The lights in the Senate Majority Leader's office remain bright late into the night, as footage of heated arguments between bipartisan lawmakers is transmitted via closed-circuit television to the White House Situation Room. Meanwhile, in Minnesota, low-income housewives who have lost federal food assistance are worrying about their next meal.

At midnight local time on January 31, parts of the U.S. federal government officially shut down. This comes just 11 weeks after the longest shutdown in history, which lasted 43 days and ended in late 2025, as the U.S. government once again faces operational paralysis.

Although the Senate passed a $1.2 trillion appropriations bill in advance, the House of Representatives is unable to vote due to its recess, leading to a funding gap. Among the nine core departments, the Department of Homeland Security, the Department of Transportation, and the Department of Education are facing funding crises, affecting approximately 45% of federal employees.

1. Reasons for the Shutdown

● The direct cause of this shutdown is the time lag in congressional procedures. On the evening of January 30, the Senate passed the appropriations bill with a vote of 71 in favor and 29 against, but the House, due to its scheduled recess, will not return to Washington to vote until February 2 at the earliest.

● The procedural disconnect has led to a "technical shutdown." In fact, even if the Senate had passed the agreement before government funds ran out, the bill would still need to wait for the House to reconvene next Monday for full approval.

● The deeper reason for the shutdown lies in the fundamental disagreements between the two parties on immigration policy. The Democrats are demanding restrictions on the Immigration and Customs Enforcement (ICE), including prohibiting warrantless home searches and mandating the use of body cameras.

2. Key Controversies

● The core of the bipartisan struggle focuses on the funding issue for the Department of Homeland Security. Recently, after ICE officers shot two American citizens in Minnesota, the Democrats have explicitly refused to allocate new government funding for the Department of Homeland Security.

● Democratic leader Chuck Schumer stated: “The American people support law enforcement and border security. But they do not support ICE terrorizing our streets and killing American citizens.”

● The Democrats are calling for reforms in immigration enforcement, including ending patrols, requiring rules, oversight, and warrants. They propose that “masks need to come off, cameras need to stay on, and officials need to have visible identification. No secret police.”

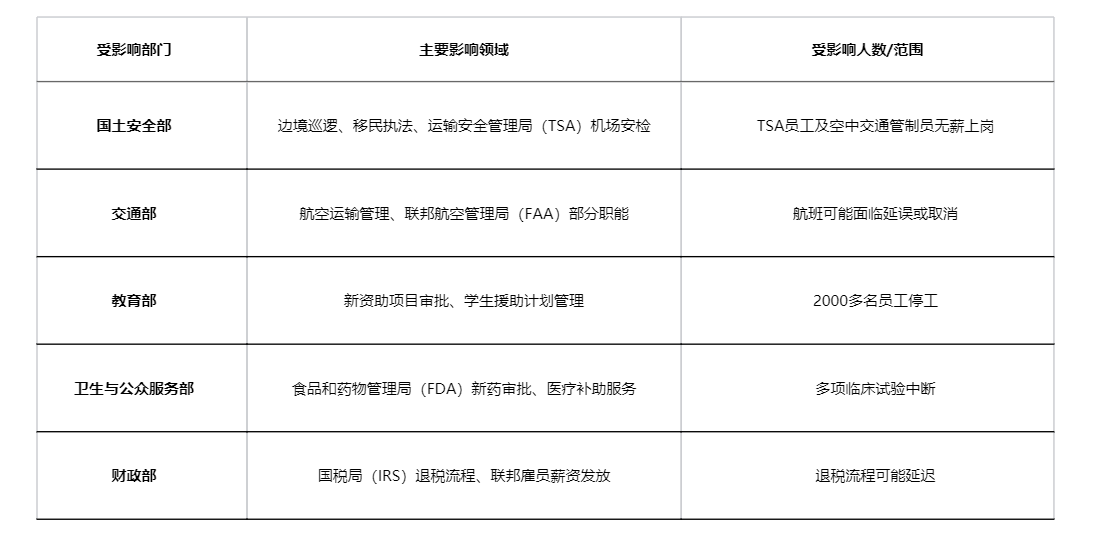

3. Actual Impact

This shutdown is "selective." Departments such as the Department of Agriculture, the Department of Commerce, and the Department of Justice are not affected due to previously passed budgets, but the nine core departments, including the Department of Homeland Security, the Department of Transportation, and the Department of Education, are all facing funding gaps.

The specific impact of this shutdown is as follows:

4. Historical Comparison

● Government shutdowns in the U.S. are no longer a novelty. Since 1976, there have been 21 funding interruptions in the U.S. federal government, with a significant increase in frequency in recent years. The most notable was the record 43-day shutdown in 2025, which caused an irreversible economic loss of $11 billion.

● The characteristics of government shutdowns in different periods show significant differences. In the 1980s, there were eight shutdowns, most lasting only 1 to 3 days; in the 1990s, there were three, with the longest lasting 21 days. Since 2010, there have been four shutdowns, although the absolute number is not high, there have been multiple crises of "shutdown" risks.

