets more appealing. Some delve into legislative processes, others specialize in climate models, and some read niche industry newsletters. Iabvek stated that the number of professional traders in the industry is still relatively small, and one can still profit in the market with simple statistical models.

In exclusive Discord communities, many trading experts exchange information, such as insider tips on "safe bets." This is their term for low-risk, low-return bets, which, while not as guaranteed as U.S. Treasury bonds, are considered "sure bets" in prediction markets. Last year, when all 12 singles from Taylor Swift's new album topped the charts, many trading experts profited from this bet. "All the experts I know said this was the safest bet of the year," said 34-year-old Long Island trader Jonathan Zubkoff.

Jonathan Zubkoff's trading career began with a $100 bet, and he claims to have made $1.03 million in profits in 2025. He once called a congressional office as a voter to inquire whether a certain congressman would attend a particular vote. During the 2021 California gubernatorial recall election, Iabvek personally traveled to California, knocking on "thousands of doors" to conduct field research, ultimately concluding that polls underestimated Governor Gavin Newsom's support. When Elon Musk hosted "Saturday Night Live" in 2021, the platform launched a market on whether he would say "DOGE," and according to two trading experts, traders were stationed outside Rockefeller Center, probing audience members watching the rehearsal for information.

Some trading experts win through exceptional analytical skills. Last January, trader Caleb Davies began betting against the trend, wagering that Bad Bunny would defeat the heavily favored Taylor Swift to become Spotify's Artist of the Year. Caleb Davies is still working full-time in IT; he discovered that in October 2023, Bad Bunny released an album but ultimately lost to Taylor Swift for the top spot; however, Bad Bunny had released a new album in January, giving him more time to accumulate streams. As he predicted, on December 3, Spotify confirmed that Bad Bunny won the title, and Caleb Davies earned over $20,000.

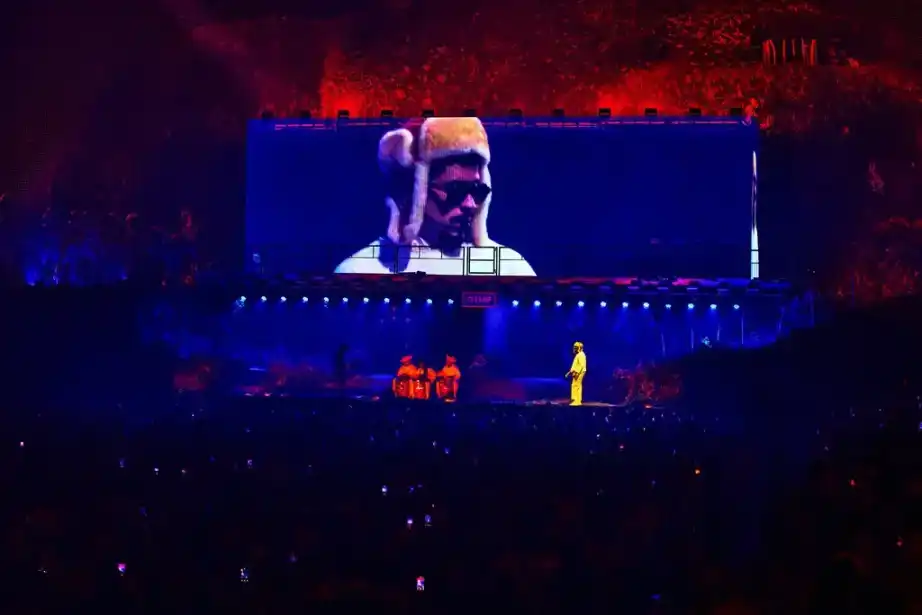

Bad Bunny performing in Puerto Rico last summer.

Some focus on specific areas. In addition to betting on political and weather events, Jonathan Zubkoff built what he calls a "Bloomberg terminal for Rotten Tomatoes"—a custom data dashboard that integrates entertainment news sources and other relevant information. With this tool, he consistently guesses the weekly Rotten Tomatoes scores for movies accurately. He stated that even if someone were to replicate this dashboard, "I would bet that I can process the relevant information faster than anyone else."