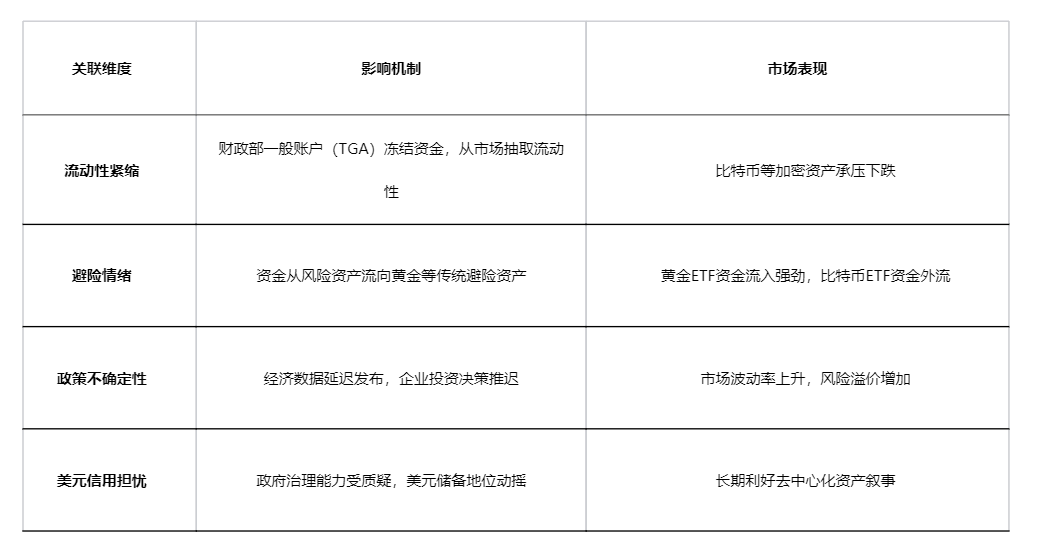

5. Connection to the Crypto Market

The risk of government shutdowns has become one of the highly watched external variables in the crypto market. Just as the risk of a government shutdown rises, the crypto market is facing a very intense window of macro events.

The Federal Reserve is about to announce its latest monetary policy statement, major U.S. tech companies are releasing earnings reports, and the risk of a government shutdown is causing market risk preferences and liquidity expectations to change dramatically in the short term.

Notably, the market's reaction to the government shutdown has changed. Looking back at the 43-day shutdown in 2025, the price trajectory of Bitcoin showed clear phase characteristics:

● Early shutdown (October 1-10): Bitcoin reached an all-time high of $126,500 on October 6. The market generally believed that the government shutdown would highlight the value of decentralized currency.

● Mid shutdown (October 11-November 4): As the shutdown extended beyond expectations, the crypto market experienced the "1011 liquidity black swan event," with Bitcoin's price plummeting to $102,000, a drop of over 20% from its peak.

● Late shutdown (November 5-12): The price fluctuated around $110,000 and did not immediately rebound as the shutdown was about to end.

This time, the market's reaction is more direct and rapid. Within 24 hours of the escalation of shutdown risks, Bitcoin's price plummeted from $92,000 to below $88,000. The market seems to have learned from the last experience, no longer viewing government shutdowns as a positive factor, but directly pricing them as a negative liquidity factor.

The crypto market's sensitive response to government shutdowns can be understood through the following related dimensions:

6. Chain Reaction

● The impact of the government shutdown extends far beyond the political realm. KPMG estimates that each week the government shutdown continues will result in approximately $15 billion in losses to the U.S. GDP. S&P Global also points out that each week of shutdown will drag down quarterly GDP growth by 0.2 percentage points.

● In addition to the airline and pharmaceutical industries, government contractors, especially small and medium-sized enterprises, will face cash flow crises due to contract payment suspensions. Business investments and hiring decisions will be delayed due to policy uncertainty, consumer confidence will be undermined, further dragging down the entire economic recovery process.

● In 2025, international rating agency Moody's downgraded the U.S. sovereign credit rating from Aaa to Aa1, and Fitch also downgraded its rating due to increased debt burdens and ineffective governance. Frequent government shutdowns have further led global investors to doubt the U.S. governance capacity, shaking one of the cornerstones of the dollar's hegemony.

7. Future Prospects

Currently, the appropriations bill passed by the Senate only provides the Department of Homeland Security with two weeks of temporary funding. If the two parties cannot reach a compromise within two weeks, the U.S. government will face its third shutdown within three months.

● At that time, border operations, visa processing, emergency relief services, and more will further collapse, and the losses to people's livelihoods and the economy will be irreparable. As of now, the House has not yet initiated a vote on the appropriations bill, and the duration of the shutdown remains uncertain.

● Johanna Donahue, a political science professor at Syracuse University, believes that the recurring "shutdown" crisis in the U.S. reflects that the polarization between the two parties is evolving towards "more severe emotional opposition" and "systematic destruction of each other's legitimacy."

● With the 2026 midterm elections approaching, this internal strife may escalate, and the U.S. economy and people's livelihoods will continue to be under pressure in this endless political farce.

In the circular hall of the Washington Capitol, staff are preparing for a possible long-term shutdown, archiving important documents and watering office plants. The electronic clock in the corridor shows that the shutdown has lasted for 47 hours.

Meanwhile, in a cryptocurrency trading hall in New York, analysts are closely monitoring the Bitcoin price chart. The candlestick chart on the screen is fluctuating violently, with each jump tugging at the nerves of global investors. A seasoned trader murmurs, “The government is closed, but the market is open, yet who would have thought that this time the safe-haven myth of digital gold seems to be shaking.”

Join our community to discuss and become stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。