For trading experts, last year was a bountiful year, and this year's prospects are even more promising. The various uncertainties brought by Trump mean that the market is filled with unpredictability, which also means there are more topics to bet on. There is a group of political fanatics, much like Taylor Swift's fans, who will bet on their idol no matter what. The attention on prediction markets has also exploded; according to blockchain media The Block, the number of active traders on Polymarket last month reached 491,000, a record high. A large influx of new funds has entered the market, including gamblers from other fields like sports betting and ordinary people who enjoy placing bets.

Stepping Out of the Internet, Still Profiting

Since January 2022, Domer has earned $2.6 million solely on the Polymarket platform. Twenty years ago, he graduated from college and made a living as a full-time online poker player but became frustrated with the illogical ups and downs of poker games. "If you play optimally for 40 hours straight and still lose money, you start to question your life." You never know if your opponent is bluffing, making it impossible to analyze the reasons for your failures.

Once, while waiting for a poker game to finish, he became bored and started thinking about what else he could bet on, eventually discovering the Irish Intrade platform, where he could bet on Oscar awards. He felt that film critic Roger Ebert had great insight, as Ebert had said that "Crash" should and would defeat "Brokeback Mountain" to win the Oscar for Best Picture in 2006. Domer bet $10 on "Crash" to win and ultimately made $80. "This opened up a whole new world for me: I realized you could bet like this."

In 2008, when Senator John McCain planned to announce his vice presidential pick in Dayton, Ohio, Domer and a friend tracked all flights to nearby airports. When they saw a flight coming in from Alaska, they immediately placed a large bet that Sarah Palin would be the vice presidential pick, resulting in substantial profits. Around that time, Domer gave up poker and fully committed to prediction market trading, as he found this job less stressful and more logical.

Today, Domer has over 1,000 unsettled bets at any given time, involving over $2 million in risk capital. He once wagered nearly $260,000 that Pope Leo would not be named Time magazine's Person of the Year, which turned out to be his most profitable bet in 2025.

A trader named Domer in a park near downtown Greenville, South Carolina.

As the market continues to expand, competition has become increasingly fierce, and trading has become more time-consuming. Domer's trading station is equipped with four monitors and a television, and he often orders Uber Eats. During the Israeli elections, his schedule completely followed Israel's time rhythm.

In 2017, Domer met his now-wife, who at the time could not have imagined that she would marry someone living this kind of life. At that time, the mainstream betting platforms were still Betfair and PredictIt, with fewer events to bet on, less competition, and less capital involved; Kalshi and Polymarket had not even been established. "Just think about it, marrying someone like me, with my phone constantly buzzing with notifications and distractions. We're sitting down for dinner, and I might suddenly say, 'I need to go upstairs; Eric Adams just tweeted,'" he mentioned, referring to former New York Mayor Eric Adams.

He continued, "The 2024 election year is a mess. I told her, 'Just wait until July; we'll go to Ireland and Basel, and it will be so much fun,'" referring to Basel, a city in Switzerland, "I've always wanted to go there."

But at the end of June last year, President Joseph R. Biden Jr. performed poorly in a debate, triggering what Domer called "the biggest political betting event in history": Will Biden withdraw from the race? "I placed a significant bet on this." Ironically, in the weeks leading up to Biden's withdrawal, Domer was overseas "stepping out of the internet and experiencing reality," not deeply immersed in the betting frenzy over "Will Biden withdraw," but instead holding most of his positions firmly, ultimately netting over $1 million in profit.

Trader Joel Holsinger, who successfully predicted the turkey pardon event, looks up to Domer as a role model and harbors the same dream. This month, Joel Holsinger's total profit surpassed $144,000, and he began contemplating his next goal, perhaps $500,000.

He wants to take on greater risks in trading: "My win rate shouldn't be this high; it means I've missed many opportunities to act."

Fueled by citrus-flavored Zyn nicotine pouches and Celsius functional drinks, Joel Holsinger is fully focused on seizing the current opportunities. "I have only one thought right now: to go all out and take the plunge."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。